At the time of writing, South Korea’s going rate doesn’t quite line up with the global average. Archived stats from coinmarketcap.com peg bitcoin at $115,514, while Upbit, at the same time, lists it at $115,133. That gap makes BTC about 0.33% cheaper in Korean won compared with the weighted global tally across major exchanges.

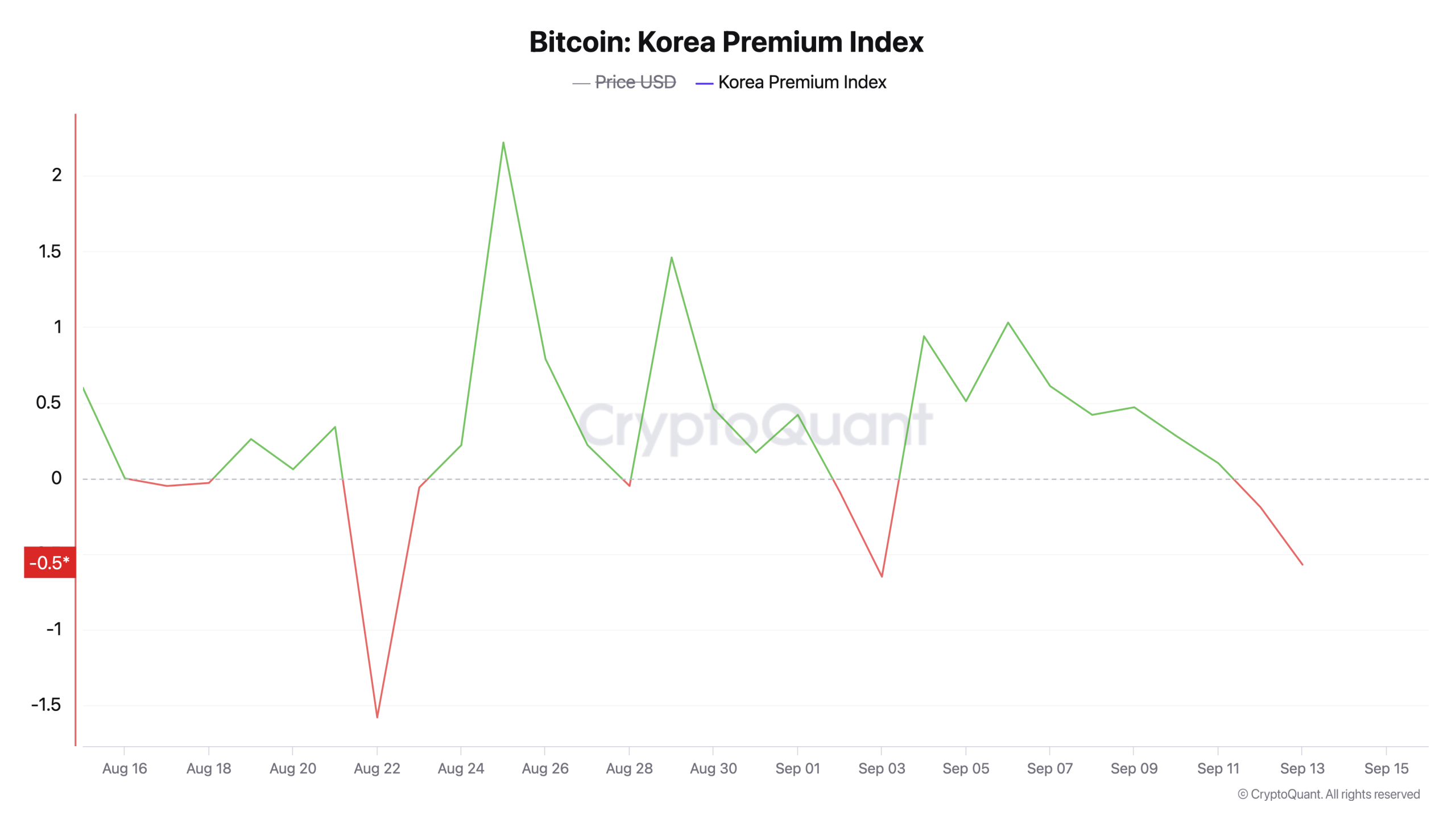

That’s a slight improvement from yesterday, when cryptoquant.com data showed the discount hovering near 0.57% on Saturday. But rewind eight days to Sept. 6, and bitcoin was actually fetching a premium of a touch above a percentage point. Just three days earlier, on Sept. 3, it flipped again — instead of a 1% premium, bitcoin was trading at a 0.65% discount.

Source: Cryptoquant.com’s Bitcoin Korea Premium Index on Sept. 14, 2025, over a 30-day timeframe.

The swings have been so rapid that even the nimblest arbitrageurs would struggle to keep pace. For example, over the past 30 days, the discount dipped to 1.58% on Aug. 22, only to flip into a 2.02% premium just three days later. Lately, September’s discounts and premiums have been more subdued, though still present.

That contrasts with the stretch from December 2024 through early July 2025, when bitcoin in South Korea mostly carried a steady premium with only minor dips. Back in February 2025, the premium even cracked past 8%. Meanwhile, Cryptoquant’s Coinbase Premium Index now shows a slim 0.04% premium over BTC’s price on Binance.

A hefty South Korean won premium often hints at heavy buying pressure from Korean retail traders, but in Coinbase’s case, a higher reading can signal stronger demand from U.S. investors flocking to the exchange. On Sunday, BTC hovers just under the $116,000 mark, yet it’s still nestling nearly 4% higher compared with a week ago. By 6:30 p.m. Eastern on Sunday, BTC was $115,923 while Upbit’s exchange rate was $115,596 in won.

The ebb and flow between premiums and discounts highlights how sentiment and liquidity can shift quickly across borders, shaping opportunities for sharp-eyed traders. These swings reveal more than simple price quirks—they reflect how regional demand, global exchange flows, and investor appetite collide, creating a market rhythm that never truly stays predictable for long.

Right now, sideways action rules the stage, with neither side holding a clear advantage. The next decisive move will depend on whether bears wrestle control or bulls seize momentum, setting the tone for bitcoin’s next chapter in this ever-shifting tug-of-war. In terms of South Korea’s price disparity, its shifting premiums and discounts often run ahead of the global market’s pulse.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。