Author: Timothée, DAT Research Analyst

Translation: Golden Finance xiaozou

"I will offer terms that the other party cannot refuse." — Alt DAT enters at a discounted mNAV and provides immediate unlock terms to PIPE investors.

This article is a DAT investment guide (pitfall manual) prepared for everyone.

The DAT market from now until the fourth quarter will be dominated by Alt DATs adopting the PIPE issuance mechanism, as they offer the fastest listing speed and can generate immediate scale effects on the underlying tokens. The BTC/ETH space is now crowded, the SOL market is about to fully unfold, and the altcoin sector is poised for takeoff.

Article Summary:

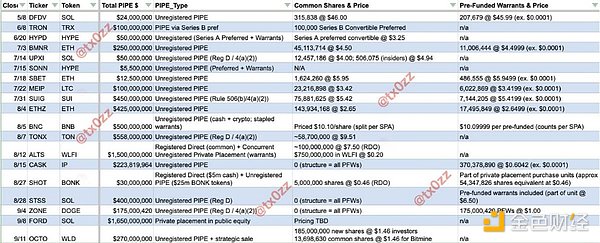

Key DAT elements — refer to the exquisite investment banking benchmarking table.

Additional questions — ask yourself: who is the ultimate owner?

DAT panic concerns — some are reasonable, most are unfounded; please read the filing documents yourself!

Fourth quarter outlook — the issuance feast is coming to an end, and the true winners will soon emerge.

Why are Alt DATs all laying out plans in the DAT field? Simply put, it is driven by multiple factors.

A new listing path: not Binance, but Nasdaq!

Buyback and burn mechanism, but can achieve monetization!

Below, I share the Alt DAT data I have compiled.

Some Alt SPACs (such as TLGY targeting ENA tokens and ETHM targeting ETH) aim to go live by the end of the year. While I personally favor TLGY, its funds cannot be utilized until the deSPAC is completed at the end of the year, making media promotion unreasonable before that.

Listed companies are adding Bitcoin strategies (not purely speculative). The premium trading window for such entities (like SMLR) is from Q3 2024 to Q3 2025; I believe these targets will trade at a discount to net asset value in the long term, as investors now have more/better options for expressing risk exposure.

Initially adopting ELOC (Emergency Line of Credit) instead of PIPE for DAT projects (cash cannot be immediately available).

Key Matters to Watch

RDO represents immediate unlock. Unregistered shares mean they must wait for registration to take effect (expected 30-45 days), but according to Nasdaq's new rules, if the PIPE portion is completed in physical form, it may now require a shareholder vote (specific guidelines to be released).

Pre-financing warrants are typically used to avoid exceeding specific shareholding thresholds to evade reporting obligations.

Although warrants are often used as credit enhancement tools, this helps DAT lock in the ability to finance in the future at a specific price — for example, when mNAV turns to a discount.

You can assume that 99% of PIPE investors will sell upon unlocking.

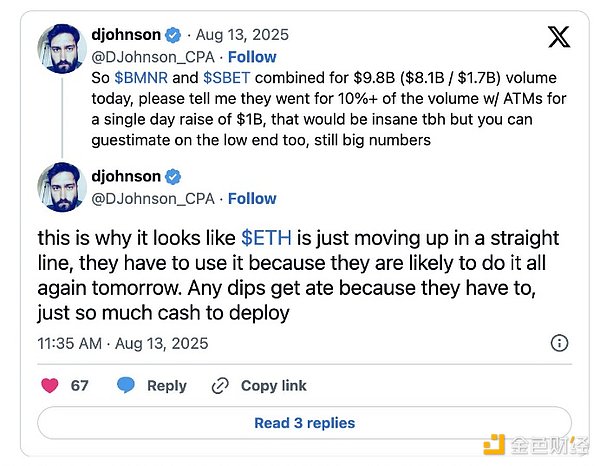

Some operators obtain WKSI (Well-Known Seasoned Issuer) status through large-scale financing and high liquidity, allowing them to immediately initiate the ATM (At-the-Market) mechanism and monetize premiums (we have seen this model in BMNR and SBET cases, and OCTO is likely to follow suit).

Structure is crucial: pay attention to the net asset value (NAV) per share and whether it faces future dilution risks such as warrants.

Focus on the specific amount of investment banking fees paid by DAT. DATs with a current scale of less than $100 million often struggle to launch smoothly due to excessive fees. The effectiveness of investment banks varies — some excel in brand building and structural design, while others specialize in shell resource acquisition.

Additional Data Dimensions / Key Due Diligence Questions

Key spokespersons (attention return rate): Who has the ability to drive market perception? Having distribution channels is important, but being able to tell the right story is equally crucial. Not everyone can be Tom Lee (founder of Fundstrat Capital), but grassroots growth does not require such heavyweight figures. For example, the DAT project SHOT has a core contributor, Nom.

Treasury management: What is the amount of this expenditure, and does it burden cash flow?

Liquidity: The percentage of circulation and trading volume relative to the fundraising scale.

Buying pressure: The proportion of net new fundraising amount to the circulating market value of the token — how much is considered excessive? What is the minimum requirement for a substantial impact? 10%? 20%?

Target company's business: Before the DAT completely divests from traditional business, does the target have any liabilities or long-tail risks?

Foundation participation: Does this DAT have foundation support, or is it just one of many similar projects?

Buyback mechanism: Will this DAT use part of the raised funds for defensive buybacks? Is there a separate pool for warrants or convertible bonds for this purpose?

Future strategy: If the DAT adopts a one-time cash harvesting strategy for PIPE, be wary of proactive communication from the target company or the incoming team (or foundation). This is not a game in the crypto space and will have real-world consequences.

Public relations/investor relations aimed at retail investors: If the DAT places data metrics before narrative logic, then its strategy is flawed. Please check their tweets; who do you think the writer and target audience are? Alt DATs must first compete at the level of awareness, and the primary target is retail attention.

Core Questions and Counterarguments

mNAV is compressing — indeed, it is reasonable that projects lacking competitiveness cannot become top-tier. The situation facing ETH stems from excessive dilution from the ATM mechanism + overall market dynamics. But ask yourself: do you believe a certain DAT can achieve per-share value growth (compared to holding spot) in a few months? If so, then discounted mNAV is your opportunity. DAT projects inherently differ — there should be one top winner in the BTC/ETH/SOL space, while the Alt space depends on each project's storytelling ability.

This is a Ponzi scheme — we have not yet seen a frenzy of leverage pouring into these DAT projects (as most are financed through equity). Even if it happens, it will not trigger a mad chain reaction, but rather a slow stagnation similar to indigestion — inefficient DATs may need to sell tokens to buy back shares, thus putting downward pressure on token prices.

They are selling to retail investors — you need to believe that Nasdaq has stricter listing standards. Projects that forcibly inject locked tokens will perform poorly. The market has seen through this phenomenon (thanks to everyone's contributions!), and I am confident that the price at listing will be determined by market arbitration mechanisms.

My views on the fourth quarter

The BTC/ETH/SOL space is basically saturated; unless there are regional plays, we should not expect too many hyper-competitive new projects to emerge.

We will see several TOP50 DAT projects supported by foundations, with total fundraising (including physical contributions) expected to remain in the $250 million range.

The compression of mNAV combined with potential restrictions on physical contributions means that traditional VCs may no longer participate in such transactions, leading to a depletion of funds. This will inadvertently cause shell company prices to decline in sync.

Structural design determines success or failure — we will soon witness which DAT projects launched in July and August have long-term success potential (reflected in Q4 performance): can they gain substantial media attention? Can they continue to operate under the capital structure after unlocking?

I am not very optimistic about the SPAC model — unless there is an all-star team and a highly differentiated story to tell. The competitive landscape led by BMNR in the ETH DAT space can be referenced, and BTC carrier projects will be similar: if challenging the king (MSTR), it must be a decisive strike.

I still believe that DAT is overall beneficial for the crypto space, provided it can raise net new capital from the equity market and create a flywheel effect for its ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。