Monday saw the Nasdaq, S&P 500, and even gold hit all-time highs, but bitcoin has climbed up more cautiously as the crypto market braces for what may be the first interest rate cut in 2025 after the Fed emerges from its two-day meeting, which starts today and ends with Fed Chair Jerome Powell’s press conference tomorrow.

Powell has held the line and kept rates steady since December 2024 despite being chastened by the Trump administration for being overly hawkish. The Fed has a dual mandate of maximum employment and stable prices, which usually translates to an inflation rate of around 2% and the “lowest level of unemployment that the economy can sustain.” The most recent Consumer Price Index (CPI) came in at 2.9% annualized last week, much higher than the recommended 2% target.

But markets brushed off Thursday’s spike in inflation, focusing instead on the surge in new unemployment claims, which most economists predict will compel the Fed to lower rates as a counter to a potential economic slowdown. The anticipation for a rate cut subsequently triggered an across-the-board rally, but now it appears bitcoin traders are taking a wait-and-see approach in case the central bank surprises markets and once again decides to maintain the current policy rate.

“For Fed Chair Jerome Powell, the risk management considerations may go beyond balancing employment and inflation risks,” said J.P. Morgan Chief U.S. Economist Michael Feroli. “We now see the path of least resistance is to pull forward the next cut of 25 bp to the September meeting.”

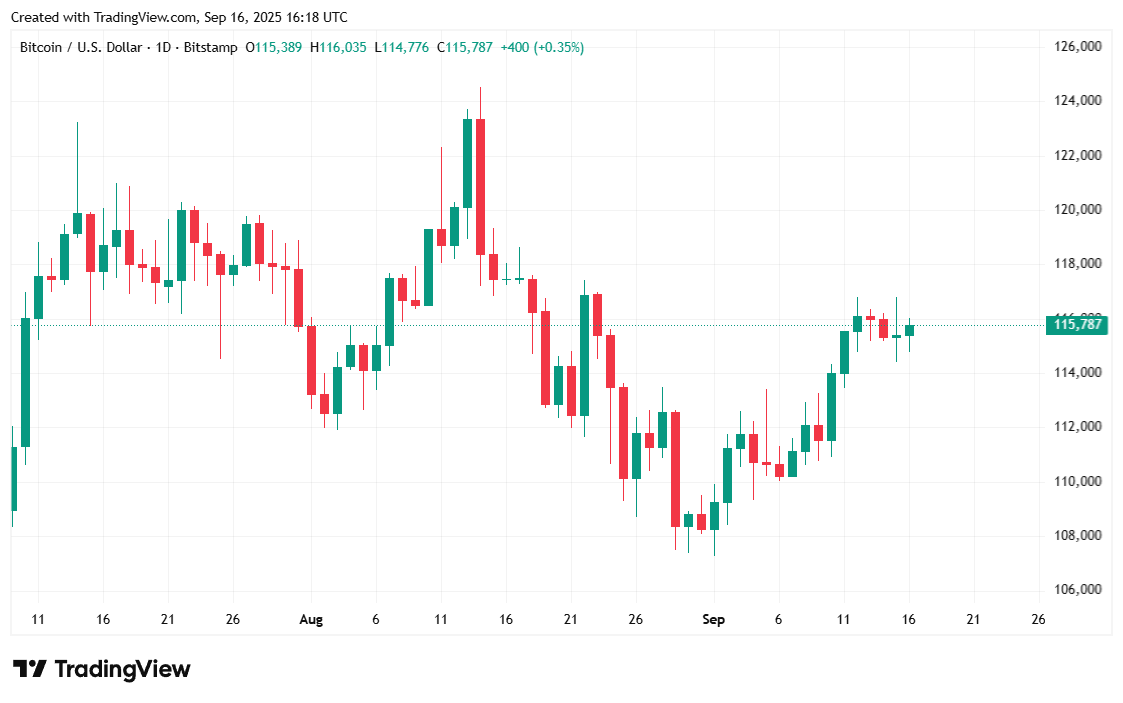

Bitcoin was trading at $115,921.47 at the time of writing, up by 0.89% over 24 hours according to Coinmarketcap. The cryptocurrency’s price has fluctuated between $114,662.18 and $116,063.26 since Monday.

( Bitcoin price / Trading View)

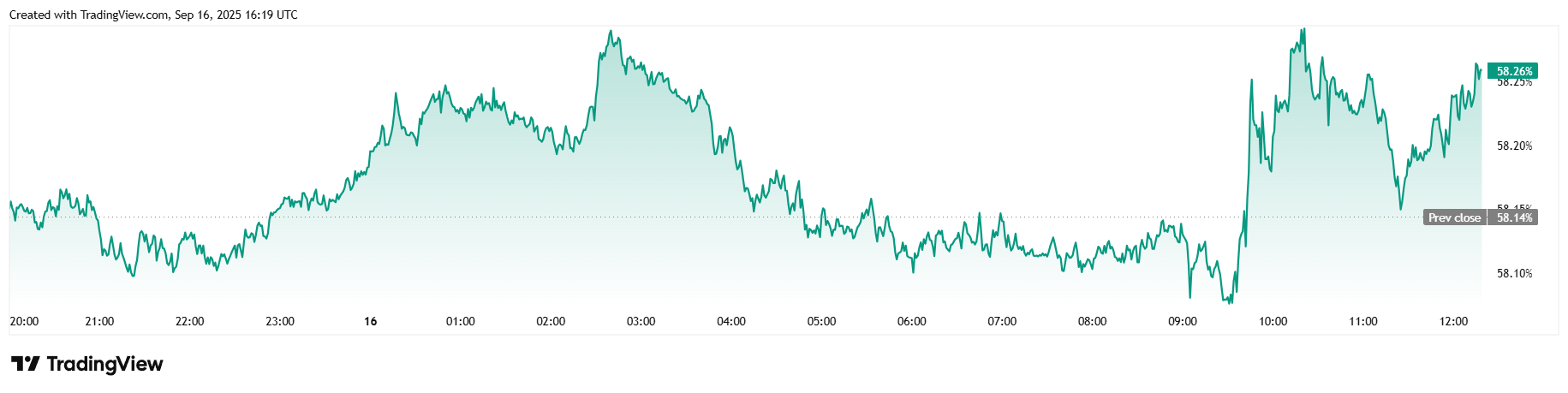

Twenty-four-hour trading volume fell 15.48% to $41.71 billion but market capitalization rose 0.94% to $2.3 trillion, in line with the increase in price. Bitcoin dominance also increased slightly, rising 0.22% since yesterday to reach 58.25%.

( Bitcoin dominance / Trading View)

Total bitcoin futures open interest was down slightly by 0.93% at $82.38 billion according to Coinglass. Bitcoin liquidations totaled $15.70 million, with shorts dominating that figure at $9.05 million in liquidations. The remaining $6.64 million in longs completed the overall liquidations picture.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。