Author: Dingdang (@XiaMiPP)

On September 4, sources revealed that Nasdaq is tightening its regulation on certain listed companies, focusing on those that issue new shares or raise funds to purchase and hold cryptocurrency assets for the long term. This has been referred to in the industry as "Digital Asset Treasury Companies" (DAT). The common characteristic of these companies is that they place Bitcoin, Ethereum, and even other tokens directly on their balance sheets, viewing them as core reserves to attract investor attention and drive up stock prices.

This news was first disclosed by The Information, and Nasdaq has not yet issued a formal statement, but insiders have confirmed that the review is underway. Following the news, several DAT concept stocks quickly came under pressure: Strategy (MSTR) fell 3.5%, Bitmine Immersion (BMNR) dropped as much as 8.7%, and SharpLink Gaming (SBET) plummeted 9%.

The Logic of the DAT Model and the Capital Flywheel

The pioneer of this model is Strategy Inc. (formerly MicroStrategy), led by Michael Saylor. Since 2020, Saylor has begun to convert cash reserves into Bitcoin on a large scale, laying the narrative groundwork for "corporate treasury = Bitcoin asset pool." By 2025, SharpLink Gaming and Bitmine also announced increases in their ETH holdings, further igniting the market's pursuit of the cryptocurrency reserve model.

The operational logic of DAT is very clear: actively and transparently incorporating digital assets into reserves and leveraging capital market tools to amplify influence. For institutional investors in traditional capital markets, DAT provides a regulated, equity-mediated exposure to cryptocurrency assets. Pension funds, sovereign wealth funds, and university endowment funds, which are constrained by custody and compliance issues, cannot hold cryptocurrencies directly but can gain indirect exposure to crypto risks by purchasing DAT stocks.

Before the emergence of DAT, the only option was almost exclusively ETFs, with approved ETFs only for BTC and ETH. However, the essence of ETFs is passive tracking, aiming to replicate the performance of the underlying assets as closely as possible; in contrast, DAT is an active entity whose management must continuously make key decisions: when to raise funds, how to finance (equity or debt), and what strategies to use for purchasing and managing assets. This proactivity gives DAT both amplifier and risk source attributes.

Its core driving force comes from the financing mechanism: when stock prices are high, issuing shares or convertible bonds converts premiums into capital, which is then invested in cryptocurrency assets. This model can create a cycle similar to a "capital flywheel": stock price increases → enhanced financing capability → increased cryptocurrency holdings → improved investor confidence → further stock price increases. However, this flywheel is also bidirectional; once market confidence weakens, it can accelerate collapse.

At Bitcoin Asia 2025, Dr. Xiao Feng, Chairman and CEO of HashKey Group, stated that DAT (Digital Asset Treasury) may become the best way for cryptocurrency assets to transition from on-chain to off-chain. He pointed out that compared to ETFs, DAT has four major advantages: stronger liquidity, higher price elasticity, more reasonable leverage design, and built-in downside protection mechanisms.

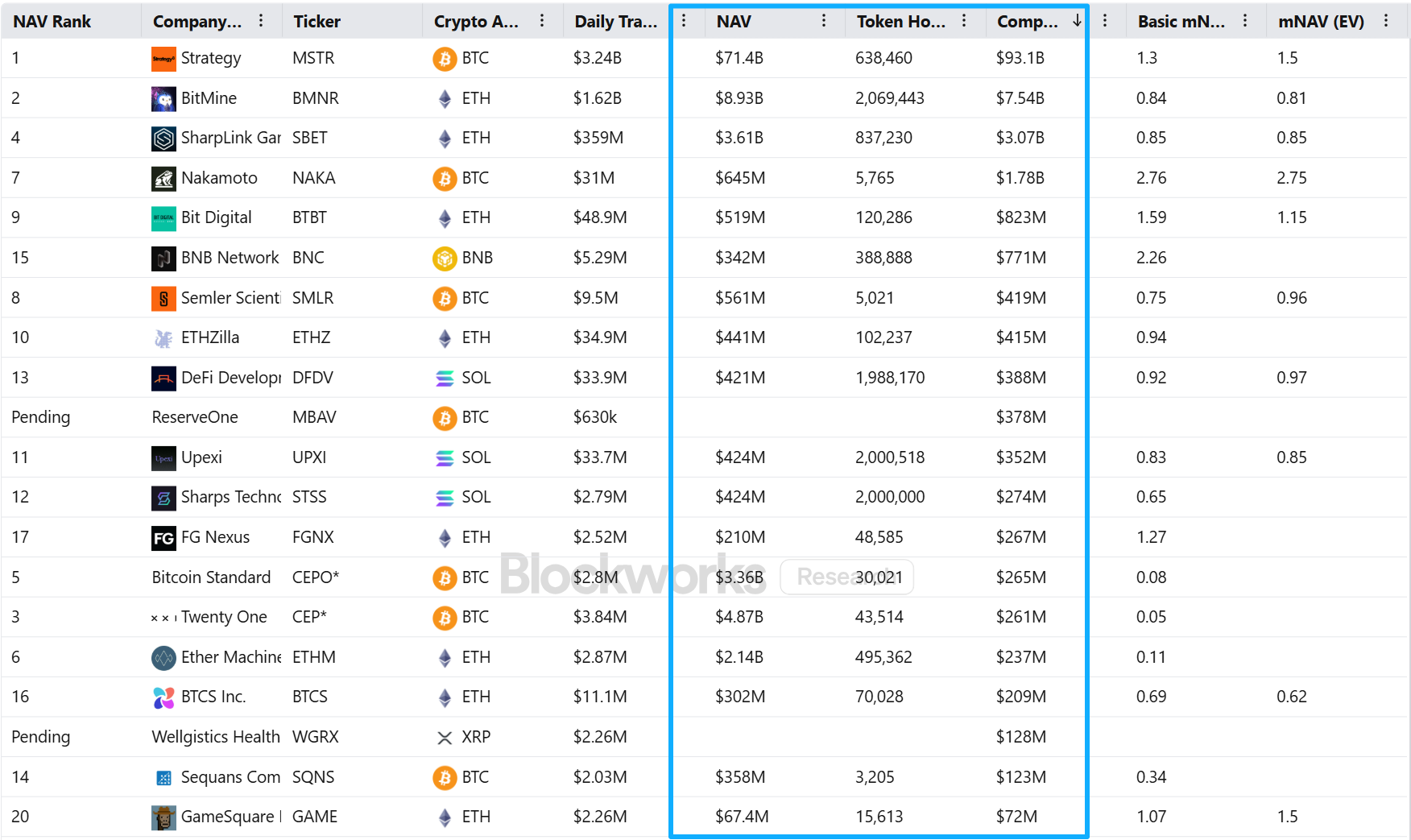

From the perspective of net asset value (NAV), it is not difficult to understand why listed companies are flocking to this model. NAV refers to the net value of the digital assets held by a company calculated at market price. Currently, the top 20 listed companies by NAV often have their net asset value accounting for 70% to 80% of the company's market value, and in some cases, it can far exceed the market value, such as Twenty One. This means that once a company fills its "treasury" with cryptocurrency assets, its stock price will be highly correlated with the crypto market, even exhibiting a premium effect.

Image source: blockworks.com

Nasdaq Tightens Regulation

The direct motivation for Nasdaq's strengthened regulation is the concern that this model may lead to market manipulation and investor misguidance. Since 2025, many U.S. listed companies have seen their stock prices soar after announcing "reserves of Ethereum or other cryptocurrencies," but once the news was digested, prices quickly fell back, exposing investors to significant volatility risks. For example, SharpLink Gaming's stock price soared from $3 to $124 after announcing an increase in ETH holdings, a more than 40-fold increase. However, as sentiment cooled, the stock price subsequently fell to around $9 and has only recovered to $14.

Nasdaq's concerns focus on two main points:

- Artificial speculation risk: Some companies use complex structures or choose smaller, less liquid tokens for hoarding, which can easily create price bubbles.

- Investor protection issues: Shareholders may not fully understand the risks associated with the company's asset structure, yet stock prices are pushed higher due to the "currency reserve" concept.

As a result, Nasdaq has proposed two core review measures:

- Shareholder approval required: Certain companies must obtain shareholder votes when issuing new shares for cryptocurrency purchases. This raises the decision-making threshold and prevents the board from unilaterally pushing high-risk investments.

- Strengthened disclosure requirements: Companies must report in detail the scale of their crypto holdings, investment strategies, potential risks (such as market volatility), and the use of funds. Nasdaq will conduct special reviews of companies that frequently trade cryptocurrencies.

Head Effect and Differentiation Pattern

The key question is: how will this tightening of regulation affect the DAT model for different assets?

From my personal perspective, Nasdaq's strengthened regulation will generally suppress the speed of institutional adoption of cryptocurrency assets, reducing corporate reserve demand, thereby exerting negative pressure on crypto prices and market dynamics. However, the extent of the impact will vary based on asset maturity, market dominance, and DAT company size.

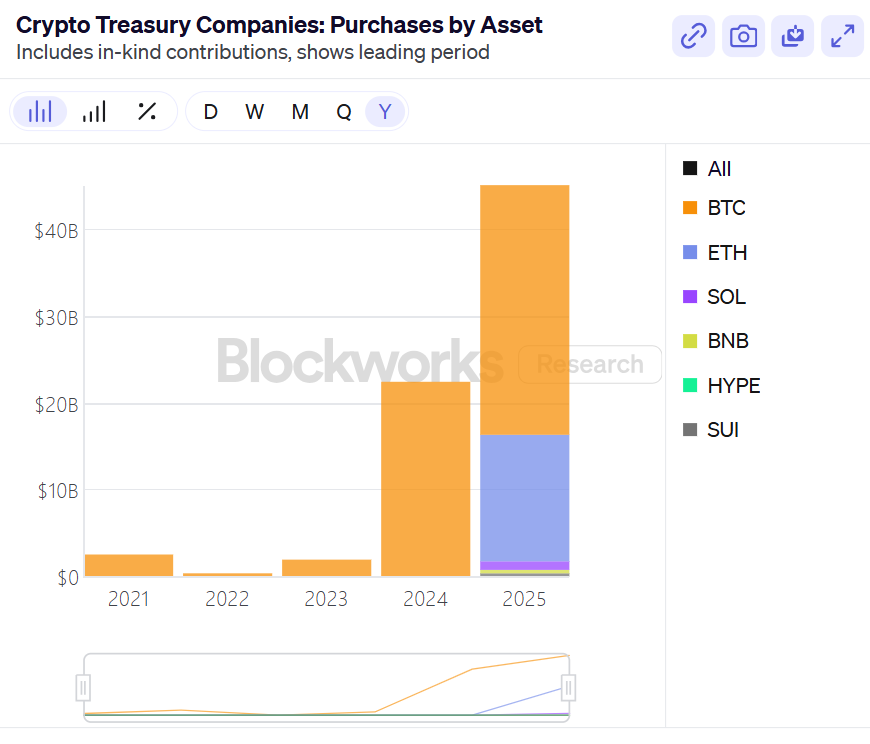

From data on blockworks.com, it is evident that the cryptocurrency assets held by DAT companies are primarily concentrated in BTC, followed by the rising ETH this year, while other cryptocurrency assets are very small in scale.

First is BTC. As the "gold standard" of the cryptocurrency market, Bitcoin's reserve status has almost become institutionalized. The value of Bitcoin held by Strategy alone exceeds $72 billion, creating a strong demonstration effect. Even if Nasdaq introduces stricter information disclosure or shareholder voting procedures, its core position remains solid. For BTC, regulation means more "additional compliance costs" rather than "existential risks."

Next is ETH. Ethereum is gradually becoming the most active reserve asset for DAT companies, with the "arms race" between Bitmine and SharpLink being a typical example, as both have become solid buyers of ETH, establishing a basic hierarchy of top players.

In response to Nasdaq's strengthened approval and disclosure requirements, both companies have quickly responded: the former emphasized that it is listed on NYSE American under the New York Stock Exchange and can issue shares through existing suspended registration without needing shareholder approval; the current ATM financing plan remains a legally registered public transaction that can continue without shareholder approval, thus not subject to Nasdaq's requirement for listed companies to obtain shareholder approval before issuing new shares to purchase cryptocurrencies.

The latter stated that the company fully complies with Nasdaq's relevant rules, and if it implements an ATM financing plan to purchase ETH, it does not need to obtain further shareholder approval. SharpLink emphasized that its strategy remains unchanged, and it will only raise funds when capital can create value for shareholders, committing to strict compliance and transparency requirements to ensure all transactions comply with Nasdaq regulations and industry practices.

Of course, the strengthened regulation may still slow down their financing and purchasing pace in the short term, especially with increased friction in shareholder approval and information disclosure. However, it is more likely to prompt companies to adopt more robust and transparent strategies rather than change the reserve logic of ETH.

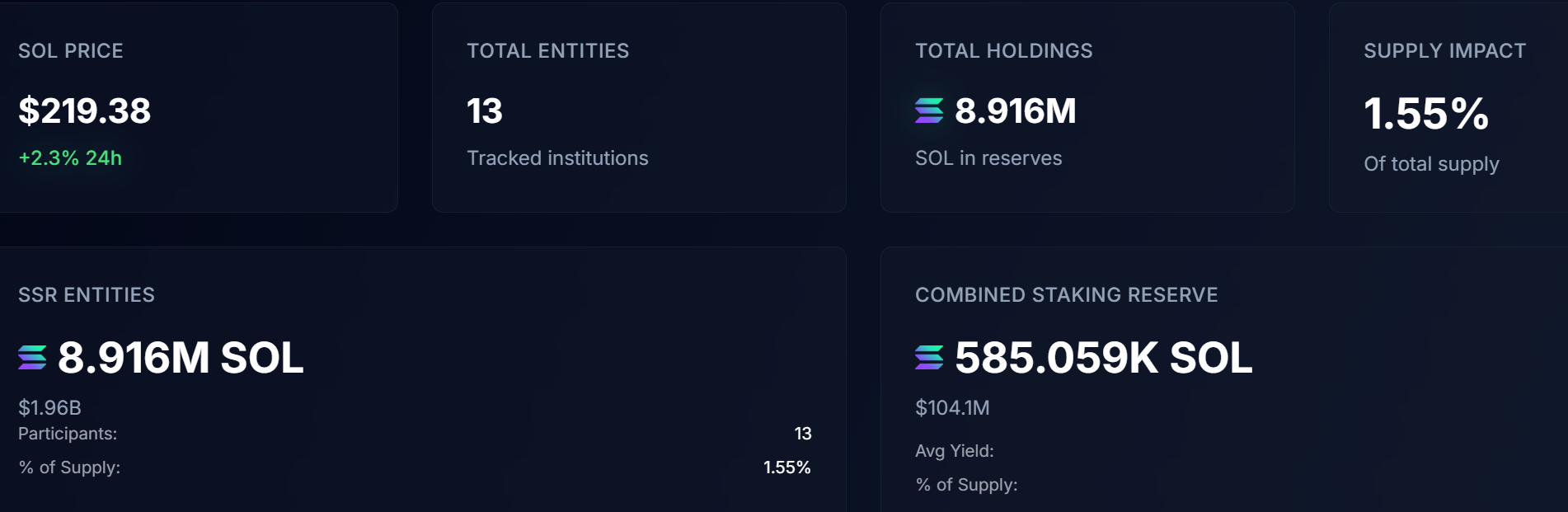

In contrast, the DAT ecosystem for SOL is still in its infancy. Data from strategicsolanareserve.org shows that there are currently only 13 related companies with total assets of $1.96 billion, of which Sharps Technology, Inc. accounts for nearly 1/4. However, compared to the tens of billions of dollars in BTC and ETH, SOL reserve companies are clearly "small players." Nevertheless, as one of the most promising infrastructure projects, competition for SOL treasuries is accelerating. Recently, many listed companies have announced their intention to join the "SOL Reserve" camp.

This small scale and intense competition also mean that SOL treasury companies are more likely to expose vulnerabilities under regulation. Shareholder voting, disclosure requirements, and high volatility in the capital market may become pressure points for these companies' survival. In other words, the magnifying effect of regulation may make the SOL DAT model more susceptible to "elimination-style differentiation" in its early stages, while truly successful leading companies will become even scarcer.

In summary, the strengthening of regulation will not have an equal effect on all assets. BTC is almost "anti-regulatory," ETH is constrained but has stable underlying demand, while SOL is most likely to face structural shocks.

This also means that in the process of DAT gradually becoming institutionalized, the advantages of leading companies and mainstream assets may be further strengthened, while marginal assets face greater survival pressure. In other words, regulation is not only an external constraint but also an "accelerator of differentiation," pushing the market structure towards clearer stratification.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。