Gold Bitcoin News: Which Safe Haven Leads in 2025—Digital or Metal?

Is Bitcoin a True Threat to Gold, or Does the Metal Still Rule?

Is BTC truly a threat to precious metal, or does the traditional metal still hold the crown as the ultimate safe haven? With both assets recording major gains in 2025, investors are closely tracking Gold Bitcoin news to see which asset will lead the safe-haven race in the coming months.

Gold-Rally Highlights Its Centuries-Old Safe-Haven Role

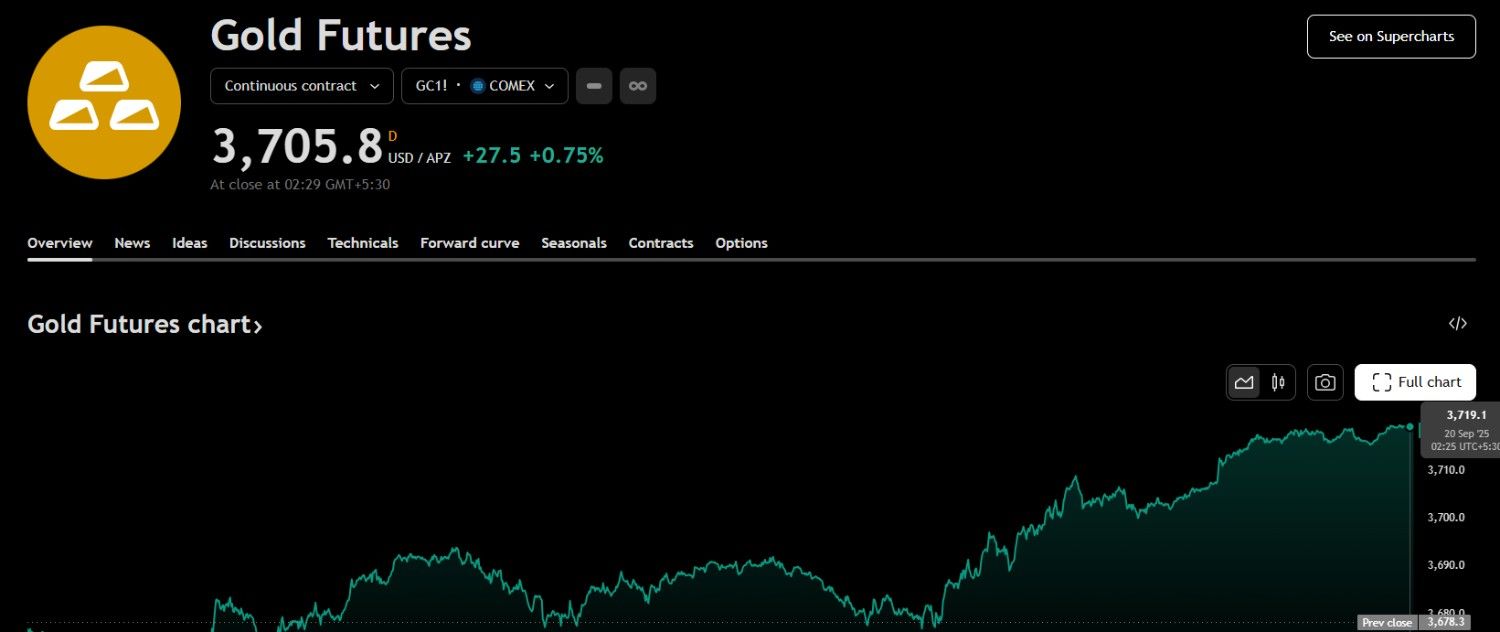

Gold-continues to prove why it is regarded as the world’s most trusted safe-haven asset. According to data shared by The Bitcoin Therapist on X , gold-futures have surged +39.36% YTD, reaching $3,719.40 per ounce.

Gold-steadily increases in value without major dips. It is less volatile than crypto or stocks, showing only minor corrections at times while maintaining long-term growth, below provided is from Trading view that shows how the precious metal attained its position.

-

Till yesterday closing, it gained $40.98 (+1.12%).

-

Over the past 30 days, it climbed $306.26 (+9.17%).

-

In six months, the precious metal added $608.05 (+20.02%).

-

In one year, it soared $1,023.51 (+39.05%).

-

Source: Trading view

It has consistently protected wealth across centuries. Unlike the volatility of cryptocurrencies, it moves steadily through market cycles. Its compounding growth confirms why investors still treat precious metal as a hedge against inflation, currency risks, and global uncertainty.

Bitcoin-Explosive Growth Fueled by Institutional Buying

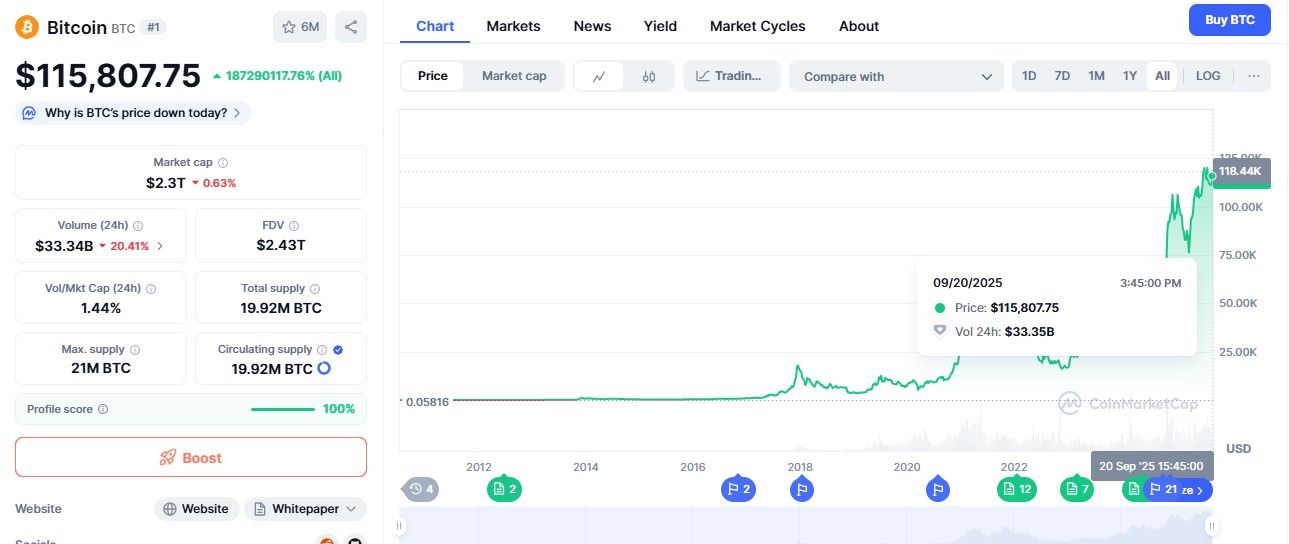

BTC's story is far more dramatic. In 2025, BTC has risen +23.78% YTD, trading around $115,687. Its long-term growth is extraordinary, as per the data of CoiMarketCap :

-

$14 in 2011

-

$334.6 in 2015

-

$27,360 in 2020

-

All-time high of $124,000 in 2025 before correcting slightly

A major reason for optimism is institutional buying. As large funds and financial institutions pour capital into BTC, its liquidity and credibility strengthen. Analysts believe this trend could push prices even higher. Unlike Precious metal, digital asset's limited supply gives it explosive upside potential if institutional adoption accelerates and currently the coin is trading at around $116k.

Source: CMC

Gold vs Bitcoin News: What Experts Are Saying

Economist Peter Schiff insists that precious traditional asset remains the safer store of value, highlighting its centuries-long trust and current highs near $3,615 (+0.79% in 24 hours, TradingView data).

On the other side, Bitcoin-advocates are unwavering:

-

Michael Saylor calls Bitcoin the future and urges investors, “Don’t sell, just hold it.”

-

Robert Kiyosaki refers to Bitcoin , as “real money,” while dismissing fiat currencies as weak against inflation.

-

This clash underscores the core debate: should investors stick to the tested reliability of precious metals or embrace the disruptive potential of digital assets?

2025 Outlook—Who Holds the Crown?

The big question for investors in 2025 is simple: Will Bitcoin overtake gold as the top safe haven , or will the traditional asset hold its crown?

-

Gold’s unmatched history makes it the preferred stability play.

-

BTC’s explosive cycles and institutional adoption position it as digital gold for the future.

For now, both assets are thriving. Gold attracts investors seeking safety, while BTC appeals to those betting on innovation and long-term growth. This tug-of-war could define markets in 2025—and the ultimate safe-haven crown may soon be contested more fiercely than ever.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。