Written by: J1N, Techub News

Sun Yuchen's recent series of suspected WLFI sell-off operations has once again become the focus. As the founder of TRON, the actual controller of HTX exchange, and an early investor and advisor for the Trump family's crypto project World Liberty Financial (WLFI), every move Sun Yuchen makes attracts significant market attention: the WLFI address freeze incident, OKX delisting Sun's tokens, and revelations from his ex-girlfriend. These events expose the complex relationships between Sun Yuchen, the project parties, exchanges, and investors, and have led to increased scrutiny of what exactly has transpired between Sun Yuchen and WLFI.

From WLFI "Blacklisting" to "Coconut Chicken"

In early 2025, he invested $75 million in the WLFI project and served as an advisor, which brought him close to the Trump family, even attending a private dinner with Trump in May, becoming the largest holder of TRUMP. However, the good times did not last long. After the WLFI token unlock in early September, the market experienced severe fluctuations, with the price dropping from $0.32 to below $0.18.

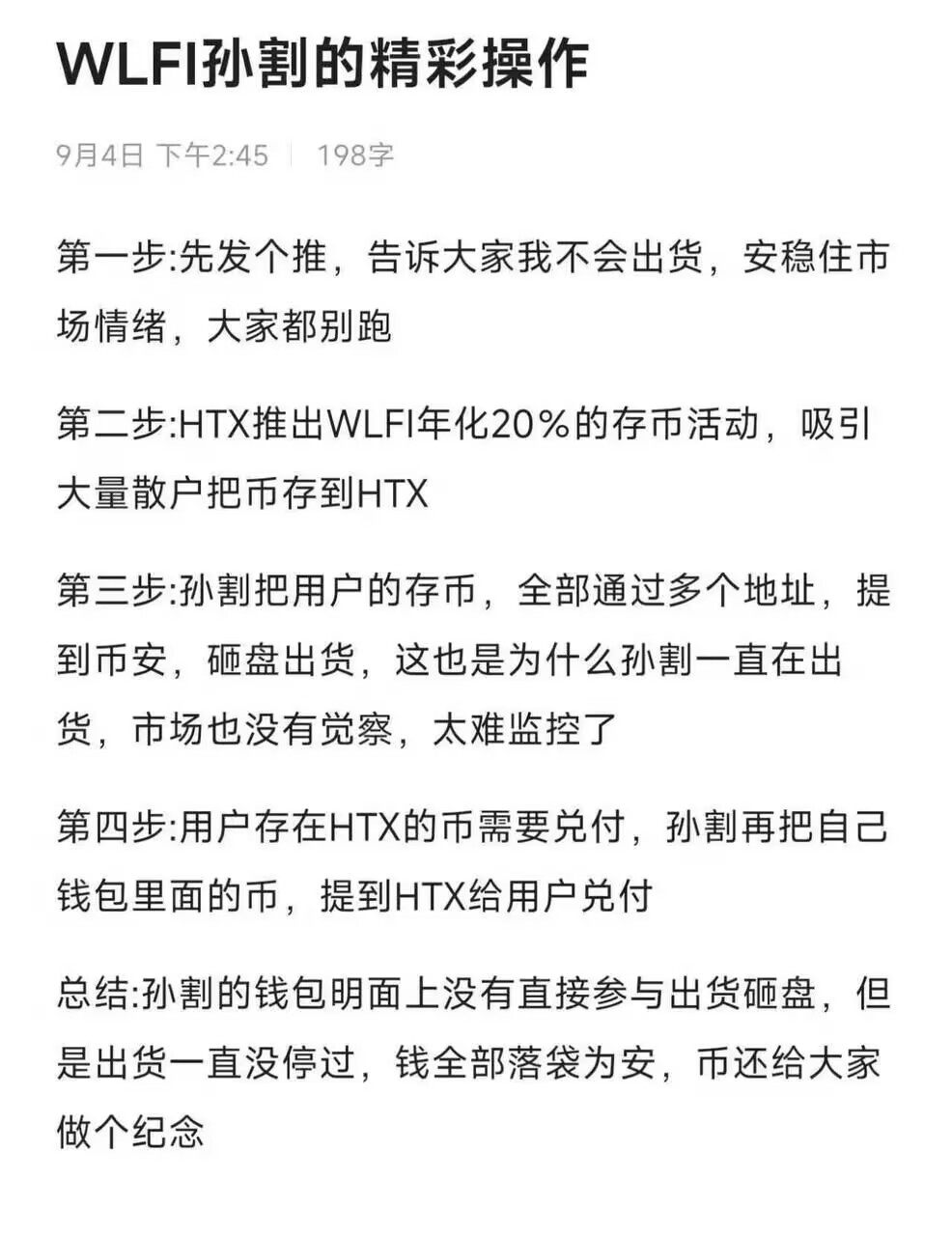

Source: Community Views

From September 2 to 3, on-chain data showed that Sun Yuchen's controlled HTX hot wallet transferred approximately 60 million WLFI tokens, worth about $12 million, to multiple exchanges (Binance, OKX). This was interpreted by the community as a "dumping" action, leading to a sharp decline in WLFI's price. On September 4, the WLFI project team directly blacklisted Sun Yuchen's wallet address, freezing approximately 540 million unlocked tokens and 2.4 billion locked tokens, with a total value exceeding $500 million. The project team stated that this move was to protect the community from manipulation.

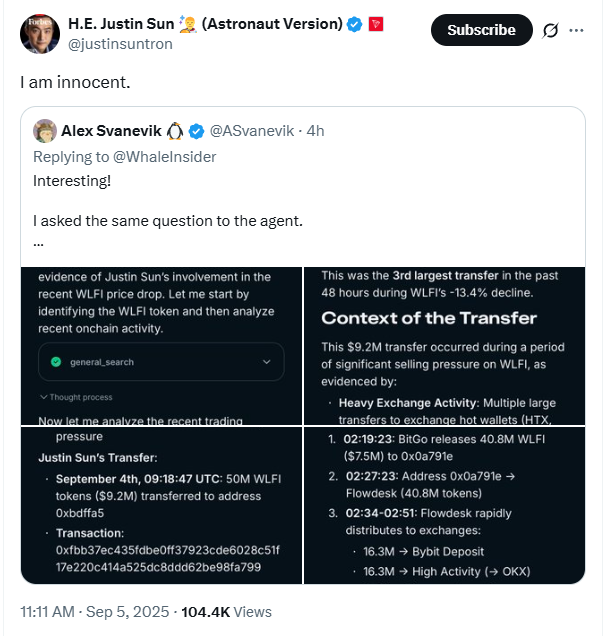

Sun Yuchen quickly responded, clarifying on the X platform that the transfer was merely a "routine exchange deposit test" and "address diversification operation," with no intention to buy or sell. He emphasized, "not selling, optimistic in the long term," and on September 5 announced plans to purchase $10 million in WLFI tokens and $10 million in ALTS stocks (associated with the WLFI project) to show support. However, the market did not respond positively, and WLFI's price once dropped over 20%, hitting a low of $0.16.

Source: Arkham

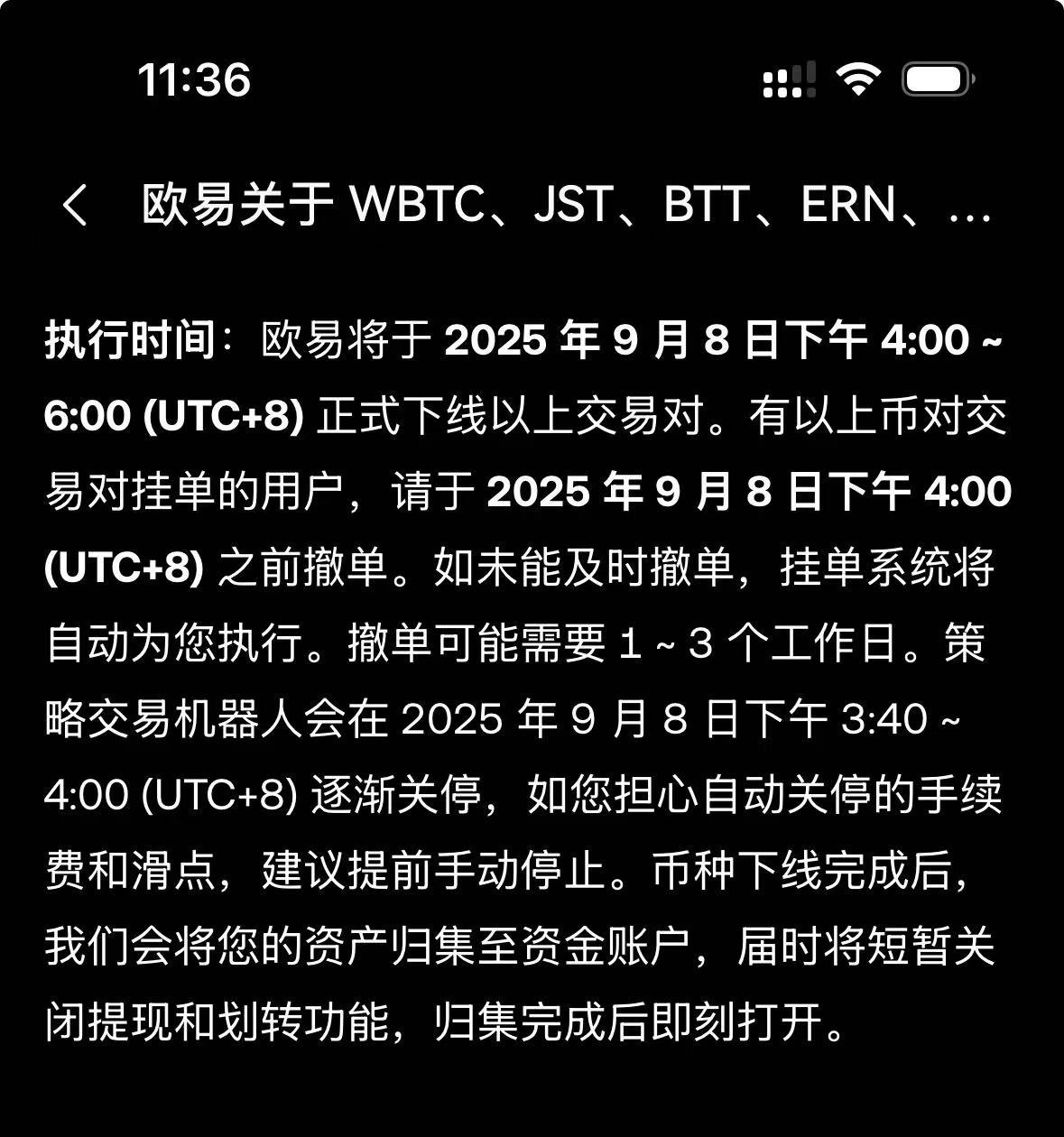

Meanwhile, Sun Yuchen's "Sun family" tokens (such as TRX, BTT) were also affected. On the evening of September 1, OKX exchange announced the delisting of all tokens related to Sun Yuchen, citing "compliance review." This was seen as a "cut-off" from OKX and sparked speculation about crypto regulation in China and the U.S., as Sun Yuchen's Chinese background and close ties to Trump could make capital outflow a sensitive topic.

Source: Okx

Earlier revelations came from Sun Yuchen's ex-girlfriend, Zeng Ying. As early as April, Zeng Ying tweeted accusations against Sun Yuchen for "using and then discarding," including buying a garage without a car, staying in a guesthouse, and hiring black writers for attacks. She also revealed that Sun Yuchen "licks strong people like a dog," and solicited dirt on him. Zeng Ying's posts quickly spread, and Sun Yuchen was humorously dubbed "Coconut Chicken Brother" based on her description of a dinner where he scooped most of a chicken into his bowl the moment it was cooked, "not giving himself a chance to miss out."

These incidents are not isolated. In August, Sun Yuchen sued Bloomberg, claiming it violated a confidentiality agreement by disclosing his crypto asset holdings (including 63% of TRX supply). Additionally, he was involved in art disputes (such as the "Le Nez" sculpture dispute with David Geffen) and space travel (taking a trip to space on Blue Origin NS-34 in August).

That said, how many ex-girlfriends does Sun have, and why are there so many stories? Coconut chicken, coupons, buying a garage without a car. As a "WEB3 marketing genius," he has indeed brought a lot of "gossip" to the Chinese community.

Decentralization vs. Centralized Control

The core contradiction in Sun Yuchen's WLFI incident lies in the conflict between "decentralization promises" and "centralized operations."

The WLFI project team's freezing of Sun Yuchen's tokens violates the crypto industry's principle of "immutability." Sun Yuchen claimed this action "violates investors' legitimate rights," raising community questions about the ambiguous areas of DeFi governance: does the project team have the right to "revoke control"?

Sun Yuchen has been accused of "misappropriating user funds to dump." HTX launched a 20% annualized staking to attract deposits but transferred tokens on-chain, which raised suspicions of "trapping" users and then indirectly offloading. The contradiction lies in: Sun Yuchen denies manipulation, but on-chain data (transferring $9 million in tokens) is hard to explain, leading to a crisis of market trust.

His ex-girlfriend's revelations overlap with the "cutting leeks" label attached to Sun Yuchen. Zeng Ying's description of "selfish behavior" echoes the community's historical accusations against him, such as knowing about China's ban before the 2017 ICO but accelerating fundraising.

These contradictions reflect a persistent issue in the crypto space: excessive personal influence makes the market susceptible to manipulation; regulatory gaps turn "blacklists" into tools.

Market Discussion: Mixed Opinions

The following summarizes representative views from mainstream media, the community, and platforms. From the project team's self-preservation logic to the community's humorous interpretations, to Sun Yuchen's strong responses, and the objective analysis of on-chain data.

Project Team's "Self-Preservation Mechanism"

Community and Public Opinion's "Dramatic Interpretation"

Twitter user @bxiaokang described Sun Yuchen and the WLFI team's operations as a "pre-scripted play," believing it to be a self-directed performance by WLFI and Sun Yuchen.

Sun Yuchen's "Public Confrontation"

Sun Yuchen also tweeted calling for platforms to unfreeze, emphasizing that the fundamental value of blockchain lies in "fairness, transparency, and trust," and that freezing actions harm the project's credibility.

On-Chain Analysis "Cleansing"

Nansen CEO Alex Svanevik pointed out that Sun Yuchen's transfer actions occurred after the WLFI price drop, suggesting he was not the primary factor in the price decline, providing technical support for his "cleansing."

Circulation Adjustment Adding Fuel to the Fire

The WLFI project suddenly announced a circulation far exceeding market expectations just before its launch, which already undermined investor confidence, and the freezing incident further pushed the project into a deep trust crisis.

Transparency of Contract Mechanisms and Power Boundaries

Cointelegraph reiterated that this incident warns investors to pay attention to the "freeze/blacklist" mechanisms in token contracts and to examine the transparency costs and credibility risks brought by such mechanisms.

In the short term, it may be necessary for the project team to balance "freedom" and "regulation" to actively apologize and calm market emotions. In the long term, industry standards such as "anti-manipulation agreements" need to be fulfilled to prevent similar incidents from recurring. The crypto landscape is inherently unpredictable, and Sun Yuchen's recent turmoil may serve as a classic warning: the greater the personal influence, the heavier the responsibility. This not only tests the crisis response capabilities of the parties involved but also pushes the entire ecosystem towards a more mature direction. Investors should remain vigilant, focus on risk assessment and rational decision-making, and avoid blindly following trends to prevent becoming the next "leek." Ultimately, such incidents may accelerate governance innovation in the DeFi space, making the crypto world fairer and more sustainable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。