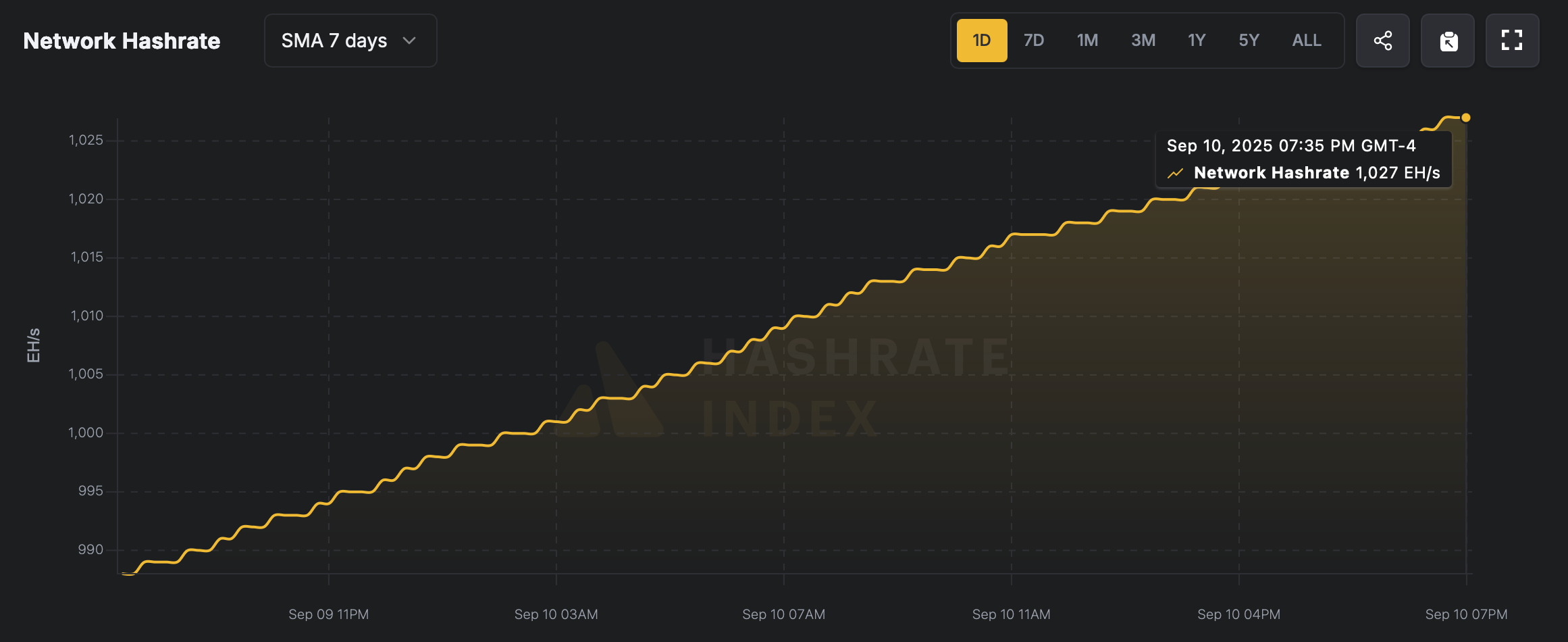

Just as bitcoin’s price these days seems perfectly at home above the $100,000 range, the network’s computational strength has been flexing comfortably around the 1 zettahash per second (ZH/s) mark. Metrics indicate the hashrate reached a lifetime peak of 1,027 EH/s, based on the seven-day simple moving average (SMA) figures tracked by Luxor’s hashrateindex.com.

Source: hashrateindex.com on Sept. 10, 2025.

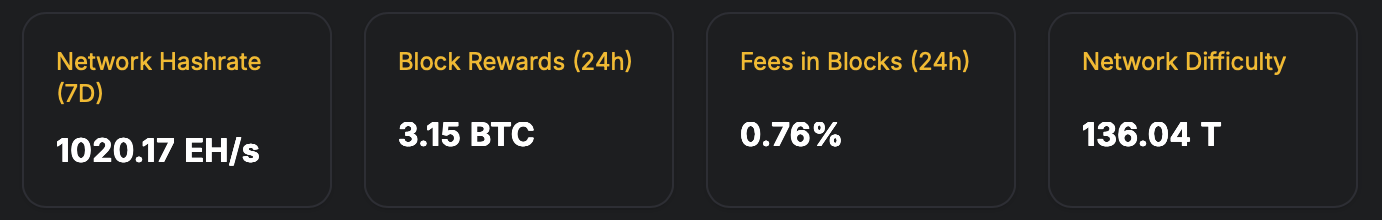

On Sept. 2, the hashrate peaked at 1,013 EH/s before slipping to 951 EH/s by Sept. 6. Since then, it’s been back in overdrive, steering toward the newest all-time high. As of 7:56 p.m. Eastern time, computational power was cruising at 1,020.17 EH/s. Block intervals are moving faster, with the average block time at 9 minutes 17 seconds, and the network sits 44% away from its next difficulty adjustment slated for Sept. 18.

Source: hashrateindex.com on Sept. 10, 2025.

With block times running quicker, the next adjustment is projected to be steeper, with current estimates pointing to a 7.67% hike. Still, with a little over 1,100 blocks remaining in the epoch, the outcome could easily shift higher or lower. As of Sept. 10, the leading 12 mining pools are Foundry USA, Antpool, ViaBTC, F2pool, Spiderpool, MARA Pool, Luxor, SEC Pool, Binance Pool, SBI Crypto, Braiins Pool, and Ocean Pool.

Foundry leads the field with 287 exahash per second (EH/s), while Antpool delivers around 159 EH/s. F2pool contributes 125 EH/s, and ViaBTC maintains 119 EH/s. Spiderpool adds roughly 73 EH/s, accounting for about 7.8% of the global total. Altogether, these five pools command 763 EH/s, which represents about 74.44% of the overall 1,025 EH/s hashrate. But while the hashrate may be climbing to record heights, miner revenue is down 8.39% compared with 30 days ago.

Currently, 1 petahash per second (PH/s) of hashing power is valued at $53.10 per day. On Aug. 10, the hashprice figure was $57.96 per PH/s, meaning miners are earning $4.86 less for every PH/s that contributes to the network. While Bitcoin’s expanding computational might highlights the network’s relentless growth, miner earnings reveal the harsher side of scaling. As efficiency accelerates, profitability always faces pressure, pointing to the constant balancing act between advancing technology and leaner rewards within the mining sector.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。