Author: Glendon, Techub News

As the mainstreaming of digital assets in the United States continues to accelerate, the recent decision by the U.S. Securities and Exchange Commission (SEC) has once again rewritten the rules of the game in this market.

On September 17, U.S. local time, the SEC voted to approve rule changes proposed by the three major national securities exchanges: the New York Stock Exchange (NYSE), Nasdaq, and Cboe Global Markets, officially adopting a universal listing standard for exchange-traded products that hold spot commodities, including digital assets.

According to this decision, exchanges can directly list and trade commodity trust shares that meet the approved standards without having to submit a rule change proposal to the SEC in advance, as required by Section 19(b) of the Securities Exchange Act. The most significant impact of this change is the simplification of the approval process, reducing the previously lengthy approval time from 240 days or more to a maximum of 75 days, while also significantly lowering compliance costs.

On the other hand, the SEC has set detailed conditions for the listing eligibility of cryptocurrency spot ETFs. To qualify for listing, a cryptocurrency spot ETF must hold a commodity that meets one of the following conditions: first, it must be traded on a market that is part of a cross-market surveillance organization and has monitoring authority; second, it must have been listed on a designated contract market for at least six months, and there must be a monitoring-sharing agreement for the futures contract underlying it. Additionally, the SEC noted in its documents that if a cryptocurrency is tracked by an ETF listed on a national securities exchange with an investment ratio of at least 40%, then that cryptocurrency spot ETF may also qualify for listing.

At the same time the decision was implemented, the Grayscale Digital Large Cap Fund, Cboe Bitcoin U.S. ETF Index, and Mini-Cboe Bitcoin U.S. ETF Index were also approved by the SEC for listing and trading, becoming the first beneficiaries of this decision.

In response, SEC Chairman Paul Atkins publicly stated in the document that this move ensures that the U.S. capital markets are the best place for cutting-edge innovation in digital assets. By simplifying processes and lowering barriers, it maximizes the range of choices for investors and strongly promotes innovation and development in the digital asset field.

With the official launch of the universal listing standard, the market's attention is focused, and the industry generally believes that the spot ETFs for Solana and Ripple will be the first to benefit from this favorable wind. Why is that?

Promising Prospects for Solana and Ripple Spot ETFs

As of the time of writing, several well-known issuers have actively positioned themselves, submitting applications for Solana spot ETFs in the U.S., including Grayscale, VanEck, Franklin Templeton, Fidelity, Invesco/Galaxy, Canary Capital, and Bitwise. The reason institutions are so optimistic about Solana is mainly due to its significant advantages of low gas fees and high liquidity, making it an ideal investment target for ETFs.

Just a week ago, Bitwise Chief Investment Officer Matt Hougan made a bold prediction, stating that the SEC is expected to make a decision on Solana spot ETF applications by October 10.

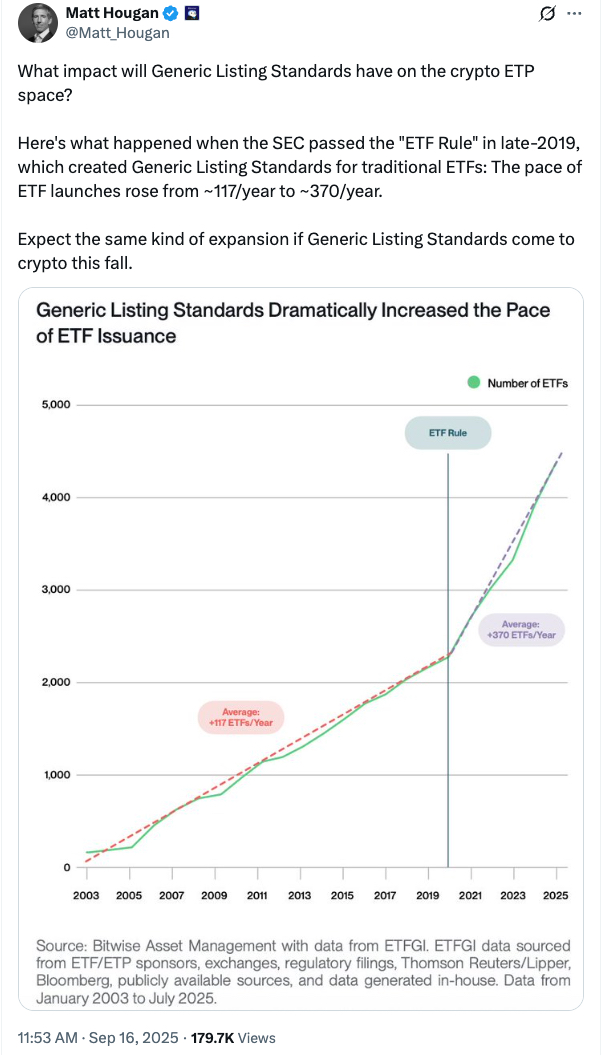

When discussing the impact of the universal listing standard on the cryptocurrency ETP field, he pointed out, "Looking at history," that the "ETF rules" passed by the SEC at the end of 2019 established a universal listing standard for traditional ETFs, which significantly increased the speed of ETF issuance from about 117 per year to about 370 per year. He predicts that once the universal listing standard is applied to the cryptocurrency field this fall, the speed of ETF issuance will also experience similar explosive growth, and the development history of ETFs provides strong evidence for this.

From the recent price trends and related data of SOL, we can clearly perceive the market's enthusiastic pursuit of this token. In terms of market performance, SOL's price has surged, successfully breaking through the $250 mark, reaching its highest level since January 25, and showing a strong upward trend. According to data from SolanaFloor, as of September 12, the first Solana staking ETF in the U.S. launched by REX Shares (code SSK) has already reached an asset management scale of $251 million, setting a historical high.

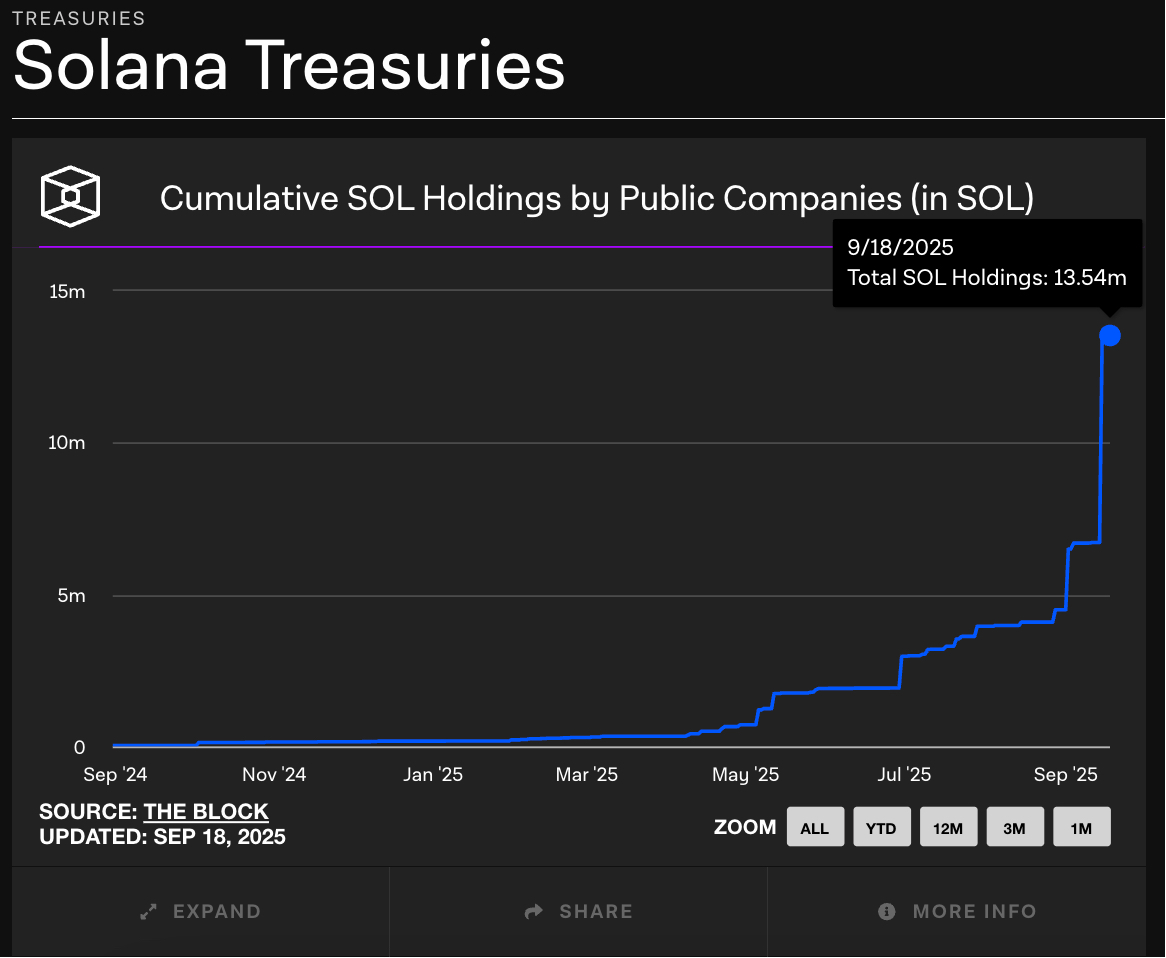

Moreover, this regulatory framework is gradually aligning with the booming Digital Asset Treasury (DAT) strategy. Currently, more and more companies are incorporating diversified digital assets as a core component of their balance sheets. Among various digital assets, the development momentum of SOL treasury is particularly rapid, with its expansion speed only second to Bitcoin and Ethereum. According to data from The Block, as of September 18, the number of SOL held by listed companies has reached approximately 13.54 million, valued at about $3.31 billion based on the price at that time. As two major markets in the "institutional era," it is foreseeable that the development of DAT and the ETF market will complement each other.

Now let's look at Ripple. Although its recent price performance and DAT development trend lag behind SOL, XRP reached a historical high of $3.6639 in early July this year. Currently, there are over 11 XRP spot ETF applications pending SEC approval, including applications from well-known companies such as Franklin Templeton, Bitwise, and Canary, which is comparable to the number for Solana. Previously, Ripple CEO Brad Garlinghouse expressed strong confidence in an interview with Bloomberg that XRP would be included in the White House cryptocurrency reserves, emphasizing that the emergence of an XRP ETF is "inevitable."

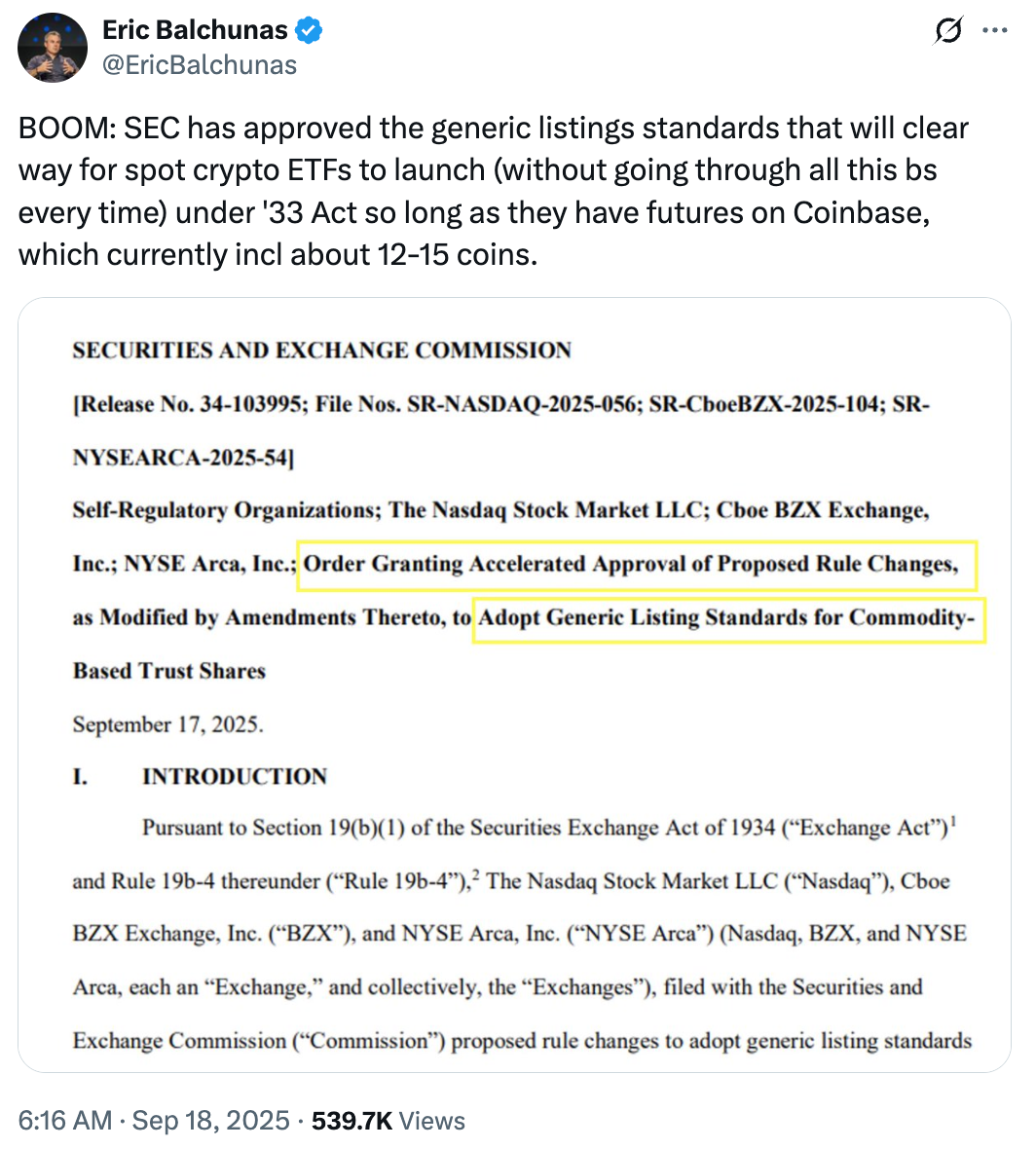

In the ETF field, Ripple's development pace is actually faster than Solana's. On September 18, the REX-Osprey XRP ETF was successfully listed in the U.S., providing exposure to XRP spot, with a first-day trading volume of up to $37.7 million. Bloomberg ETF analyst Eric Balchunas pointed out on Twitter that this ETF, with its first-day trading volume, has become the largest in terms of first-day trading volume among funds listed in 2025.

It is worth mentioning that the DOGE ETF launched by REX-Osprey was listed on the same day as the XRP ETF, with a first-day trading volume of $17 million. Although some analysts believe that DOGE lacks solid fundamental support, its strong demand in the market cannot be underestimated.

From the above performances, it is not difficult to see that both Solana and Ripple exhibit very strong data and development potential, making them the current focus of attention in the cryptocurrency ETF market.

In addition to the aforementioned notable cryptocurrency projects, as of September, the SEC has accepted over 90 cryptocurrency ETF applications, covering various mainstream altcoins and meme coins such as Litecoin, Cardano, Avalanche, and Polkadot, making it a "hundred boats competing for the current." Among them, Grayscale's application for the Litecoin Trust has been successfully accepted by the SEC, and Bloomberg has predicted that the probability of LTC ETF approval is over 90%; Grayscale, Bitwise, and VanEck have all applied for Cardano spot ETFs, and Nasdaq has applied to include ADA in the cryptocurrency index to pave the way for ETF approval; additionally, Bitwise's spot AVAX ETF has also entered the approval process. Industry insiders analyze that, apart from meme coin ETFs like BONK and TRUMP, the approval probability for most ETFs is close to 90%.

Based on this, Eric Balchunas further predicted on Twitter that following the introduction of the new regulations, we may see over 100 cryptocurrency ETFs listed in the next 12 months. He also emphasized that as long as cryptocurrency projects have futures on the Coinbase platform (they may be approved for ETFs), there are currently about 12-15 tokens.

It is evident that the SEC's introduction of a universal listing standard for cryptocurrency ETFs undoubtedly opens a door to a vast world for the entire cryptocurrency market. So, what profound impacts will this move bring to the market?

New Regulations Break the Deadlock: What Impacts Will the ETF Wave Bring?

Undoubtedly, the introduction of this new regulation by the SEC will reshape the competitive landscape of the global cryptocurrency market. From a short-term perspective, setting aside the two giants, Bitcoin and Ethereum, the opening of a compliant channel will attract at least $20 billion in institutional funds into the cryptocurrency ETF market, with assets like Solana and XRP potentially accounting for over 60% of the share; of course, due to the continued fermentation of the "head effect," the so-called strong will remain strong, and the dominant position of Bitcoin and Ethereum ETFs will be further solidified by the new regulations.

From a medium to long-term perspective, this decision will produce multiple chain reactions. The most direct impact is that the overall cryptocurrency market will welcome an upward trend, and the penetration of traditional finance will further accelerate. The launch of ETFs will make it easier for traditional investors to allocate cryptocurrency, and their standardized characteristics will lower the entry barriers for conservative institutions such as banks and pension funds, thereby significantly enhancing the correlation between cryptocurrency assets and traditional markets. It is noteworthy that the U.S. may set a template for other jurisdictions through this "classified regulation" model, and once the EU, Singapore, and other regions accelerate their follow-up, it is expected to promote the convergence of global cryptocurrency regulatory frameworks.

On the other hand, blockchain projects with compliance advantages (such as Solana and Ripple) will attract more developers and capital, while tokens that comply with U.S. CFTC regulations and have futures contracts lasting over six months (such as Cardano and Avalanche) also have the opportunity to become the next batch of ETF targets. However, small and medium-sized public chains and projects may face severe challenges from the "Matthew effect."

In this regard, Matt Hougan's view is that although the SEC has simplified the approval process for cryptocurrency ETPs, leading to a new wave of products, this does not guarantee their success. He cautions against equating the launch of cryptocurrency ETFs with a resurgence in token popularity. In reality, the existence of cryptocurrency ETPs does not necessarily mean that there will be a significant influx of funds; investors need to have a fundamental interest in the underlying assets. For example, ETPs based on Bitcoin Cash (BCH) may struggle to attract capital.

Additionally, SEC Commissioner Caroline Crenshaw has expressed concerns about the new listing standards. She bluntly pointed out, "The Commission is shirking its responsibility to review these proposals and conduct necessary investor protection investigations, instead supporting the rapid introduction of these new, potentially unverified products to the market." She emphasized that one important reason the universal listing standard is not applicable to digital asset ETPs is that the underlying cryptocurrency spot market still carries unique risks, and funds holding volatile assets may themselves be volatile. In her view, this approach is likely to lead to a market flooded with inadequately reviewed products, thereby posing potential risks to investors and harming their interests.

Crenshaw's concerns are certainly not unfounded, but it should be noted that for cryptocurrency ETF products to achieve final listing, they still need to meet specific standards to gain approval, which is not an easy task. Therefore, although the regulatory door has been opened, the launch of cryptocurrency ETFs still requires a lot of work. As the saying goes, "To forge iron, one must be strong oneself"; it is crucial for cryptocurrency projects to develop their own advantages and complete compliance work. Regardless, the SEC's introduction of a universal listing standard will undoubtedly trigger a wave of ETFs, which will become new catalysts in the market, propelling the cryptocurrency market into a new stage of development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。