Written by: angelilu, Foresight News

On the evening of September 10, Paul Atkins, Chairman of the U.S. Securities and Exchange Commission (SEC), stood at the podium of the Organization for Economic Cooperation and Development (OECD) roundtable meeting, declaring to financial leaders from 38 countries, "We must acknowledge that the era of cryptocurrency has arrived!" This statement immediately ignited market sentiment, causing a surge in the crypto market.

As a result of this positive news, the price of BTC broke through $114,000, with a 24-hour increase of over 2%; ETH surpassed $4,450, rising by 3.9%. Prior to this, the crypto market had already seen four consecutive days of gains, with BNB breaking through $900 to reach a historical high, and SOL returning to $220 after six months.

In terms of contract data, according to Coinglass, over the past 24 hours, the total liquidation of open contracts across the network exceeded $262 million, with long positions liquidating over $106 million and short positions liquidating over $150 million.

Key Points from SEC Chairman's Speech

In his speech, Paul Atkins clearly announced a significant shift in the SEC's regulatory direction: "For a long time, the SEC has used its investigative, subpoena, and enforcement powers to disrupt the cryptocurrency industry. This approach is not only ineffective but also harmful; it pushes jobs, innovation, and capital overseas. American entrepreneurs are the first to suffer, forced to invest heavily in legal defenses instead of developing their businesses. This history is now behind us."

At the international summit with participants from 38 countries, the SEC Chairman introduced a comprehensive plan named "Project Crypto," aimed at reforming the existing regulatory framework:

- Clarifying the legal status of tokens: "Most crypto tokens are not securities, and we will clearly define these boundaries";

- Promoting on-chain financing innovation: "We must ensure that entrepreneurs can raise funds on-chain without facing endless legal uncertainties";

- Supporting "super app" trading platforms: Allowing platforms to offer trading, lending, and staking services under a single regulatory framework;

- Promoting comprehensive on-chain markets: Modernizing securities rules to enable market on-chain transformation.

Atkins emphasized that regulators should provide "the minimum effective regulatory dose needed to protect investors, no more," to avoid overburdening entrepreneurs with redundant rules.

Atkins also praised the European Union's Markets in Crypto-Assets (MiCA) regulatory framework, calling it a "comprehensive digital asset system," and stated that the U.S. could learn from it. He called for international cooperation to "promote more innovative markets."

U.S. Macroeconomic Data Boosts Market Optimism

Market sentiment was also buoyed by U.S. macroeconomic data:

Last night, on September 10, the U.S. released PPI data, showing an unexpected decrease of 0.1% in August PPI month-on-month (expected to rise by 0.3%), adding new support for the Federal Reserve's decision to cut interest rates next week. This marks the first negative month-on-month PPI in four months, and the market generally expects a 25 basis point rate cut, with a minority betting on a 50 basis point cut.

Additionally, on September 9, the U.S. government announced a significant downward revision of employment numbers, with a reduction of 911,000 jobs over the past year ending in March, far exceeding the market expectation of 682,000. This is the largest downward revision since 2000, equivalent to an average monthly increase of nearly 76,000 jobs, accounting for 0.6% of the total workforce. This revision reflects a weak labor market, intensifying concerns about the health of the U.S. economy and providing more pressure for the Federal Reserve to cut rates.

Market Outlook

Regarding the current market situation, most traders are showing an optimistic attitude.

MEXC partner Ted stated that ETH is reflecting BTC's performance during the 2020-2021 cycle. If viewed over a 3-4 month timeframe, Ethereum's price could reach around $8,000 to $10,000. However, in the short term, the price may decline.

CryptoKaleo noted that Bitcoin's dominance chart has performed quite well so far, and the altcoin season is approaching.

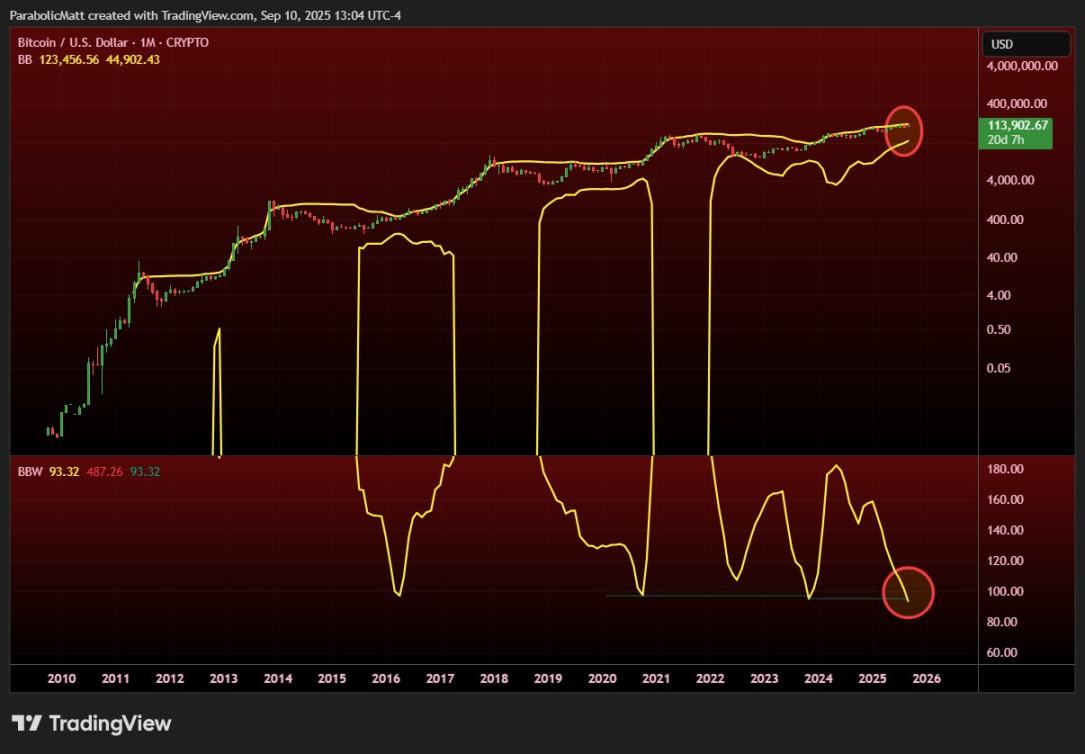

Trader Matthew Hyland mentioned, "The BTC monthly Bollinger Bands are at the most extreme levels in BTC's entire history, with the largest squeeze in 15 years."

Key Upcoming Time Points

Investors should closely monitor several key upcoming time points:

- September 11 CPI data release: The previous three CPI data releases have led to a 9%-11% drop in Bitcoin prices, and this data will be an important indicator for the market's short-term trend. Although the market generally expects the CPI data to be "hot," Wall Street analysts believe that the weak labor market has become the core variable determining Federal Reserve policy, and the CPI data is unlikely to change expectations for a rate cut in September.

- September 17 FOMC meeting: The Federal Reserve's monetary policy meeting will be a key event determining the market's mid-term trend. The market has fully priced in a 25 basis point rate cut, and attention will focus on the Federal Reserve's statements regarding the future rate cut path. Some analysts expect BTC to continue rebounding to a maximum of around $117,000 before the FOMC meeting.

- Rate cut path before the end of the year: Besides September, the market expects the Federal Reserve may take further rate cut actions in October and December. As the rate cut cycle begins, capital liquidity is expected to increase, further driving up the prices of crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。