Original | Odaily Planet Daily (@OdailyChina)

In recent TGE projects, Aster is undoubtedly the most dazzling presence. On its first day of token ASTER's launch, it created a frenzy: the total trading volume exceeded $345 million within 24 hours, with the token price starting at $0.03015 and soaring to $0.528, achieving a single-day increase of 1,650%. Such performance not only caught the market's attention but also drew a mention from CZ, who said, "Well done! A good start, keep building!" Behind such a strong start, it is worth questioning: what gives Aster such confidence?

Aster is supported by YZi Labs (formerly Binance Labs) and is expected to be the next-generation Perp DEX on the BNB Chain. Looking at the entire crypto industry, Hyperliquid has proven to the market through its impressive trading volume and capital capacity that decentralized perpetual contracts are no longer a financial experiment for small funds, but a main battlefield capable of accommodating large capital.

However, turning our attention to the BNB Chain, a public chain known for its large user base and activity, it has yet to nurture a flagship perpetual contract platform that can represent its ecosystem. This gap is precisely Aster's entry point. It is both a response to the Hyperliquid model and a fill for the gap in the BNB Chain derivatives ecosystem, attempting to carve out a new path for on-chain finance.

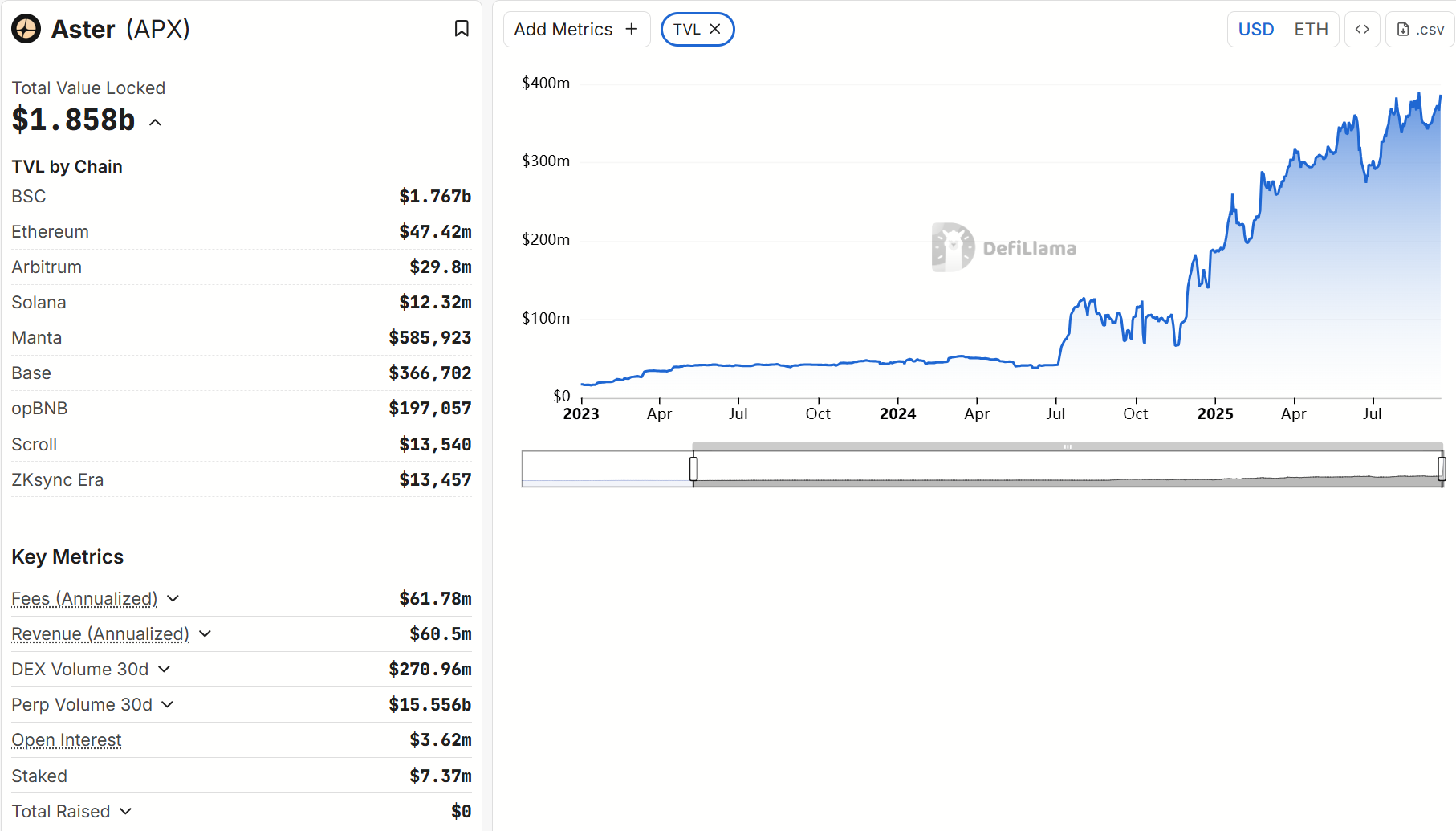

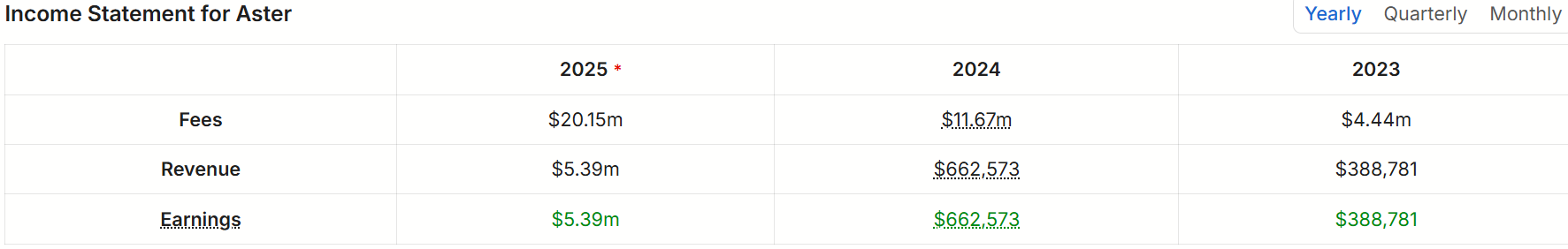

This assertion is not without reason. Data from defillama.com shows that Aster's contract trading volume has ranked first on the BNB Chain in the past 30 days, with its total value locked on-chain exceeding $1.8 billion, annual revenue exceeding $60 million, and an annual revenue growth rate approaching 700%. Behind these numbers, Aster has not only established a product experience and liquidity moat but has also initially secured a foothold in user stickiness and revenue models, rapidly rising to become a core node within the BNB Chain ecosystem.

Aster Introduction: A New Generation Derivatives Platform Under Binance Narrative

In fact, Aster is not a newcomer without foundation in the decentralized derivatives space, but rather a product of long-term accumulation and integration. Its predecessor can be traced back to Astherus and APX Finance, the former being a multi-asset liquidity protocol and the latter focusing on decentralized perpetual contracts. Both are star projects within the BNB Chain ecosystem and have received investment support from YZi Labs (formerly Binance Labs).

At the end of 2024, the two projects joined forces to complete a merger, integrating their technology, resources, and community advantages, returning to the perpetual contract space with a "new look." On March 31, 2025, they officially debuted under the new identity of Aster. This merger not only represents a brand refresh but also marks a clear direction for its development: upgrading from a single perpetual contract trading platform to a comprehensive derivatives platform with an ecosystem map and product matrix.

It is worth noting that Aster's development trajectory inherently carries the "Binance system" gene. The deep support from YZi Labs gives it differentiated advantages in strategy, traffic, and capital. Compared to other similar DEXs that often struggle to find liquidity and users during the cold start phase, Aster stands at a higher starting point by leveraging the natural entry of the BNB Chain ecosystem.

Among Binance's user base, Aster's identity label even serves as a trust certificate. For many users transitioning from the Binance exchange to DeFi, Aster's entry barrier is much lower than that of unfamiliar projects—this "traffic dividend" brought about by psychological inertia means it has a natural first-mover advantage in user acquisition and ecosystem penetration.

Therefore, Aster is not just "another perpetual DEX," but more like a missing piece in the BNB Chain ecosystem puzzle. Its strategic significance lies not only at the product level but may also become an important carrier for extending the Binance DeFi narrative.

Aster's Product Matrix: From Core Contracts to Multi-layered Ecosystem

If the merger and renaming have given Aster a clearer identity, its true competitiveness lies in the diversified layout of its product matrix and ecosystem map. Unlike many Perp DEXs that focus on single-point breakthroughs, Aster seems to be attempting to extend outward with "contract trading" as the core, gradually building a multi-layered product matrix and ecosystem map.

Core Product: Aster Pro Perpetual Contracts

At the product matrix level, Aster's foundation remains perpetual contract trading. Its core product is Aster Pro, a perpetual contract trading system based on an order book model. Unlike most AMM-based Perp DEXs, Aster Pro can provide users with depth and liquidity closer to centralized exchanges through a specialized matching engine and order book mechanism, while maintaining transparency and self-custody advantages on-chain. This means users can enjoy a trading experience with low slippage and accurate pricing while avoiding the risks of centralized custody.

The design core of Aster Pro lies in its flexible margin system and risk management tools. It supports both Single-asset Mode and Multi-asset Mode, providing differentiated choices for different types of traders.

- Single-asset Mode limits margin to USDT, suitable for users who prefer a simple structure. Moreover, its positions are mutually independent, with profits and losses calculated separately, providing stronger risk isolation, closely resembling the isolated margin logic of centralized exchanges.

- Multi-asset Mode accepts mainstream assets such as BTC, ETH, BNB, and re-staked assets (SlisBNB, asBNB, etc.) as margin, and all positions can share margin, allowing for real-time hedging of profits and losses between positions, thus enhancing capital utilization efficiency. The system supports automatic asset balancing, which automatically converts other assets to supplement when a certain asset is insufficient, without incurring additional fees.

This dual margin system provides users with a contract trading experience that combines professionalism and flexibility. It not only narrows the experiential gap between on-chain and CEX but also offers DeFi traders a higher-level space for capital management and strategy implementation, allowing users to choose based on their risk preferences.

Stock Perpetual Contracts

Aster Pro also pioneered the introduction of Stock Perpetual Contracts, opening up a new frontier for decentralized trading platforms. Unlike conventional DEXs that can only trade crypto assets, Aster allows users to trade US stock perpetual contracts directly on-chain based on USDT margin. The first trading pair launched is AAPL/USDT (Apple Stock Contract), where users can operate long and short positions with up to 50x leverage, with all positions and profits settled in USDT. The index price is provided by Pyth Oracle and multi-source data feeds, ensuring transparent and fair pricing.

This innovation is not only a reconstruction of traditional financial products on-chain but also provides a new asset allocation channel for crypto traders and global investors. The launch of AAPL/USDT can be seen as Aster's starting point in exploring on-chain capital markets, with potential that goes beyond just a new trading pair, possibly heralding the future unified trading platform for stocks, crypto, and RWA assets.

Ecosystem Matrix

Aster's ecosystem is not limited to the contract market; the spot and pre-market trading markets are also part of it. Aster has introduced a centralized limit order book (CLOB) mechanism, combining the matching depth of CEX with the self-custody advantages of DEX. On September 7, 2025, Aster officially launched its spot market and entered into deep cooperation with Four.meme, a representative incubation platform on the BNB Chain. The first batch of projects launched includes Creditlink (CDL), which recently set a new high in fundraising on Four.meme. More importantly, Four.meme has long focused on early investment and continuous support for on-chain innovative projects, introducing funding and community enthusiasm for new assets through the BNB Guardians program. This collaboration signifies a deep integration of Four.meme's incubation advantages with Aster's trading ecosystem, constructing a complete ecological cycle from incubation, financing to actual trading within the BNB Chain.

In addition, stablecoins are also one of Aster's important products. Aster introduces liquidity into its ecosystem through a dual-layer design of USDF and asUSDF. On one hand, USDF, as a fully collateralized stablecoin, can be freely exchanged with USDT at a 1:1 ratio, designed to attract and utilize USDT liquidity while creating additional returns for users through decentralized finance (DeFi) strategies. On the other hand, asUSDF provides staking-derived yields, further extending DeFi application scenarios. This means that users can not only complete perpetual and spot trading within Aster but also achieve efficient asset circulation through stablecoins.

Roadmap: Comprehensive Upgrade of Infrastructure and Ecosystem

At the end of 2024, Astherus and APX Finance officially merged, completing the integration of resources and technology. This step laid the foundation for subsequent product upgrades, and the new Aster returned to the market. On April 10, 2025, Aster launched the first phase of the Aster Spectra plan, allowing users to earn Rh points through trading and unlock ASTER air drop eligibility. This event concluded successfully on June 22, with 527,224 unique wallets generating over $37.7 billion in trading volume over 20 weeks, allowing Aster to capture nearly 20% of the monthly trading volume share in the decentralized contract market within just a few months. This not only brought initial user retention to Aster but also warmed up the launch of its token economics.

Now, Aster has conducted its TGE on September 17. Since the ASTER token currently only supports spot trading on the Aster DEX, this platform has become the sole entry point for funds and users. As a result, within 24 hours, the platform's daily TVL surged from $660 million to $1.005 billion, with a total daily trading volume of nearly $1.5 billion and over 330,000 new unique wallet addresses created.

Currently, the second phase of Aster Genesis has been launched, allowing users to trade on Aster Pro to earn Rh points for the second phase rewards.

If the short-term focus is on "dual-driven product and user growth," the long-term vision is a comprehensive upgrade of infrastructure and ecosystem.

- Launch of Aster Chain: In future plans, Aster aims to create a dedicated chain focused on high-performance derivatives, bringing greater autonomy and expansion space to Aster.

- Building the Aster Financial Ecosystem: Gradually extending financial products such as stablecoins and RWA around Aster DEX to form a relatively complete financial ecosystem.

- Becoming a Pillar of Perpetual Trading on BNB Chain: Aster's ultimate vision is to learn from Hyperliquid and become a representative protocol for perpetual contract trading on BNB Chain, potentially becoming a key piece in Binance's DeFi strategy.

In other words, Aster's development path is clear: from a single product to an ecosystem matrix, from BNB Chain infrastructure to a cross-market financial platform. Its narrative is not just about being a Perp DEX, but about impacting the landscape of the on-chain derivatives market.

Track Analysis: The "Second Half" of On-Chain Derivatives

Track Overview

In the crypto financial market, perpetual contracts are one of the most representative products. Compared to the spot market, they feature high leverage, no expiration date, and a funding rate balancing mechanism, making them core tools for traders to hedge, speculate, and arbitrage. At the centralized exchange level, the trading volume of perpetual contracts is nearly five times that of spot trading, making it almost a "traffic engine" for the crypto market.

With the rise of decentralization, users' demand for asset self-management and transparent settlement has been continuously increasing, and Perp DEX has gradually become a new growth point. Its logic is to migrate derivative trading, which originally relied on centralized matching and clearing, onto the chain, using smart contracts and oracles to complete matching, clearing, and funding rate settlement. This not only reduces centralized risks but also provides users with greater freedom.

More importantly, as L2 scaling and cross-chain interoperability mature, the user experience gap for on-chain derivatives is narrowing. For example, dYdX approaches CEX in experience through an order book model, while GMX's GLP pool offers users a new way to "market-making while mining." In other words, the competition for perpetual contracts has entered the second half: shifting from "proving feasibility" to "competing on efficiency, depth, and ecosystem synergy."

Perpetual DEX Market Landscape

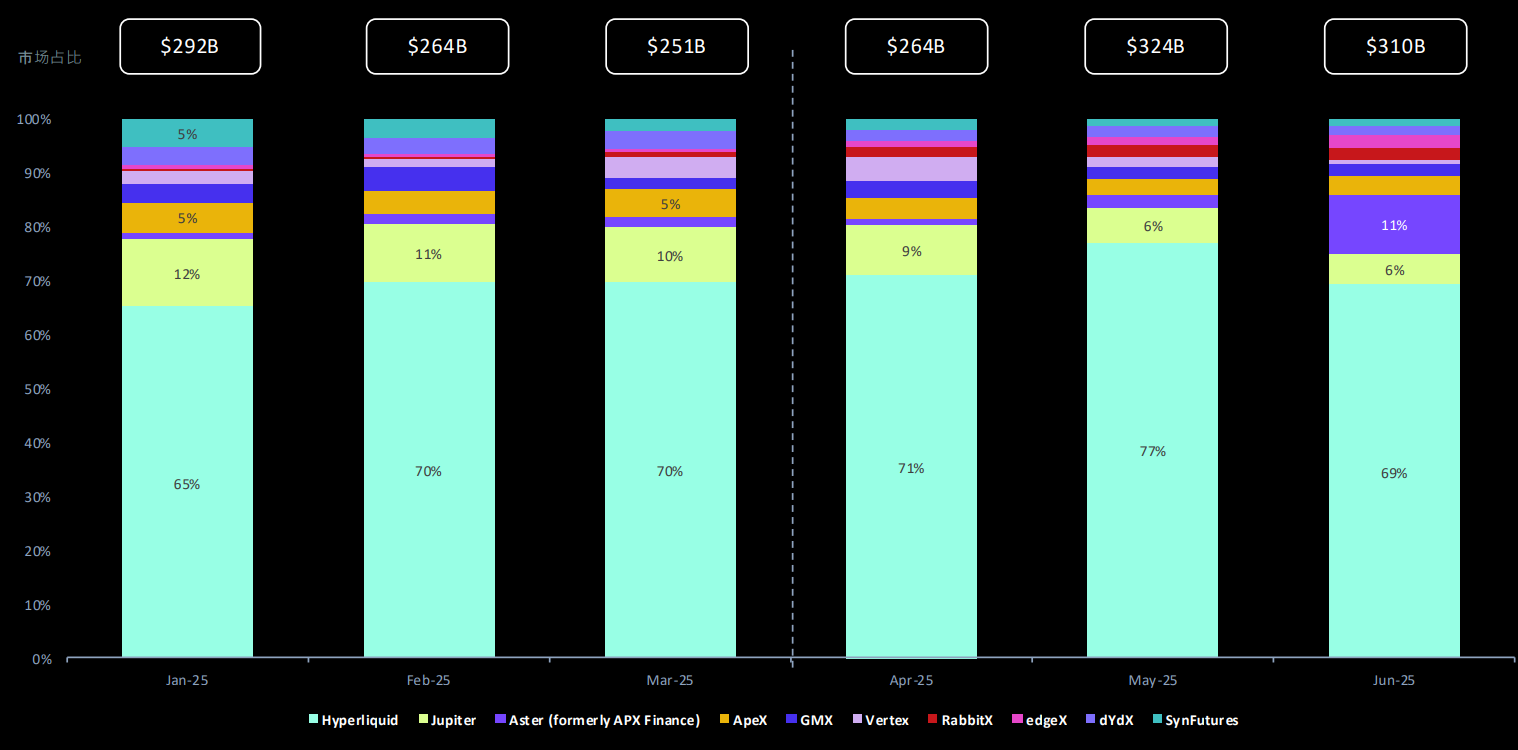

From an overall market perspective, on-chain perpetual trading is still in a rapidly growing upward channel. According to the 2025 Q2 Industry Report released by Coingecko, the total quarterly trading volume of the top ten decentralized perpetual contract trading platforms (Perp DEX) reached $89.8 billion, an 11.3% increase from Q1's $80.66 billion, setting a new historical high.

However, what is more noteworthy is that among the Top 10 list, only Hyperliquid, Aster, RabbitX, and edgeX recorded growth, with Aster's performance being particularly impressive: thanks to the launch of Aster Pro, its quarterly trading volume doubled compared to the previous quarter, quickly becoming one of the fastest-growing newcomers in the industry.

In stark contrast, the once-leading dYdX has seen its trading volume continue to decline, with an average monthly trading volume of only $5.3 billion in Q2, less than half of what it was at the beginning of the year. This shifting pattern highlights that the new generation of Perp DEX represented by Aster is gaining market validation.

Aster's Differentiated Advantages

In the increasingly competitive on-chain derivatives market, how to stand out is a challenge Aster must face. Currently, Aster's advantage lies not in superficial "faster growth" or "more users," but in its construction of a differentiated moat.

(1) Product Diversification, Breaking Through the Ceiling of a Single Track

Most Perp DEXs remain focused on the single track of crypto perpetual contracts, while Aster is attempting to build its own ecosystem map by opening new boundaries with stock perpetual contracts. This not only serves crypto-native users but may also accommodate cross-border demands from traditional markets, a dimension that other similar projects have yet to touch.

(2) Technical Architecture and Experience Advantages

In terms of user experience, Aster's order book model narrows the experience gap between on-chain and CEX. The flexible single/multi-asset margin mechanism meets the risk isolation needs of novice users while satisfying the capital efficiency pursuits of professional traders. This "dual-focused" design broadens Aster's target user base and enhances the platform's scalability.

(3) Strategic Depth and Narrative Space

Aster's deep binding with YZi Labs provides it with funding, technology, and traffic advantages. Its linkage with the BNB Chain ecosystem also gives Aster a natural advantage in cold-start traffic and market recognition, which serves as a unique trust moat in the fiercely competitive early stage. In the long run, Aster's goal is not to remain a "Perp DEX on BNB Chain," but to achieve higher strategic depth through the launch of Aster Chain and the expansion of its financial ecosystem. Externally, it can accommodate cross-chain traffic and traditional market demands; internally, it will become the core infrastructure of the BNB Chain derivatives market. In other words, Aster is not merely a follower in the track but is attempting to reshape the entire competitive landscape of on-chain derivatives.

In the decentralized derivatives track, the keyword for competition is no longer "proving the model," but "who can establish barriers in efficiency and ecosystem." Aster's emergence is both a filler for the gap in the BNB Chain derivatives market and a narrative representative of this round of track evolution. Through a diversified product matrix, it aims to build a broader prototype of the on-chain financial market.

In the future, whether Aster can truly become the "pillar" of perpetual contracts on BNB Chain, or even step towards cross-chain financial infrastructure, still requires time to test. But it is certain that it has already thrown out a new proposition for the industry: the second half of decentralized derivatives is not only about competing in trading experience but also about competing in ecosystem synergy and narrative depth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。