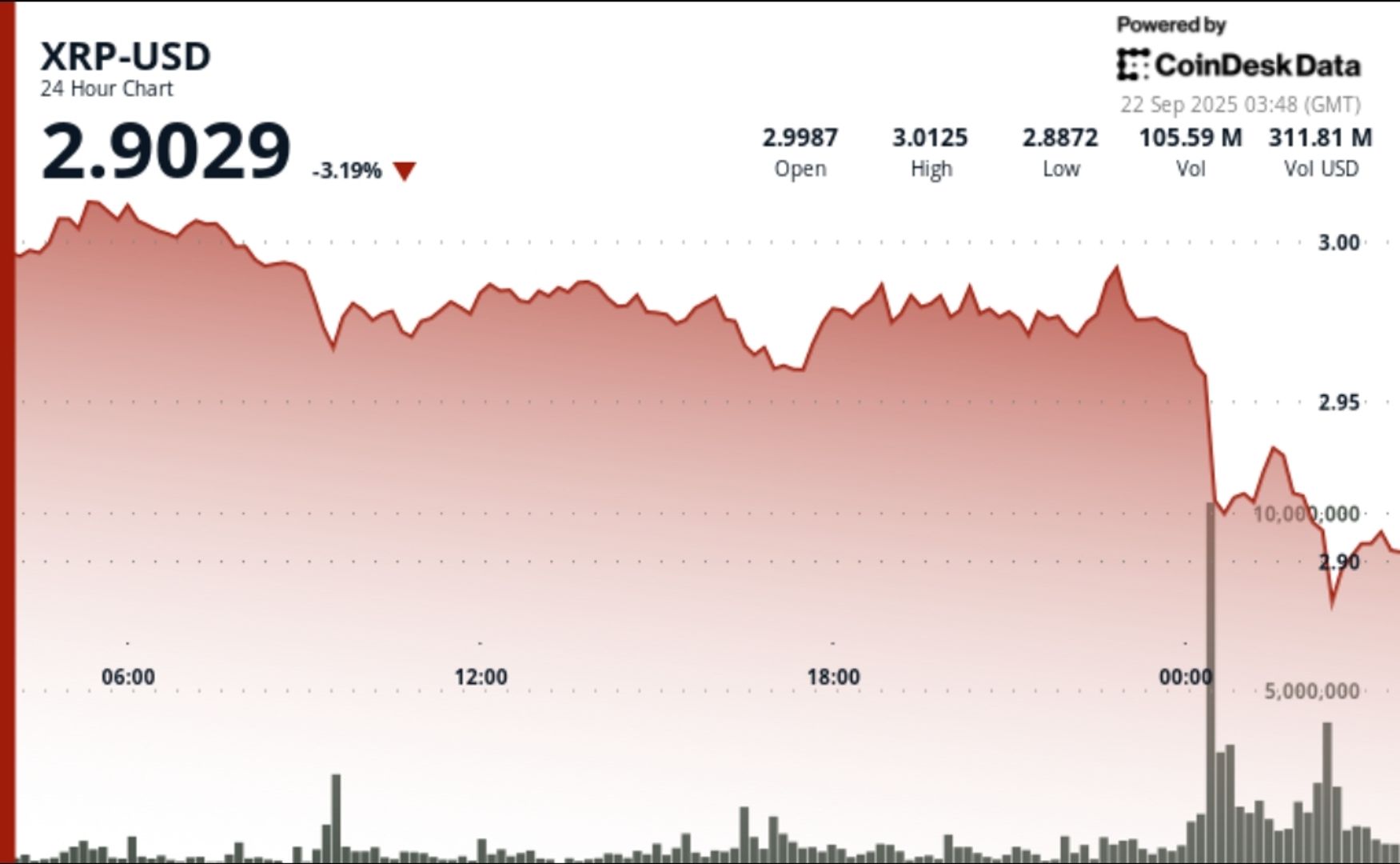

XRP endured a volatile 24-hour session from September 21 at 03:00 to September 22 at 02:00, swinging 3.46% between a $3.014 high and $2.910 low.

The selloff coincided with the debut of the first U.S.-listed XRP ETF, which set records with $37.7 million in opening-day volume, but institutional profit-taking overwhelmed the bullish catalyst.

News Background

• First U.S.-listed XRP ETF launched September 21, generating $37.7 million in day-one volume — the largest ETF debut of 2025.

• Federal Reserve policy easing remains in focus, with markets pricing near-certain September rate cuts that typically support digital assets.

• Analysts warn of structural consolidation despite ETF momentum, with resistance persisting near $3.00.

Price Action Summary

• XRP fell 3.46% during the 24-hour period, collapsing from $3.01 to $2.91 before closing at $2.92.

• Midnight crash drove price from $2.973 to $2.910, unleashing 261.22 million in volume — quadruple daily averages.

• Liquidations totaled $7.93 million during the rout, with 90% hitting long positions.

• Final 60 minutes saw XRP rebound from $2.92 to $2.94, only to retreat back to $2.92, creating a resistance cluster at $2.93-$2.94.

Technical Analysis

• Trading range: $0.104 span representing 3.46% volatility between $3.014 high and $2.910 low.

• Resistance established at $2.98-$3.00 following high-volume rejection.

• Support zone formed at $2.91-$2.92, tested repeatedly after the crash.

• Consolidation emerged near $2.92 in final hour as XRP failed to hold above $2.93.

• Volume explosion of 261M confirms institutional selling wave dominating overnight flows.

What Traders Are Watching

• Can XRP reclaim and sustain closes above $3.00, or does resistance at $2.98-$3.00 cap upside?

• How secondary flows from the new ETF affect liquidity, given record-breaking day-one participation.

• Fed’s September rate decision and whether dovish policy sparks renewed crypto inflows.

• Exchange reserves at 12-month highs, signaling potential supply overhang despite institutional interest.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。