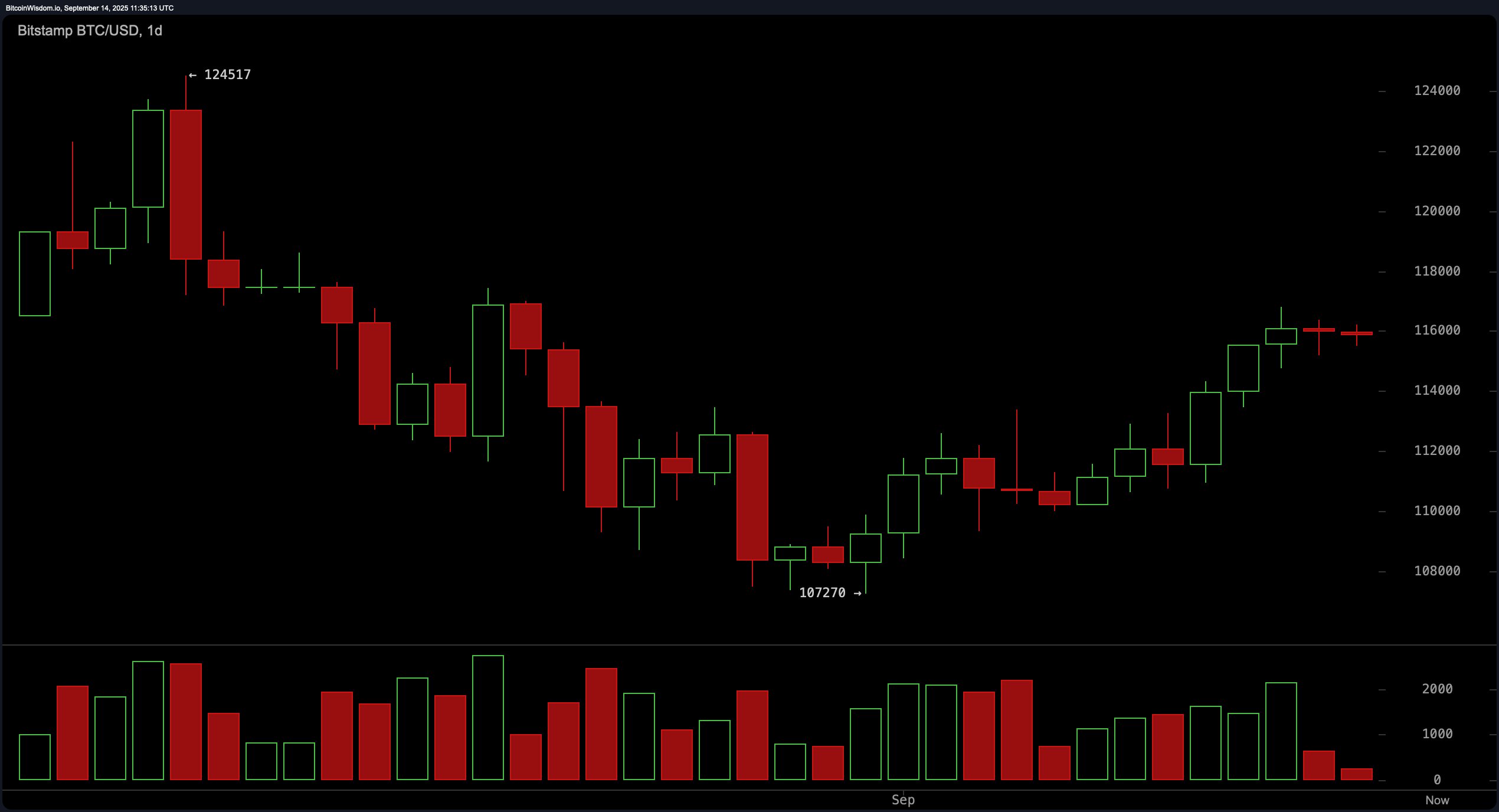

On the daily bitcoin chart, the structure reflects a bullish recovery from a bottom near $107,270, with higher highs and higher lows carrying price into a resistance band around $116,000 to $116,500 as volume tapers — a setup that can precede a pause or reversal. The current playbook favors looking for a pullback toward $112,000 to $113,000 accompanied by a bullish reversal candle, while noting indecision as price presses resistance. It also cautions against buying now because the relative strength index (RSI) would likely be near overbought, and candles look indecisive.

BTC/USD 1-day chart via Bitstamp on Sept. 14, 2025.

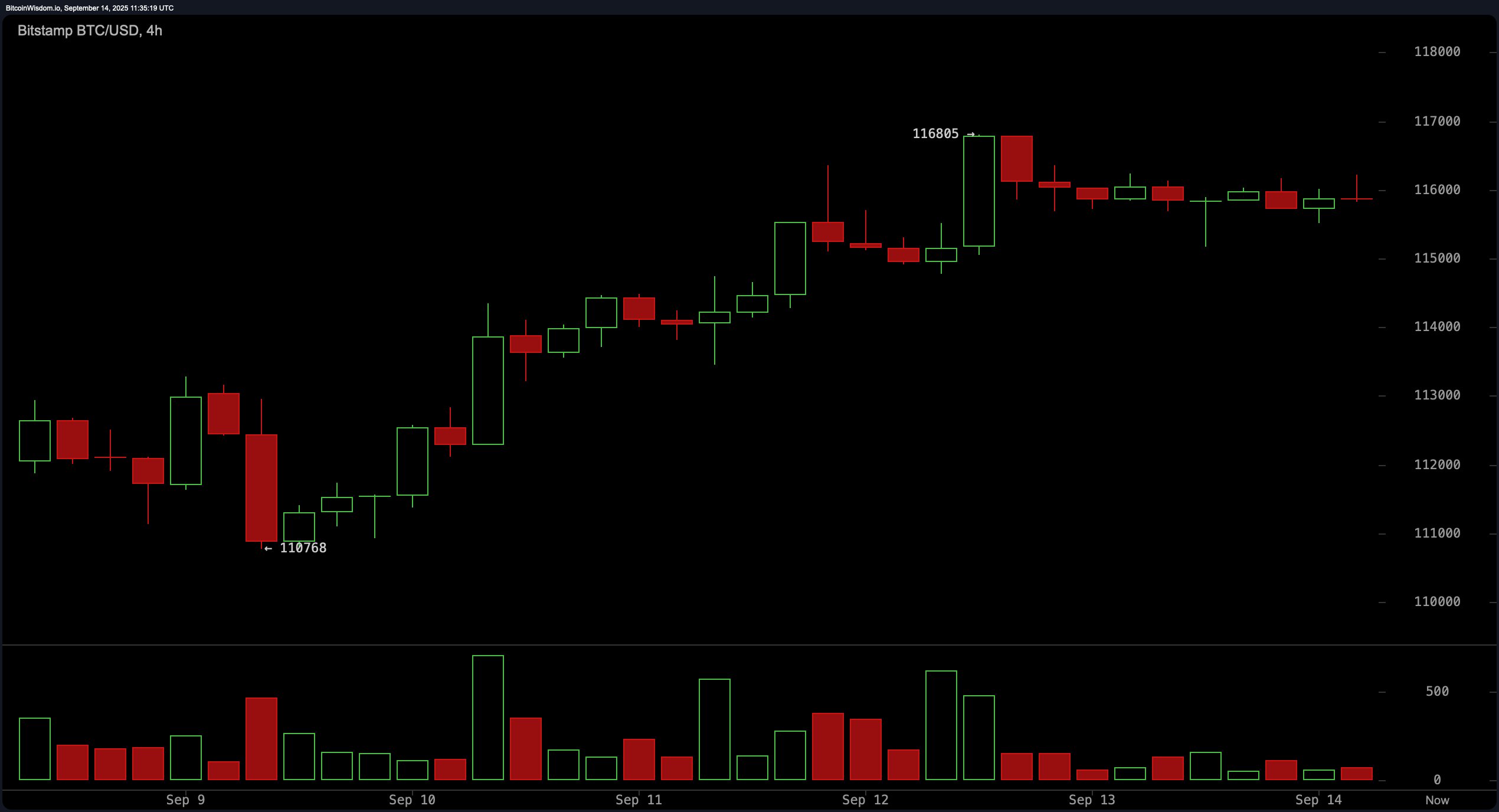

The 4-hour view shows the bitcoin price advance launching from support around $110,768 and stalling just off a recent peak at $116,805, with momentum slowing and volume easing after an earlier breakout spike. Within that framework, the plan is to monitor a potential pullback into $114,500 to $115,000 for a bounce, align profit-taking near 117,000, and treat a strong close above $117,000 on volume as a fresh breakout trigger. Together, these midcycle cues frame a market that is constructive but tiring near resistance.

BTC/USD 4-hour chart via Bitstamp on Sept. 14, 2025.

On the 1-hour chart, price is coiling in a narrow consolidation between $115,177 and $116,364, with compressed volatility and light participation signaling an impending range expansion. The intraday playbook is explicit: consider a breakout long above $116,400 with a stop below $116,000, or a breakdown short below $115,100 targeting the $114,600 area, and use tight stop-losses given the small profit windows. In short, intraday execution is tactical until a decisive move clears the range.

BTC/USD 1-hour chart via Bitstamp on Sept. 14, 2025.

Oscillators show a mixed but mostly nonconfirmational backdrop: the relative strength index (RSI) reads 58, neutral; stochastic registers 91, bearish; the commodity channel index (CCI) is 156, bearish; the average directional index (ADX) is 17, neutral; and the awesome oscillator stands at 1,327, neutral. Offsetting those softer notes, momentum is 5,082, positive, while the moving average convergence/divergence (MACD) level is 386, positive.

Moving averages (MAs) are uniformly constructive. Every MA — exponential moving average (EMA) (10) at $113,994, simple moving average (SMA) (10) at $113,308, EMA (20) at $113,305, SMA (20) at $111,858, EMA (30) at $113,381, SMA (30) at $112,796, EMA (50) at $113,381, SMA (50) at $114,503, EMA (100) at $111,243, SMA (100) at $112,599, EMA (200) at $105,193 and SMA (200) at $102,508 — carries a bullish designation. That breadth of trend support contrasts with resistance near $116,000; if volume remains weak, range-bound action or a minor pullback is possible, with no significant bearish reversal pattern identified.

Bull Verdict:

Bitcoin continues to hold above key moving averages across all major timeframes, with a constructive structure that supports the longer-term uptrend. If buyers can reclaim and hold above $117,000 with conviction, the path opens for continuation toward fresh all-time highs. The breadth of bullish moving averages suggests dips into support zones may be opportunities rather than threats.

Bear Verdict:

Despite underlying trend strength, price is pressing against a thick band of resistance near $116,000 with fading momentum and mixed oscillator signals. A rejection here, particularly with volume unable to expand, could drive a pullback toward $113,000 or even $112,000 in the near term. Traders should be cautious of overextension, as bearish divergences may yet assert themselves.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。