In the ever-changing cryptocurrency market, there are always tokens that leap from obscurity to market focus at an astonishing speed. Over the past week, MYX Finance (MYX) has undoubtedly been the star of this annual spectacle. In just a few days, the price of this decentralized perpetual contract exchange token skyrocketed by over 1550%, triggering a frenzy of market chasing and deep scrutiny. Its market capitalization quickly expanded from less than $200 million to $3.59 billion, successfully entering the top 100 cryptocurrencies by market cap.

Behind this phenomenal surge is a complex interplay of various forces: the grand technological narrative of new protocol upgrades, the precise catalysis of high-profile market events, and the bloody truth of high-leverage long-short games in the derivatives market.

1. Surge Documentation: From Unknown to Star at 15x Speed

The rise of MYX has not been a smooth ascent but rather a typical "stair-step" explosion. Data shows that its price started at around $1.2 on September 3, broke through $3 on September 8, and peaked at $14.48 within a single day. Subsequently, the price further climbed to a high of $18.58 on September 9. This price performance led to a staggering 685.90% increase in its 24-hour trading volume on platforms like Binance.

Alongside the price explosion, its trading volume and market activity also surged, with MYX briefly ranking fourth in Binance futures trading volume, indicating that market interest in MYX was primarily concentrated on high-risk, high-leverage futures contracts.

Figure 1: MYX Price Change Trend

2. Driving Force Analysis: The Resonance of Technological Narrative, Event Catalysis, and Capital Flow

The surge of MYX is not coincidental; it is the result of a clever intertwining of multiple factors that together construct a strong upward narrative.

2.1 Technological Narrative: The "Zero Slippage" Vision of the V2 Protocol

The upcoming V2 protocol upgrade of MYX Finance provides a strong fundamental narrative support for this round of market activity. The V2 version promises to achieve zero slippage trading, enhanced cross-chain functionality, and a better user experience. Its core Matching Pool Mechanism (MPM) eliminates slippage by pooling liquidity and supports leverage trading of up to 50 times. This technology aims to position MYX as an "on-chain CEX" directly competing with centralized exchanges (CEX), catering to DeFi traders seeking efficient trading experiences.

Market traders view this as the main catalyst for the price increase. MYX's official social media hinted that "V2 is closer than you think," a message quickly captured by the market, igniting the frenzy. The zero slippage and cross-chain features of V2 directly address the pain points of DeFi trading, providing "reasonable" investment rationale for speculative capital, thus blurring the lines between technological value and speculative bubble, intensifying investors' FOMO sentiment.

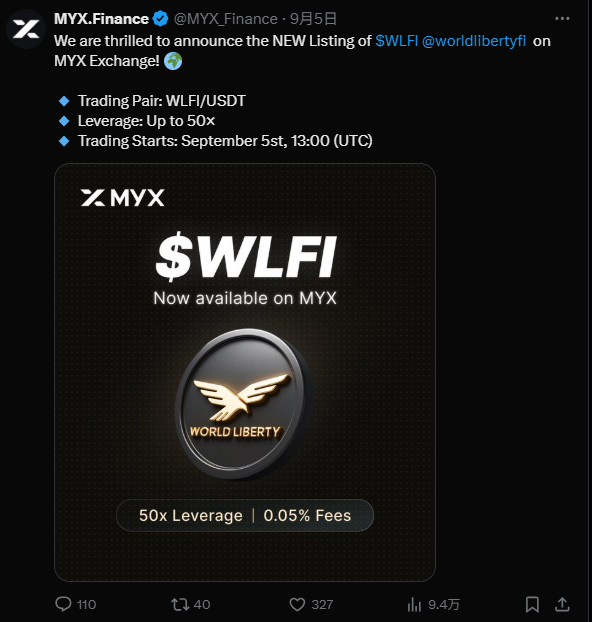

2.2 Event Catalysis: WLFI Listing and the "Binance" Halo Effect

Beyond the technological narrative, a series of market events played a role in amplifying the momentum. On September 5, MYX Exchange announced support for the listing of WLFI (World Liberty Financial) tokens associated with former U.S. President Donald Trump's family. This event quickly attracted massive social attention, linking political hotspots with the cryptocurrency market, bringing a flood of traffic and speculative capital to MYX.

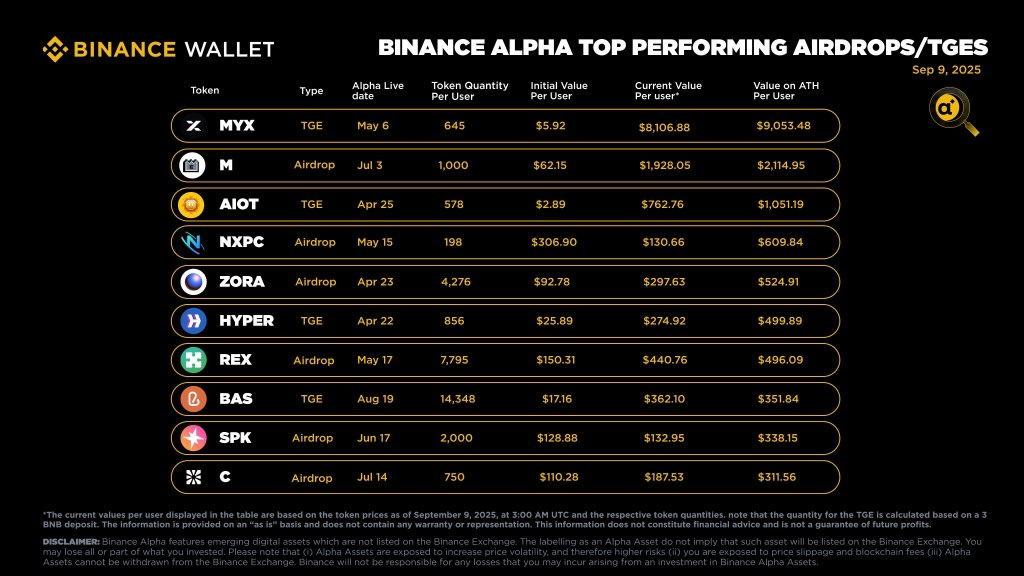

Additionally, MYX's exposure on the Binance platform played a crucial role. Its high ranking in Binance futures trading volume and outstanding performance on Binance Alpha provided strong credibility backing for the project. This "halo effect" from a top exchange further amplified MYX's visibility, attracting more institutional and retail traders. The price surge of MYX can, to some extent, be seen as a successful marketing case, leveraging the cryptocurrency market's high sensitivity to external hotspots, cleverly combining a technological project with a cultural phenomenon, achieving a "small effort yielding great results."

2.3 Token Economics and Airdrop Logic

MYX's token economic model also provided short-term fuel for this surge. 14.7% of the token supply was allocated for airdrops, which greatly stimulated community participation and token demand in the short term. However, this mechanism also sparked controversy. Blockchain analysis firm Bubblemaps pointed out on the X platform that a single entity might have acquired $170 million worth of tokens in the MYX airdrop through 100 new addresses, which is suspected to be a form of "Sybil Attack." A Sybil Attack refers to a single entity creating numerous fake identities to influence or control a network, which contradicts the spirit of decentralization.

Moreover, the token unlock schedule also brought uncertainty to the market. MYX had already conducted a token unlock in August, leading to some investors (such as Hack VC) selling off, while another batch of tokens is scheduled to unlock in November 2025. This concentration of airdrops and the "unlock and sell" behavior of VCs together form a typical "insider trading" model, suggesting that MYX's surge may be providing liquidity for early investors and insiders to exit at high levels.

3. Deep Game: The Long-Short Duel and Insider Clouds Behind the Bubble

The surge of MYX is not a completely "organic" process; behind it lies a deep game of high-leverage long-short battles and suspected market manipulation.

3.1 "Bloody" Short Squeeze Under High Leverage

The high-leverage trading characteristics of MYX make it a natural battleground for short squeezes. When the price rises due to positive news or buying pressure, those who short the token are forced to buy back tokens to close their positions and stop losses. This large-scale passive buying behavior further pushes up the price, creating a self-reinforcing positive feedback loop.

The trend of MYX is a typical example of this mechanism. Between September 6 and September 10, the total liquidation amount of short positions reached $89.51 million, far exceeding the liquidation amount of long positions. This indicates that the buying pressure generated by forced liquidations of shorts is a direct driving force behind the price surge, with each liquidation injecting new fuel into this "rocket" market. The phenomenon of derivatives trading volume far exceeding spot trading reveals that MYX's surge primarily occurred in a highly speculative leveraged market rather than in the real demand of the spot market.

3.2 On-Chain Investigation and the "Shadow" of Insider Trading

In addition to high-leverage games, MYX's on-chain data has also triggered accusations of market manipulation. Bubblemaps' report on the airdrop "Sybil Attack," along with the previous behavior of VC firm Hack VC quickly selling off $2.15 million worth of tokens after the token unlock, points to the possibility of a highly concentrated token distribution.

This token distribution structure, combined with the VC's "unlock and sell" model, forms a typical "insider trading" logic: a few large holders utilize concentrated tokens from airdrops, push up prices through marketing and manipulation, and then cash out at high levels. Although on-chain data can reveal suspicious behavior, it cannot directly prove the legal intent of "insider trading," so these remain at the level of "accusations." However, this potential manipulation risk, along with the betrayal of the project's spirit of decentralization, is the most fatal aspect of its long-term risks.

4. Historical Reflection: Similarities and Differences Between MYX and Mantra (OM)

For investors in MYX, the collapse of Mantra (OM) in early 2025 serves as a serious risk warning. OM experienced a high surge before its price plummeted by over 90% in a single day.

There are many similarities between the trends of MYX and OM: both experienced short-term surges; both were associated with specific external events (OM's Dubai collaboration, MYX's WLFI listing); and both collapses were related to large-scale forced liquidations on centralized exchanges.

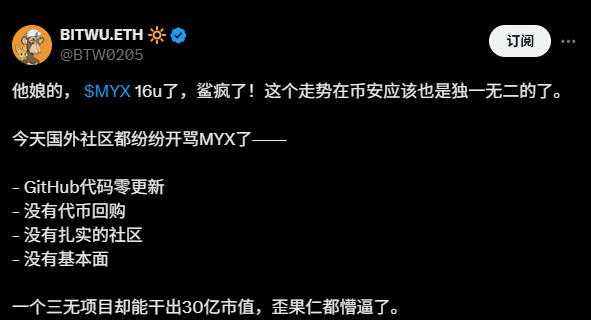

Community concerns about MYX's fundamentals also echo those of OM back then. X platform user @BTW0205 pointed out that MYX lacks GitHub code updates, has no token buyback mechanism, and has weak community building, questioning whether its fundamentals can support a market cap of $3 billion. This questioning of fundamentals, combined with the high-risk factors of leverage liquidation and token concentration, makes MYX's trend appear to be replaying the story of OM. History shows that when a token's price is primarily driven by speculation and leverage, accompanied by fundamental doubts, its ultimate outcome is often a rapid collapse, revealing the tragic state of a burst bubble once the tide recedes.

5. Conclusion and Outlook: After the Tide Recedes, Who is Swimming Naked?

The surge of MYX is a complex product of the interplay of technological narrative (V2 protocol), event-driven factors (WLFI listing), capital speculation (short squeeze), and market sentiment (Binance effect). Its upward logic is solid and clear, but the hidden risks are equally deadly.

Table 2: MYX Bullish and Bearish Scenario Analysis

Scenario

Key Driving Factors

Potential Price Targets

Core Risks

Bullish

Successful implementation of V2 protocol, more mainstream exchange listings, sustained DeFi enthusiasm

$20-22

Technical delays, market enthusiasm waning, overall market correction

Bearish

Market manipulation confirmed, token unlock selling pressure, leveraged long liquidations

Below $5

Insider trading accusations, liquidity crisis, weak fundamentals

Investment Advice and Risk Warning

Although MYX has achieved an incredible surge over the past week, its explosive growth in price and trading volume has occurred in a highly unstable market environment. Potential insider trading, Sybil attacks, and short squeezes driven by a high-leverage derivatives market all pose significant risks.

At this current juncture, investors should remain highly vigilant and avoid blindly chasing highs. It is advisable to closely monitor the following key factors:

V2 Protocol Progress: Pay attention to MYX's official announcements regarding the release and actual operation of the V2 protocol. Whether the technological narrative can ultimately be realized will determine its long-term value.

Token Unlock Dynamics: Be wary of the upcoming token unlock in November, which may bring new selling pressure.

Technical Indicators: Technical indicators such as RSI and MACD have shown signs of overbought conditions, indicating a risk of pullback in the short term.

Do Your Own Research (DYOR): Return to fundamentals, conduct independent research on the project's codebase updates, community activity, and team background, and avoid being swayed by a single narrative and social media sentiment.

The cryptocurrency market is highly volatile, and any investment may face significant losses. Please make decisions after thorough research and assessment of your own risk tolerance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。