Authors: Zhao Qirui, Liang Yu

Editor: Zhao Yidan

As innovations in the private sector frequently dominate the headlines, a more profound and far-reaching transformation is quietly taking place: the underlying rules and key infrastructure of the multi-trillion-dollar Real World Asset (RWA) market are being laid out by governments and sovereign entities around the world. These state-led initiatives are not monolithic; they represent a diverse array of strategic ambitions, ranging from enhancing domestic financial efficiency to projecting international economic influence.

This article aims to guide readers on a global exploration, examining the regulatory sandboxes in Asian financial centers, the Middle East, and Europe, as well as the pragmatic infrastructure applications emerging in North America. In this process, a core tension gradually emerges: on one end is the ecosystem development led by regulators, pursuing openness and transparency; on the other end is the business ventures driven by state capital, whose ultimate goals and governance structures often remain deliberately vague. Understanding the interplay between these two forces can help us grasp the future trajectory of RWAs.

Chapter 1: Asian Pioneers — A Race of Two Visions

Asia has become a core testing ground for state-led RWA development, where different strategic models collide fiercely, vying to shape the future of digital finance. From the top-level design of financial centers to the inclusive finance explorations in emerging markets, and the overseas layouts driven by state capital, a complex and diverse picture is unfolding.

1.1 Hong Kong and Singapore: The Battle for Digital Asset Supremacy

As the two major financial centers in Asia, Hong Kong and Singapore's competition has extended from traditional finance to the realm of digital assets. However, upon closer examination, their strategies reveal subtle yet profound differences. Singapore is committed to building an open and collaborative global ecosystem, while Hong Kong focuses more on creating a world-class financial market infrastructure controlled by sovereign entities.

Singapore's "Project Guardian": Led by the Monetary Authority of Singapore (MAS), its most distinctive feature is its collaborative model of "inviting guests." The project brings together over 40 top global financial institutions (such as JPMorgan, Apollo Global Management) along with international regulatory partners like the UK's Financial Conduct Authority (FCA) and Japan's Financial Services Agency (FSA). This model reveals MAS's deep strategic considerations: the primary goal of Project Guardian is not only to test technology but also to address the core issue of interoperability from the outset. By establishing a shared industry framework (such as the Guardian Fund framework), MAS aims to position Singapore as a neutral and trusted hub where different digital asset networks can converge and communicate, thereby avoiding the common "fragmentation" trap seen in the early stages of technology application. Its pilot projects cover various asset classes, including funds, bonds, and foreign exchange, demonstrating its determination to build a comprehensive ecosystem rather than a single product. The tokenized notes issued by DBS on Ethereum are a commercial outcome of this open environment, significantly lowering the investment threshold of traditional structured products from $100,000 to $1,000.

The Hong Kong Monetary Authority (HKMA), on the other hand, has adopted a more focused and sequenced approach, advancing its digital asset strategy through two major projects.

- "Project Evergreen" and Tokenized Green Bonds: This is Hong Kong's "proof of concept" pioneer. The HKMA has assisted the government in successfully issuing two batches of large-scale tokenized green bonds: the first batch of HKD 800 million bonds in February 2023, and a multi-currency bond worth HKD 6 billion issued in February 2024. These are real-world transactions that powerfully demonstrate the practical benefits of tokenization in enhancing issuance efficiency (reducing the settlement cycle from T+5 to T+1) and increasing transparency, solidifying Hong Kong's position as a green finance center.

Project Evergreen has proven the feasibility of the product, gaining market confidence and political support. This "build the nest first, then attract the phoenix" model ensures that when the market scales up in the future, its core settlement layer will be firmly in the hands of the HKMA, thus gaining unique advantages in efficiency and regulation. This stands in stark contrast to Singapore's more decentralized, partnership-dependent ecosystem model.

1.2 Mainland China: A Dual Narrative of Cautious Exploration and Ambiguous Ambitions

China's RWA strategy presents a unique dual structure: on one hand, under the compliance framework within the mainland and Hong Kong, the government encourages state-owned enterprises to leverage blockchain technology to enhance industrial and financial efficiency; on the other hand, some overseas RWA projects with vague backgrounds and low transparency seem to be exploring a new path to extend national economic influence.

Policy Direction of the Shanghai State-owned Assets Supervision and Administration Commission: The "Three Persistences" strategy proposed by the Shanghai State-owned Assets Supervision and Administration Commission in 2025 clearly identifies asset digitization (RWA) as one of the key exploration scenarios for "integration of production and data," providing top-level policy support for state-owned enterprises to participate in RWA experiments.

Shenzhen Futian Investment Holding's Public Chain Bonds: This is a milestone case. As a district state-owned enterprise, Shenzhen Futian Holding Group successfully issued RWA digital bonds worth 500 million RMB through the public chain Ethereum in Hong Kong. This move is highly significant. Against the backdrop of strict restrictions on cryptocurrency trading in mainland China, state-owned capital pragmatically chose the public chain infrastructure most familiar to global developers and investors in Hong Kong, an international financial center. This indicates that its decision is not based on ideology but purely on instrumental rationality—utilizing globally recognized technical standards to attract international capital and broaden financing channels.

- Greenland Group's Licensed Layout: As a subsidiary of Shanghai state-owned enterprise Greenland Holdings, Greenland (Asia) Securities has clearly planned to explore RWA and other digital asset businesses after upgrading its virtual asset-related licenses (VA4, VA9) issued by the Hong Kong Securities and Futures Commission (SFC). This represents a model where state-owned enterprises become licensed players through a "compliance first" approach, steadily entering the digital asset field within the existing regulatory framework.

1.3 Thailand's G-Token: The Path to Inclusive Sovereign Debt

In stark contrast to other regions in Asia that focus on institutional business or capital outflows, Thailand's G-Token project showcases the unique potential of RWA in promoting domestic financial inclusion.

Led by the Thai Ministry of Finance, G-Token is the world's first tokenized government bond explicitly aimed at domestic retail investors. The initial issuance amount is 5 billion Thai Baht (approximately $153 million), with a minimum investment threshold as low as 100 Baht, aimed at allowing ordinary citizens to participate in purchasing government bonds traditionally dominated by large institutions. The project collaborates directly with local licensed digital asset exchanges (such as KuCoin Thailand) regulated by the Thai Securities and Exchange Commission for distribution, directly linking national credit with the emerging digital asset ecosystem.

The issuance of G-Token has dual strategic significance. For the government, it opens a potentially more efficient and lower-cost new channel for public debt financing. For the market, it greatly promotes the legitimization and maturation of the domestic digital asset industry by providing a "blue-chip" digital asset backed by national credit. This is an example of cleverly combining public debt management with financial market development.

Chapter 2: Pioneer Models Beyond Asia

Expanding our view globally, we can see a diverse picture of RWA development driven by different motivations across countries, from reshaping the financial core to strengthening key industries and upgrading government foundational functions.

2.1 Switzerland's "Project Helvetia": Reconstructing the Core of Finance

Switzerland's "Project Helvetia" is arguably the most systemically significant RWA exploration globally. It does not focus on the tokenization of a specific asset but attempts to fundamentally rebuild the settlement layer of the entire financial system.

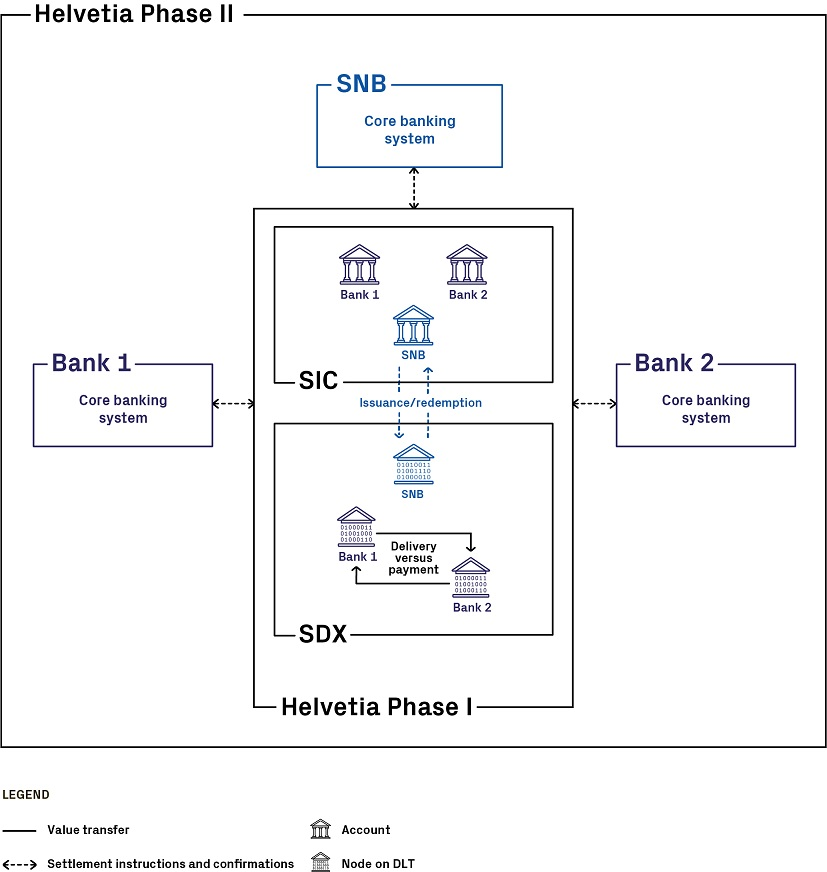

This landmark project, jointly initiated by the Swiss National Bank (SNB) and the Bank for International Settlements (BIS) Innovation Hub, has a core mission to test how to use the safest settlement asset—central bank money—to settle tokenized assets on a distributed ledger technology (DLT) platform. The project explores two parallel paths: one connects the DLT platform (SIX Digital Exchange - SDX) with the existing real-time gross settlement (RTGS) payment system; the other directly issues wholesale central bank digital currency (wCBDC) on the DLT platform to achieve synchronized delivery of assets and funds. Currently, the project has entered its third phase, which involves real-time pilots using actual wCBDC and will continue at least until 2027, demonstrating its long-term and serious nature.

Project Helvetia is a direct response from the central banking community to the potential financial fragmentation and disintermediation risks posed by private digital currencies and stablecoins. By proactively developing wCBDC for the wholesale market, SNB and BIS ensure that even if the underlying technology of assets shifts to DLT, central bank money remains the "ballast" of the financial system. This is a key strategic move to maintain monetary sovereignty and financial stability in the digital age.

2.2 Dubai: Shaping the Skyline of Global Capital Tokenization

Dubai's real estate tokenization project is a clear industrial policy tool led by the Dubai Land Department (DLD). Its goal is to leverage RWA technology to enhance the liquidity, accessibility, and global appeal of its core economic pillar—the real estate sector.

The project is collaboratively promoted by DLD, the Virtual Assets Regulatory Authority (VARA), the Central Bank of the UAE, and the Dubai Future Foundation, aiming to split property ownership into digital tokens. The investment threshold has been lowered to approximately $545 (2000 dirhams), significantly broadening the investor base. Notably, all transactions during the pilot phase are settled in the local currency dirham rather than cryptocurrency, reflecting a cautious attitude that encourages innovation while strictly controlling risks. Through officially recognized platforms like Prypco Mint, the first batch of tokenized property projects sold out within minutes, demonstrating strong market demand.

The essence of the Dubai model lies in the close collaboration between its industry promoter (DLD) and financial regulator (VARA). DLD is responsible for driving business plans to attract capital, while VARA simultaneously builds a tailored regulatory framework to provide investor protection and compliance assurance. This "dual-driven" strategy aims to position Dubai as a leading, regulated center for tokenized real estate globally, transforming local real estate into a financial product available for global trading.

2.3 The United States: Pragmatic Modernization of Public Infrastructure

In stark contrast to top-down, finance innovation-focused projects in other parts of the world, the case from Bergen County, New Jersey, reveals another fundamental motivation for national entities adopting blockchain technology: the modernization of public management aimed at enhancing efficiency, security, and cost savings.

The Bergen County Clerk's Office is collaborating with the private company Balcony to digitize 370,000 real estate contracts valued at $240 billion across the county, recording them on the Avalanche public blockchain. The project's goal is not to create new financial products but to address real administrative pain points: reducing contract processing time by over 90% and significantly lowering fraud, property disputes, and management errors. Specifically, the project will record the hash values of contract documents (a type of digital fingerprint) on the blockchain rather than the complete documents themselves, utilizing the immutability of blockchain to provide a cheap and reliable layer of anti-counterfeiting and verification for the existing filing system.

This project represents the "substance rather than the appearance" of RWA applications. It demonstrates that in a jurisdiction like the United States, where regulation is decentralized and there is a cautious attitude towards government intervention in the financial sector, the most direct and scalable application scenario for state entities adopting blockchain may lie in improving fundamental public services. This is not about financial innovation but about "good governance." This model, due to its non-controversial nature and direct value to taxpayers, may be easier for thousands of local governments in the U.S. to replicate than issuing financial products.

Chapter 3: Comparative Analysis and Critical Outlook

By synthesizing the above cases, we can outline several typical models of state participation in the RWA field and identify the fundamental challenges facing the entire industry.

3.1 The Spectrum of State Participation: A New Typological Classification

The roles played by governments in the RWA field vary widely and can be summarized into the following four main types:

Regulatory Architect: Represented by Singapore, Hong Kong, and Switzerland. Central banks and financial regulatory agencies actively design the top-level architecture of the entire market, focusing on setting standards, ensuring interoperability, and maintaining systemic stability. Their goal is to build a secure, efficient, and globally integrated digital financial system.

State-Owned Enterprise Commercial Pioneer: Represented by Shenzhen Futian Investment Holding and Greenland Group. Large state-owned enterprises act as commercial entities, leveraging their capital and government support to conduct targeted RWA experiments in domestic and international markets to gain competitive advantages and explore new financing models.

Geopolitical Operator: Represented by opaque projects with a Chinese background. Entities connected to the state participate in governance-ambiguous, low-transparency RWA projects. Their motivations may extend beyond pure commercial returns to include ensuring strategic resources, projecting geopolitical influence, or establishing alternative capital circulation channels outside the Western-dominated financial system.

Government Service Provider: Represented by Bergen County in the U.S. and the Dubai Land Department. Government departments utilize tokenization technology to improve specific public services or boost a key domestic industry, with core demands for efficiency, transparency, and economic growth.

3.2 Key Challenges and Unresolved Mysteries

Transparency Deficit: The opaque projects analyzed in the report reveal significant risks in the industry. When the external world cannot verify the legal status of the "Odin Foundation" or the real business of "Terra Nexus," these projects are fundamentally untrustworthy from the perspective of institutional investors. This lack of transparency could damage the reputation of the entire RWA industry, leading to "bad money driving out good."

The Dilemma of Public vs. Private Chains: Case studies show a clear divergence in technical routes. Switzerland and Hong Kong are building their core infrastructure on private, permissioned DLTs to pursue maximum control and compliance. In contrast, Shenzhen Futian Investment Holding and Bergen County are leveraging the global network effects and interoperability of public chains like Ethereum and Avalanche. This reflects a trade-off between control and openness. Whether and how these two worlds can interconnect in the future remains a significant unresolved issue.

Fragmentation and Coordination of Regulation: Although Singapore's Project Guardian is actively promoting the establishment of global standards, the reality is that the development of global RWAs remains within independent national-level sandboxes (Hong Kong, Dubai, Switzerland), each operating independently. This regulatory fragmentation is a core obstacle to forming a truly global, highly liquid RWA market.

The Uncertain Path to Widespread Adoption: The target audiences of different projects vary greatly. Project Helvetia serves wholesale financial institutions, Thailand's G-Token targets domestic retail investors, while Dubai aims at global real estate investors. The technology, compliance, and user experience required to serve different users are entirely different. Whether RWA can truly transition from a niche market for institutions to mainstream retail applications remains full of unknowns.

Conclusion: Inevitable Convergence

The analysis in this article indicates that state involvement in RWA is not a singular trend but a collection of diverse strategic actions reflecting the unique priorities of various countries. From the infrastructure competition in Asian financial centers to the ambiguous overseas layouts of Chinese state capital, from the profound reshaping of the financial future by the Swiss central bank to the pragmatic pursuit of administrative efficiency by local governments in the U.S., RWA has become a new stage for great power competition and national governance innovation.

The "experimental phase" is rapidly coming to an end, and a new stage of strategic competition has begun. The core conflict in the future will revolve around two distinctly different paradigms: one represented by Singapore and Switzerland, pursuing openness, interoperability, and high transparency; the other reflected in certain projects, characterized by greater closure, opacity, and geopolitical strategic undertones.

The future of RWA will no longer be defined by a single technological breakthrough but will depend on the ultimate solutions to these geopolitical and regulatory tensions. Countries and economies that can successfully establish credible, scalable, and interoperable frameworks will not only attract trillions of dollars in capital but will also have the opportunity to write the rules of the next generation of global finance.

This is no longer a simple consideration of commercial interests but a delicate and intricate balance between corporate missions and national strategies. Beyond directly participating in the construction of dollar-denominated RWAs, is there a more challenging but strategically valuable "third path"—for example, focusing from now on building RWA infrastructure centered around the digital renminbi or renminbi stablecoins, even if this means initially bearing market cultivation costs and liquidity risks far exceeding those of peers? This requires decision-makers to transcend short-term financial statements and view the ultimate significance of each action with a rare long-term strategic vision and historical sense of responsibility.

Because one thing is certain: the emphasis of states on capital flows, financial security, and monetary sovereignty, along with their long-standing vigilance against the hegemony of the dollar, together form the most solid and untouchable "red line" in this chess game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。