UK FCA Rule Change Clears Path for BlackRock Bitcoin ETF Listing

BlackRock is preparing to launch its iShares Bitcoin ETP, often called the BlackRock Bitcoin ETF, on the London Stock Exchange.

Source: X (formely Twitter)

Source: X (formely Twitter)

The timing lines up with a major change in UK rules. Starting 8 October 2025, retail investors will finally be allowed to buy cryptocurrency exchange-traded notes (ETNs) again.

This puts the UK back in step with Europe, where everyday investors already have access to these products.

The FCA Rule Change

In 2021, the Financial Conduct Authority (FCA) banned retail traders from buying crypto ETNs, saying they were too risky.

Since then, the market has grown and regulations have tightened. The FCA now believes there’s room for retail investors to participate again, but with stronger protections.

From October, these products can be sold on FCA-approved exchanges, as long as firms provide clear risk warnings and follow strict promotion rules. The risks remain, but investors will at least have a better idea of what they’re stepping into.

Why It Matters

This change makes way for the BlackRock Bitcoin ETF to reach everyday investors in the UK . Up until now, only institutions and professionals could trade these products. Listing on the London Stock Exchange gives people a regulated and familiar way to get exposure to BTC without holding it directly.

It also signals something bigger: BTC is moving closer to being accepted as a regular part of global finance, much like gold or traditional exchange-traded funds.

BlackRock’s Global Focus

The company is using the UK listing to strengthen its role in the growing crypto investment space. Rather than focusing on past launches elsewhere, the firm is zeroing in on the chance to open access for UK investors.

By introducing the BlackRock Bitcoin ETF to London, it wants to expand adoption and set a new standard for how Bitcoin can be offered through regulated financial products .

Market Buzz and Investor Reactions

The launch is already creating buzz. On social media, traders are calling it a bullish sign, pointing out that big investors seem to be positioning ahead of time. Some expect the listing to draw fresh demand and push Bitcoin’s price higher.

But not everyone is convinced it will be smooth sailing. Analysts warn that while demand could increase long term, short-term price swings are still likely.

This crypto's recent trading has shown higher volumes as some traders take profits, which could mean more volatility around the launch.

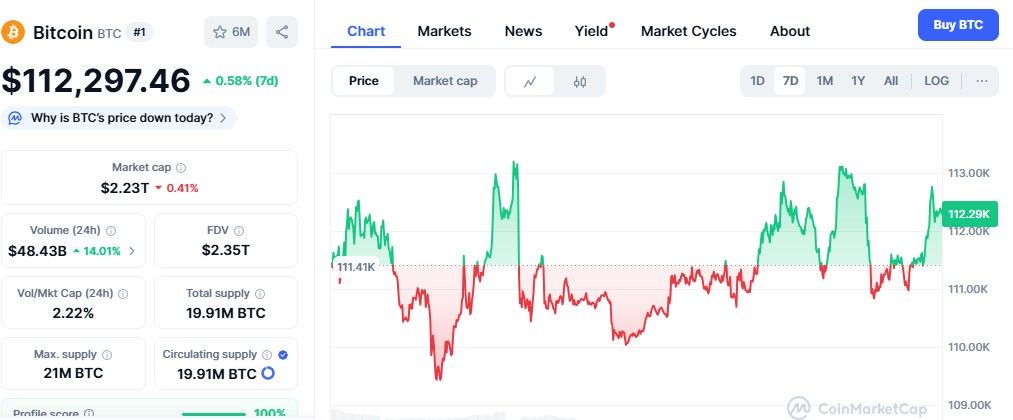

Source: CoinMarketCap

Currently the coin is trading at $112,297 with a decrease of 0.37% in the last 24 hours, while a weekly increase of 0.6% is recorded by the CoinMarketCap.

US BTC ETF: According to Sosovalue, BlackRock's IBIT holds $83.72B in assets , with $169.31M net inflow in one day. Total BTC ETF assets are $144.30B, proving rising global demand.

BlackRock’s Growing Crypto Position

For weeks prior to the launch of the ETF, the organisation has been gradually ramping up its exposure to digital assets.

The company recently acquired $44.2 million in ETH and $169.3 million in BTC to add to its already enormous crypto presence.

BlackRock currently has more than $100 billion in digital assets, a sign of strong institutional belief even before the UK launch.

Key Things to Know

-

The BlackRock Bitcoin ETF is another name for the iShares Bitcoin ETP.

-

8 October 2025 is when retail investors in the UK can start buying again.

-

Crypto ETNs remain high risk. They are not covered by the FCA’s compensation scheme, and this cryptocurrency is still very volatile.

Looking Ahead

BlackRock's UK launch might prove to be a watershed moment. If the ETF is well subscribed, it can encourage other asset managers to launch similar products to the market. For retail investors, it would mean additional ways to invest in this crypto without having to exit the regulated financial system.

The BlackRock Bitcoin ETF isn't simply providing individuals with a new investment choice; it's another indication that this crypto is here to stay as a participant in the world's financial system.

Also read: Federal Judge Blocks Trump From Removing Fed Governor Lisa Cook免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。