Written by: White55, Mars Finance

Market Turmoil: A Silent "Long-Short Squeeze"

On September 22, 2025, the cryptocurrency market experienced extreme volatility once again. Bitcoin (BTC) initially held steady at the $115,000 mark during the Asian trading session but suddenly plummeted within hours, breaking through key integer support levels, and hitting a low of $111,800, with a daily fluctuation exceeding 5%. Ethereum (ETH) also saw a sharp decline, dropping from around $4,500 to $4,077, a daily loss of 6.2%. Mainstream altcoins like Solana (SOL) followed suit, and the market was instantly engulfed by panic.

According to Coinglass data, the total liquidation amount across the network in the past 24 hours reached $1.7 billion, setting a new high for the year. Among these, long liquidations accounted for over 95% ($1.617 billion), while short liquidations made up less than 5%, highlighting that leveraged long positions faced a "precise strike" during this downturn. The largest single liquidation occurred in the BTC-USDT contract on the OKX exchange, valued at $12.74 million—this could represent the sudden demise of a whale or institutional account, or a brutal reflection of market liquidity traps.

Reasons for the Decline: Good News Fully Priced In and Whale Profit-Taking

1. Federal Reserve Rate Cut: "Good News Fully Priced In" After Expectations Were Met

Although the Federal Reserve announced a 25 basis point rate cut at the September meeting, aligning with market expectations, the policy implementation did not sustain the previous euphoria in risk assets.

Federal Reserve Chairman Jerome Powell clearly stated that this rate cut was a "risk management" measure, not a signal of aggressive easing, and emphasized that future decisions would be "assessed at each meeting."

This cautious stance has cooled market expectations for consecutive large rate cuts, weakening the momentum for traditional funds to flow into the crypto market. Historical data shows that while the rate cut cycles in 2019 and 2020 ultimately drove the crypto market up, they were accompanied by severe volatility and expectation corrections in the short term.

2. Whale Sell-Off: Phase Profit-Taking by ETH Whales

On-chain data revealed another layer of pressure: concentrated cashing out by ETH whales.

Glassnode data shows that on September 18, whales holding 1,000 to 10,000 ETH cashed out $1.5 billion in a single day, and when including larger holders' actions, the total cashing out reached $2.15 billion.

This sell-off behavior is reminiscent of the historical moment when ETH broke above $3,500 in July—at that time, active buying by the U.S. Treasury offset selling pressure, but this time, the Treasury company Bitmine holds $9 billion in ETH (with a cost basis of $3,949). If prices continue to fall below the cost line, its ability to increase holdings may be limited, further weakening buying support.

3. Technical Resistance and Overheated Market Sentiment

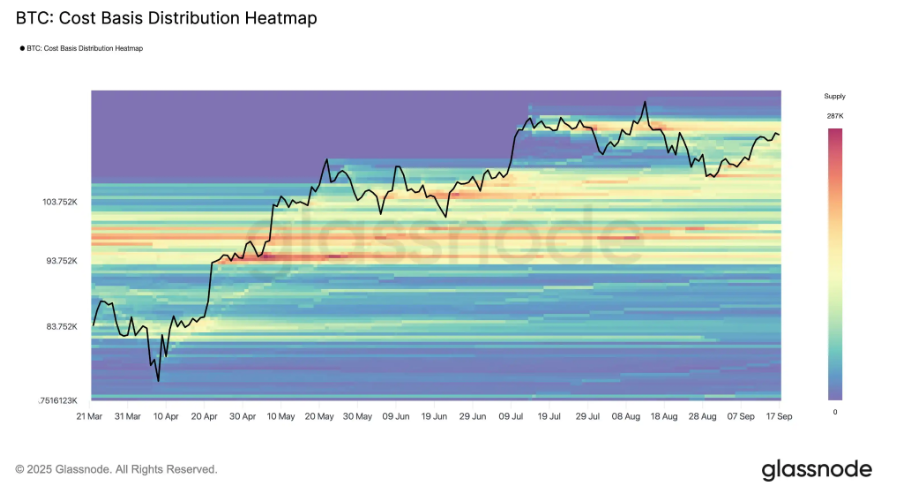

Bitcoin's CBD (Cost Basis Distribution) heatmap shows significant supply congestion around $117,000, forming a key resistance zone. The failure to effectively break through this level has dampened bullish confidence. Meanwhile, market sentiment indicators have shown signs of overheating: the cryptocurrency Fear and Greed Index has fallen from a high of 80 to 61 but remains in the "Greed" zone; the Altcoin Season Index is nearing an overheated level of 65, which historically signals a risk of correction.

Is the Bull Market Over? Cycle Reconstruction in the Process of Institutionalization

1. Differentiation of Institutionalization and Historical Cycles

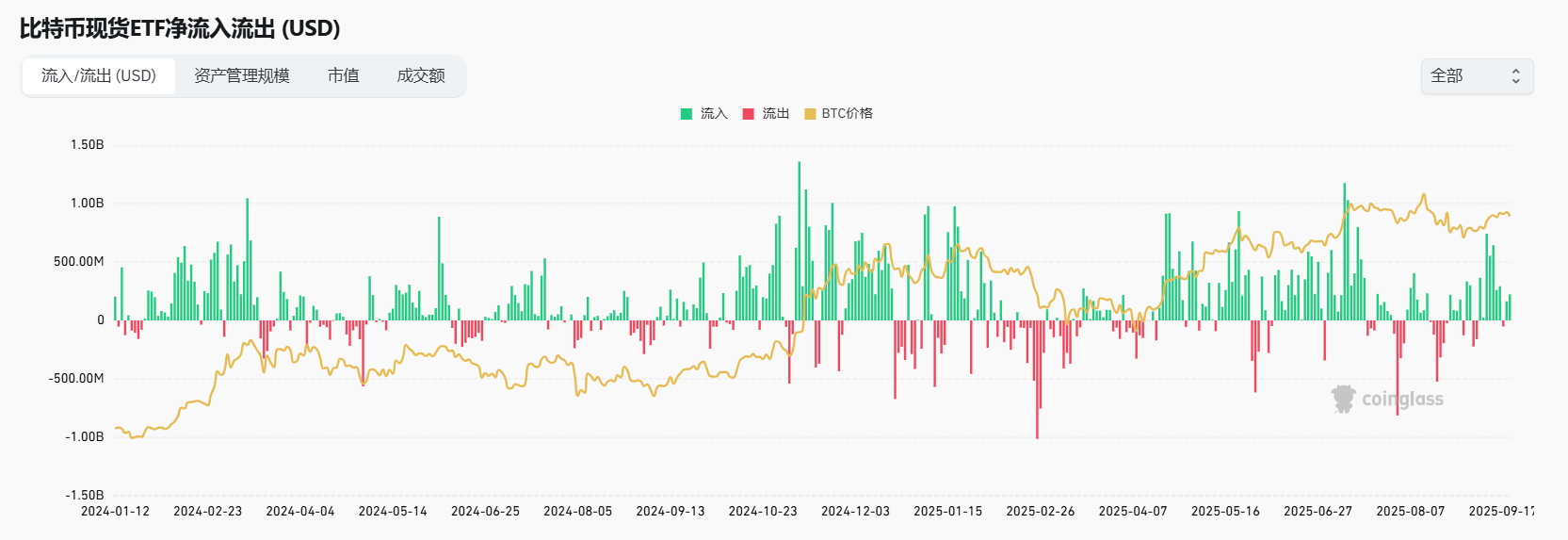

Contrary to traditional beliefs, the core driving force of this bull market has shifted from retail investors to institutions. Asset management giants like BlackRock have been continuously increasing their holdings through Bitcoin spot ETFs, with a net inflow of $246 million on September 19 alone; Ethereum ETFs saw a net inflow of $478 million during the same period, with total assets under management accounting for 5.51% of ETH's market cap.

This structural change has reduced market volatility but has also extended the cycle span. As Michael Saylor stated: "Early holders cash out, institutional funds enter, and market volatility decreases."

While historical cycle patterns (such as the 4-year bull-bear cycle) suggest a potential peak in 2025, the qualitative change in institutional participation reduces the probability of "simply repeating history." For instance, Bitcoin's volatility has dropped to its lowest level since 2020, attracting more conservative institutions to build positions.

2. Divergence of On-Chain Indicators and Fund Flows

Despite the severe short-term correction, on-chain data still shows long-term optimistic signals:

Long-Term Holder Behavior: Glassnode's long-term holder actual profit-loss ratio indicates that profit-taking activities have receded from the peak in March, resembling the pattern of a rebound after a correction in 2021;

Exchange Net Outflows: The net outflow of BTC from exchanges has surged, reflecting a rising "HODL" sentiment;

DeFi and Staking Ecosystem: In a low-interest-rate environment, the attractiveness of staking and yield-generating DeFi projects has increased, with ETH staking on the Beacon Chain surpassing 12.6 million ETH, exemplified by a whale staking $1.25 billion in ETH.

3. Macroeconomic Environment and Policy Uncertainty

The Federal Reserve's slowing rate cut pace (the dot plot indicates only two more rate cuts this year) may suppress the performance of risk assets.

Additionally, regulatory dynamics have become a potential variable: the U.S. and EU are tightening compliance requirements for stablecoins and ETFs, and Grayscale has submitted a Dogecoin ETF application, which, if approved, could further broaden funding channels, but non-compliant projects will face increased pressure.

Future Outlook: Structural Opportunities Amidst Volatility

1. Short-Term Trend: Bottoming Out and Key Support Testing

Technically, Bitcoin's $110,000 is a key support level, having been validated multiple times over the past few months. If it breaks below, it may test the $101,000-$105,000 range;

Ethereum needs to hold above $4,000; if it fails, it may test the 120-day moving average and the 0.382 retracement level around $3,800, with sideways fluctuations potentially lasting 30-60 days, and a clear bottom may emerge in late October.

2. Mid to Long-Term Logic: Institutional Funds and Ecological Innovation

Bitcoin as "Digital Gold": Its anti-inflation properties remain attractive in a low-interest-rate environment, especially when traditional asset returns decline;

Ethereum Staking ETF: If approved by the end of the year, it could bring in new funds;

Altcoin Differentiation: BNB, supported by the Binance ecosystem, has seen its market cap surpass $140 billion, reaching a historical high; meanwhile, tokens lacking real applications may be eliminated.

3. Investor Strategy: Risk Management and Value Anchoring

Reminder: "The last 10% of a bull market may not be worth risking all profits." It is recommended to adopt the following strategies:

Reduce Leverage: Avoid using high leverage during increased volatility; the painful lessons from long liquidations highlight the priority of risk control;

Gradual Operations: Take profits in batches on profitable positions, keeping cash on hand for potential pullback opportunities;

Focus on Fundamentals: Prioritize projects with real applications and strong compliance (such as BTC, ETH, BNB), and steer clear of purely speculative hype.

Conclusion: The Bull Market is Not Over, but the Rules of the Game Have Changed

This sharp decline is not the beginning of a bear market but a necessary adjustment in market structure during the process of institutionalization. The liquidity benefits from the Federal Reserve's rate cuts have not yet been fully released, but will only truly manifest after mid-December; whale sell-offs and retail leverage liquidations have accelerated short-term clearing, laying the groundwork for healthy upward movements in the future. Historical experience shows that the crypto market has never risen straight up but has redistributed wealth through severe volatility.

For investors, the current period is both a time of risk and opportunity. If Bitcoin holds its key support and institutional funds continue to flow in, the market is still expected to reach new highs by the end of the year; however, if the macro environment deteriorates or regulatory black swans emerge, one must be wary of deep corrections. Only by maintaining rationality and abandoning fantasies of quick wealth can one survive and profit in the new cycle of the crypto market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。