Coin-Stock? RWA? What if we create trading pairs between cryptocurrencies and stocks! (Part 1)

In the past few days, while recovering at home, I spent a lot of time trying to refine the compliance issues surrounding the $BTC to $IBIT trading pair. Unfortunately, despite consulting numerous compliance personnel and intermediary methods, I couldn't find a way to make the coin-stock trading pair fully compliant for all audiences. If it's just for professional investors, there are ways to do it, but for retail users, the laws in the U.S., Singapore, and Hong Kong currently do not allow it. Only Germany and Switzerland can accommodate this, but only for users in those two regions.

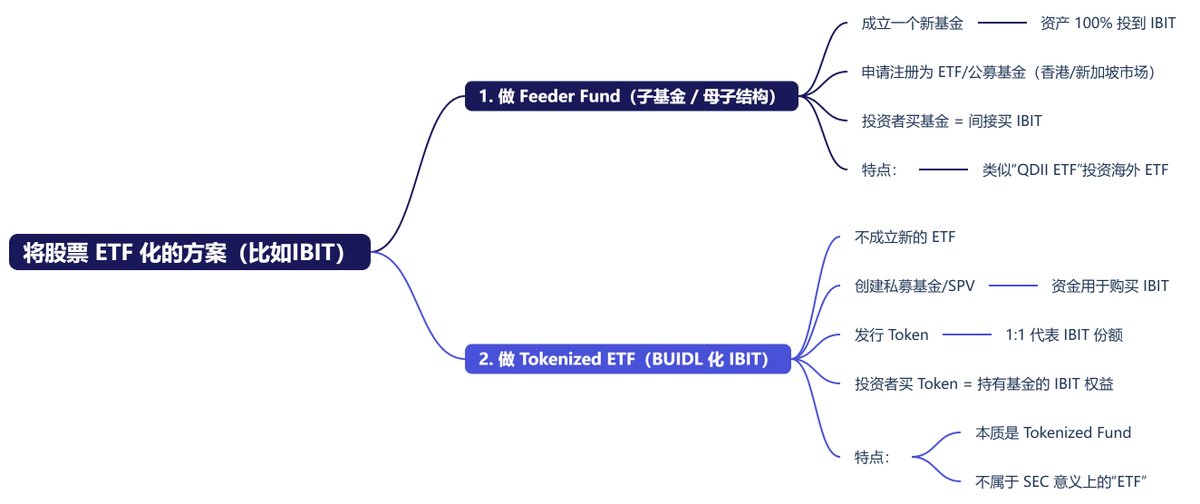

However, this doesn't prevent me from sharing my thoughts. Currently, there are two common schemes for issuing stocks as tokens:

The first and most commonly used method is based on the Feeder Fund approach. This method involves establishing a fund that uses the capital injected into it to fully invest in a specific stock or ETF. For example, I am using $IBIT as an example, and then applying for an ETF or a public fund with this fund. When users purchase my ETF or fund, it is equivalent to purchasing IBIT.

Up to this point, compliance can be achieved. If operating in Hong Kong, a Type 1 license (fund distribution) and a Type 9 license (fund management) are required. In Singapore, RFMC (for professional investors) and/or LFMC (for retail users) are needed. In Switzerland, compliance with the FINMA framework and the DLT and STO legislation is necessary. In Germany, compliance with the BaFin framework and approval through a Central Securities Depository or a BaFin-approved registration platform is required. The U.S. is a different story.

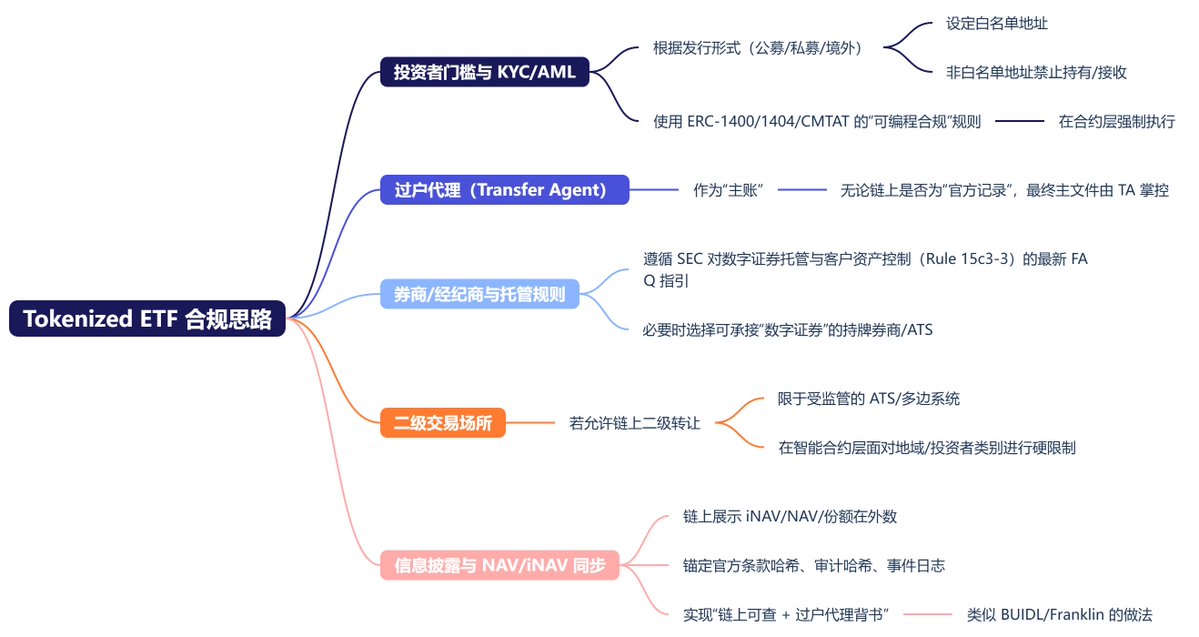

However, in the subsequent token issuance phase, while it can still be conducted, there are no compliant solutions for public (retail) sales in the U.S., Singapore, or Hong Kong, apart from Switzerland and Germany. Tokenization does not equal regulatory exemption; it is still a share of securities. If forced to sell to professional users, it can only be done within a whitelist system, such as ERC-1400 / ERC-1404 / CMTAT.

The second method is the Tokenized ETF approach, which is more complex and has very strong compliance requirements. BlackRock's BUIDL adopts this method. To put it simply:

A. Establish a legal entity in a trusted or international fund-friendly jurisdiction (like BVI) to provide legal identity + investor agreement structure.

B. Clearly define investor qualifications, opening only to qualified and/or professional investors, using high thresholds to avoid retail legal complexities.

C. Manage assets entirely with traditional low-risk financial instruments (government bonds, cash, repurchase agreements) to ensure principal safety + liquidity.

D. Digitize fund shares into tokens, but all issuance and/or redemption and/or transfer and/or control (transfer agent, custodian, whitelist) are still handled by traditional financial institutions or regulated entities.

E. Provide on-chain visibility + DeFi liquidity + stable value commitment, meeting both traditional regulatory requirements and being acceptable to the crypto market and/or institutions.

Comparing the two schemes, the first one is somewhat simpler. If a partially compliant approach is adopted, the first method can be advanced. Let me briefly summarize the practical application of the first scheme, still using $IBIT as an example:

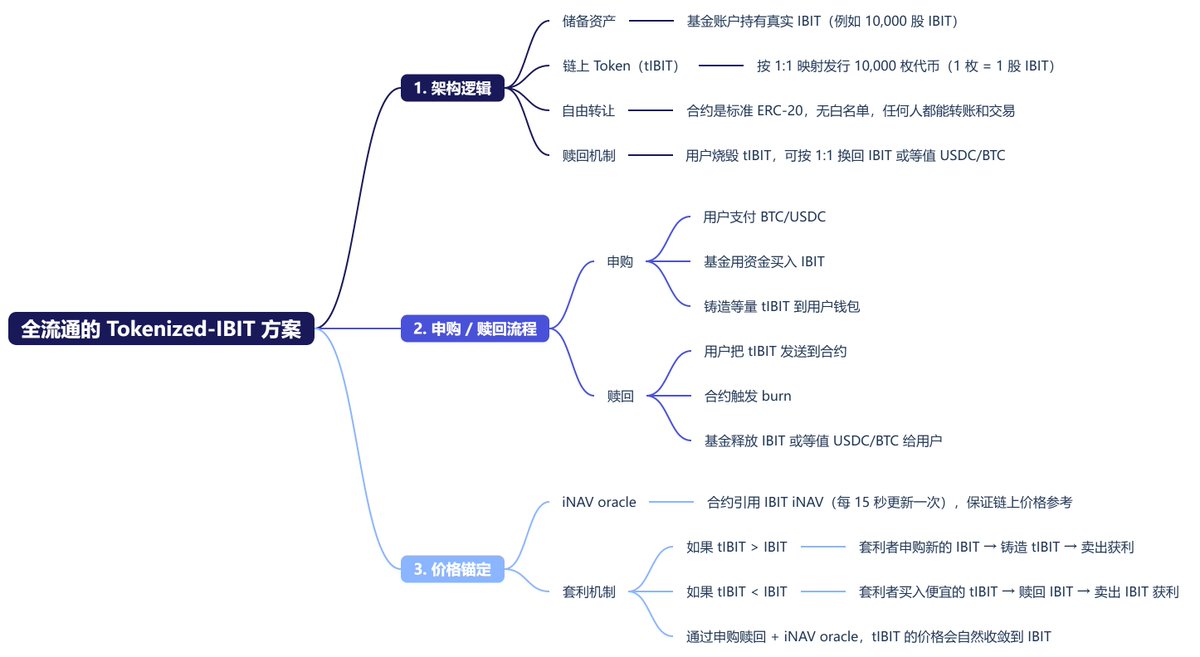

- Structural Logic:

A. Reserve Assets: The fund account holds real IBIT (for example, 10,000 shares of IBIT).

B. On-chain Token (tIBIT): Directly issue 10,000 tokens mapped 1:1 (1 token = 1 share of IBIT).

C. Free Transfer: The contract is a standard ERC-20, with no whitelist, allowing anyone to transfer and trade.

D. Redemption Mechanism: Users burn tIBIT to exchange for IBIT or an equivalent amount of USDC/BTC at a 1:1 ratio.

- Subscription / Redemption Process:

Subscription: Users pay with cryptocurrencies like BTC/USDC, the fund uses the capital to buy IBIT, and then mints an equivalent amount of tIBIT to the user's wallet.

Redemption: Users send tIBIT to the contract, triggering a burn, and then the fund releases IBIT or an equivalent amount of USDC/BTC to the user.

- Price Anchoring:

A. iNAV oracle: The contract references the IBIT iNAV (updated every 15 seconds) to ensure on-chain price reference.

B. Arbitrage Mechanism:

If tIBIT > IBIT: Arbitrageurs subscribe for new IBIT → mint tIBIT → sell for profit.

If tIBIT < IBIT: Arbitrageurs buy cheap tIBIT → redeem IBIT → sell IBIT for profit.

Through subscription and redemption + iNAV oracle, the price of tIBIT will naturally converge to IBIT.

For example, suppose:

The fund holds $1,000,000, buys 10,000 shares of IBIT ($100/share), and issues 10,000 tIBIT.

When the market price of tIBIT rises to $105:

Arbitrageurs pay $100 to subscribe for 1 share of IBIT, mint 1 tIBIT, and sell for $105 profit, bringing the price back down to $100.

When the market price of tIBIT drops to $95:

Arbitrageurs buy 1 tIBIT ($95), redeem 1 share of IBIT (worth $100), and profit $5, pulling the price back up to $100.

This is the general design. Interested parties can reach out to discuss further. There is actually a lot more I want to write, but I have to head out soon, so I will stop here.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。