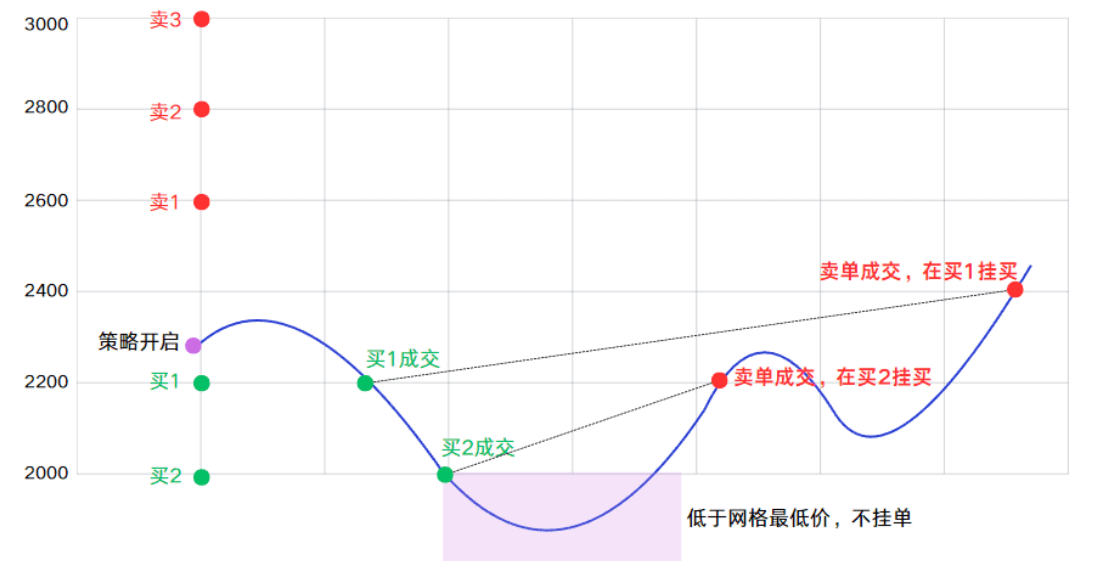

Hey everyone, in a volatile market, if you want to steadily grasp your profits, grid trading is definitely a "king-level" choice! Today, we’re talking about AI grids, which essentially means letting the program automatically "buy low and sell high" for you, so you don’t have to stay up late watching the market!

We won’t go into the specifics of the concept, as the director shared related content last week. Let’s get straight to the point — how to set the grid range, which is the core step in running a grid. Getting it right the first time can save you from taking detours.

For beginners who find setting the range troublesome and want to run grids with zero threshold, you can directly use our AI recommended strategy! The latest version has optimized the algorithm, and the grid range has been expanded, making it more flexible to operate. Alright, let’s get back to the main topic and discuss a few practical methods for setting the grid range.

The AiCoin editor knows that everyone is most concerned about this — how to set the grid range? It’s actually not that complicated; a few small tricks can do the job!

The quickest method is to capture the high and low prices. Just find the highest and lowest prices over a certain period (like the last month) and use these two numbers as the "top" and "bottom" of the grid. It’s simple, straightforward, and effective.

The second method is the "main force order method," which is also very easy to grasp. We can set the grid range according to the main force's order range. For example, in the case of OKB, where there are dense orders both above and below, it is particularly suitable for grid trading. You should know that the main force's orders hide their "psychological defense line" and cost area; they are not just randomly placed.

The AiCoin editor also needs to add: for assets like OKB with dense main force orders, the grid can also be set densely to align with market rhythms. Friends who want to focus on OKB should definitely try the grid strategy.

The bottoms of those dense large orders (where buy orders are concentrated) can be considered strong support areas, which are generally hard to break; while the tops of dense large orders (where sell orders are clustered) are strong resistance areas, which are also not easy to break through. If you are worried about risks, you can set a fixed price stop-loss to layout confidently.

The third method is the "AI intelligent analysis method," which can be called a "zero-thinking" tool that doesn’t require any brainpower. Just use our little A to analyze and let it help you break down the large cycle market trends of the corresponding cryptocurrency. For example, analyze the BTC trend over a 1-day cycle, derive clear buy and sell points, and synchronize them to the K-line, using the corresponding high and low points as the grid range, which is both worry-free and precise.

The fourth method is the "Fibonacci retracement method," which is particularly handy during trend pullbacks. First, find a clear rising or falling range, use the Fibonacci retracement tool to mark the high and low points, and then focus on the two key positions of 0.618 and 0.382, using them as references for the grid range.

The fifth method is the "support and resistance method," which technical traders are definitely familiar with and is your first choice. If you want to find pressure points, you can use chip distribution, BOLL indicators, or any custom indicators you are used to; it all depends on personal trading habits. If you don’t want to adopt a one-sided strategy, fearing missing out or being trapped, a neutral grid is very suitable for you!

Take Bitcoin as an example; currently, from a long-term perspective, the market is generally optimistic. Both spot grid trading and DCA are suitable. If the price drops, it’s a good opportunity to add to your position and steadily accumulate chips. Personally, I prefer to use "main force large orders" or technical analysis to set the grid range, as I feel it aligns better with the real market rhythm.

If anyone has any questions about setting the grid range, feel free to ask! Also, a little secret: our app can now directly run grids, and using AI strategies is super convenient. This is also a major trend right now. Interested friends can start with a small amount of capital to test the waters, and remember to set stop-losses; risk control is key to peace of mind.

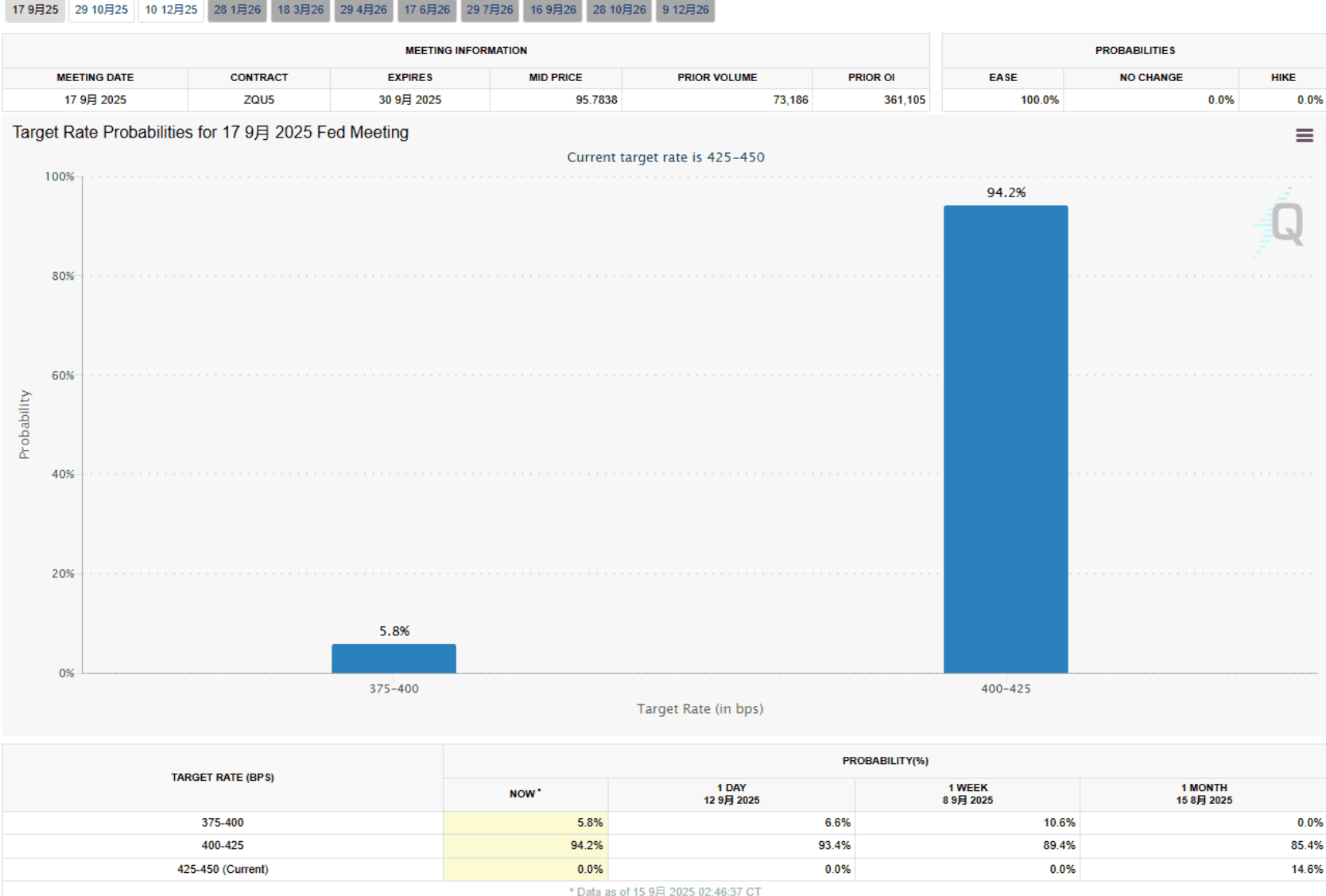

By the way, there’s an important reminder: although many friends already know this, it still needs to be emphasized: remember to pay attention to the Federal Reserve's interest rate meeting early Thursday morning, which is likely to result in a moderate rate cut, significantly impacting market trends.

You can also look at the 3-day cycle trend; the fast and slow lines are approaching the zero axis, and the subsequent market trend is worth looking forward to!

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoinen

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=7JmRjnl3w

This article only represents the author's personal views and does not represent the platform's stance or views. This article is for information sharing only and does not constitute any investment advice to anyone.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。