CoinW Research Institute

- Bitcoin Plunge and Market Resonance

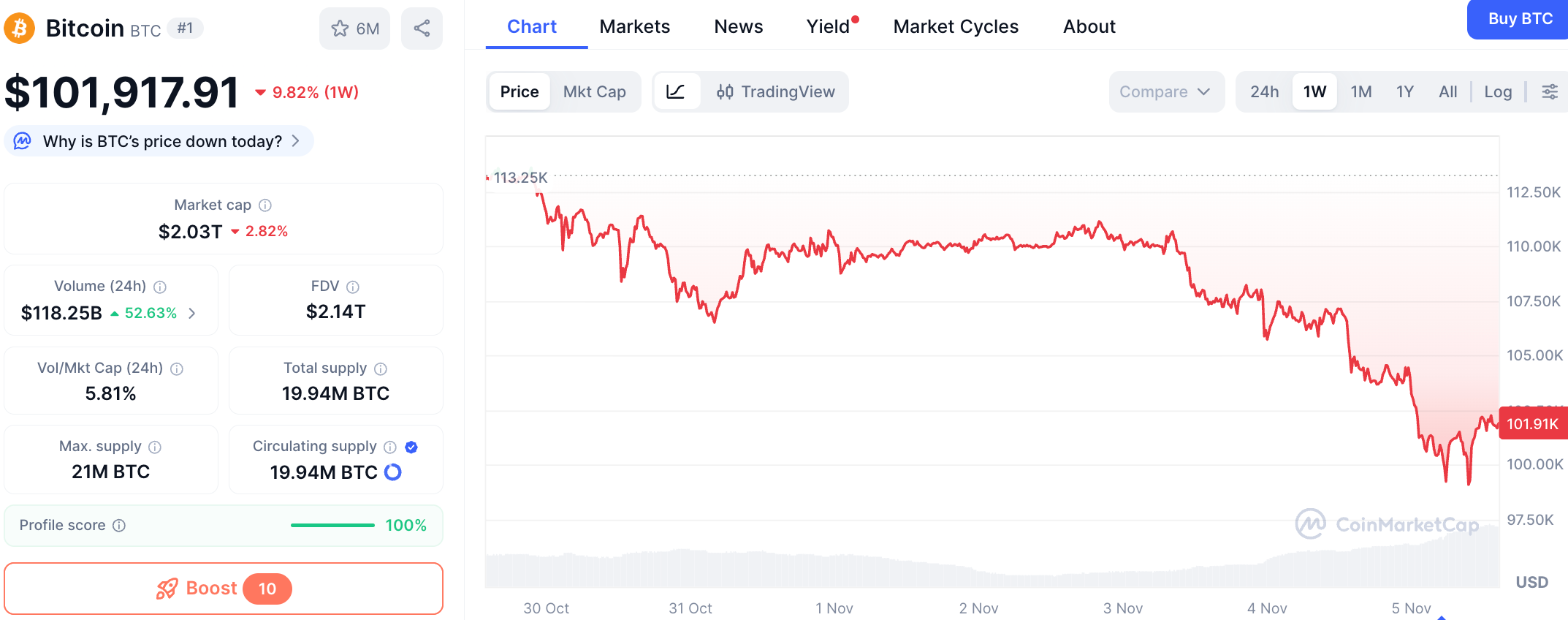

On November 4, the crypto market experienced a severe shock, plunging into a downturn. Bitcoin's price briefly fell below the $100,000 mark, hitting a low of $99,000, marking the most significant correction since its peak earlier this year. Meanwhile, Ethereum also suffered, with its price dropping to around $3,000, a new low for the past six months. Altcoins and meme coins saw significant price declines, with liquidity and trading volume plummeting.

Data Source: https://coinmarketcap.com/currencies/bitcoin/

From the overall market performance, this was not an isolated event. On the same day, global risk assets generally declined, putting pressure on the crypto market. According to Coingecko data, as of November 5, the total market capitalization of the crypto market was approximately $3.45 trillion, down about 9.5% from November 3 (approximately $3.81 trillion).

Data Source: https://www.coingecko.com/en/charts

At the same time, a large-scale liquidation wave occurred in the derivatives market. Coinglass statistics show that on November 4, the total liquidation amount across the network exceeded $2 billion within 24 hours, with long positions losing $1.63 billion, accounting for nearly 80%. The overall Total Value Locked (TVL) in the DeFi ecosystem also significantly declined, dropping from $150 billion on November 3 to $141.7 billion on November 4, a single-day drop of 5.5%; as of November 5, the TVL further fell to $133 billion, a cumulative decline of about 11.3%.

This round of decline reflects a sharp collapse in market confidence and a sudden tightening of liquidity, as well as a concentrated reaction after BTC prices broke away from support levels. This article will further analyze potential triggering factors and explore the deeper impacts that this adjustment may bring.

2. Analyzing the Causes of the Plunge: Recent Events and Macroeconomic Factors

Balancer Hacked for $116 Million: Intensifying DeFi Security Crisis

On November 4, the established DeFi protocol Balancer was hacked due to a smart contract vulnerability, resulting in the theft of over $116 million in assets, raising concerns about DeFi security in the market. Notably, in the past year, mature DeFi protocols like Curve and Euler Finance have also suffered significant capital losses due to contract vulnerabilities, exposing the systemic risks that even established protocols in the industry cannot avoid. These continuous security incidents have significantly reduced the market's risk appetite and severely weakened investor trust in the DeFi ecosystem, leading to increased capital outflows from the DeFi market and a severe shrinkage of TVL. The Balancer incident undoubtedly deepened market anxiety, prompting investors to accelerate their exit from high-risk assets, further exacerbating Bitcoin's plunge.

Macroeconomic: U.S. Federal Government "Shutdown" Triggers Market Risk Aversion

The U.S. federal government shutdown has entered its 35th day. The direct consequence of the shutdown is a severe restriction on public services and government spending, heightening concerns about U.S. economic growth. As a high-risk asset class, the crypto market has been notably affected by this event, with market risk aversion rising significantly, leading investors to take profits and reduce risk exposure. The outflow of substantial capital directly impacted the price trends of digital assets like Bitcoin, further deepening market panic.

Declining Expectations for Fed Rate Cuts Strengthen the Dollar and Tighten Liquidity

In addition to the impact of the government shutdown, the Federal Reserve's monetary policy is also a factor influencing market turbulence. As expectations for a rate cut in December have decreased, the dollar index has rebounded, and the strengthening dollar trend has negatively affected risk assets, including Bitcoin. A stronger dollar often accompanies a tightening of global liquidity, which is undoubtedly a "bearish" signal for the crypto market. As liquidity tightens, the market's risk appetite decreases, prompting investors to reassess the value of crypto assets, leading to sell-offs and exacerbating the decline of assets like Bitcoin.

Divergence in Financial Markets: Gold Rises, Bitcoin Falls

During the turmoil on November 4, a clear divergence emerged between the movements of gold and Bitcoin. Despite heightened market risks, gold, as a traditional safe-haven asset, rose, while Bitcoin failed to exhibit similar safe-haven characteristics. Data indicates that gold prices continued to rise, while Bitcoin prices fell. This phenomenon suggests that the crypto market is not widely viewed as a safe-haven asset; in fact, during times of increased macro uncertainty, the market tends to favor traditional safe-haven assets like gold over digital currencies. This also reflects the vulnerability of the crypto market in risk aversion, especially against the backdrop of increasing global economic uncertainty, where investor confidence in Bitcoin and similar assets remains low.

3. On-chain Capital Outflow and Institutional Movements

The Role and Changes of Corporate and ETF Support for Bitcoin Prices

This year, corporate Bitcoin treasuries and ETF participation have provided strong support for BTC prices. Companies have purchased Bitcoin by issuing stocks or bonds, incorporating it into their balance sheets, while ETFs have absorbed new Bitcoin supply through continuous capital inflows, forming a robust demand foundation. This mechanism has helped Bitcoin withstand financial pressure and stabilize prices during tense global economic conditions. However, as policy and macroeconomic uncertainties have intensified, the investment trends of ETFs and corporations have changed significantly. The outflow of ETF funds and the slowing pace of corporate accumulation have weakened market demand support for Bitcoin, making price support more fragile.

Continuous Net Outflow from BTC ETFs: A Signal of Institutional Withdrawal

According to Sosovalue data, since the end of October, Bitcoin ETF funds have shown a continuous outflow, with a single-day outflow of $570 million on November 4. Although Bitcoin's fundamentals still appear solid, the outflow of ETF funds clearly reflects institutional withdrawal behavior. This indicates that institutional investors are concerned about future market uncertainties, leading them to reduce their Bitcoin holdings. As liquidity weakens and market confidence declines, Bitcoin's price has faced increased selling pressure, resulting in greater market volatility.

Data Source: https://sosovalue.com/assets/etf/TotalCryptoSpotETFFund_Flow?page=usBTC

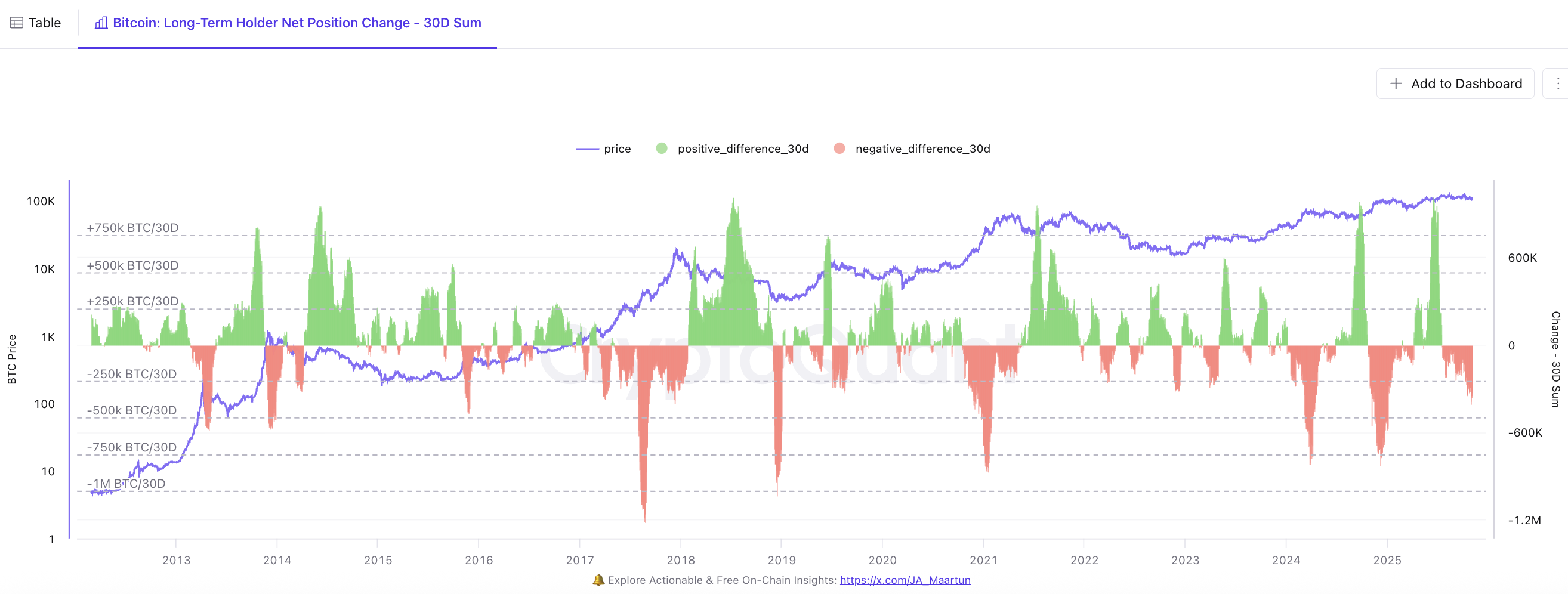

Long-term Holders Selling: Smart Money Locking in Profits

The significant selling behavior of long-term holders (LTH) is also an important factor putting pressure on the current Bitcoin market. Long-term holders are typically seen as "smart money" in the market; they usually accumulate assets during market uptrends and choose to lock in profits when prices reach certain highs. On-chain data shows that a large number of LTH have recently begun to gradually reduce their Bitcoin holdings, with LTH cumulatively selling over 400,000 BTC in the month leading up to November 4, accounting for about 2% of the current circulating supply (19.94 million), cashing out over $40 billion. Particularly when Bitcoin prices are fluctuating at high levels, the selling behavior of long-term holders often exacerbates downward pressure on the market. This signal of capital withdrawal indicates that investors' risk appetite is decreasing, and they may have begun to worry that Bitcoin is nearing a cyclical peak.

Data Source: https://cryptoquant.com/analytics/query/65ed815767c8123d4840c81e?v=65ed815767c8123d4840c820

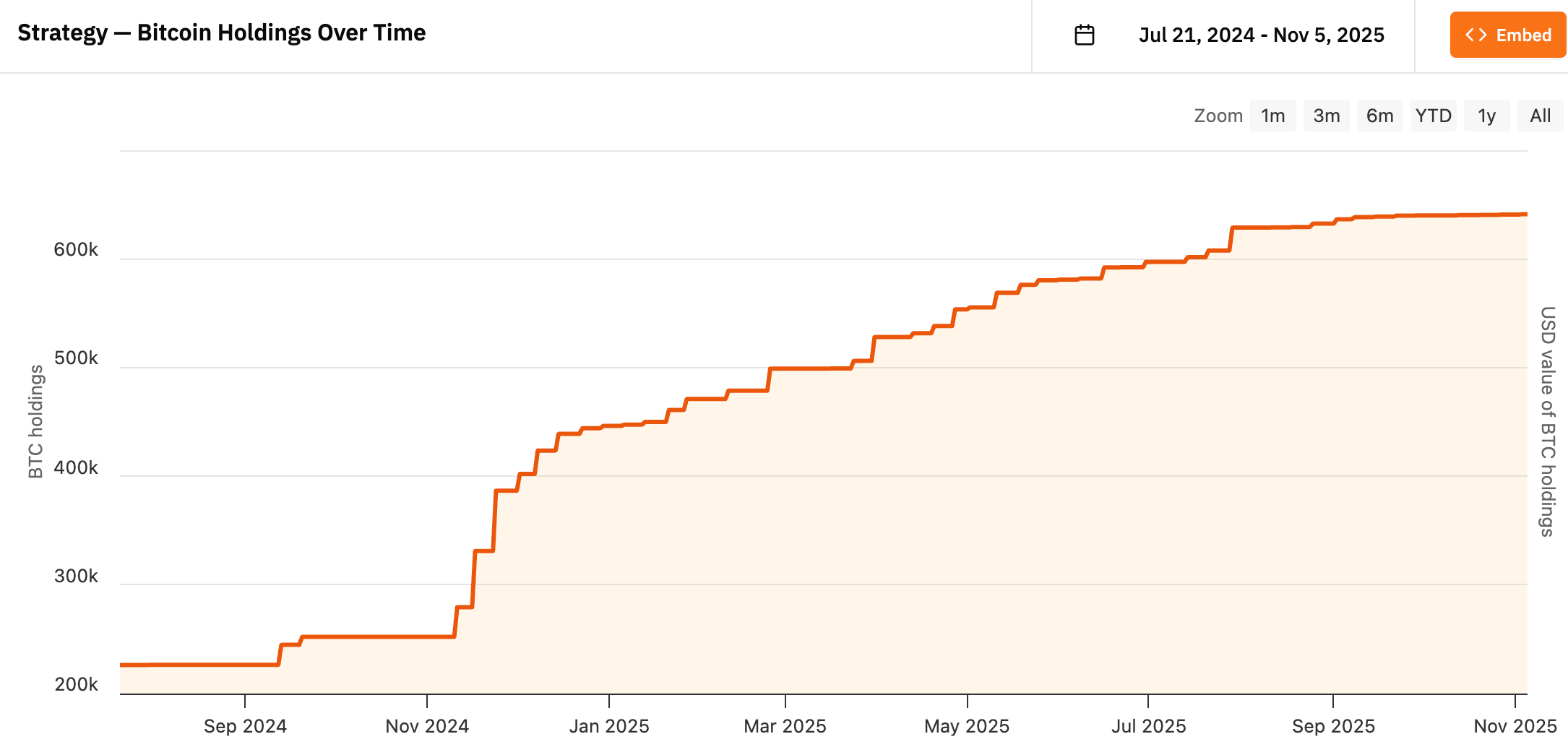

Corporate Treasury Accumulation Slows: A Signal of Cyclical Peaks

In addition to ETF fund outflows and investor cashing out, corporate Bitcoin treasury accumulation strategies are also cooling down. In the past, many companies increased their Bitcoin holdings to hedge risks and enhance asset allocation flexibility. However, recent data shows that this trend is slowing. For instance, the world's largest Bitcoin-holding company, Strategy, only increased its holdings by about 12,000 BTC between August and October, far below previous growth rates, and other companies are also slowing their accumulation pace. This reflects a more cautious approach from institutions regarding macroeconomic uncertainties, leading them to reduce their risk exposure to Bitcoin. A decrease in corporate buying means that the originally stable "structural demand" in the market is disappearing. When ETF fund outflows coincide with weakened corporate buying, the market's absorption capacity declines, and Bitcoin prices become significantly more sensitive to short-term selling pressure. This is one of the reasons why Bitcoin's price was able to quickly break through key support levels during the decline in early November.

Data Source: https://bitcointreasuries.net/public-companies/microstrategy

4. Future Outlook and Potential Impacts

The recent Bitcoin market is in a "high-level hesitation period." Continuous net outflows from ETFs, institutional reductions, and slowing corporate accumulation all indicate that mainstream capital is becoming cautious in the current price range, and the market may have entered an observation phase at the cyclical peak.

The key variables for the future still lie in macro liquidity and institutional behavior. If the Federal Reserve resumes its rate-cutting cycle early next year, leading to a shift towards a more accommodative funding environment, risk assets may regain support, and Bitcoin could potentially resume its rebound logic. Meanwhile, if ETFs see a return to continuous net inflows and institutions rebuild their positions, this will become an important signal for a reversal in market sentiment. From both technical and psychological perspectives, the $100,000 mark may become an important "psychological bottom" and mid-term support level for Bitcoin. Once this price level is widely accepted by the market, Bitcoin may form a new oscillation center within this range in the future.

However, if the macro economy continues to face pressure, U.S. inflation proves stickier than expected, or regulatory policies tighten again, the market may enter a longer period of consolidation and digestion. Overall, the direction of the Bitcoin market in the coming months will depend on the triple resonance of macro policy, institutional attitudes, and market sentiment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。