Highlights

**- The year of standardized AI payments begins: Google, in collaboration with the industry, releases the **AP2 (Agent Payments Protocol), incorporating *AI transactions on behalf of users* into a unified, auditable paradigm through a mandate + verifiable credentials.

- Coinbase, along with the Ethereum community, promotes x402, making API calls as payments a reality—native to stablecoins, directly connecting A2A (Agent-to-Agent).

**- Two tracks converge: the fiat track (AP2) and the crypto track (x402) progress together, pointing towards the same ultimate goal: the **payment semantic layer for Agents.

**- Startup window: The most needed productized components and security risk control platforms on top of the protocol. *FluxA* chooses to be among the first batch of mass-producible vehicles.**

Opening: Tech giants compete to lay out AI payments, the real turning point emerges

The AI sector is perhaps the most sleepless battlefield right now, with various tech giants engaged in an arms race on the model side, while a brand new battlefield—AI payments—slowly comes to the forefront. Stripe announced it will launch its own payment L1, Tempo, and Paypal announced an investment in Kite.AI. Just yesterday, Google announced it will launch its own open-source payment protocol, the Agent Payments Protocol (AP2), and will collaborate with Coinbase's previously launched X402, integrating X402 into Google's self-developed A2A framework.

As AI gradually develops, the industry's contemplation of AI's capability boundaries and commercialization has also entered the next stage. More and more people are beginning to realize that payment capability is essential for Agents, as payment is not merely a function; it represents a fundamental shift in traditional e-commerce operations, advertising, and distribution logic in internet finance when Agentic AI becomes the new "first-class citizen" of the internet, and it will give rise to a new AI-centric Agentic Commerce.

This article will deeply analyze the latest developments of the two giants in the AI payment field: Google's AP2 and Coinbase's X402, starting from here to analyze the development trends and existing opportunities in the AI payment sector.

01|AP2: Incorporating How AI Spends into a Regulated Common Syntax

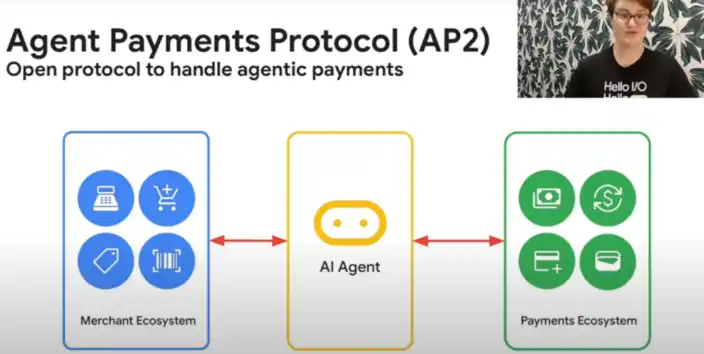

Google, in collaboration with over 60 payment networks, financial institutions, e-commerce, and blockchain companies, released the AP2 (Agent Payments Protocol) this week, attempting to establish a unified standard for the intersection of AI and payments.

Before AI, traditional payments were completed by someone clicking "buy" in the payment backend, and any automated payment behavior not initiated by a human would be deemed "unsafe" by the entire payment system. The payment system has developed a very mature risk control system to manage this risk. However, in the AI era, this becomes a challenge because if we allow AI to replace humans in initiating transactions, how do we confirm: 1. Did the user truly authorize AI to make this transaction? 2. Does the AI's request represent the user's true intent? 3. If a transaction goes wrong, how do we hold AI accountable?

Google's AP2 addresses this by defining an open protocol standard that provides a common language for secure and compliant transactions between AI and merchants. This is essentially a dual authorization mechanism established between the user, AI, and merchant:

- Intent Mandate: The user provides a clear intent of what they want to buy, budget limits, and time windows;

- Cart Mandate: The agent finds specific products and prices, and requests the user to sign for confirmation again.

Both authorizations are encrypted signatures with verifiable credentials, forming an irrefutable evidence chain after user confirmation. For merchants and clearing networks, this means: they receive payment requests not from an unidentifiable robot, but from a user-authorized, verifiable "transaction contract," allowing merchants and clearing networks to confidently recognize the legality of the transaction and approve it.

AP2 does not aim to overhaul networks like Visa/ACH/stablecoins and blockchain; instead, it adds a trust semantic layer of who is spending, why they are spending, and accountability on top of them, attempting to adapt and solve the issue of confirming AI payment intentions across different stablecoin and fiat clearing networks. In traditional payment scenarios, this is initiated by each of us manually clicking the "buy" button, while in the "dark forest" of the AI and stablecoin era, we need to use cryptography and process constraints to bring every AI's behavior into order, ensuring that AI does not misuse its power to harm users' funds.

Although the entire design and development of AP2 are still in very early stages, we can clearly see Google's thoughts and focus on AI payments, which is to alleviate the concerns of all participants in the agent payment chain regarding the potential issues of agents overspending. This is an essential part of AI completing payment actions:

- For consumers: Yes, AI payments become a trust of boundaries. Budgets, categories, time windows, and exception rules are all solidified in the authorization; issues can be traced back to what was authorized at the time, achieving prevention of overreach and post-appeal.

- For merchants and payment networks: Upgrading the confirmation of whether it is the user's true intent from verbal/interface confirmation to encryptable verification of intent credentials; chargebacks and dispute resolution have chain evidence, reducing gray losses and compliance uncertainties.

- For the ecosystem: Establishing a common semantic layer for AI participation in payments, facilitating multi-party collaborative innovation (identity, risk control, clearing and settlement, factoring, etc.) to maintain consistency in defining the same issues.

- For enterprise IT/compliance: Transitioning processes like automated procurement, subscription expansion, and bill payments from policy documents + manual review to protocol-level policy execution; auditing shifts from end-of-month alignment to real-time traceability, meeting the penetrating requirements of internal control and external regulation.

02|x402: Binding Payments and Services, Building a New Machine Economy with Stablecoins

If Google focuses more on the authorization and security issues of AI payments above the clearing chain, then Coinbase, which is inherently closer to stablecoins and blockchain, directly addresses the AI transactions themselves. Through the x402 protocol promoted by the Ethereum Foundation, Coinbase aims to shape stablecoins and blockchain into the native currency and payment primitives for AI payments, coupling AI payment behavior with "consumption" behavior.

x402 derives its name from HTTP 402, which is actually a status code in the HTTP protocol indicating "payment is required to use this resource." Before the era of AI and stablecoins, this status had almost never been standardized for use in history. However, the rise of AI in recent years has allowed developers to see its potential, as the increasing access to web pages and API calls comes more from AI rather than real people. Shouldn't AI also pay for their access?

The idea behind x402 is to start from the payment chain, allowing API calls and payments to be natively coupled:

When an AI agent calls a service, x402 will respond to the AI agent with a payment "bill" based on the payment information originally defined by the service provider. The AI agent can then use stablecoins like USDC to directly settle the service on-chain according to this "bill," and the service provider will immediately release the service to the AI.

Although it is just a simple protocol rather than a complete product, x402 combines the capabilities of AI and stablecoins, illustrating the possible appearance and potential of native AI payments:

For AI agents, the existence of x402 allows them to complete service calls and payments together. Leveraging a decentralized, highly programmable stablecoin network, AI can bypass the human workflow of "binding credit cards—initiating deductions—waiting for channel callbacks" and truly achieve pay-as-you-go. Moreover, unlike the relatively low-frequency payment needs of humans, the parallel processing capabilities of AI agents will far exceed those of humans. x402 makes it more suitable for AI agents to complete fine-grained, automated micro-payments and flow payments, allowing AIdaili to automatically negotiate prices when encountering a 402 challenge without pre-setting various accounts and API keys.

For providers of AI services, x402 brings the capability of "access equals pricing" down to the protocol level: In the future, developers in the x402 ecosystem can finely create micro-payments for pages, APIs, and data slices, billing by request, by token, by duration, and other complex payment models; simultaneously, leveraging stablecoins to achieve instant, cross-border, low-fee settlements, even under extremely high transaction volumes, making transaction reconciliation easy.

---

03|Two Tracks, Pointing to the Same Ultimate Goal

If AP2 is the AI extension of the traditional payment system, then x402 resembles the AI native payment module of the Web3 world. The convergence of the two represents the two tracks of AI Payment: fiat payments and crypto payments, both evolving towards being callable by Agents.

- AP2: Incorporates real-world regulation, risk control, and consumer protection into Agent transactions;

- x402: Integrates Web3's instant settlement and programmability into Agent transactions.

The conclusion is evident: The next stage of AI Payment will not be a choice between two options, but rather dual-track parallelism and interoperability:

- Users and merchants gain compliance and trust under AP2;

- Computing power/data/microservices gain speed and programmability under x402;

- Upper-layer products need unified abstraction to seamlessly orchestrate the two tracks for Agent use.

04|Entrepreneurial Track: The Most Needed Execution Layer Above the Protocol

Tech giants often start by defining standards to build ecosystems and influence, but standards like X402 and AP2 are still far from usable AI payment products in real environments. The focus should be on creating usable and scalable productized components above the protocol. This is precisely the direction that entrepreneurs in this track should pursue.

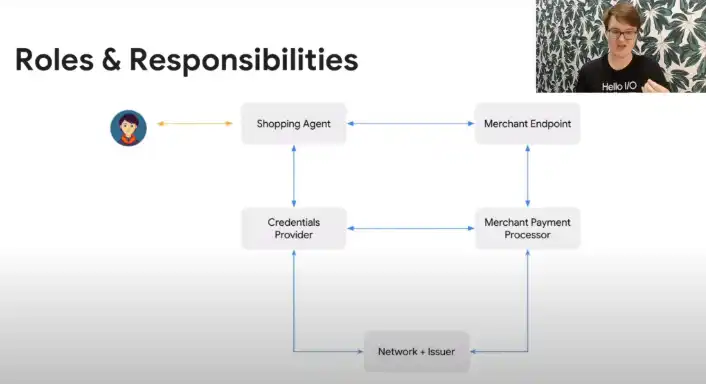

In the image, Google engineers summarize the various roles and responsibilities designed in the Agent payment process. Protocols like AP2 primarily coordinate multiple parties in the payment chain to trust requests from AI Agents through verifiable credentials. We can see that AP2 is not the execution layer of payments; the execution layer is openly supported by other payment participants.

Credentials Provider, Merchant Payment Processor, and Network/Issuer constitute the three major roles of the payment execution layer. In the era of Agent payments, whether the payment execution layer can give rise to the next trillion-dollar market and players is a question that AI innovation pioneers are seeking to answer.

05|FluxA: Building Mass-Produced Vehicles Above the Protocol

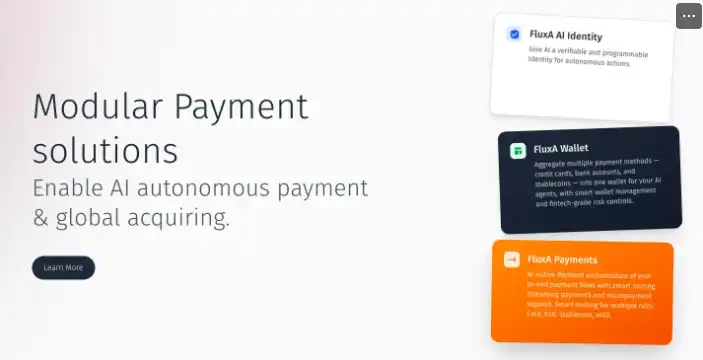

FluxA is a payment execution layer native to AI, founded by former executives from Alibaba and Ant Group, and is actively joining the Agent payment race.

FluxA aims to create a payment primitive for the Agent economy, modularizing identity, wallets, and payments so that developers can assemble their own Agentic economic services using components provided by FluxA, much like building with blocks.

FluxA's core products cover the four essential aspects of AI Agent payments: identity, wallets, acquiring, and payment channels.

AI Wallet: Aggregates all payment methods callable by AI Agents (bank cards, e-wallets, stablecoin wallets, etc.), providing a unified payment entry for AI Agents. The security and risk control module is a key focus of this AI wallet, ensuring that AI Agents conduct proxy consumption under the user's intent.

AI Identify: The AI wallet naturally provides a trusted AI identity ID for AI Agents, which includes not only user information authentication but also authentication of the AI Agent's execution steps. Based on the AI identity provided by FluxA, merchants and downstream payment participants can further enhance risk control levels, avoiding risk exposure caused by providing programmable interfaces to AI Agents.

AI Payment: Provides services for merchants to collect payments from AI Agents. The core idea of FluxA AI Payment is to aggregate acquiring and multiple payment channels available to AI Agents, relieving merchants from worrying about AI Agents' inability to complete payments. It also integrates industry protocols like AP2 and x402, offering diverse AI-native payment methods.

Stablecoin rail: Stablecoins are in the early stages of mainstream adoption, with many details in consumer wallets and merchant acceptance needing improvement. FluxA will build a user-friendly stablecoin channel around mainstream compliance and low-threshold adoption, specifically serving AI payments.

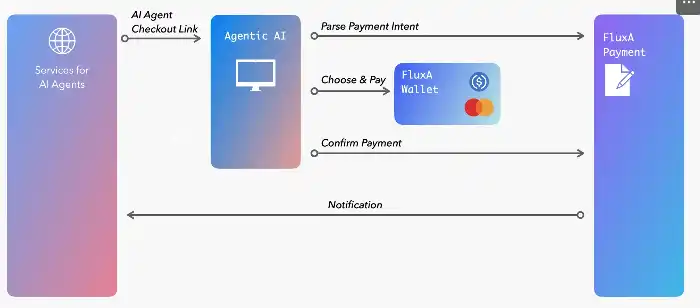

If Google AP2 and Coinbase x402 provide the highways, FluxA aims to be the first batch of mass-produced vehicles on the highway:

- Integrate protocols like AP2 and x402 → Ensure compatibility with global payment standards.

- Provide SDK/API → Allow developers to quickly enable payment capabilities for AI without needing to study underlying protocols.

- Target application scenarios → Whether for B-end SaaS automated procurement or C-end Agent e-commerce shopping, FluxA can serve as the payment execution layer.

In the early stages of the innovation track, entrepreneurs often take the first exploratory steps faster than tech giants. Open protocols have just begun, and truly usable products in the market remain scarce; enterprises want to quickly integrate AI into payments while ensuring the process is fast and orderly, creating an urgent demand for compliant and auditable landing platforms. Meanwhile, developers are reluctant to exhaust themselves connecting to dozens of gateways or wallets; they need a one-stop abstraction layer that makes payment capabilities as simple and direct as calling an API.

FluxA will not create its own protocols but will deeply align with and closely follow the evolution of AP2 and x402, prioritizing adaptation to mainstream payment service providers and wallet ecosystems. At the same time, FluxA's value lies in filling the gaps, transforming protocols into truly usable products, turning standards into actionable business capabilities, and internalizing security requirements as default configurations. In this way, tech giants are responsible for setting rules and building highways, while entrepreneurs are the first to launch mass-producible vehicles on this highway.

Payments themselves constitute a vast ecosystem, and the relationship between startups and tech giants is not one of opposition but rather one of complementarity:

- FluxA does not create protocols but deeply aligns. It closely follows the evolution of AP2/x402 and prioritizes adaptation to mainstream payment service providers and wallet ecosystems;

- FluxA's value lies in occupying an ecological niche: transforming protocols into products, turning standards into operational capabilities, and making security requirements default and built-in.

Conclusion: From Dialogue to Transactions, the AI Economy Truly Starts

As Google and Coinbase exert efforts on their respective tracks to promote the establishment of protocol standards, the market needs not new slogans but the courage to implement them first. AP2 provides guarantees for compliance and trust, x402 opens up spaces for instant settlement and programmability, while FluxA transforms these abstract standards and protocols into truly callable payment primitives.

The next stage of AI Payment will be jointly defined by standards and execution layer products. Agents not only need to be granted permissions but must also be verifiable and accountable; payment processes should not just execute a single transfer but achieve orchestration, observation, and expansion; for developers, the ideal state is to quickly integrate and launch AI payment capabilities within days.

The turning point has arrived. FluxA hopes to work with ecosystem partners to advance the Agent economy from papers and demonstrations to a reliable, usable, and scalable reality.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。