Written by: Leeor Shimron

Translated by: Saoirse, Foresight News

ETH holders looking to stake their tokens may want to start queuing up, as a significant surge in staking demand could occur in the coming weeks.

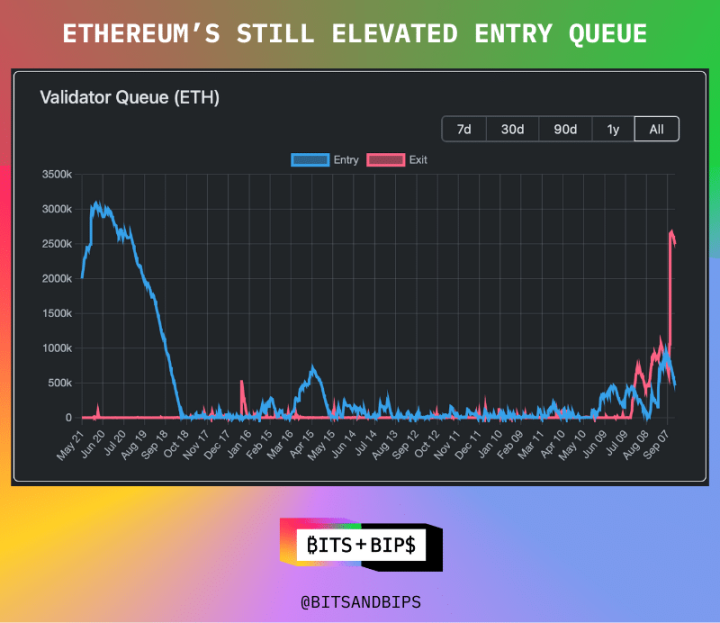

As of September 18, there are a total of 422,143 ETH in the Ethereum network's validator admission queue, valued at $1.94 billion at current prices. Although this figure is down from 986,824 ETH in August, it still represents a historical high for the network since the "The Merge" event in September 2022, when Ethereum officially enabled the PoS consensus mechanism.

(Validator queue data chart)

But do not be misled by the appearance of "decreasing number of stakers" in the chart above—this trend has reduced the staking wait time from 16 days to 8 days, but the number of people in the queue is likely to surge again soon.

What is the reason?

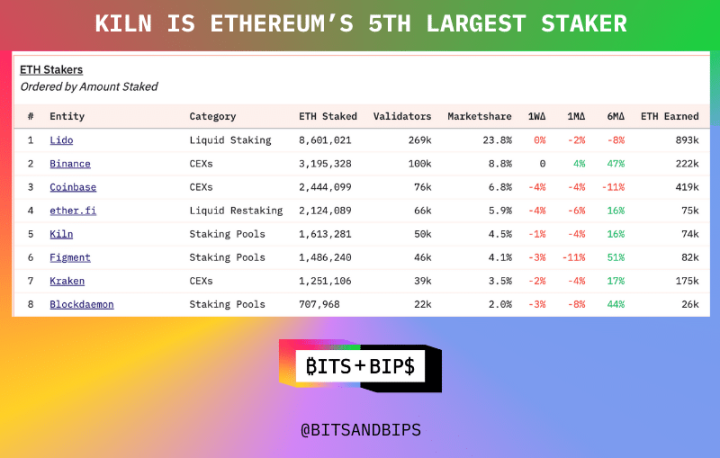

On September 9, staking service provider Kiln, which manages $15 billion in assets and provides security support for multiple proof-of-stake networks, experienced a security incident. As a result, Kiln preemptively unstaked all of its ETH holdings. For reference, Kiln is currently the fifth-largest ETH staking institution, managing over 1.6 million ETH. As shown in the chart above, this action directly caused the Ethereum "exit queue" (the amount of ETH waiting to be unstaked) to surge from just over 500,000 ETH to more than 2.5 million ETH.

(Dune Analytics)

However, "exit" will eventually lead to "return"—once Kiln determines that the network is secure, all of its previously unstaked ETH will re-enter the staking queue. This "return" point may coincide with the explosive period of three other major sources of staking demand, at which time the staking wait time for Ethereum could significantly extend.

Other Key Sources of Demand

Digital Asset Treasuries (DAT)

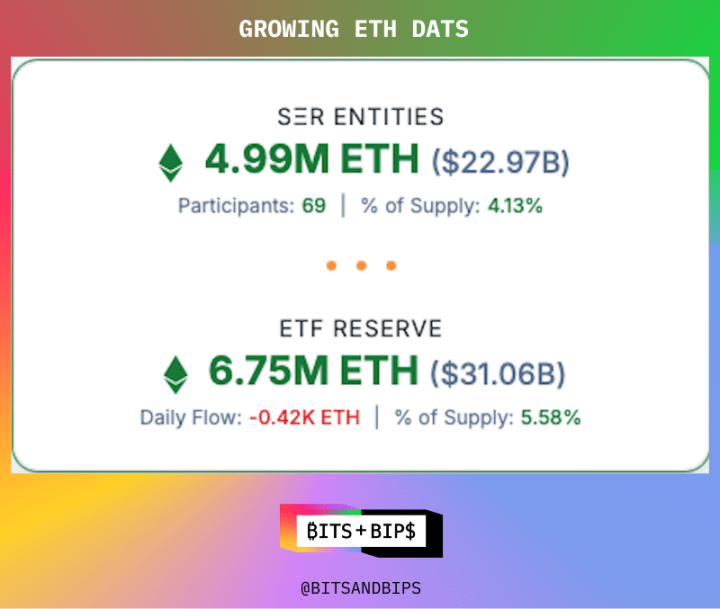

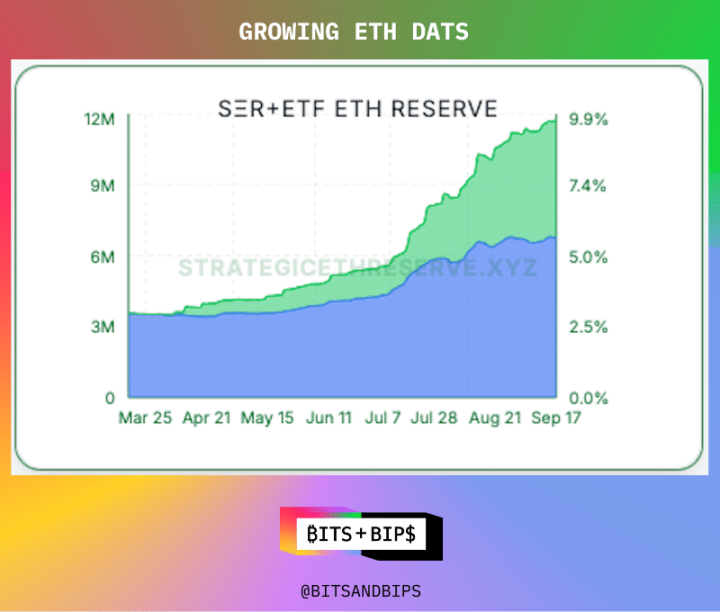

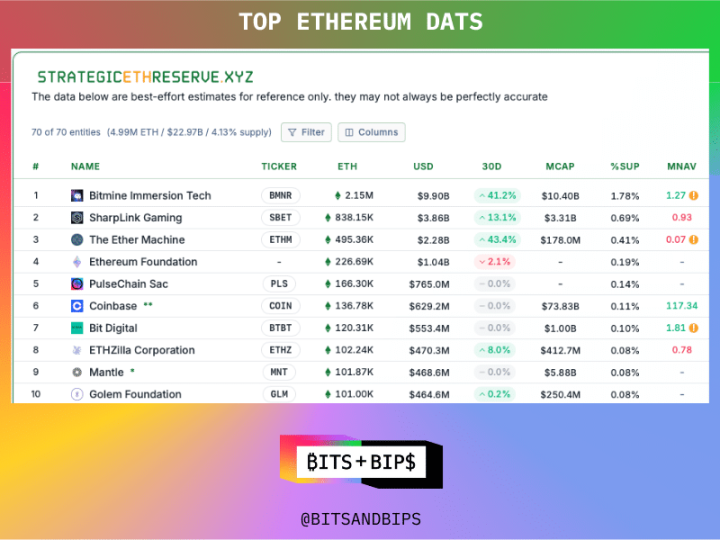

If 2024 is the "Year of the ETF," then 2025 is undoubtedly the "Year of Digital Asset Treasury (DAT) Companies." Aside from Bitcoin, ETH is the highest-valued asset locked in digital asset treasuries. According to data aggregation platform "Strategic ETH Reserves," companies like Bitmine Immersion, Ether Machine, and Sharplink Gaming currently hold a total of 499,000 ETH, valued at $2.297 billion (see the chart below). These companies' ETH holdings have grown rapidly, nearing the holdings of ETH spot ETFs—currently, ETH spot ETFs hold a total of 675,000 ETH, valued at just over $3.1 billion.

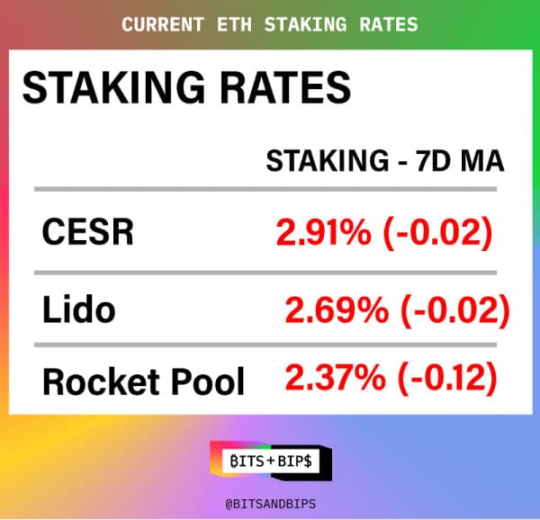

(Strategic ETH Reserves)

ETH supporters believe that this asset is more suitable for crypto asset treasury companies primarily because these companies can earn passive income by staking ETH. According to the "Compound Ethereum Staking Rate" (CESR, a daily benchmark rate representing the average annual staking yield of the Ethereum validator community), the current annual staking yield for ETH is 2.91%—however, this yield will adjust with fluctuations in ETH prices and changes in the total amount staked at specific times. Chris Perkins from Coinfund stated that this "yield" can be likened to the "London Interbank Offered Rate (LIBOR)" in the Ethereum space, representing the "risk-free rate" in that ecosystem. It is important to note that if using liquid staking tools like Lido or Rocket Pool, the actual yield will be lower than 2.91% due to additional fees charged by the platforms.

(Rho Protocol)

Additionally, unlike Bitcoin (which, despite its capped supply of 21 million, remains an inflationary asset), Ethereum's current mechanism is set to become a deflationary asset "when network usage is sufficiently high."

As various digital asset treasury companies compete to increase their ETH holdings (with the leader being Bitmine Immersion, owned by Tom Lee, holding ETH valued at $9.9 billion), they will quickly stake the additional ETH to start accumulating returns as soon as possible. Given that most of these companies raised their funds this summer, this "post-increase staking" action is likely one of the core reasons for the previous expansion of the Ethereum staking queue.

Kam Benbrik, research director at institutional staking service provider Chorus One, pointed out: "A significant portion of the new staking volume comes from digital asset treasuries like Sharplink—Sharplink is the second-largest digital asset treasury, holding about $3.6 billion in ETH, and has publicly announced that 'nearly 100% of its holdings are used for staking.' We expect the staking queue to further expand, and one of the core driving factors is Bitmine. On-chain data shows that Bitmine has not yet started staking its ETH holdings, and as the largest ETH digital asset treasury, once it begins staking, it will significantly impact the size of the Ethereum staking queue." (Editor’s note: The author, Leeor, currently works at Chorus One as the head of the U.S. market.)

(Strategic ETH Reserves)

As these digital asset treasury companies plan to raise more funds, the likelihood of a similar increase in the size of the Ethereum staking queue in the future is very high.

However, it is still unclear what proportion of the funds raised by these companies has already been allocated for staking. In response to media inquiries from Unchained, Sharplink stated that "nearly 100% of ETH has been used for staking," while Ether Machine claimed that "over 90% of assets have been used for staking"; however, the current staking scale of Bitmine remains unclear—representatives from the company declined to provide specific data during an interview with Unchained, only suggesting to refer to the company's official website for information.

Mara Schmeidt, CEO of institutional staking service provider Alluvial, also believes that a significant amount of ETH held by digital asset treasuries remains "idle and unstaked." She stated: "Several well-known digital asset treasury companies have acquired ETH but have not yet used it for staking—these companies are all familiar names in the industry. We estimate that the amount of idle ETH could reach several billion dollars."

Staking ETFs

The second major source of demand is "staking Ethereum ETFs"—these ETFs are expected to receive approval from the U.S. SEC this fall and officially launch ETH staking operations. Although the SEC has postponed the approval decisions for several staking ETF applications from September 10 to October, the final approval deadline is approaching. Bloomberg analyst James Seyffart expects these ETFs to be approved in mid to late October.

Mara Schmeidt shares Seyffart's view, stating: "So far, the core issue facing staking ETFs is not SEC approval but tax issues or trust-related issues for grantors. I am highly confident that by October, the path for ETFs to engage in staking operations will be completely clear—this is clearly the most influential event, and we will see a significant increase in ETH staking participation. The scale of capital inflow could be enormous, so the phenomenon of Ethereum staking queues will not disappear in the coming months."

Holiday Optimism

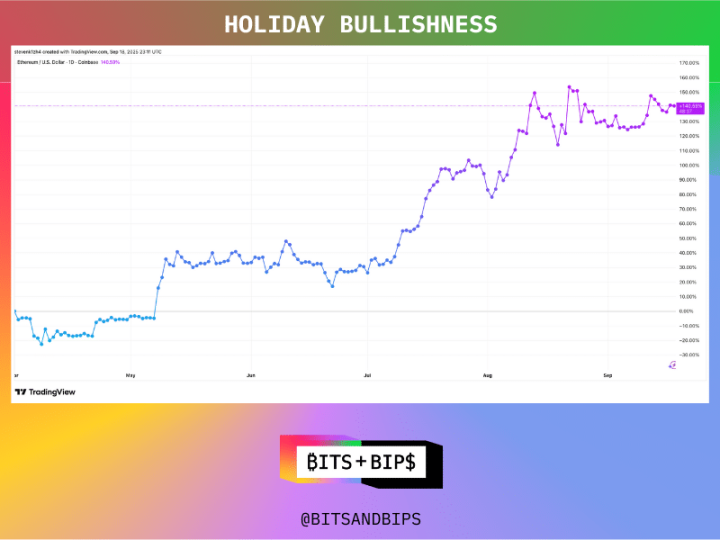

Additionally, despite ETH having seen a significant price increase this year (up 36.6% year-to-date, and up as much as 140.59% since April 1), considering that the fourth quarter is historically a "bullish cycle" for the cryptocurrency industry, ETH may still experience a new round of price increases in the fourth quarter of this year.

(TradingView)

In past cycles, ETH has performed particularly well in the fourth quarter: a return of 142.81% in Q4 2017 and a return of 22.59% in Q4 2021. If historical patterns repeat, the surge in ETH demand will simultaneously drive the expansion of the staking queue.

(Coinglass)

Revisiting Kiln: The Returning Staking Demand

In terms of overall scale, Kiln and its management of 1.6 million ETH may not seem particularly large, but the key point is that the funds from the four major sources of demand will flood into the same staking queue around the same time. Unchained has attempted to contact Kiln to inquire when it plans to restart ETH staking, but no response was received before the publication of this article.

Moreover, the concentrated explosion of these demands will significantly compress the "redundancy space" in the staking queue—once other large stakers enter the market, the waiting time in the queue will further extend. A typical case is: at the beginning of September, a "dormant wallet from the ICO era" suddenly staked 150,000 ETH (valued at $646 million).

Beneficiaries: Projects and Tokens in the Spotlight

Assuming users can endure the long waiting period in the staking queue, the activity in the staking queue will bring developmental dividends to Ethereum's "liquid staking ecosystem" and "re-staking ecosystem"—as users are more likely to choose efficient staking solutions that optimize returns.

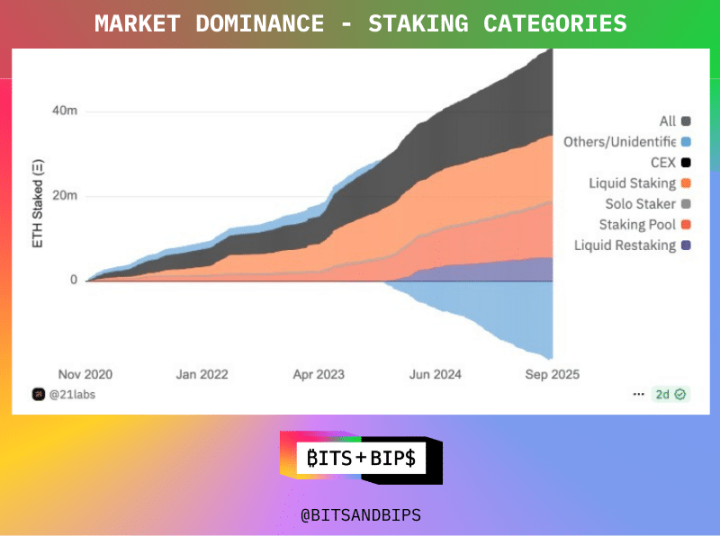

In the liquid staking field, leading projects Lido (with the corresponding token stETH) and Rocket Pool (with the corresponding token rETH) will directly benefit from users' demand for "additional yield strategies" and "liquidity." Lido controls about 24% of the ETH staking market share, with a total locked value (TVL) of $37 billion, reflecting a sustained and stable market demand; Rocket Pool's rETH has a total locked value of $2.8 billion, with its core advantage being a "higher degree of decentralization"—compared to Lido, this platform has more independent stakers (rather than institutional stakers).

Re-staking protocols may also experience explosive growth. These protocols provide compounded returns to users through "Active Validation Services (AVSs)" (i.e., "borrowing" security from already staked ETH), with yields (approximately 3.5%-5.5%) significantly higher than native staking (approximately 2.8%). Currently, leading projects in the re-staking field include:

- EigenLayer: Total locked value of $19 billion, industry-leading;

- Ether.fi: Total locked value exceeding $11 billion, enhancing the growth potential of its native token ETHFI through innovative strategies;

- Renzo (with the corresponding token ezETH): Total locked value of $1.5 billion.

As the demand for re-staking grows, the native tokens of these protocols (EIGEN, ETHFI, REZ) may see an increase in value.

(Dune)

Despite recent short-term capital outflows, the participation in Ethereum's liquid staking, liquidity re-staking, and staking pools has been on the rise in recent months, indicating that such on-chain activities are continuing to heat up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。