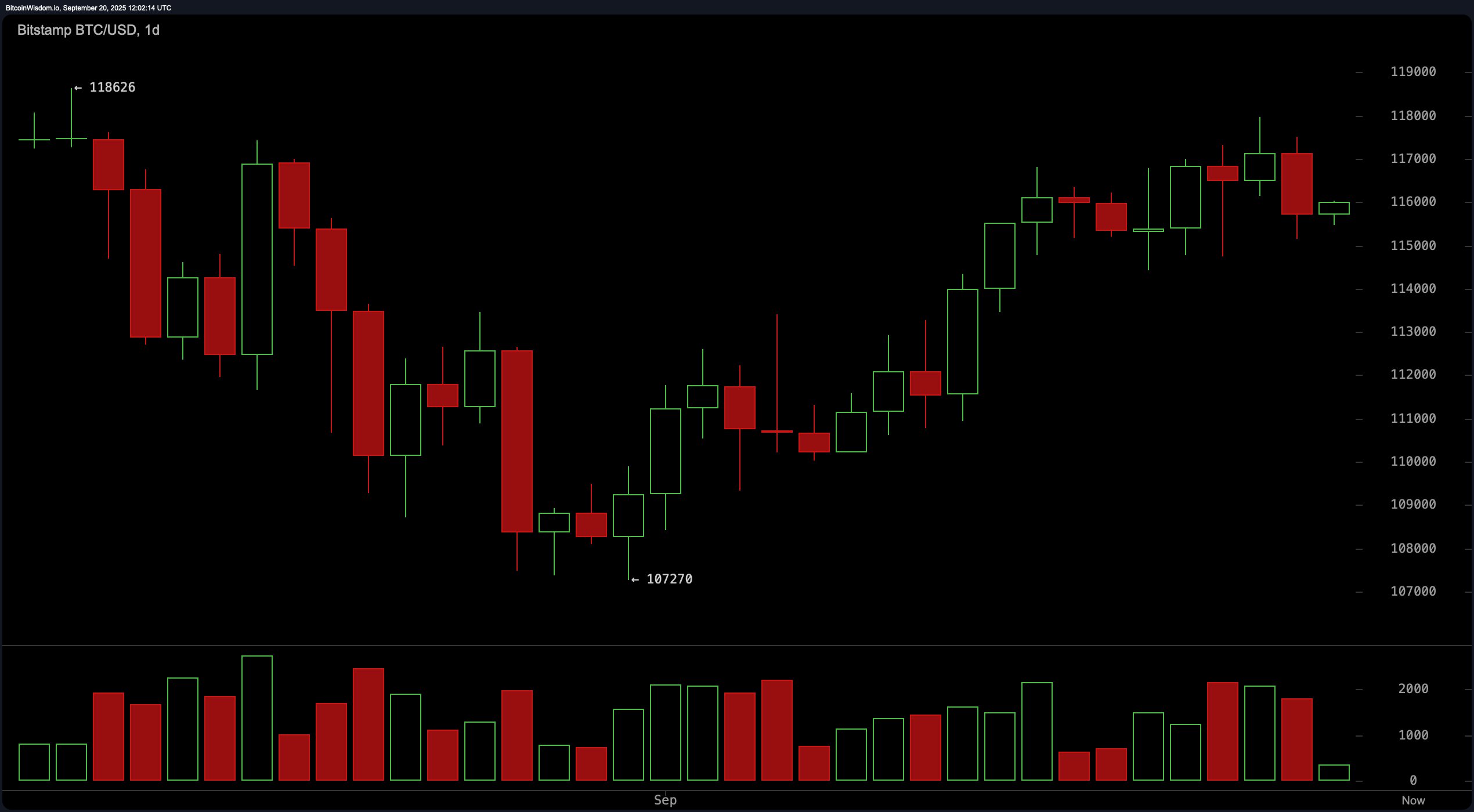

On the daily chart, bitcoin recently recovered from a low near $107,270 to above $117,000, indicating a strong rebound. However, the upward momentum appears to be slowing, with shorter green candlesticks suggesting buyer fatigue.

Key resistance is positioned between $118,000 and $119,000, while support is established around $112,000. A pullback to the $112,000–$113,000 area with increased volume may present a viable long entry opportunity, with potential exits near the upper resistance zone.

BTC/USD 1-day chart via Bitstamp on Sept. 20, 2025.

The 4-hour bitcoin chart shows signs of a short-term downtrend, marked by lower highs since September 18. After reaching a local high of $117,968, bitcoin declined to $114,421 before stabilizing. Price action indicates a consolidation phase with a bearish tilt. A sustained break above $117,000 with high volume could validate a bullish continuation, whereas another rejection at this level may trigger a move down toward $114,000.

BTC/USD 4-hour chart via Bitstamp on Sept. 20, 2025.

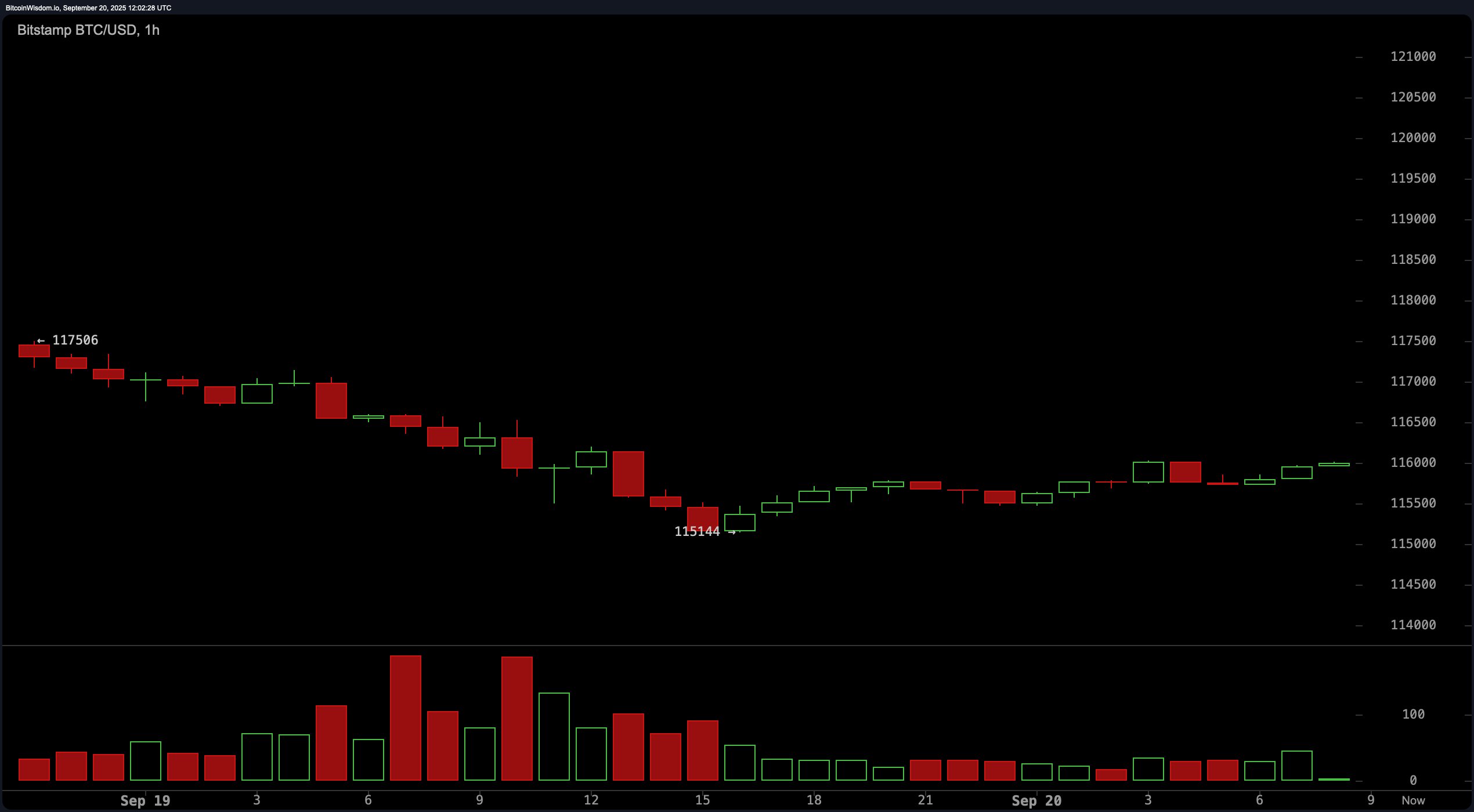

The 1-hour bitcoin chart reveals a recent breakdown to $115,144 followed by sideways consolidation, indicating market indecision. There is no significant volume suggesting strong buying activity. If the price rises above $116,200, a short-term long position could be considered with caution. Conversely, another rejection at the $116,500–$116,800 level may signal a potential pullback to $115,000.

BTC/USD 1-hour chart via Bitstamp on Sept. 20, 2025.

Oscillators present a largely neutral outlook. The relative strength index (RSI) stands at 56, Stochastic at 78, commodity channel index (CCI) at 64, average directional index (ADX) at 18, and Awesome oscillator (AO) at 3,176 — all indicating a neutral stance. The momentum oscillator signals a bearish trend, while the moving average convergence divergence (MACD) shows a bullish signal today.

Moving averages reflect broader bullish sentiment. All exponential moving averages (EMAs) from 10 to 200 periods are in a bullish territory. Similarly, most simple moving averages (SMAs) indicate a bullish signal, with the exception of the 10-period SMA, which is currently signaling a bearish trend.

In summary, bitcoin maintains a neutral to slightly bullish technical outlook. Long positions may be considered near the $112,000–$113,000 support zone, while caution is warranted near the $117,500–$118,000 resistance cluster. Traders are advised to wait for stronger volume confirmation before taking significant positions.

Bull Verdict:

With a series of higher lows, strong support around $112,000, and the majority of moving averages signaling buys across all timeframes, bitcoin retains a structurally bullish posture. If volume increases and price breaks through the $117,000 level, a continuation toward the $118,000–$119,000 resistance zone is likely, reinforcing the bullish case for further upside momentum.

Bear Verdict:

Despite recent recovery, weakening momentum and consistent rejections below $117,000 suggest the current rally lacks conviction. The short-term downtrend on lower timeframes and neutral oscillator readings point to potential downside pressure, especially if bitcoin‘s price fails to hold above $114,500. A break below this level could open the path for deeper correction toward the $112,000 zone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。