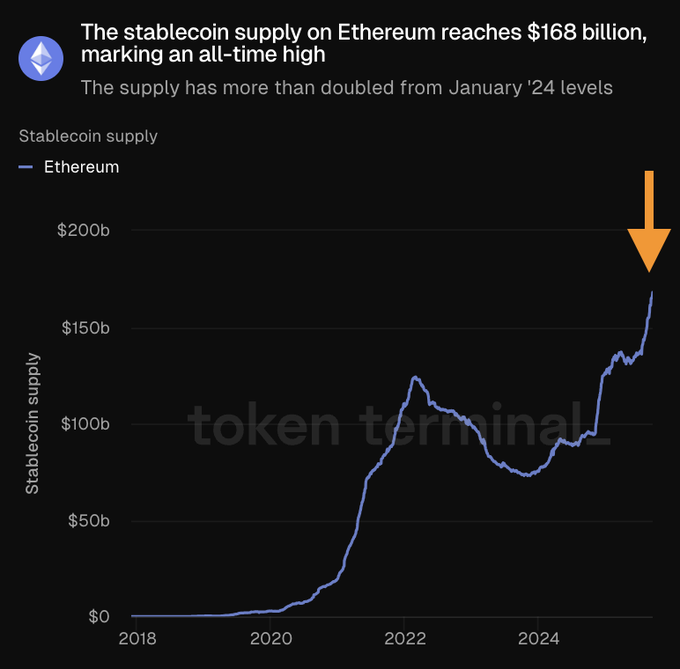

⚡️The supply of stablecoins on Ethereum has reached a historic high of $168 billion—

Stablecoins are not enemies that replace the US dollar, but rather a "new carrier" for the financial export of the US dollar.

So you can expect continuous growth in the stablecoin market and policy support!

As long as the US fiscal deficit continues, there will need to be new buyers to absorb government bonds—stablecoins naturally have the motivation to expand.

The biggest narrative in the crypto market over the next few years is not Meme coins, nor L2, but:

Digitalization of the US dollar → Scaling of stablecoins → Globalization of US Treasuries → Functionalization of DeFi → Valuation of BTC.

Based on this strategic motivation, the US government will promote stablecoin policies, directing global dollar flows into a controlled stablecoin system, which will become a stable structural source of funds.

Currently, stablecoins can basically be divided into four categories—

1⃣ USDT/USDC: The foundational stablecoins, the cash layer for global payments and settlements, still the main incremental force until policies are clarified.

2⃣ USDe / sUSDe: Yield narrative, coupon-bearing assets in a declining interest rate cycle, directly linked to market returns, a strong engine for the next phase of narrative.

3⃣ USDS system: Backed by Sky and Spark, vertically integrated + predictable funding costs, most friendly to institutions, with assets staying longer-term, potentially increasing share under compliance trends.

4⃣ Emerging stablecoins like Falcon: Although small in size, they act as experimental fields, continuously testing market limits, providing arbitrage and liquidity opportunities.

Stablecoins are just the entry point; the more critical question is: where will this money go once it comes in?

- Cash-type needs to leverage the lending market;

- Yield-type needs protocols to standardize and compound;

- Experimental types need liquidity networks to absorb volatility.

So I am more focused on the infrastructure that supports these layers, such as Pendle turning coupon payments into interest rate trading targets, and Spark creating a circular system that automatically directs funds to the most suitable and profitable places.

I have recently been involved with @sparkdotfi quite a bit. After the USDC subsidy ended, I allocated part of my position into OKX chain finance, enjoying Spark's highest yield of 9%.

Currently, Spark's TVL has reached $8.59 billion, firmly ranking third in DeFi lending, almost entirely in stablecoins:

📍 In SparkLend, stablecoins can be borrowed at low interest rates, with stable rates that are more budget-friendly for institutions compared to a 2–15% volatility range;

📍 In SparkSavings, USDS/USDC/DAI automatically compound, with 4.75% sUSDS becoming a standardized sample;

📍 In Spark Liquidity Layer, stablecoins can be exchanged without slippage, minted across chains, and automatically allocated into RWA (government bonds, USTB, etc.)

For those with lending/saving needs, check here 👉 https://link.spark.fi/bitwu

Two more appealing data points—

1) 74% of funds stay for more than 30 days, indicating that institutions are genuinely placing long-term money;

2) Yield efficiency of 0.41%, with Spark performing better under unit risk.

So, when we talk about "scaling stablecoins," we are not discussing an isolated asset, but rather a new type of financial cycle:

Fiscal deficit creates demand → Stablecoin expansion absorbs funds → RWA provides anchoring → DeFi completes delivery and compounding.

If stablecoins really grow to a scale of $10 trillion, it would mean re-anchoring the foundation of the crypto market within the US fiscal system.

In an environment where interest rates drop to 2%, this cycle can complete the transition from "speculative bull market" to "debt bull market."

Borrowing a line from @CryptoHayes—

US fiscal deficit → Stablecoin expansion → Stable demand for US Treasuries → Deepening of global dollarization → Funds flow into DeFi → Bull market continues until 2028!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。