Defillama shows total value locked (TVL) dipped 1.17% in the past 24 hours, but the stack hasn’t looked this hefty since the last cycle. Stablecoins sit at a $292.626 billion market cap, with $16.005 billion in 24-hour decentralized exchange (DEX) volume and $22.74 billion through perpetuals—ample fuel if traders hit the gas.

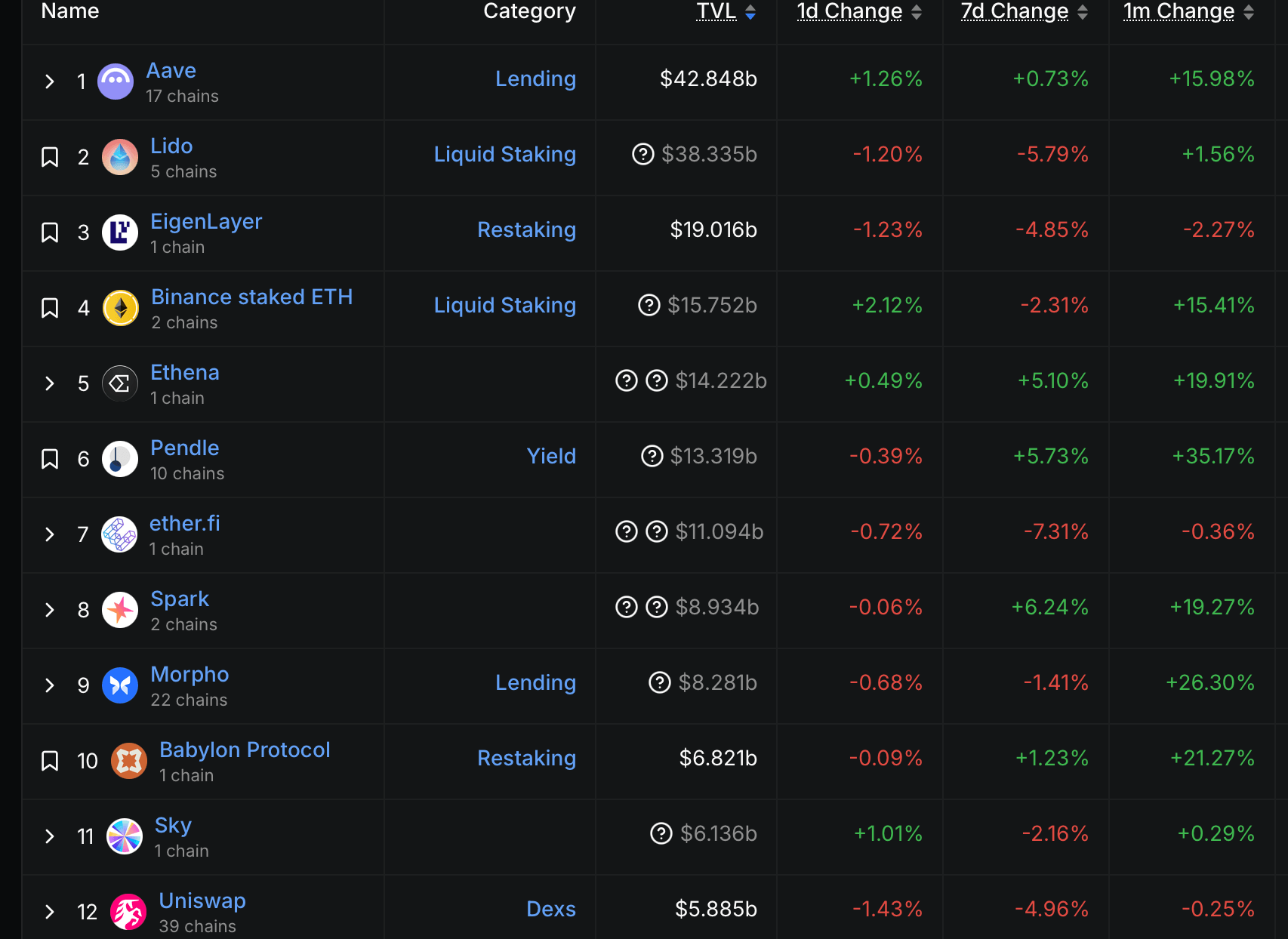

At the protocol level, Aave leads with $42.848 billion in lending collateral after a 1.26% daily lift and a 15.98% gain over the month. Lido ranks second at $38.335 billion in liquid staking, softer on the day (-1.20%) and week (-5.79%) but slightly higher on the month (+1.56%). Eigenlayer holds $19.016 billion in restaking, easing 1.23% on the day and 4.85% on the week as re-staking operators catch their breath.

Top 12 DeFi protocols by TVL on Sept. 20, 2025, per defillama.com stats.

Binance Staked ETH parks $15.752 billion in liquid staking, green on the day (+2.12%) and month (+15.41%). Ethena clocks $14.222 billion with a modest daily rise (+0.49%), up 5.10% on the week and 19.91% over 30 days. Pendle’s yield venue is at $13.319 billion, nearly flat on the day (-0.39%) but up 35.17% on the month—carry traders look hydrated.

Rounding out the top dozen: Ether.fi at $11.094 billion (down 0.72% daily, off 7.31% weekly); Spark with $8.934 billion (even on the day, +6.24% weekly, +19.27% monthly); Morpho lending at $8.281 billion (down 0.68% day, -1.41% week, +26.30% month); Babylon Protocol restaking at $6.821 billion (flat day, +1.23% week, +21.27% month); Sky at $6.136 billion (+1.01% day, -2.16% week, +0.29% month); and Uniswap, the flagship dex, at $5.885 billion (-1.43% day, -4.96% week).

The mix spells this cycle’s pecking order: lending reclaimed the crown, liquid staking throws its weight around despite softer weekly prints, and restaking keeps attracting long-term capital. Meanwhile, yield plays Pendle and credit upstarts Morpho and Spark nibble market share while incumbents guard moats.

If TVL closes the remaining gap to the old high of $177.421 billion, expect a calmer victory lap than 2021. Money is more distributed, plumbing sturdier, and builders act like they’ve got deadlines. Call it a glow-up: fewer fireworks, better foundations. At press time, DeFi’s TVL stands around $16.436 billion away from surpassing the November 2021 peak.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。