The U.S. Securities and Exchange Commission (SEC) has cleared a path for a flood of new crypto exchange-traded products to hit the market, a move analysts say could reshape how money flows into digital assets.

On Wednesday, the agency approved generic listing standards for "commodity-based trust shares" across regulated exchanges Nasdaq, Cboe BZX and NYSE Arca.

Read more: SEC Makes Spot Crypto ETF Listing Process Easier, Approves Grayscale's Large-Cap Crypto Fund

The new rules remove the need for each crypto ETP to undergo its own individual rule filing under Section 19(b) of the Exchange Act. Instead, an offering whose underlying assets satisfy certain objective eligibility tests — for example, if the crypto trades on a market that is a member of the Intermarket Surveillance Group (ISG), or if the underlying asset's futures contract is listed on a CFTC-regulated designated contract market for at least six months — can be listed using these generic standards.

What's next?

The regulatory shift marks a watershed for the crypto industry, removing much of the procedural drag that has historically slowed getting new crypto products to the market, analysts said.

"[The] crypto ETF floodgates are about to open," said Nate Geraci, a well-followed ETF analyst and president of NovaDius Wealth Management.

"Expect an absolute deluge of new filings and launches," he said. "You may not like it, but crypto is going mainstream via the ETF wrapper."

Matt Hougan, chief investment officer of digital asset management firm and ETF issuer Bitwise, said the SEC's move is a "coming of age" moment for crypto.

"[It's] a signal that we’ve reached the big leagues," he wrote. "But it’s also just the beginning."

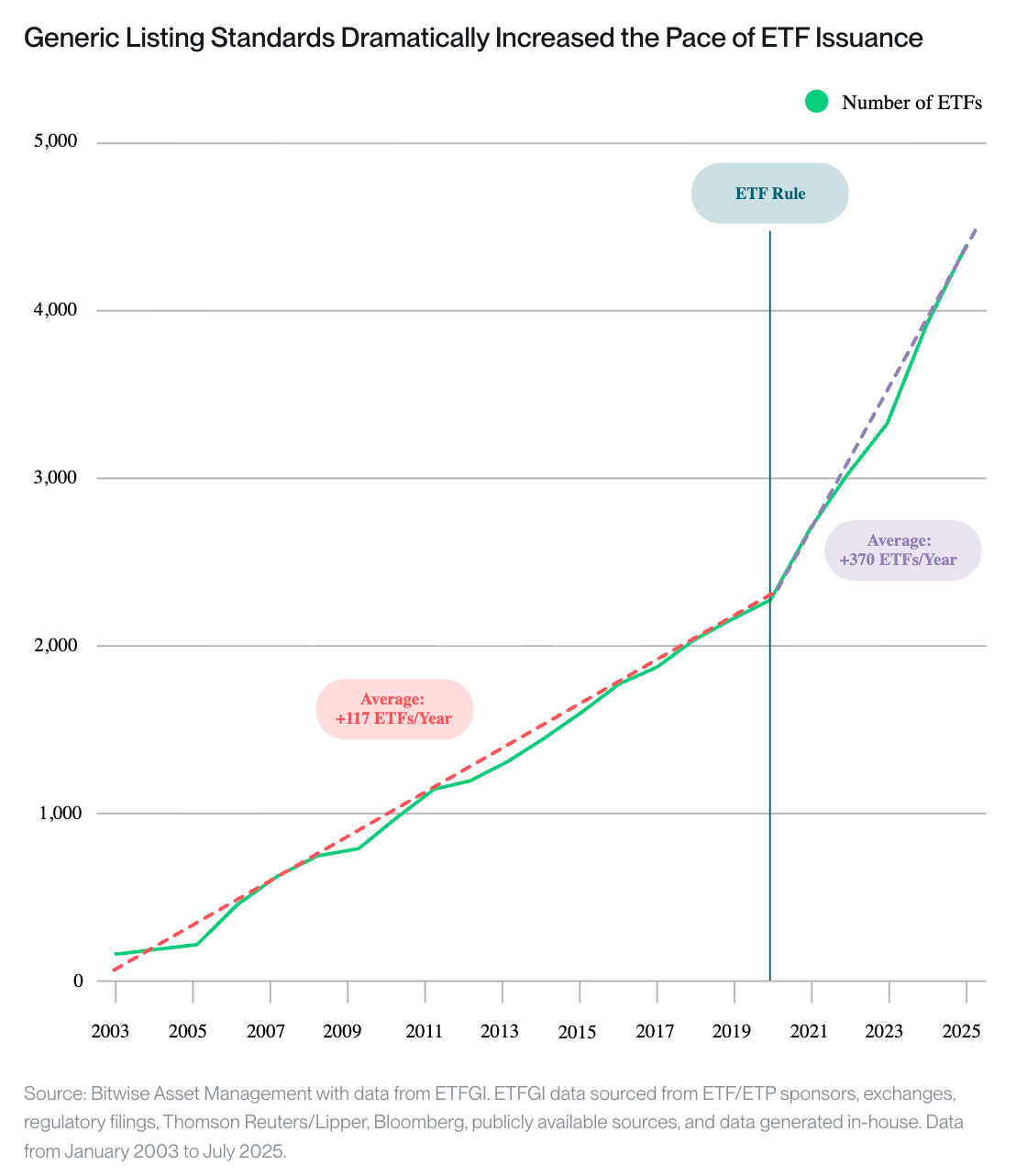

History backs up predictions that the number of new crypto ETF launches will accelerate under the new regime.

When the SEC approved generic listing standards for bond and stock-based products in 2019, the number of ETFs launches more than tripled in a year, rising to 370 from 117 the year before, Hougan pointed out.

What does it mean for crypto prices?

Hougan cautioned against assuming new crypto ETPs will automatically drive large inflows. "The mere existence of a crypto ETP does not guarantee significant inflows," he wrote. "You need fundamental interest in the underlying asset."

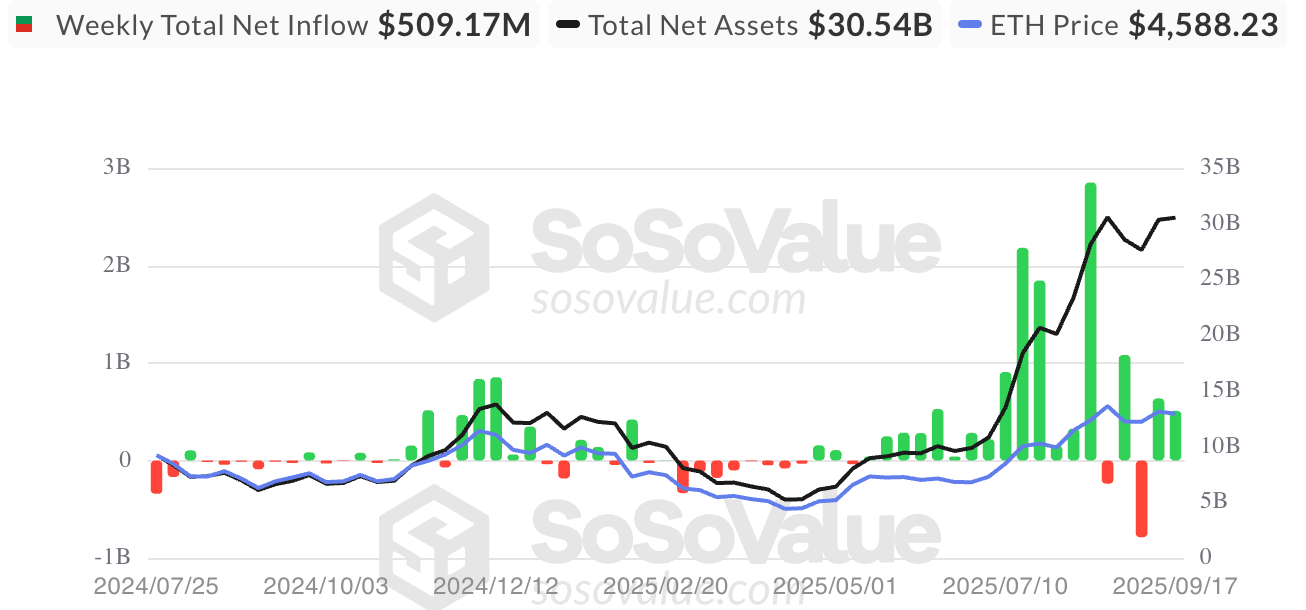

Take, for example, the slow start of spot ether (ETH) ETFs. They only began gathering meaningful inflows nearly a year after launch, once stablecoin activity and — by extension — Ethereum's investment narrative picked up, Hougan wrote.

By contrast, products tied to smaller-cap assets with less tangible use cases may struggle to attract capital absent renewed fundamentals, he added.

Still, he argued that ETPs dramatically lower the barrier for traditional investors, making it far easier for institutional and retail allocators to pivot into crypto once sentiment turns. They also help demystify cryptocurrencies for mainstream audiences when names like Avalanche (AVAX) and Chainlink (LINK) appear in brokerage accounts, Hougan said.

"What we are seeing now are underlying assets further down the value curve being rolled into these wrappers and strategies," Paul Howard, senior director of Wincent told CoinDesk in a note. "For institutions that cannot own spot [crypto] directly, these vehicles provide a wrapper and move liquidity into the ecosystem."

The tokens most likely benefitting from this are large-cap altcoins. "Dogecoin (DOGE), XRP (XRP), Solana (SOL), Sui (SUI), Aptos (APT) and others are now ushering in the next wave of [products] as investors look for opportunities and applications outside of bitcoin (BTC) and ETH," Howard said.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。