A rough start to the week sent both bitcoin and ether exchange-traded funds (ETFs) sliding, as investors trimmed exposure following a stretch of volatile flows. Monday’s numbers reveal significant withdrawals across both markets, leaving no ETF untouched by red.

Bitcoin ETFs recorded a collective outflow of $363.17 million, their heaviest daily exit since early September. Fidelity’s FBTC bore the brunt with a $276.68 million withdrawal, while Ark 21Shares’ ARKB followed with $52.30 million in redemptions.

Grayscale’s GBTC lost $24.65 million, and Vaneck’s HODL closed out with $9.54 million in exits. Not a single fund saw fresh inflows. Trading activity remained strong at $3.43 billion, but net assets dipped to $148.09 billion.

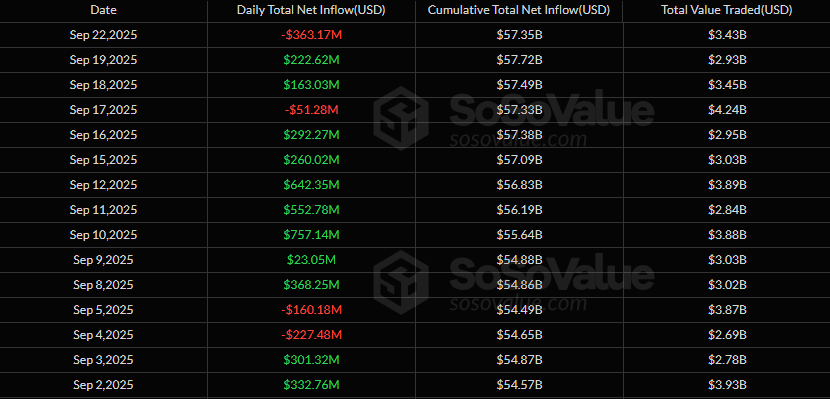

Monday, Sept. 22, was the heaviest day of outflows for BTC ETFs so far in September. Source: Sosovalue

Ether ETFs also turned lower, registering $75.95 million in total outflows. Fidelity’s FETH saw the steepest losses at $33.12 million, with Bitwise’s ETHW close behind at $22.30 million. Blackrock’s ETHA logged a $15.07 million exit, while Grayscale’s Ether Mini Trust slipped by $5.45 million. The day’s value traded reached $2.06 billion, leaving net assets at $27.52 billion.

The synchronized pullback suggests that crypto ETF investors are moving cautiously, pulling capital after last week’s inflow-heavy rebound. With both bitcoin and ether ETFs starting the week in the red, all eyes will be on whether Tuesday brings a reversal or deepens the outflow streak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。