Sharplink Gaming, Inc. (Nasdaq: SBET) announced Sept. 9 that it started executing share repurchases to “drive long-term stockholder value.” The company, which describes itself as one of the world’s largest corporate holders of ether (ETH) and a promoter of ethereum adoption, framed buybacks as the preferred use of capital while the stock trades under its net asset value.

Sharplink said its common stock is “significantly undervalued” and that buybacks are compelling at current levels. The company repurchased about 939,000 shares at an average price of $15.98 and further said it expects to buy additional shares depending on market conditions, using cash on hand, cash generated from staking operations, or other financing means.

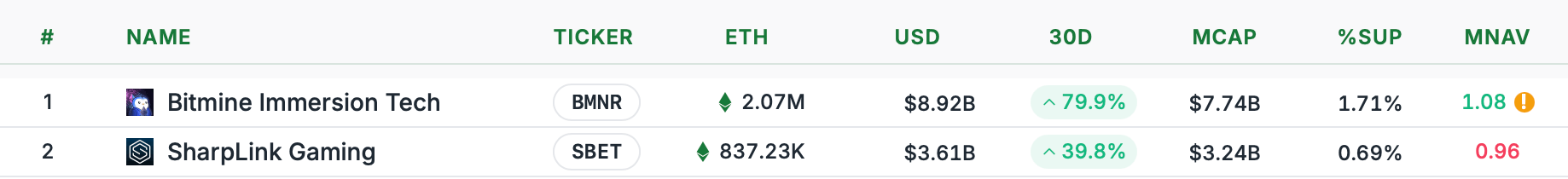

Sharplink is the second-largest ETH treasury company under Bitmine. Source: strategicethreserve.xyz

Some market participants interpret a depressed mNAV as evidence of hidden value—a “bargain”—while others caution it may reflect waning appetite and, in turn, pose the risk of a value trap for ETH-linked equities. Sharplink’s management highlighted a balance sheet anchored by approximately $3.6 billion in ether with no outstanding debt. Nearly all of that ether is staked, the company said, producing meaningful revenue to fund operations and support capital allocation.

Sharplink also stated it has not tapped its at-the-market facility while trading below NAV, noting such issuance would be dilutive on an ether-per-share basis. The company said it may use the ATM in the future if market conditions allow it to do so in a way that benefits existing stockholders.

“Maximizing stockholder value remains our top priority,” co-CEO Joseph Chalom said, citing a “position of strength” built on its ether treasury and income from staking. He added that Sharplink is focused on “disciplined capital allocation — including share repurchases” and on the long-term opportunity it sees in ethereum.

If repurchases persist while shares trade below NAV, Sharplink’s ether-backed balance and staking income could boost per-share ether exposure, benefiting remaining holders. A narrowing discount or ether weakness, however, might redirect capital priorities and test management’s commitment to ongoing buybacks.

Likewise, several U.S. and overseas crypto treasury firms have seen depressed or erratic mNAVs even during periods of rising token prices, stemming from factors such as dilution via equity offerings, absence of redemption mechanisms, and doubts surrounding overall business strategy. Archived metrics indicate ETHZ, BTCS, and ETHM are all reflecting depressed mNAVs this week.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。