The next major airdrop project is likely to come from the Perp DEX track. According to incomplete statistics from Rhythm BlockBeats, there are currently at least ten Perp DEX projects on the market that have not yet issued tokens: edgeX, Lighter, paradex, variational, Pacifica, Aster… We want to know: what can ordinary people do in this track to avoid being overly aggressive while not missing out on the Alpha?

To answer this question, Rhythm BlockBeats reached out to a deep player in the Perp DEX space, anymose (@anymose96), who is the author of "Understanding Web3 from Scratch" and "A Minimalist Introduction to NFTs," and is also someone who has deeply researched early alpha projects.

Among the currently most promising players in this track, anymose has chosen edgeX as his current main focus, considering various factors such as trading depth, mobile experience, API experience, project background, and airdrop profit-loss ratios.

Next, we will provide a detailed analysis of anymose's practical experience on edgeX—from point acquisition strategies to weight amplification techniques, from TGE time predictions to point value assessments, offering readers a replicable operational path.

"Cost Reduction and Efficiency Improvement" Point Strategy

In this cycle, the "point system" has become the mainstream method for calculating early airdrop shares for projects. Points record real contributions and distribute rewards based on the ledger during TGE or airdrops. The advantages of this mechanism are obvious—more compliant, controllable timing, precise incentives, and better anti-bot effects. In the Perp DEX track, Hyperliquid has successfully validated this logic, and edgeX has adopted the same mechanism.

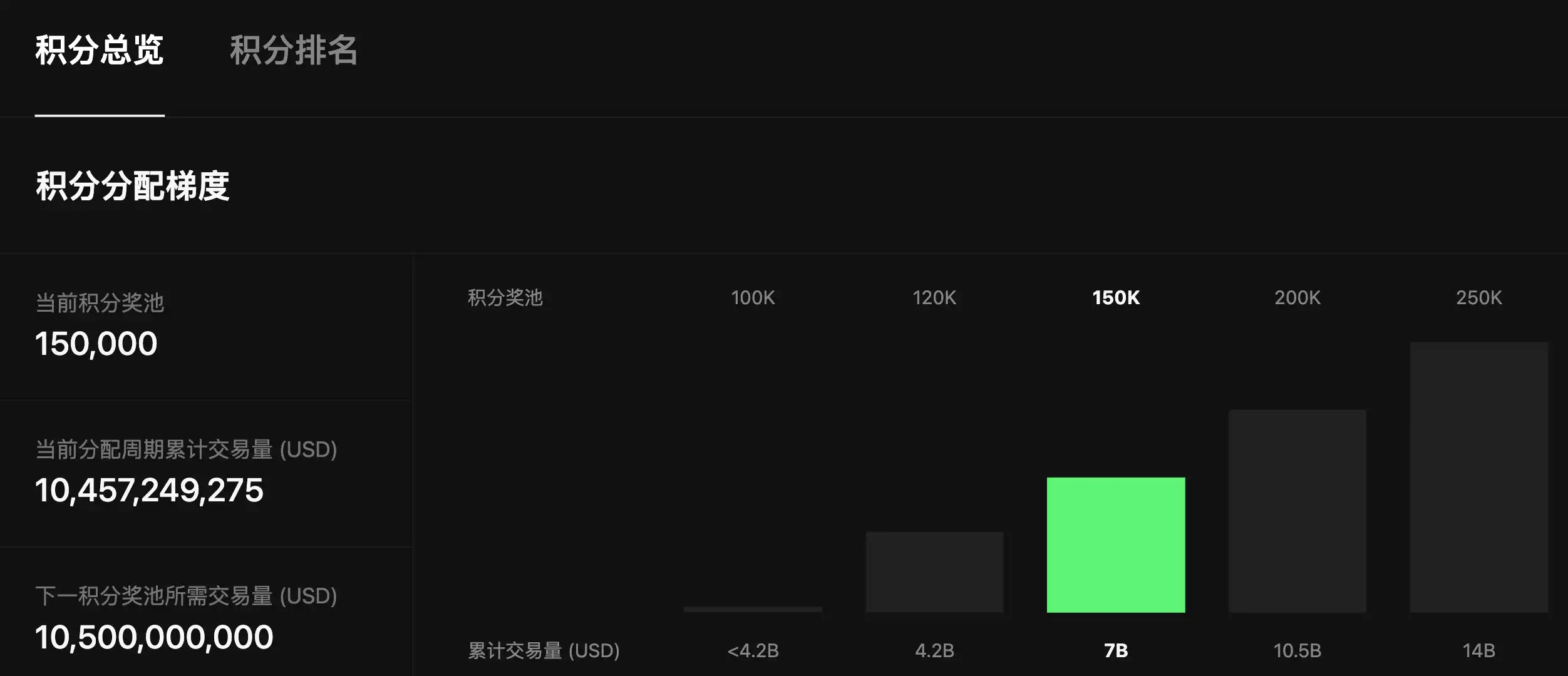

The point distribution of edgeX uses a "weekly, tiered, contribution-split" model. The specific operational mechanism is as follows: the platform distributes points every Wednesday, setting a total point prize pool divided into five tiers based on the total trading volume of all users for the week. For example, if the volume is below $4.2 billion, the prize pool is 100,000 points; if it reaches $4.2 billion, it is 120,000 points, and so on, with a total of five prize pools. According to observations from Rhythm BlockBeats, the point prize pools in recent weeks have mostly fallen into the third tier (150,000 points) and fourth tier (200,000 points).

Point prize pool tier illustration

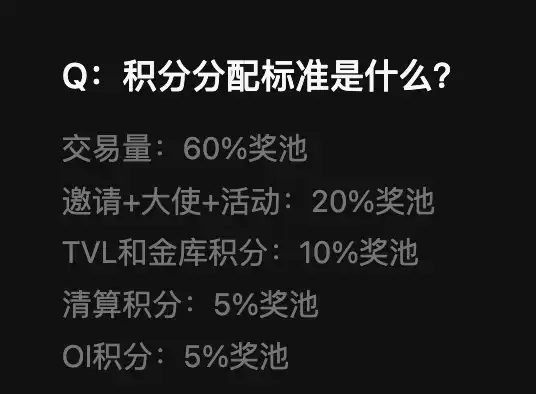

After determining the total prize pool, users can acquire points through the following five methods, each with different weights.

The largest source of the point prize pool is trading volume, which aligns with anymose's observations: "If we were to rank the weights of points, we estimate it as: order amount (contribution fees) > positions > profit and loss."

This means that trading volume is the main way to acquire points. So how much trading volume is needed to earn 1 point, and what is the approximate cost of acquiring points? This may also be one of the most concerning questions for users. From the perspective of a frontline player, anymose provided his answer.

"Our team contributed about $200,000 in fees on edgeX," and based on edgeX's fee ratio, we can roughly infer that anymose's total trading volume is approximately in the range of $830 million to $1.54 billion. Since edgeX's current point distribution is a dynamic point system, the difficulty of acquiring points changes weekly, making it hard to provide an accurate figure for "how much trading volume gets 1 point." However, according to anymose's estimates, "the cost of 1 point averages around $10."

Because he participated relatively early and deeply, anymose's cost is relatively low. For ordinary users, the cost will be somewhat higher. According to community discussions, currently, every $50,000 to $70,000 in trading volume can earn 1 point, with a cost of about $15.

This is also why anymose no longer recommends users create "premium accounts" instead of spamming multiple accounts: "Cost reduction is the best and should be the most important strategy for playing edgeX."

Concentrating funds on one "premium account" allows for upgrading to VIP status after reaching a certain trading volume and number of invites, which reduces fees, thereby significantly lowering the cost of acquiring points. With the same amount of capital, one can obtain more points at a lower cost. As shown in the figure below, different VIP levels can offer lower trading fee discounts.

In addition to upgrading to VIP status, another way to reduce costs is during the new token launch phase, where there are often activities that provide extra points. Additionally, anymose added: "Participating in community activities, trading competitions, referral commissions, and becoming ambassadors, among other methods, can also earn extra points and lower average costs."

Running API + Full Vault

"From historical data, the average weekly wallet points acquisition has dropped to a historical low of 24 points for two consecutive weeks, while the number of trading users has reached a new high, making it overall more difficult," anymose stated.

Early "tricks," such as opening multiple new accounts to complete beginner tasks or using liquidation amounts to exchange for points, have become less applicable as edgeX's popularity has increased, leading to a rise in the cost of acquiring points. Therefore, real trading volume has become the core element for obtaining points.

"Ultimately, it is still closely related to your trading volume." Therefore, anymose highly recommends becoming a high-frequency trader or a quantitative trader, connecting to the API for automated trading: "Our strategy is quite simple; we just look at the funding rates and connect to edgeX's API for one-sided trades. The experience is very good and very smooth. The API was paused for over a month, but it is now open again."

In addition to Perp trading, the eLP vault is another major highlight of edgeX. According to official documentation, the income from edgeX eLP's APY comes from passive market-making profits, liquidation fees, and a portion of platform trading fees. Each user's eLP vault limit increases as Perp trading grows. Currently, the vault allocation rules are: individuals receive a $30 limit for every $50,000 in trading volume; invited users receive a $30 limit for every $300,000; with a cap of 50% of the $100,000 recharge limit.

Although the eLP vault only accounts for 10% of the prize pool's weight, it boasts high APR returns, with a performance of around 13.65% APR over the past month. Therefore, the choice of the anymose team is: "Fill the vault to capture points and high APY returns at any time."

As of the time of publication, the TVL of the eLP vault is $196 million; data source: edgeX

Regarding the community's concern about the "witch rule," anymose stated that the edgeX team’s stance on witches is: "As long as you have obtained points, there is no such thing as a witch."

"This means: if there are witches, then you won't get any points," anymose said.

However, one thing to note is that edgeX's trading rules include a clause: self-trading does not count for points. "Self-trading means placing an order and then filling it yourself, which is easy to identify," anymose explained. Additionally, according to information obtained by Rhythm BlockBeats in the community: ultra-short reversals (opening and immediately closing) have lower weight, and holding positions longer with the same trading volume gives greater point weight.

Therefore, the most prudent approach is to: first concentrate capital to create one premium account to upgrade VIP status, prioritize limit orders to reduce fees, engage in real trading to avoid self-trading, combine activities and ambassador commissions, and fill the eLP vault or gradually increase positions. This way, one can optimize the cost per point while simultaneously enhancing real trading and stable returns.

1 Point at $30, Overestimated or Underestimated?

Recently, discussions about the price of edgeX points have been seen on social media. Although the off-market trading volume is not large, the price of $30 per point seems reasonable to anymose.

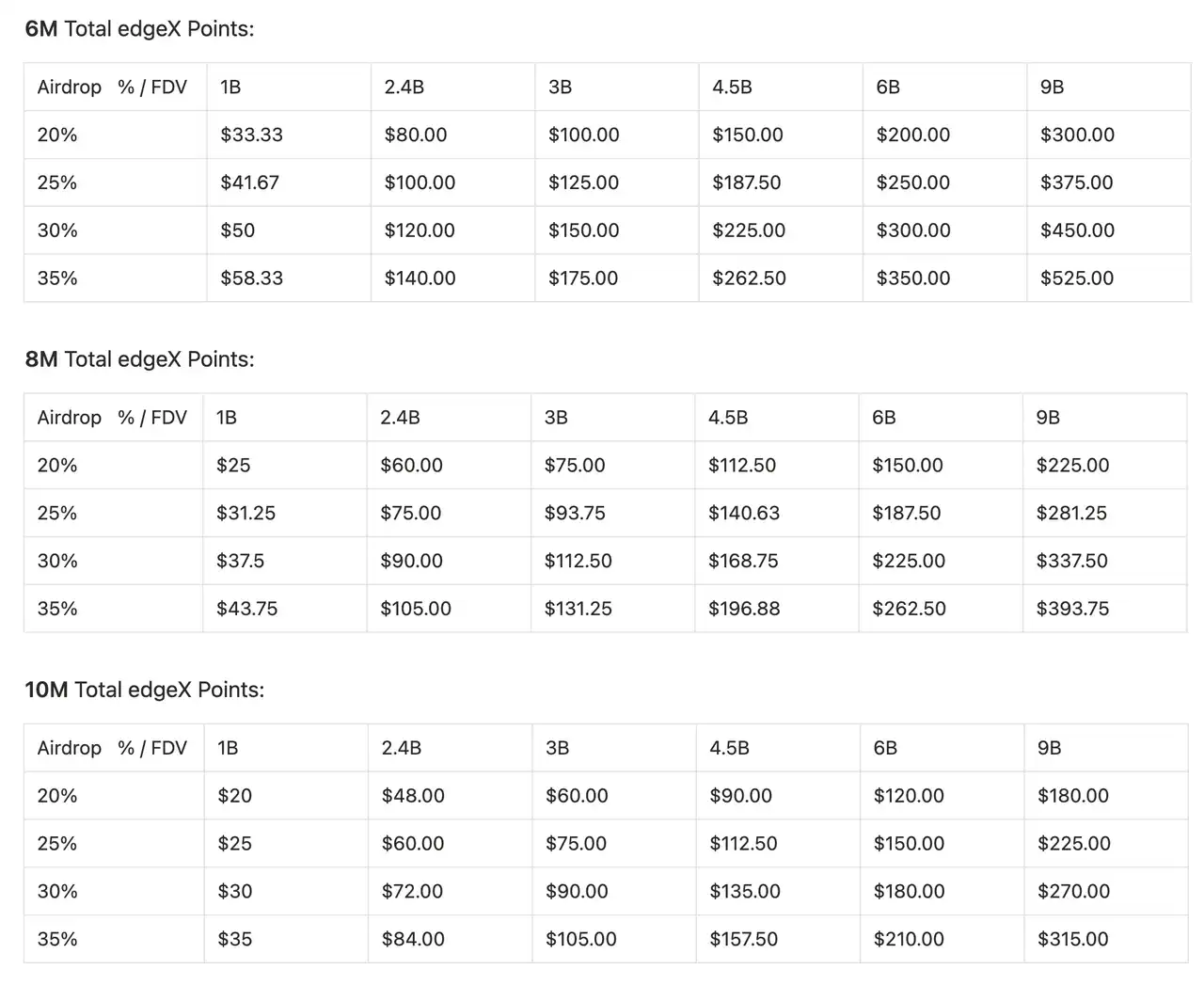

"I conservatively estimate edgeX's FDV to be around $2 billion, with an airdrop ratio of 20%. If we calculate the total points at 6 million, then the price of 1 point is $67. However, considering valuation aspects with a 50% elasticity up and down, we ultimately calculate that the price of 1 point is in the range of $30 to $50, so the current OTC price is not outrageous."

According to statistics from Rhythm BlockBeats, edgeX has already distributed a total of 2.83 million points, including points distributed in the first season, Alpha Season, and those in the second season, Open Season. If in the next 7 weeks, 250,000 points are distributed each week, the total points will be 4.83 million.

At this point, if we refer to another community member akonresearch's calculation model: if when edgeX issues tokens, the daily trading volume reaches $1.5 billion, the daily trading user count reaches 8,000, and the TVL reaches $500 million, then the FDV can be reasonably estimated as 1/20 of the hype, which is $2.4 billion. Therefore, with a total of 6 million points, if the airdrop share is estimated at 20%-35%, the value of the points could reach $80 to $140, which is much higher than anymose's estimate.

Of course, this estimate is based on the assumption that "the second season will also last 21 weeks." If the market performs poorly, the timeline may be extended, and the estimated value of the points may also be adjusted downward. However, from another perspective, although the total number of points may continue to grow and cause dilution, the maturity of the product, healthier liquidity, and user structure may lead to more stable price support after TGE. "After all, edgeX still has many products in development, and the depth of trading pairs outside the mainstream and system stability need time for further optimization," anymose candidly stated.

In terms of the timeline, the official stance is: if the market and product progress go smoothly, the target is TGE in the fourth quarter of this year. anymose provided more detailed observation points: "So the next key time point is 7 weeks later, at the end of October. The open season is now in its 14th week, and this season may end in the 21st week."

In addition to focusing on the product situation and market environment after 7 weeks, anymose also suggested paying attention to several signals as TGE approaches: whether trading volume will surge again, the addition of partners, and progress on products such as the vault and V2 testnet, etc.

Among the competitors in the track, anymose bluntly stated that Lighter might rush to TGE: "Lighter's model and pace are faster, and they may have more resources from VCs, with a more singular product focus. However, from the perp perspective, it differs too much from edgeX. If Lighter launches first, our marginal investment in edgeX will decrease, and we will shift to a defensive strategy." But in the long run, anymose is still more optimistic about edgeX's growth potential, "In terms of the team, my interactions with the edgeX people show that they are very focused on the business and not so flashy or aggressive."

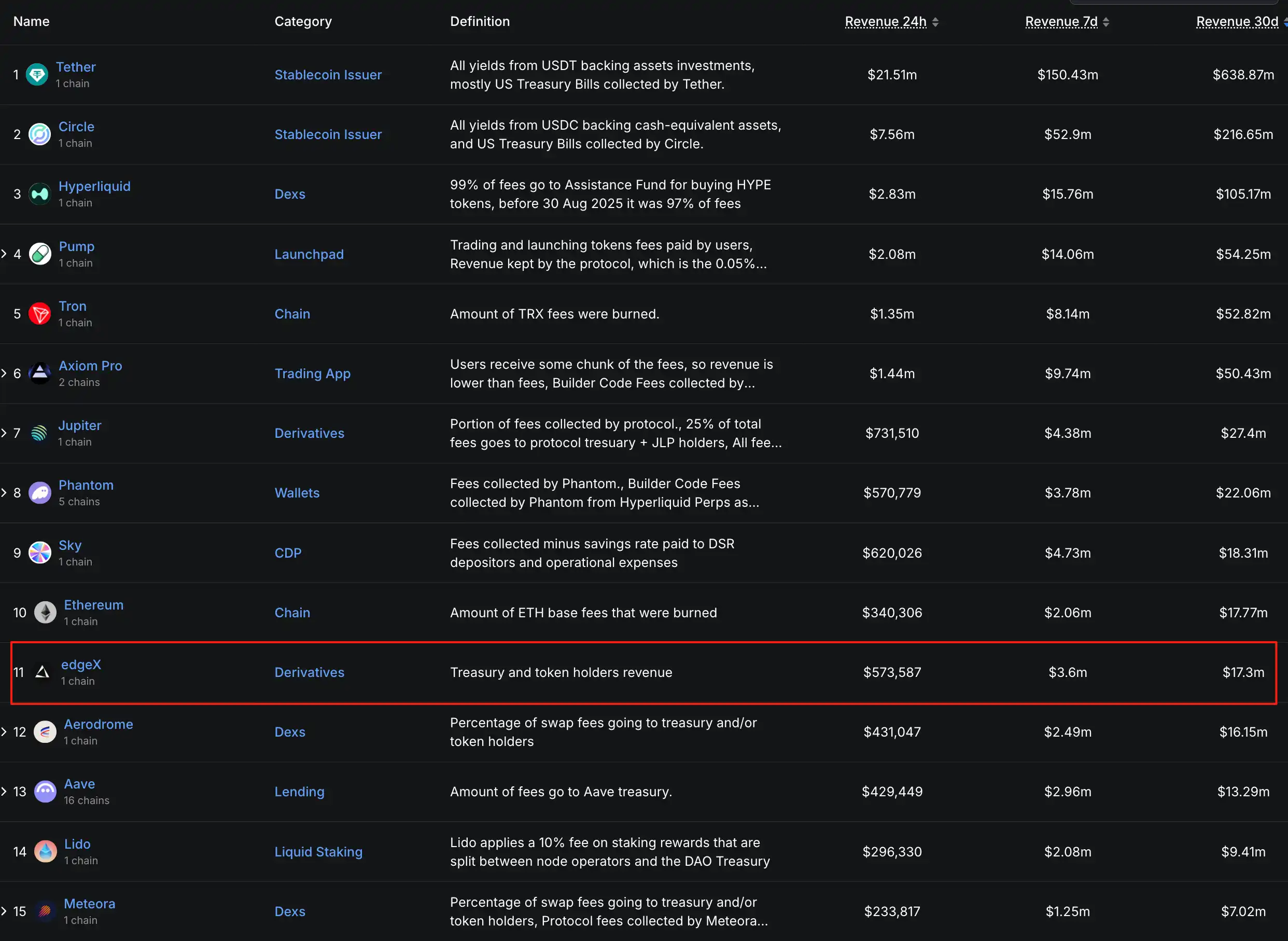

In fact, the revenue data also supports anymose's judgment. As of the time of publication, edgeX's 30-day revenue ranks 11th among all crypto protocols. Among the top 15 protocols (excluding the issuers of stablecoins USDT and USDC, and Axiom, which has repeatedly stated it has no plans to issue tokens), only edgeX has not issued tokens. More about edgeX's revenue can be read in: "This DEX that hasn't issued tokens has revenue exceeding Uniswap."

In terms of liquidity depth, within the 0.01% price spread range, edgeX's order book can accommodate a maximum order volume of about $6 million for BTC, higher than Hyperliquid (about $5 million), Aster (about $4 million), and Lighter (about $1 million). Although the overall depth is still slightly inferior to Hyperliquid, edgeX has the best depth among Perp DEXs, except for Hyperliquid, for most cryptocurrencies. Coupled with trading volume, edgeX ranks just behind Hyperliquid and Lighter. This means that in terms of product completeness and various data, edgeX is pushing for second place and securing third in the Perp DEX track.

So is $30 per point expensive or not? The answer depends on your expectations for FDV, airdrop ratios, and the total number of points. More importantly, the method of participation determines your marginal cost. Concentrating on trading volume with a "premium account," upgrading levels to reduce fees, and combining ambassador activities/invitations with the eLP vault can lower the cost per point, while waiting for the TGE window.

Among these, the most important eight strategies may just be cost reduction and efficiency improvement, simplicity is the ultimate sophistication.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。