What Happened In Crypto Today: Tether’s Launch, Polymarket $10B buzz

The global Cryptocurrency market continued to spike, with a total market capitalization of $4.17 trillion, up 1.1% over the last 24 hours. Trading activity is strong, with $178 billion in daily volume. Bitcoin continued to lead with 55.5% dominance, followed by Ethereum at 13.6%.

No Crypto Events Today

Source: Forex Factory

24 Hour Crypto Market Update

Bitcoin price climbed to $116,151, a modest 0.3% increase, supported by a massive $49.7 billion trading volume and a market cap of $2.31 trillion.

Top trending cryptocurrencies include Hifi Finance (HIFI), which skyrocketed by 347.5% to $0.3913 with strong trading volume of $652M. Solana (SOL) also gained momentum, rising 5.9% to $243.16 on $13.6B turnover. Meanwhile, Linea (LINEA) slipped 1.7% to $0.02294 despite trading activity above $205M.

Top 3 gainers: Hifi Finance (HIFI) soared an impressive 347.1%. Unibase (UB) followed with an 82.6% jump, backed by $83M in trades. Ethernity Chain (ERN) also surged 77.2%, pushing its price to $2.95.

Top 3 losers: OG Fan Token (OG) dropped 21.4% to $16.48. Collector Crypt (CARDS) declined 15%, while Gems VIP (GEMS) slipped 10.3% to $0.1849, showing weakness in select niche tokens.

The Decentralized Finance (DeFi) sector had a market cap of $179 billion, which represented a 3.0% gain. DeFi now represents 4.3% of the global crypto market with almost $10 billion in trading volume.

The market cap of the Stablecoin was $292 billion, which witnessed a 0.3% rise in the last 24 hours, supported by a whopping $137.5 billion trading volume.

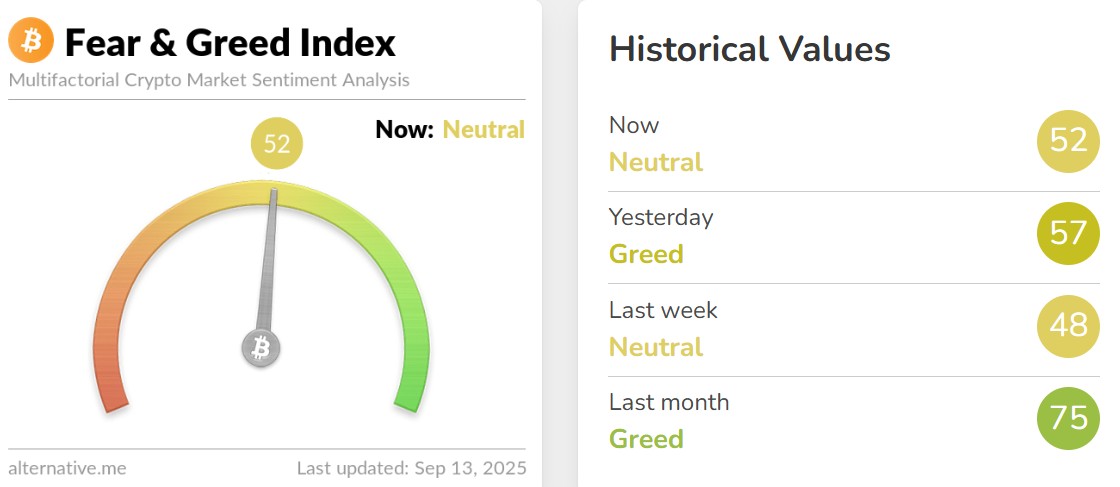

Fear and Greed Index Today

Source: Alternative Me

The Bitcoin Fear & Greed Index currently sits at 52 (Neutral), showing balanced sentiment. Yesterday’s reading was 57 (Greed), while last week's was 48 (Neutral). A month ago, sentiment was much higher at 75 (Greed). This suggests traders have shifted from strong optimism toward a more cautious outlook.

Latest Market News Today

Gemini, the crypto exchange backed by the Winklevoss twins IPO priced at $28 per share, raising $425 million and valuing the firm at about $3.3 billion. The 15.2 million-share sale was 20 times oversubscribed. Shares trade on Nasdaq under GEMI, with Nasdaq itself investing $50M. Goldman Sachs, Citi, Morgan Stanley, and Cantor underwrote the deal.

Avalanche has teamed up with Ethena Labs and Pendle Finance to boost DeFi on its fast, low-cost network. Ethena’s sUSDe, a yield-bearing stablecoin, is now live, while Pendle brings fixed and variable yield markets. Backed by delta-neutral hedging, sUSDe creates rewards from funding fees and collateral yields, which increases the opportunities for DeFi across Avalanche's ecosystem .

U.S. consumer sentiment fell in September 2025, with the University of Michigan index dropping to 55.4, down 4.8% from August and 21% lower than last year. Expectations slipped to 51.8, while current conditions eased slightly to 61.2. Inflation outlooks stayed high, with one-year expectations at 4.8% and long-term expectations edging up to 3.9%.

Polymarket, a crypto prediction platform, is set to raise new funding that could triple its value, with one offer putting it at $10 billion, Business Insider reports. The buzz comes after CEO Shayne Coplan said the company gained U.S. regulatory clearance. Investors expect a big U.S. launch, fueling excitement around Polymarket’s rapid growth.

Tether has launched USAT , a U.S.-regulated, dollar-backed stablecoin, and named Bo Hines as CEO of Tether USAT. Backed by transparent reserves and aligned with the GENIUS Act, USAT aims to give institutions a compliant digital alternative to cash. With Anchorage Digital as issuer and Cantor Fitzgerald as custodian, USAT reinforces U.S. dollar dominance in digital finance.

Disclaimer: Coingabbar provides informational content on cryptocurrencies, NFTs, and other decentralised assets. This is not financial advice. Users, please DYOR, understand the risks, and consult financial professionals before investing. CoinGabbar is not responsible for any financial losses. Crypto and NFTs are highly volatile—invest wisely.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。