Author: Jianing Wu, Galaxy Digital

Compiled by: Tim, PANews

In August, the macroeconomic environment and the cryptocurrency market presented various mixed signals.

In traditional markets, investors faced conflicting inflation signals: the CPI released at the beginning of the month was below expectations, but the subsequently released Producer Price Index (PPI) was above expectations. Meanwhile, employment data gradually weakened, and market expectations for the Federal Reserve to begin cutting interest rates in September continued to strengthen. At the end of the month, during the Federal Reserve meeting in Jackson Hole, Wyoming, Chairman Powell exhibited a dovish stance, emphasizing the "risk balance changes" brought about by rising unemployment rates, which reinforced expectations for a shift in monetary policy towards easing. The stock market fluctuated and closed higher, with the S&P 500 index showing volatility around the data releases, while defensive assets like gold performed notably well at the end of the month.

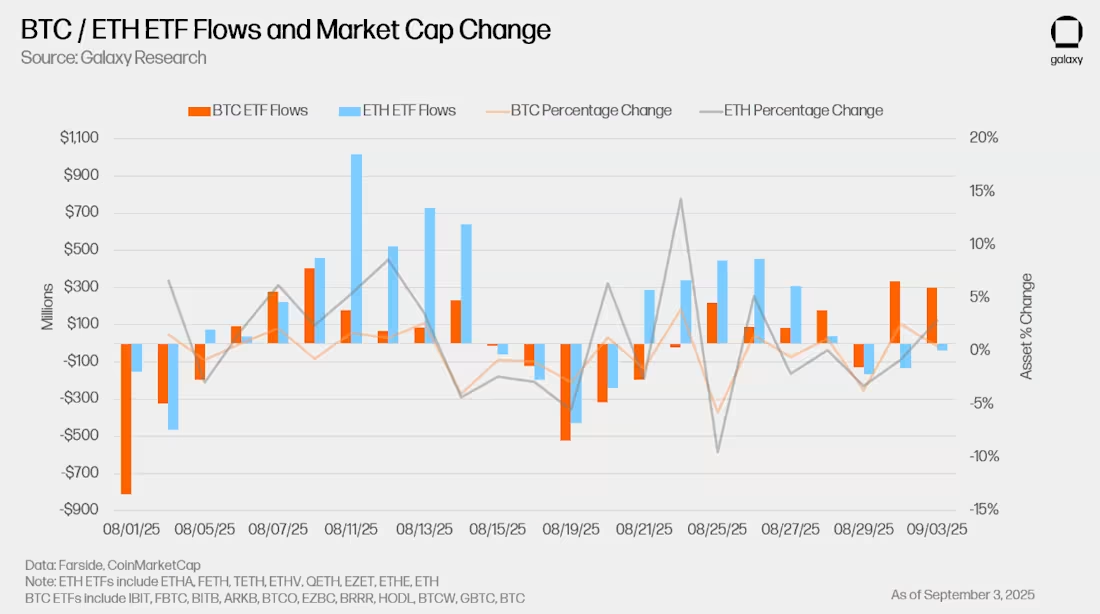

The cryptocurrency market reflected this macro uncertainty, with volatility increasing. Bitcoin reached a historic high of over $124,000 in mid-August, then retreated to around $110,000, while Ethereum outperformed Bitcoin throughout the month. After experiencing the largest single-day outflow for Ethereum ETFs at the beginning of the month, strong capital inflows quickly followed, and despite Ethereum's smaller market capitalization, its related product data briefly surpassed that of Bitcoin.

However, the recovery in demand pushed the ETH price close to $4,953, setting a new high, and the ETH/BTC exchange rate rose to 0.04 for the first time since November 2024. The fluctuations in ETF trading highlighted that institutional position adjustments are increasingly influencing price trends, with ETH clearly being the leader in this cycle.

In terms of legal policies, regulators are gradually advancing reforms to reshape the industry landscape. The U.S. Department of Labor opened the door for cryptocurrency assets in 401(k) pension plans; the U.S. SEC explicitly stated that certain liquid staking operations do not fall under the category of securities.

The trends in market structure and institutional applications are further deepening. Treasury Secretary Yellen disclosed for the first time that strategic Bitcoin reserves have reached between 120,000 to 170,000 coins, revealing the government's cumulative cryptocurrency asset holdings. Corporate activities are also accelerating: stablecoin issuers Stripe and Circle announced plans to develop independent L1 blockchains, Wyoming became the first state government in the U.S. to issue a dollar stablecoin, and Google joined the enterprise-level blockchain competition with its "Universal Ledger" system. Meanwhile, cryptocurrency treasury companies continue to increase their asset allocations.

Overall, August reinforced two key trends. On one hand, macro volatility and policy uncertainty triggered significant fluctuations in both the stock and cryptocurrency markets; on the other hand, the deepening trend of market institutionalization is accelerating, from ETF capital flows to widespread adoption by sovereign institutions and enterprises. As the market enters autumn, these interacting forces may continue to dominate market trends, with the Federal Reserve's policy shift and ongoing structural demand likely setting the tone for the next phase of the cycle.

1. Surge, Breakthrough, and Reversal

In the first half of August, Ethereum led the market, outperforming Bitcoin and driving a general rise in altcoins. The Bloomberg Galaxy Cryptocurrency Index showed that on August 13, Bitcoin reached a historic high of $124,496, followed by a reversal, closing at $109,127 at the end of the month, down from $116,491 at the beginning of the month. A week later, on August 22, Ethereum broke through the previous cycle's high, reaching $4,953, surpassing the November 2021 high of $4,866, ending a four-year consolidation.

Ethereum's strong performance is particularly noteworthy, as it had underperformed for much of this cycle. Since falling to around $1,400 in April, the price of Ether has more than doubled, driven by strong ETF capital flows and purchases by cryptocurrency treasury companies. In August, U.S. spot Ethereum ETFs recorded approximately $4 billion in net inflows, making it the second strongest month after July, while U.S. spot Bitcoin ETFs saw net outflows of about $639 million.

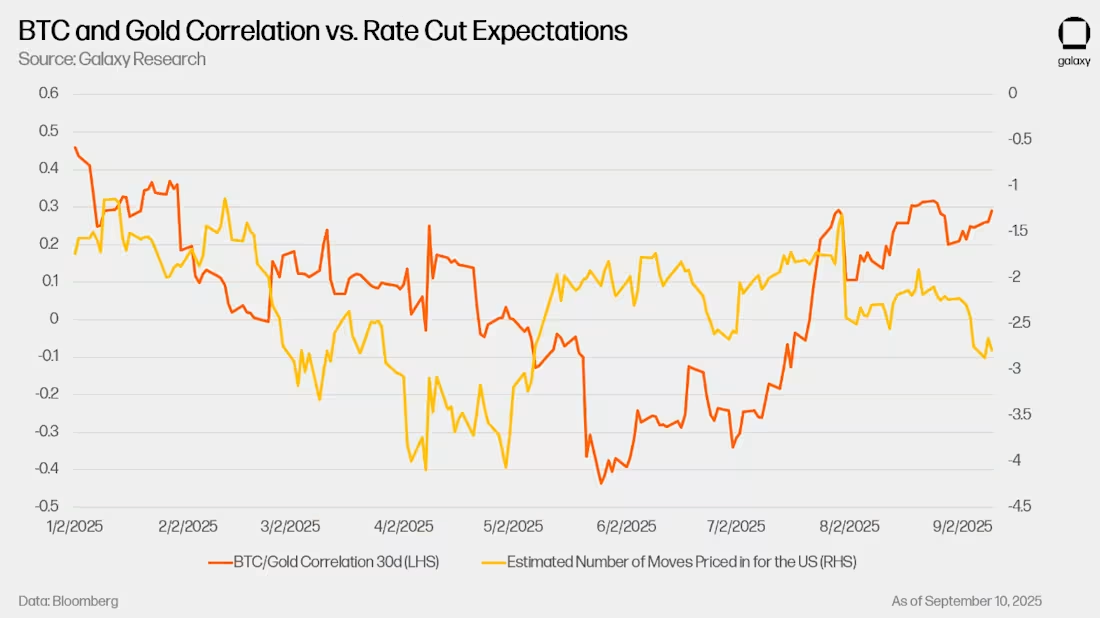

However, despite the price decline in the last two weeks of August, Bitcoin ETF inflows turned positive. As market expectations for aggressive interest rate cuts by the Federal Reserve heated up, Bitcoin's narrative as a store of value regained focus. With the increased likelihood of rate cuts, the correlation between Bitcoin and gold significantly strengthened during the month.

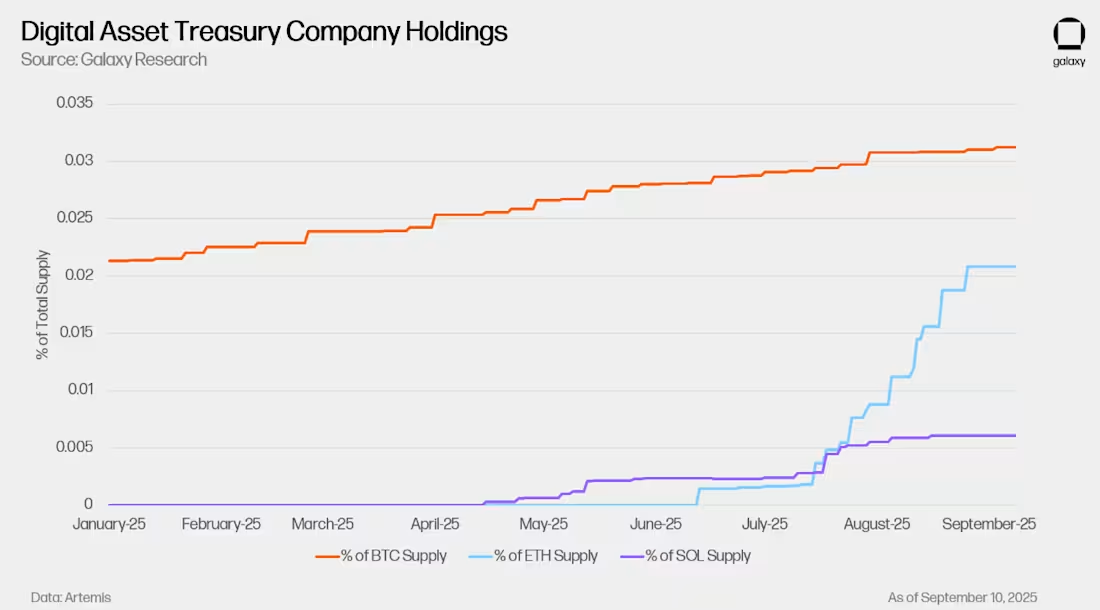

Aside from ETFs, cryptocurrency treasury companies remain an important source of demand. These companies continued to accumulate throughout August, with those focused on Ethereum injecting substantial capital. Given that Ethereum's market capitalization is smaller than Bitcoin's, corporate capital inflows have an outsized impact on spot prices; a $1 billion allocation to Ethereum can bring about market changes that are not comparable to the same amount allocated to Bitcoin. More importantly, there is still a significant amount of capital in publicly disclosed cryptocurrency treasury companies that has not yet been deployed, indicating that more positive developments are likely to come in the market.

The total market capitalization of cryptocurrencies climbed to a historic high of $4.2 trillion, highlighting the deep connection between cryptocurrency assets and overall market trends. The warming expectations for interest rate cuts boosted risk appetite in both the stock and cryptocurrency markets, while ETF capital inflows and corporate reserve accumulation directly propelled BTC and ETH prices to new historical highs. Despite market fluctuations near the end of the month, the multiple interactions of macro policy easing, institutional capital flows, and cryptocurrency treasury reserve demand still keep the cryptocurrency market at the core of the risk asset narrative.

2. Companies Launch Their Own L1 Blockchains

Regulatory tailwinds are giving companies more confidence to directly enter the cryptocurrency market. In late July, SEC Chairman Paul Atkins announced the launch of "Project Crypto," aimed at promoting the on-chain issuance and trading of stocks, bonds, and other financial instruments, marking a key step towards integrating traditional market infrastructure with blockchain technology. Encouraged by this, companies are breaking through the application limitations of existing blockchains and are beginning to launch their own L1 networks.

In August, three large companies announced the launch of new L1 blockchains. Circle launched Arc, which is EVM-compatible and uses its USDC stablecoin as the native gas token. Arc features compliance and privacy functions, an on-chain settlement forex engine, and will start with a permissioned validator set. After acquiring stablecoin infrastructure provider Bridge and crypto wallet service provider Privy, Stripe launched Tempo, which is also EVM-compatible and focuses on stablecoin payments and enterprise applications. Google released the private permissioned chain Google Cloud Universal Ledger (GCUL), which focuses on payments and asset issuance, supports Python-based smart contracts, and has attracted the Chicago Mercantile Exchange as a pilot partner.

The logic behind companies building blockchains can be summarized as value capture, control, and autonomous design. By owning the underlying protocol, companies like Circle do not need to pay fees to third-party payment networks and can profit directly from transaction activities. Stripe can integrate its proprietary blockchain more closely with its payment system, developing new features for customers without relying on the governance mechanisms of other chains. Both companies view control as a key element for compliant operations, especially in the context of regulators intensifying scrutiny of illegal financial activities. Choosing to build L1 rather than L2 avoids being constrained by other blockchain networks in settlement or consensus mechanisms.

The response from the crypto-native community has been mixed. Many believe that projects like Arc and GCUL, while borrowing the technical standards of existing L1 chains, fall short in design quality and exclude Ethereum and other native assets. Critics point out that permissioned validators and enterprise-led governance models weaken decentralization and user autonomy. These debates echo the failed "enterprise blockchain" wave of the mid-2010s, where those projects ultimately failed to attract real users.

Despite the skepticism, these companies' initiatives are still significant. Stripe processes over $1 trillion in payments annually, capturing about 17% of the global payment processing market. If Tempo can achieve lower costs or provide better developer tools, competitors may be forced to follow suit. Google's entry indicates that large tech companies view blockchain as the next evolutionary level of financial infrastructure. If these companies can leverage their scale advantages, distribution capabilities, and regulatory resources in this field, it could have far-reaching impacts.

In addition to companies launching their own L1 chains, other developments are reinforcing the trend of economic activities migrating on-chain. U.S. Secretary of Commerce Raimondo announced that GDP data will be published on public chains through oracle networks like Chainlink and Pyth. Galaxy has tokenized its shares to test on-chain secondary market trading. These initiatives indicate that, despite ongoing debates about the appropriate balance between compliance and decentralization, businesses and governments have begun embedding blockchain technology into core financial and data infrastructures.

3. Hot Trend: Cryptocurrency Treasury Companies

The trend of cryptocurrency treasury companies that we emphasized in earlier reports continues. Holdings of BTC, ETH, and SOL are steadily accumulating, with ETH performing particularly well. Holding data shows that ETH's cryptocurrency treasury sharply increased throughout August, primarily driven by Bitmine's reserves, which grew from about 625,000 ETH at the beginning of August to over 2 million ETH currently. SOL holdings also maintained steady growth, while BTC holdings continued a slower but steady accumulation trend.

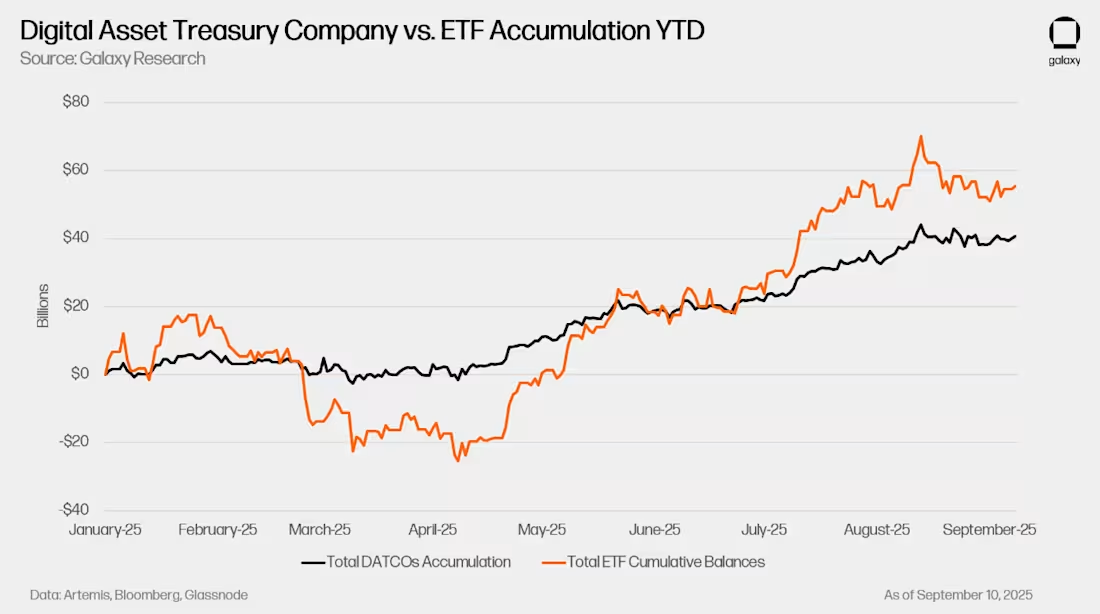

Compared to ETF capital flows, the activities of cryptocurrency treasury companies appear relatively subdued. The inflows into ETFs in July and August outpaced those of cryptocurrency treasury companies, with the cumulative balance of ETFs exceeding the accumulated scale of cryptocurrency treasury companies.

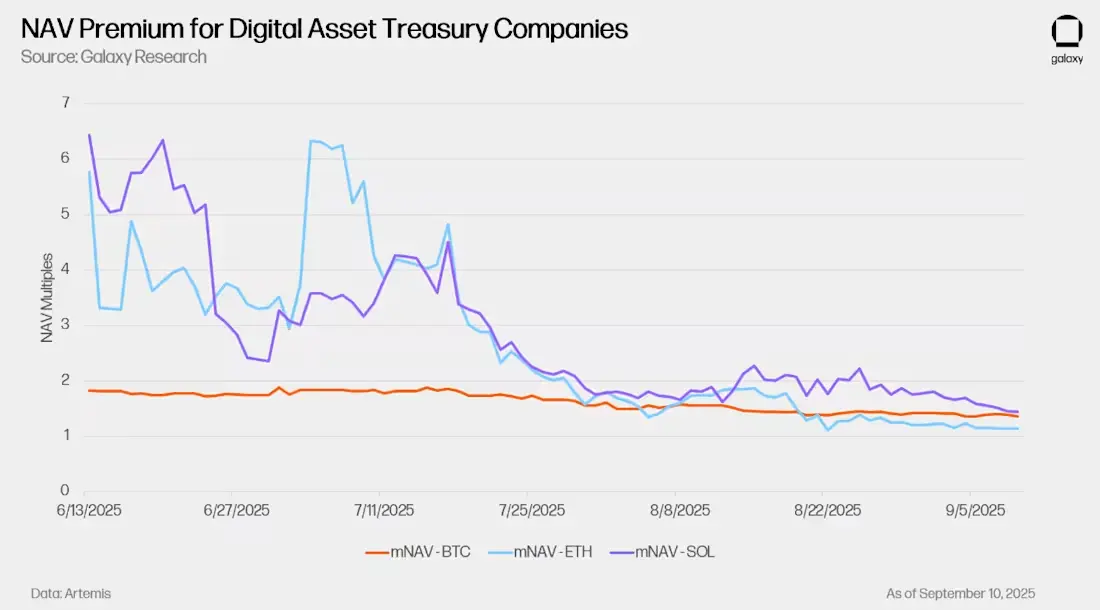

As the premiums on cryptocurrency treasury company stocks have fully contracted, this divergence is becoming increasingly apparent. Earlier this summer, the price-to-earnings ratio of cryptocurrency treasury companies was significantly higher than their net asset values, but now the premiums have gradually returned to normal levels, indicating that stock market investors' attitudes have become more cautious. The changes in stock prices are evident: KindlyMD (the parent company of Nakamoto) has fallen from a peak of nearly $25 at the end of May to about $5, while Bitmine has dropped from around $62 at the beginning of August to about $46.

In late August, reports emerged that Nasdaq might strengthen its regulation of cryptocurrency treasury companies acquired through stock issuance, leading to more pronounced selling pressure. This news accelerated the market's sell-off of stocks in cryptocurrency treasury companies focused on Ethereum. In contrast, companies focused on Bitcoin (such as Strategy, formerly MicroStrategy, ticker: MSTR) were less affected, as their acquisition strategies relied more on debt financing rather than stock issuance.

4. Hot Trend: Altcoin Season

Another hot trend is the rotation of altcoins. Bitcoin's dominance has gradually declined, from about 60% at the beginning of August to 56.5% by the end of the month, while Ethereum's market share increased from 11.7% to 13.6%. Data indicates that funds are rotating from Bitcoin to Ethereum and other cryptocurrencies, which aligns with the strong performance of Ethereum ETFs and the inflow of funds into cryptocurrency treasury companies. Although Bitcoin ETF inflows have rebounded in recent weeks, the overall trend remains unchanged: this cycle continues to expand beyond Bitcoin, with Ethereum and altcoins gaining incremental market share.

5. Our Views and Predictions

As the market enters the last few weeks of September, all eyes are on the Federal Reserve. The weak labor market has strengthened expectations for recent interest rate cuts, and risk assets have rebounded again. The employment report emphasizes that the economic slowdown may be more severe than initially reported, raising questions about how much easing is needed to buffer the economy.

Meanwhile, the long end of the yield curve is sending warning signals. Persistently high yields on 10-year and 30-year Treasury bonds reflect market concerns that inflation may be sticky, and fiscal pressures could ultimately force central banks to finance debt and spending through increased money supply. The expectation of short-term interest rate cuts is driving a rebound in risk assets, but the tug-of-war between short-term rate cuts supporting the market and long-term concerns pushing yields and precious metals higher will determine the sustainability of this rebound. This contradictory situation has a direct impact on cryptocurrencies: Bitcoin's role as a store of value hedge is increasingly correlated with gold, while Ethereum and altcoins remain more sensitive to changes in overall risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。