Gemini (Nasdaq: GEMI), a global cryptocurrency platform, has debuted on Nasdaq following its initial public offering. On Sept. 12, Cameron and Tyler Winklevoss visited the Nasdaq Market in Times Square and rang the Opening Bell.

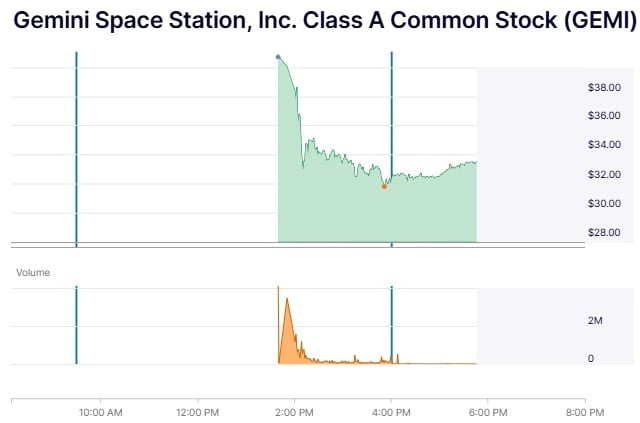

The stock opened at $37.01 and fluctuated between $31.56 and $45.89 before closing at $33.10. The gains followed strong investor interest, with the offering heavily oversubscribed.

GEMI stock performance on IPO day. Source: Nasdaq.

The day before, Gemini Space Station Inc.—which operates the platform founded by the Winklevoss twins in 2014—announced it had priced its IPO at $28 per share. The offering includes 15,178,572 shares of Class A common stock. Underwriters have a 30-day option to purchase up to 300,565 additional shares from Gemini and 458,364 shares from existing shareholders to cover over-allotments. The company emphasized that sales by selling stockholders will not generate proceeds for Gemini. The firm noted: “The offering is expected to close on September 15, 2025, subject to customary closing conditions.”

A large banking group is coordinating the offering. Goldman Sachs & Co. LLC and Citigroup are leading the syndicate, joined by Morgan Stanley and Cantor as lead bookrunners. Other bookrunners include Evercore ISI, Mizuho, Truist Securities, Cohen & Company Capital Markets, Keefe, Bruyette & Woods, Needham & Company, and Rosenblatt. Academy Securities, AmeriVet Securities, and Roberts & Ryan have been named as co-managers. Gemini highlighted that the IPO is being conducted exclusively through a prospectus, available via the U.S. Securities and Exchange Commission’s (SEC) EDGAR system or directly from the lead institutions. The SEC has already declared the registration statement effective.

The Gemini platform today reaches more than 60 countries, offering crypto services to both individual and institutional users. The firm underscores that its products are designed to be secure and reliable while broadening financial access. The IPO positions Gemini to secure new capital through public markets, deepening its institutional presence at a time when regulatory oversight of the crypto industry remains intense. By joining the Nasdaq, Gemini strengthens its visibility among mainstream investors and adds to the growing number of digital asset companies bridging into traditional financial channels.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。