The August additions were valued at $5.2 billion at Aug. 31’s $108,695 price, while the full 3.68 million bitcoin ( BTC) stack was worth roughly $400 billion at month-end. Category totals included public companies, private firms, governments, exchange-traded funds (ETFs), and BTC tied to decentralized finance (DeFi) and smart contracts.

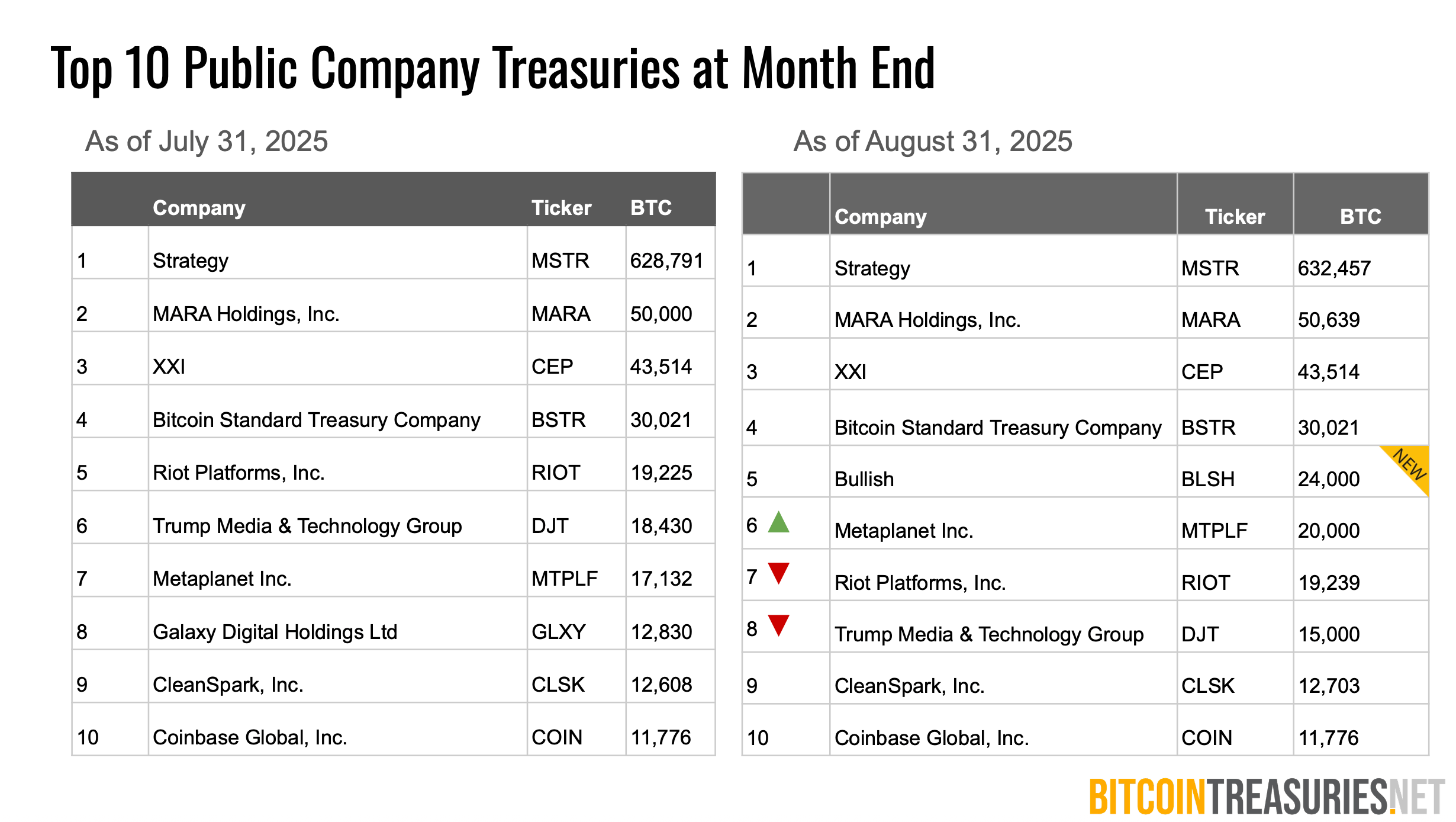

Bitcointreasuries.net’s report states that public company balances have roughly doubled since late 2024, and early September data showed public treasuries topping 1 million BTC, valued near $111 billion on Sept. 4. Corporate listings have nearly doubled since January as more firms adopt treasury programs.

Source: Bitcointreasuries.net report August 2025.

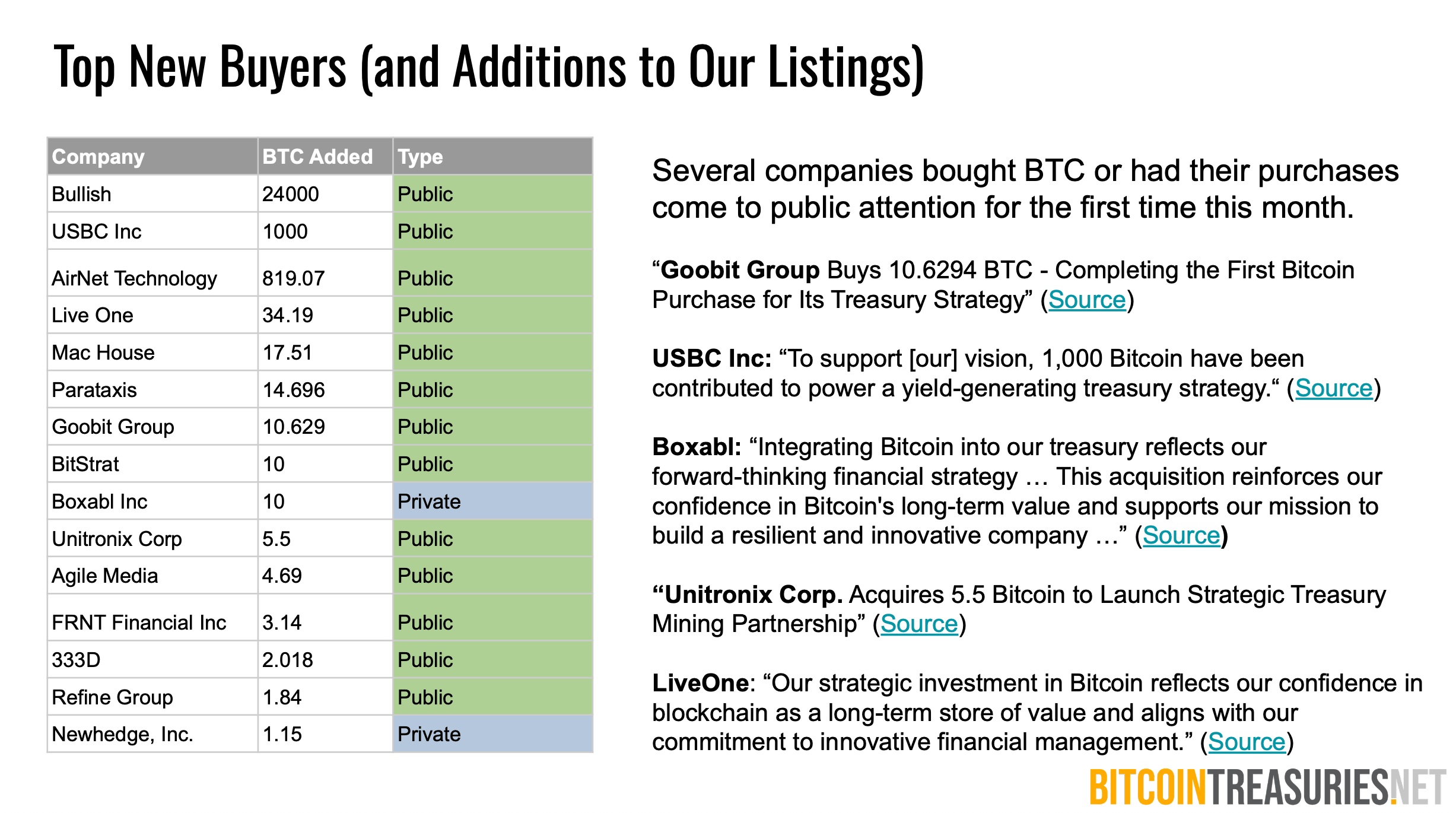

The month’s largest single addition came from crypto exchange Bullish, added after its successful August initial public offering (IPO), with 24,000 BTC. Other notable moves included KindlyMD’s 5,744 BTC acquisition, Strategy’s 3,666 BTC, Galaxy Digital’s 2,894 BTC, and Metaplanet’s 1,859 BTC.

Metaplanet, based in Japan, executed four August transactions that brought its holdings to 18,991 BTC at month-end, placing it sixth among public treasuries. The company outlined financing plans that include 555 billion JPY of perpetual preferred stock (about $3.7 billion) and an international share offering estimated at $880 million.

Source: Bitcointreasuries.net report August 2025.

Fundraising plans accelerated, with programs around August exceeding $15 billion, bitcointreasuries.net’s researchers explain. Strategy detailed a $4.2 billion at-the-market program, KindlyMD disclosed a $5 billion equity raise tied to treasury growth, Metaplanet mapped the JPY issuance alongside the share sale, and Parataxis pursued a SPAC deal that could add about $640 million.

Bitcointreasuries.net added about 17 entities during the month, most of them publicly listed. By its estimate, 95 of the 174 public companies it tracks originated outside crypto, though crypto-native firms still hold about three times as much bitcoin as those newcomers.

Roughly 10 of August’s additions were based in or listed in the United States. The report noted that the latest regulatory context included new Nasdaq requirements in early September that add shareholder-approval hurdles for crypto-treasury funding, while Strategy said its capital-markets activities were unaffected.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。