Author: seed.eth

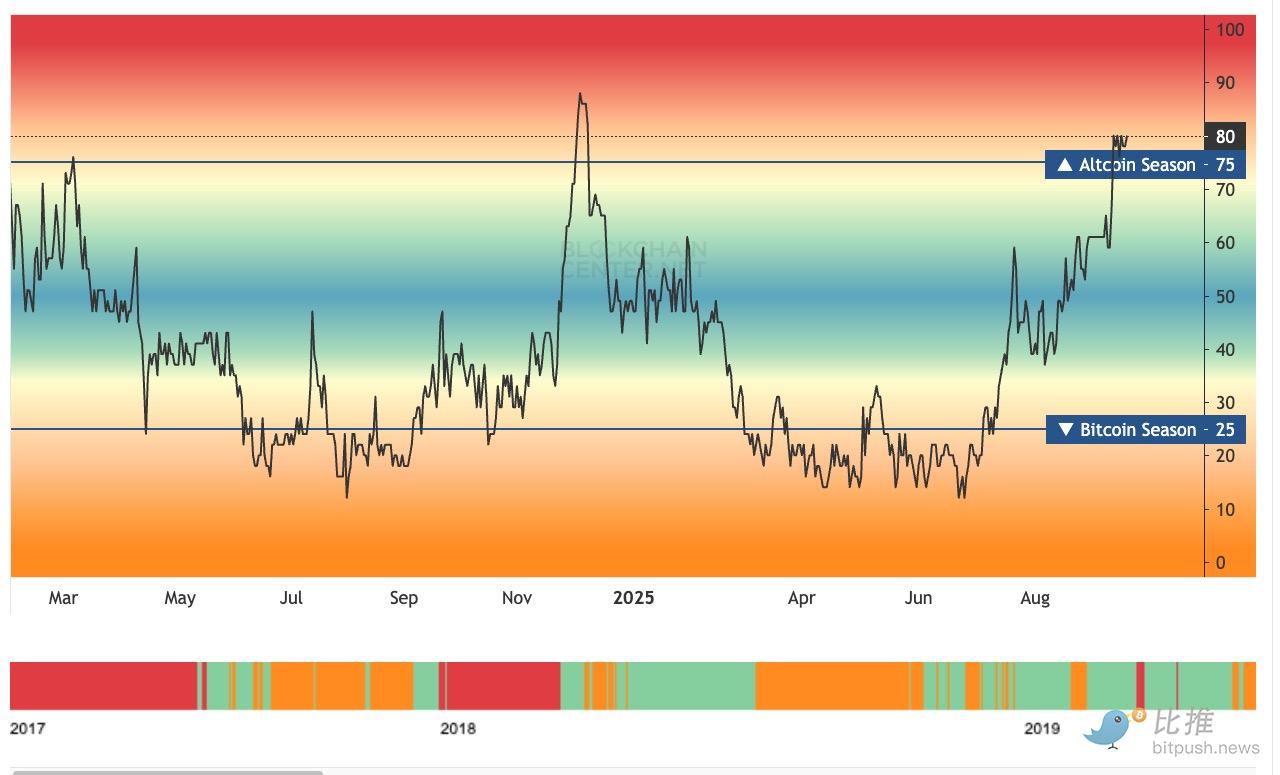

The Altcoin Season has officially begun.

As the "Altcoin Season Index" breaks the 80 mark, market funds are massively flowing from Bitcoin to other mainstream coins like Ethereum, Solana, and XRP. Recently, BNB has also continuously broken historical highs, adding strong momentum to this round of market activity.

Behind this round of capital rotation, the real driving force comes from the shift in the regulatory environment: the SEC's easing stance on crypto assets is giving rise to a wave of Altcoin ETF issuances, completely igniting bullish sentiment in the altcoin market.

Simplified ETF Mechanism: Hundreds of Altcoin Funds Coming Soon

The SEC approved the "General Listing Standards" for crypto ETFs yesterday, fundamentally changing the speed of product listings.

This important step reduces the ETF approval time from a lengthy 240 days to just 75 days. Exchanges can now list and trade commodity trust shares that meet the general standards without having to submit individual 19b-4 applications.

The SEC is currently reviewing over 90 exchange-traded products, including altcoin ETFs for cryptocurrencies like Solana, XRP, and Litecoin.

Bloomberg senior ETF analyst Eric Balchunas stated that with the new rules in place, at least 12 to 15 crypto assets are expected to qualify for ETFs within the 75-day window, and it is anticipated that over 100 crypto ETFs will be launched in the coming year.

This signals the opening of a massive institutional channel, providing an unprecedented way for traditional financial capital to flow safely and conveniently into altcoins.

First Batch of ETF Trading Booms, Funds Accelerate Inflow

The huge demand for altcoin ETFs has already been reflected in trading volumes.

The REX-Osprey XRP ETF was listed on Thursday, with the stock code XRPR. The two companies also launched the REX-Osprey DOGE ETF on the same day, with the stock code DOJE, and both products had impressive trading volumes in the first hour after listing. The former exceeded $24 million in trading volume, while the latter reached $6 million.

Meanwhile, one of the world's largest derivatives exchanges, the Chicago Mercantile Exchange Group (CME Group), announced this week that it plans to launch Solana and XRP futures options on October 13, pending regulatory review.

All signs indicate a strong interest from traditional investors in altcoins, and once these funds receive broader approval, their impact on the prices of underlying cryptocurrencies will be significant.

Technology and Macro: Support for Altcoin Season

In addition to the funding channels brought by ETFs, technical indicators and the macro environment also provide strong support for the altcoin season:

Analysts point out that Bitcoin's dominance (BTC Dominance) has formed a death cross, a rare signal that has marked the beginning of every major altcoin season since 2016.

Additionally, Tradingview data shows that Bitcoin's dominance has declined for 12 consecutive weeks, indicating that capital is continuously flowing out of Bitcoin.

Coupled with the Federal Reserve's interest rate cut on Wednesday, signaling a shift towards an accommodative monetary policy, this typically injects more liquidity into the financial system, increasing demand for high-risk assets like cryptocurrencies, further driving up altcoin prices.

Overall, in this round of institution-led expansion, capital rotation and market confidence have become key factors driving the market. As Bitcoin enters a consolidation phase, more funds are gradually shifting towards high-risk assets. Historical experience shows that this process is often accompanied by stronger performance from altcoins. Although the pattern of a broad rally remains controversial, structural opportunities led by mainstream coins have already emerged, indicating that a more layered and fundamentally driven altcoin cycle is on the horizon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。