I. Introduction

On September 17, local time, the Federal Reserve announced a 25 basis point reduction in the target range for the federal funds rate to 4.00%–4.25%, marking the first rate cut since December 2024. Following the announcement, U.S. stocks initially surged before retreating, the dollar index briefly dipped, and the cryptocurrency market quickly rallied after a brief period of volatility, with Bitcoin strongly surpassing $117,000, Ethereum breaking through $4,600, and altcoins collectively rebounding. Market risk appetite is beginning to re-emerge.

The Fed's decision to restart rate cuts is seen as a continuation of the pause in easing measures that began at the end of last year. However, unlike previous instances, this rate cut is not a response to a deep recession or systemic crisis, but rather a proactive adjustment aimed at "risk management." The U.S. economy has not entered a contraction, the unemployment rate remains low, and while inflation has not fully returned to target, it has eased somewhat. The Fed is choosing to find a balance between a soft landing and risk prevention. This suggests that the pace of easing in 2025 may not be rapid but rather resemble a "gentle and prolonged" policy trial.

Combining the historically strong performance of "Uptober" in October and the usual seasonal patterns of Q4, along with marginal easing in macro policy, the fourth quarter of 2025 is widely expected to usher in a comprehensive "altcoin season." This article will review the historical impact of the Fed's rate cycle and the 2024 rate cuts on the market, analyze the unique background and policy characteristics of the September 2025 rate cut, and explore whether the altcoin market is already on a countdown, considering the altcoin season index, Bitcoin's market cap share, and institutional capital flows. Finally, looking ahead to Q4, we will assess how "Uptober" combined with the Fed's easing expectations may influence market dynamics. Through this comprehensive analysis, readers will gain a clearer understanding of the current position of the cryptocurrency market and the potential opportunities and risks in the coming months.

II. Review of the Fed's Rate Cycle and 2024 Rate Cuts

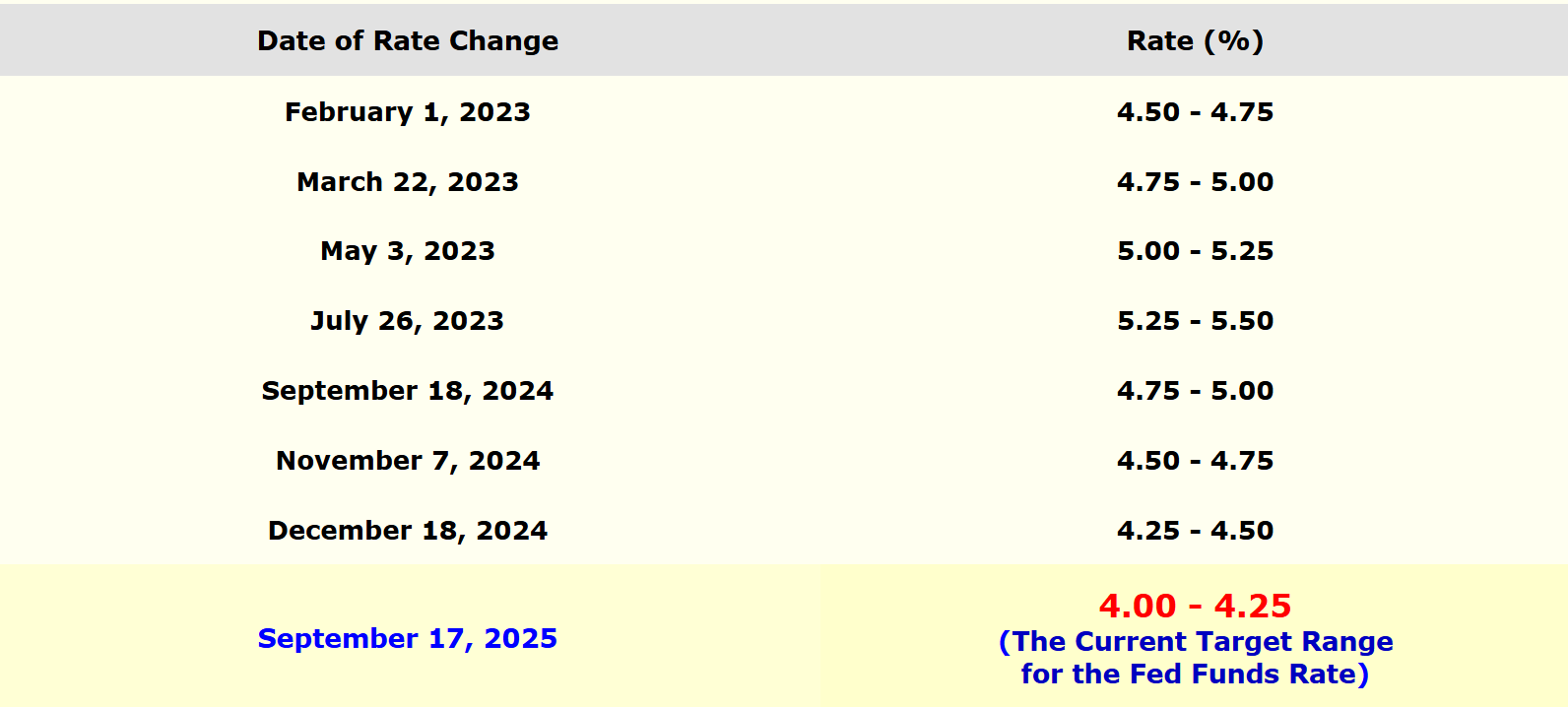

Looking back at past rounds of the Fed's rate cycle, the policy shifts of "easing—tightening—easing again" have often profoundly impacted global asset prices, including crypto assets. Historical data shows that when the financial environment is significantly eased, Bitcoin prices tend to appreciate significantly; conversely, during periods of sharp financial tightening, the crypto market is prone to bear markets. For example, during the Fed's gradual rate hikes from 2016 to 2017, while overall rates remained low, Bitcoin experienced a major bull market; in contrast, in 2018, the Fed's continued rate hikes and balance sheet reduction led to Bitcoin plummeting over 80% that year. Similarly, the ultra-low global interest rates and quantitative easing from 2020 to 2021 spurred the prosperity of the crypto market, while in 2022, as the Fed aggressively raised rates to high levels, crypto assets faced a winter. From 2022 to 2023, the Fed rapidly raised rates to a peak of 5.5%, entering a rate-cutting phase starting in September 2024, currently down to 4.25%. The turning points in the rate cycle often correspond to shifts in the crypto market trend.

2024 is seen as a key year for the crypto market's transition from bear to bull, with one important background being the shift in the Fed's monetary policy. After a cumulative tightening of over 500 basis points from 2022 to 2023, the Fed halted rate hikes in the latter half of 2024 and began signaling rate cuts. As inflation rates fell from high levels to below 3% quarter by quarter, and employment growth significantly slowed or even turned negative, the Fed's tightening cycle finally peaked. In the second half of 2024, the Fed cut rates three times, reducing rates by 50 basis points in September and by 25 basis points in both November and December. By the end of 2024, the target range for the federal funds rate had dropped from a peak of 5.25%–5.50% to 4.25%–4.50%, marking the official turn down of the fastest rate hike cycle in the world over the past two years.

The impact of this policy turning point on the crypto market was immediate. Bitcoin began a strong upward trend in the second half of 2024: the Fed's initiation of rate cuts in September acted as a catalyst, combined with the supply shock from Bitcoin's halving in April of that year, leading to a rapid shift in investor sentiment towards bullishness. Bitcoin's price soared from around $60,000 in mid-September 2024 to surpass $120,000 by mid-July 2025. The macro liquidity turning point reversed the long-term market trend, with large-scale capital beginning to flow back into the crypto space: the first U.S. spot Bitcoin ETF was approved for listing, the discounts on institutional trusts like Grayscale narrowed, and major tech companies announced on-chain strategies… all of these laid the foundation for the crypto recovery from late 2024 to 2025.

Source: https://www.fedprimerate.com/fedfundsrate/

Historically, the timing of the Fed's first rate cut typically occurs during the latter stages of the previous rate hike cycle, when economic growth slows and the unemployment rate begins to rise from a low point. This "policy turning point" is often viewed by the market as a signal for a turnaround in risk assets. The impact of rate cuts varies under different macro backgrounds: if the rate cut is due to crisis or recession expectations (as in 2008 and 2020), the market may initially decline due to panic; if it is a "preventive" or "mid-cycle" cut, where the economy has not yet entered recession and only a slight easing is implemented for risk management, the effect on market confidence is more pronounced. This rate cut has been referred to by Powell as a "risk management rate cut," not stemming from a dramatic change in economic fundamentals, but rather aimed at balancing employment and inflation risks. This also suggests that the current rate-cutting cycle may be gradual and moderate.

III. Analysis of the Background and Characteristics of the September 2025 Rate Cut

The September 2025 rate cut is a "proactive defensive" risk management rate cut, reflecting the Fed's subtle balance in ensuring a soft landing while suppressing inflation. This rate cut has several characteristics that differ from previous ones:

From a macro perspective, the current U.S. economy is not in recession, and the rate cut is more preventive than a reactive choice. The FOMC statement noted that recent economic growth has slowed, job growth has cooled, and the unemployment rate has slightly increased but remains low, while inflation has eased to a state of "somewhat elevated but overall declining." This indicates that the motivation for the rate cut is to guard against employment downturn risks and achieve a soft landing, rather than to respond to uncontrolled risks.

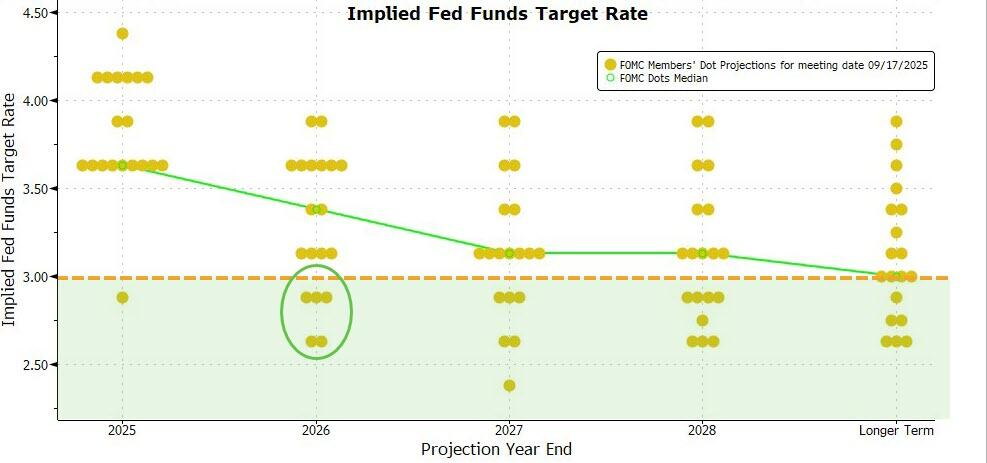

In terms of policy continuity, this is the first rate cut of 2025 and the restart of policy after a 9-month hiatus. The dot plot from the September meeting indicates that there may be two more 25 basis point cuts within the year, with one cut each in the following two years, following a gradual downward path. This reflects the Fed's continued confidence in economic resilience and its desire to retain policy space to avoid excessive easing that could reignite inflation.

Source: https://wallstreetcn.com/articles/3755793

The language conveyed during this rate cut announcement is also noteworthy. Powell deliberately emphasized that "this is not the beginning of a series of rate cuts." In other words, the Fed does not want the market to overly anticipate sustained easing, to avoid causing excessive loosening of financial conditions. For the crypto market, a short-term decline in rates helps enhance the attractiveness of risk assets. However, in the long term, if the economic fundamentals do not show significant deterioration, the Fed may not indefinitely lower rates to zero, and policy may stabilize around neutral levels. Therefore, while easing expectations boost market confidence, short-term volatility and uncertainty still exist.

While continuing to cut rates, the Fed has not relaxed its balance sheet reduction (QT) process, with its balance sheet shrinking from nearly $9 trillion in May 2022 to about $6.6 trillion currently. This means that the improvement in liquidity conditions is gradual, and long-term rates remain constrained by supply pressures.

For the crypto industry, this rate cut sends a clear signal of liquidity benefits, but investors should continue to monitor the dynamics of the FOMC in October and December, as well as changes in economic data, to assess the certainty and strength of subsequent easing.

IV. How Far is the Altcoin Season: Data and Signals Overview

Source: https://coinmarketcap.com/charts/altcoin-season-index/

Surge in the "Altcoin Season Index": An important indicator measuring the relative strength of altcoins is the Altcoin Season Index. This index tracks how many of the top 100 cryptocurrencies have outperformed Bitcoin over the past 90 days, with over 75% indicating the onset of altcoin season. Data from September 18 shows that the Altcoin Season Index has risen to 71%, meaning it is just 3 percentage points away from confirming the start of altcoin season. In the first half of this year, this indicator remained below 50%, indicating that Bitcoin significantly outperformed the market. The recent rapid rise suggests that capital is gradually shifting from Bitcoin to higher-risk altcoins. Historically, similar situations often occur during periods of Bitcoin's strong upward movement followed by consolidation, creating space for altcoins to perform. Currently, Bitcoin is fluctuating around $110,000, while many quality altcoins remain far below their historical highs, naturally attracting capital seeking rotation opportunities.

Bitcoin Dominance Eases: Corresponding to the above, Bitcoin's market cap share has begun to decline from its high levels. In Q2 of this year, Bitcoin's dominance briefly surpassed 50%, reaching a nearly two-year high, reflecting concentrated investor bets on Bitcoin. As we entered Q3, signs of weakening Bitcoin dominance emerged. By mid-September, Bitcoin's dominance had fallen by about 3-5 percentage points from its peak, indicating that the overall market cap growth rate of altcoins is catching up to and exceeding that of Bitcoin. A typical rotation model is: Bitcoin surges → stagnation period → capital flows into mainstream altcoins → then spreads to mid- and small-cap altcoins. We are currently in the middle stage of this model. As long as Bitcoin does not experience a significant deep correction, altcoins are likely to take the lead in driving gains, further reducing Bitcoin's dominance. During the comprehensive altcoin season in 2021, Bitcoin's dominance dropped sharply from over 60% to below 40%, with many altcoins achieving tens or even hundreds of times in gains.

Traditional Institutions Increasing Exposure to Altcoins: Not only retail investors are discussing altcoins, but many institutional funds are also beginning to target quality altcoin assets. On one hand, crypto treasury (DAT) strategy companies continue to diversify their digital asset allocations. Relevant data indicates that by mid-2025, the total value of digital assets held by publicly listed companies globally has exceeded $100 billion, with Bitcoin accounting for over $93 billion, dominating the space; Ethereum-centered treasuries have also rapidly grown to over $4 billion, with more companies incorporating ETH into their reserves; some companies are also investing in high-performance public chain tokens like SOL and BNB; and others are collaborating deeply with specific public chains to allocate assets like SUI and XRP. These trends indicate that quality altcoins are gaining recognition from an institutional perspective. Large crypto funds are also heavily betting on the altcoin space. This confirms that institutions are positioning themselves in advance for the altcoin season, focusing on leading and high-potential tokens to prepare for an altcoin explosion, and their movements are worth noting.

Looking back at past crypto cycles, once the altcoin season is established, capital inflows often bloom comprehensively, with various sectors taking turns to perform. However, there are patterns to follow: typically, new narratives and concepts supported by fundamentals become the leading drivers, subsequently pulling up older coins. Potential hotspots this round, in addition to traditional public chains and DeFi, include RWA (Real World Assets), AI, and cross-chain protocols, all of which are considered to have opportunities to become new focal points for speculation. Many analysts predict that the tokenization of real assets will be a heavyweight story in the next cycle, as it represents the integration of on-chain liquidity with traditional finance; similarly, AI-driven decentralized applications are expected to spark a new wave of imagination around computing tokens and data tokens; furthermore, cross-chain infrastructure (such as LayerZero, Chainlink CCIP, etc.) has already shown value and may become a target for institutional interest.

V. "Uptober" Approaches: Q4 Market Outlook

Source: https://www.coinglass.com/today

With the dust settling on the September rate cut, market attention is turning to the upcoming October FOMC meeting. The CME FedWatch tool shows that investor bets on another rate cut in October are rapidly heating up. If economic data does not show unexpected improvement, a 25 basis point cut at the end of October is highly likely. Goldman Sachs expects the Fed to cut rates once in September, October, and December, followed by two more cuts in 2026, bringing the final rate down to 3.0%–3.25%. This path aligns closely with the dot plot. It can be inferred that the Fed is expected to cumulatively cut rates by 75 basis points in Q4 this year, injecting more liquidity into the market. Easing expectations are accumulating, and the soil for a bull market is becoming fertile.

Under the backdrop of macroeconomic benefits, the seasonal patterns for Q4 2025 are also worth looking forward to. There is a saying in the crypto community about "Uptober," and statistics show that since 2013, Bitcoin's average monthly increase in October has reached +22.9%. This includes seasonal capital flow factors, such as the return of funds to risk assets before the end of the year and reduced selling pressure, as well as psychological factors among investors, who, after a Q3 consolidation, look forward to the year-end market. When macro and seasonal factors resonate, the market tends to exhibit "self-fulfilling prophecies."

Of course, we should also recognize the potential uncertainties. On one hand, the disagreements among Fed officials during the September meeting indicate that there is still controversy over the future path; if economic data unexpectedly strengthens, the possibility of slowing the pace of rate cuts or even a brief pause cannot be ruled out. On the other hand, after this year's significant upward movement, Bitcoin may experience phase-based fluctuations or even corrections at high levels to digest profit-taking and accumulate momentum.

In summary, Q4 2025 possesses many elements reminiscent of the crypto frenzies of 2017 and 2020: the macro easing wind is blowing, institutional capital continues to flow in, market sentiment is shifting from caution to FOMO, and innovative narratives such as RWA tokenization, ETH spot ETFs, and U.S. publicly listed companies venturing into blockchain are emerging one after another. As long as no black swan events occur externally, the performance of the crypto market in Q4 is worth optimistic expectations. Especially as Bitcoin continues to set new highs and consolidates, we are likely to see significant capital rotation into high-performing altcoins, ushering in a long-awaited "altcoin season."

VI. Conclusion: Seizing Opportunities Between Frenzy and Calm

Currently, the crypto market is at an exciting juncture: macro interest rate trends are turning downward, institutional and retail sentiment is warming in sync, Bitcoin is poised to set new highs, and altcoins are rising in succession. Q4 2025 is highly likely to witness a spectacular "altcoin season." We hold a cautiously optimistic view for the coming months: the Fed's moderate rate cuts will continue to nourish the market, the "Uptober" seasonal effect is expected to manifest again, and a scenario where altcoins significantly outperform Bitcoin may unfold, making for an exciting and challenging crypto Q4 that we can witness together.

However, historical experience repeatedly reminds us: the more exuberant the market, the more rational scrutiny is needed. While the altcoin season is enticing, it also brings "joy for some and sorrow for others." On one hand, it can indeed lead to astonishing wealth effects—those who strategically position themselves in high-quality altcoins may reap several times or even dozens of times in paper profits; on the other hand, the altcoin season is often rife with speculative bubbles, with many mediocre or even absurd coins being wildly traded, leaving someone to inevitably take the last baton.

Every altcoin season is an adventure filled with both opportunities and traps. Currently, institutional funds in crypto asset treasuries and whale accounts with millions are significantly increasing their positions in altcoins, indicating that this "smart money" also sees potential in this round of market. Nevertheless, investment is ultimately a personal journey. Maintaining independent thinking, overcoming human greed and fear, and striking a balance between rationality and madness are essential skills for any investor who wishes to exit the bull market celebration unscathed.

About Us

Hotcoin Research, as the core research institution of Hotcoin Exchange, is dedicated to transforming professional analysis into your practical tools. Through our "Weekly Insights" and "In-Depth Reports," we analyze market trends for you; leveraging our exclusive column "Hotcoin Selection" (AI + expert dual screening), we help you identify potential assets and reduce trial-and-error costs. Each week, our researchers also engage with you through live broadcasts to interpret hot topics and predict trends. We believe that warm companionship and professional guidance can help more investors navigate cycles and seize the value opportunities of Web3.

Risk Warning

The cryptocurrency market is highly volatile, and investment carries risks. We strongly recommend that investors conduct investments based on a full understanding of these risks and within a strict risk management framework to ensure the safety of their funds.

Website: https://lite.hotcoingex.cc/r/Hotcoinresearch

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。