Written by: Yokiiiya

Foreword: The licensing requirements for engaging in the stablecoin payment industry, especially in Hong Kong, are much stricter than those for traditional financial businesses, and are closer to the regulatory standards of banks and other financial institutions.

Today, we will compare the familiar POS machine payment method to better understand how "strict" this new field really is.

1. Comparison of Two Payment Scenarios

Traditional POS Machine Payment:

Customer swipes card → POS machine reads card information → Information is transmitted to UnionPay/card organization through acquirer (such as Lakala, UnionPay Business) → Card organization requests verification and deduction from the customer's issuing bank → Funds are settled and arrive in the merchant's account after T+1 day.

Stablecoin Payment:

Customer scans the merchant's payment code → Customer's digital wallet prompts payment confirmation → Customer clicks confirm → An equivalent amount of stablecoin is transferred directly from the customer's wallet to the merchant's wallet over the blockchain network within seconds.

Because the stablecoin payment chain is shorter and faster. However, due to this "direct" and "borderless" nature, regulation is much stricter.

Currently in China, according to the 2021 notice from ten departments, all activities related to virtual currencies are illegal, and services provided by overseas exchanges to domestic residents are also considered illegal financial activities; financial institutions and payment institutions are not allowed to engage in or provide services for them. This means that the issuance/trading/exchange of stablecoins and providing brokerage and intermediary services for them are currently prohibited.

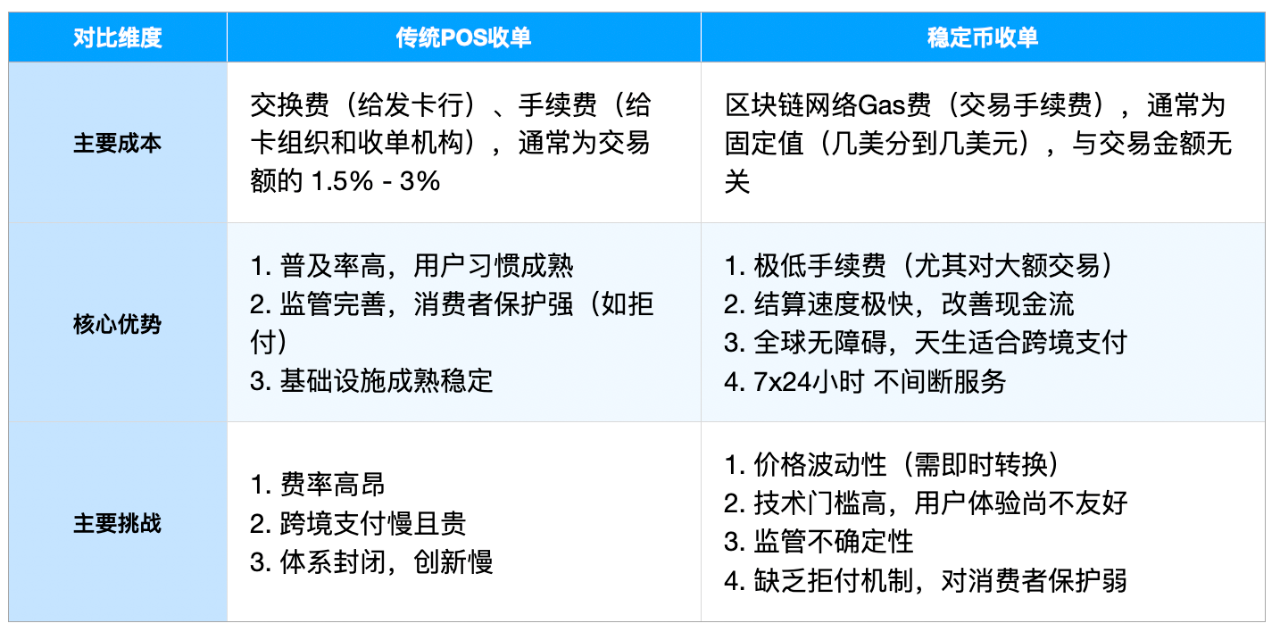

Comparison of costs between the two payment methods

The core application scenarios for stablecoin acceptance are very clear:

Local payments in high-fee industries: such as luxury goods, B2B large transactions.

Cross-border e-commerce: bypassing complex correspondent bank networks to complete cross-border settlements directly, quickly, and at low cost.

Fields requiring 24/7 instant settlement: such as digital goods, API service payments, etc.

2. Core Differences Comparison

We can use a more vivid analogy to understand the fundamental differences in qualifications between the two:

Doing POS machine acceptance is like joining a mature "payment club." You need to apply to the central bank for a payment business license (payment license) to prove that you have the capability to safely handle cash flow and manage risks. After that, you can provide payment services to merchants under existing rules from UnionPay, Wanglian, etc.

Issuing stablecoins or providing stablecoin acceptance services is like opening a small "digital payment bank." The regulatory requirements for you are based on the standards of banks and other deposit-taking institutions.

3. Conclusion

Through comparison, we can see a clear regulatory logic: the balance between safety and innovation.

For mature POS acceptance, the regulatory framework is already very well established, with the core focus on ensuring the stable and safe operation of this large system.

For the emerging stablecoin payment, the regulatory attitude is more cautious and strict. It employs an almost "bank-level" entry threshold to ensure that only the strongest and most compliant players can enter, thereby reducing the potential global risks that this efficient but powerful new tool may bring from the source.

Therefore, obtaining stablecoin-related licenses signifies that this institution or company has received top-level regulatory recognition in terms of capital strength, compliance risk control, and application scenarios.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。