The decentralized exchange (DEX) Hyperliquid platform has announced the launch of its native stablecoin USDH, with the issuance party to be determined through a validator voting mechanism. This initiative has attracted participation from industry giants such as Ethena Labs, Paxos, Frax Finance, and Sky Ecosystem, with the expected winner set to control the issuance rights of digital currencies worth billions of dollars and earn approximately $220 million in reserve income annually. The proposal submission window will close today (September 10, 2025, UTC 10:00), and voting will officially begin on September 14. The decision made by the Hyperliquid community will reshape the stablecoin ecosystem of the platform.

Hyperliquid's Strategic Motive: Breaking Free from External Dependencies to Achieve Ecological Independence

As a leading platform in the DeFi space in 2025, Hyperliquid saw perpetual contract trading volume reach $400 billion last month, with a total stablecoin supply on the platform amounting to $5.6 billion, of which 95% relies on USDC issued by Coinbase. The leadership believes that this excessive dependence on external stablecoins not only increases risk but also causes the platform to miss out on potential gains from treasury yields and liquidity incentives. To address this, Hyperliquid has chosen to launch USDH as "Hyperliquid's first, consistent, and compliant dollar stablecoin," aiming to reduce reliance on USDC and USDT and promote ecological self-sufficiency.

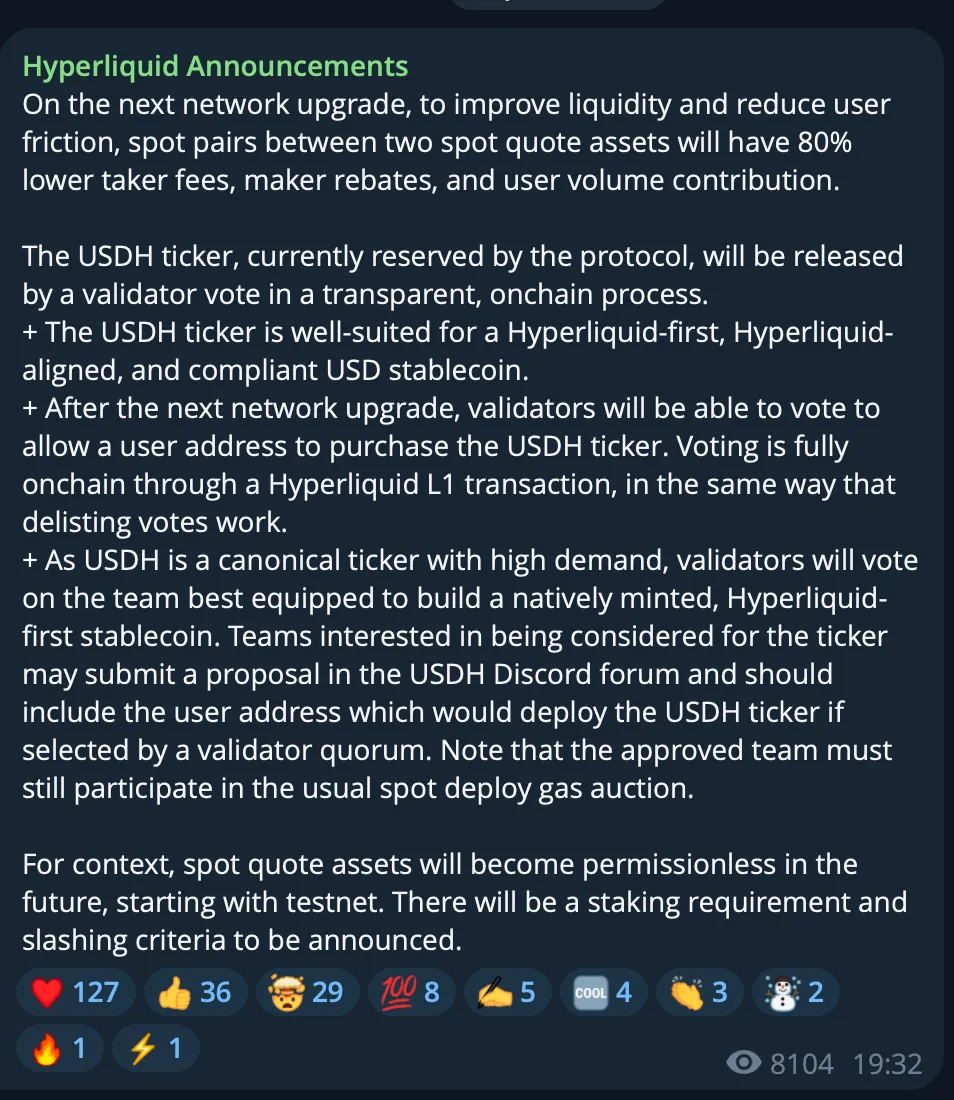

This decision is not isolated but is synchronized with the platform's upcoming network upgrades, including an 80% reduction in spot trading fees, the introduction of a permissionless spot quoting asset mechanism, and enhanced liquidity through on-chain governance. The launch of USDH will test Hyperliquid's governance model, allowing validators to directly participate in key infrastructure decisions, which is seen as a milestone in the democratization of DeFi. The platform emphasizes that USDH is not an exclusive stablecoin but one of many dollar-pegged assets in the ecosystem, though its ticker code will bring significant liquidity advantages.

Intense Competition: Ten Giants Submit Proposals, Revenue Sharing Becomes the Focus

So far, ten major participants have submitted USDH contract proposals, including Ethena Labs, Paxos, Frax Finance, Sky Ecosystem, Curve Finance, Native Markets, Bastion Platform, and Agora. Each proposal varies in structure, ranging from fiat-backed centralized solutions to decentralized collateralized debt position (CDP) models, but all emphasize compliance, first-day liquidity commitments, and revenue sharing with the Hyperliquid ecosystem.

Ethena Labs: The latest competitor, whose proposal uses BlackRock-backed USDtb as the 100% backing asset for USDH, issued by the federally chartered bank Anchorage Digital. Ethena promises to return 95% of net reserve income to the Hyperliquid community, cover the migration costs from USDC to USDH, and provide at least $75 million in ecosystem incentives. The proposal emphasizes institutional-grade cash management and on-chain liquidity, with BlackRock's digital asset head Robert Mitchnick stating that this will bring unique value to Hyperliquid users.

Paxos: As an experienced stablecoin issuer, Paxos emphasizes enterprise-grade infrastructure and regulatory compliance (in line with GENIUS Act and MiCA standards). Its proposal allocates 95% of interest income for HYPE token buybacks and promises zero-cost migration from USDC. Paxos has deeply integrated with Hyperliquid ecosystem projects such as LHYPE and WHLP, receiving positive community feedback, believing it can ensure broad adoption of USDH outside the crypto space.

Sky Ecosystem (formerly MakerDAO): Proposes a multi-collateral scheme similar to USDS, supporting instant redemption of $2.2 billion USDC, and allocates about 4.85% of the revenue from USDH held by Hyperliquid for HYPE buybacks. Sky commits to investing $25 million to launch the "Hyperliquid Genesis Star" program to promote DeFi development and migrate a buyback engine generating over $250 million annually to the platform. This proposal leverages Sky's $8 billion balance sheet, emphasizing efficient returns and ecological growth.

Frax Finance: Offers a zero-interest model, with on-chain treasury yields flowing directly to Hyperliquid. Frax plans to natively issue USDH on Hyperliquid, pegged to frxUSD, supporting minting/redemption across USDC, USDT, and dollars. This scheme is seen as user-friendly, emphasizing fairness and decentralization.

Other proposals, such as Native Markets' issuer-neutral Bridge technology, Curve Finance's decentralized CDP model, and Agora's alliance-based infrastructure, also have their highlights. Agora founder Nick van Eck emphasizes that 100% of the revenue will be used for HYPE buybacks and has received support from MoonPay, promising large-scale distribution. The differences in these proposals highlight the clash between traditional financial institutions and local DeFi teams, with observers noting that this competition is not just a battle for revenue but also a struggle for control over stablecoin governance.

Market Reaction and Controversy: Prediction Markets Boil, Fairness Questions Arise

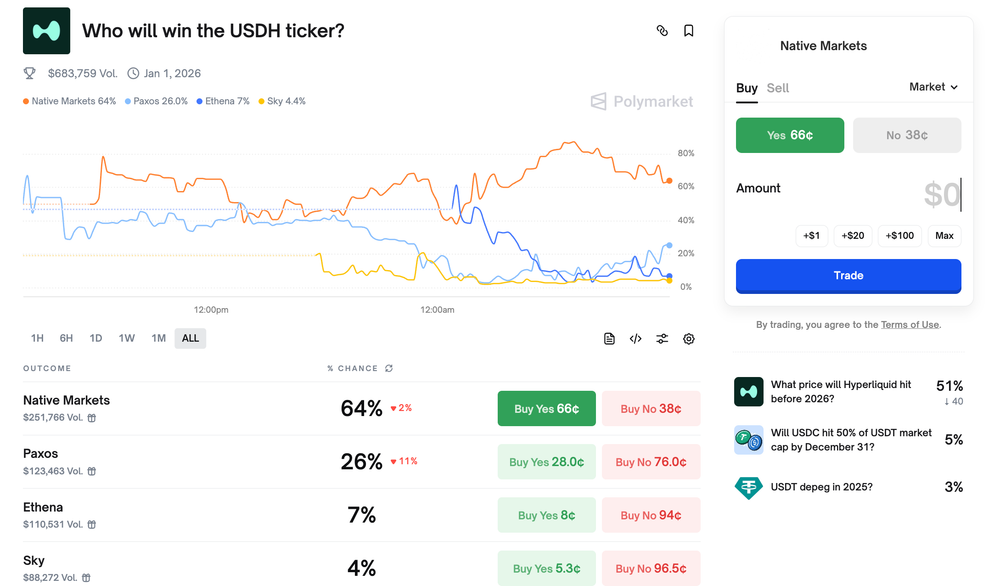

The voting has sparked widespread attention, with prediction markets like Polymarket opening betting pools, currently leading with Native Markets and Paxos in second place. The price of HYPE tokens has surged, breaking a new high of $54, with an increase of 3.4%. However, the competition has not been smooth sailing. The existing stablecoin protocol Hyperstable has accused the USDH ticker of being previously "blacklisted," forcing it to use USH, and has questioned the timing of Native Markets' proposal (suspected to have prior knowledge). Additionally, a Stripe-related proposal has triggered community backlash, raising concerns about potential conflicts of interest due to vertical integration. Ethena's entry has further intensified the competition, seen as a challenge to Paxos and Frax.

On X (formerly Twitter), community discussions are lively. User @pana067 supports Paxos's balanced proposal, stating it "controls the stablecoin stack from A to Z"; @CamiRusso praises Hyperliquid's "genius" outsourcing strategy, avoiding legal and technical risks while forcing bidders to benefit HYPE holders. Some posts question the transparency of the voting process, but the Hyperliquid Foundation has confirmed it will "abstain" to ensure community leadership.

DeFi Governance Experiment and Industry Turning Point

This USDH contest is not just an internal matter for Hyperliquid but a testing ground for the DeFi ecosystem. It demonstrates how to democratize stablecoin selection through on-chain voting, shifting revenue from centralized issuers to the community. At the same time, it challenges Circle's dominance with USDC, indicating that the next generation of stablecoin infrastructure may be led by local DeFi teams.

As the proposal window closes, validator voting will take place on September 14 from UTC 10:00 to 11:00, with the results determining Hyperliquid's long-term independence. Regardless of who wins, this event will inject new vitality into the industry and is worth close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。