Crypto ETFs Soar: Bitcoin Sees One of Its Largest Inflows as Ether Joins the Rally

It was a blockbuster day on Wednesday, Sept. 10, for crypto exchange-traded funds (ETFs). Investors piled into both bitcoin and ether funds, producing one of the strongest inflow days in recent memory.

Bitcoin ETFs surged with $757.14 million in inflows, a level that underscored growing institutional confidence. Fidelity’s FBTC was the day’s leader with a $298.98 million inflow, followed closely by Blackrock’s IBIT at $211.16 million and Ark 21Shares’ ARKB with $145.07 million.

Additional strength came from Bitwise’s BITB at $44.40 million, Grayscale’s Bitcoin Mini Trust at $17.61 million, Valkyrie’s BRRR with $15.70 million, and Vaneck’s HODL at $12.03 million. Smaller contributions included Grayscale’s GBTC at $8.92 million and Franklin’s EZBC with $3.28 million. Trading activity was robust at $3.88 billion, with bitcoin ETF net assets climbing to $147.83 billion.

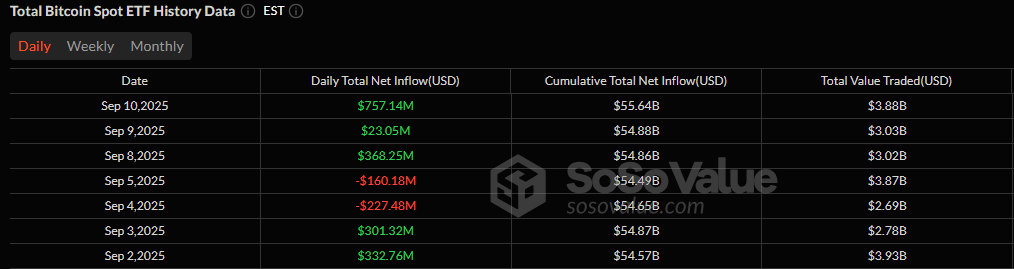

Inflows worth over $1 billion over the past three days have revitalized Bitcoin ETFs. Source: Sosovalue

Ether ETFs also joined the rally, securing $171.54 million in inflows across nearly every fund. Blackrock’s ETHA led with $74.50 million, while Fidelity’s FETH added $49.55 million. Other contributors included Vaneck’s ETHV with $11.07 million, Grayscale’s ETHE with $8.91 million, Bitwise’s ETHW at $8.36 million, Grayscale’s Ether Mini Trust with $7.73 million, 21Shares’ TETH with $7.12 million, and Invesco’s QETH at $4.31 million. Total trading volume reached $2.28 billion, with ether ETF net assets closing at $27.73 billion.

With both bitcoin and ether ETFs in the green, Wednesday highlighted a strong resurgence of institutional demand, fueling optimism for broader market momentum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。