Sky, formerly known as Makerdao, proposed a decentralized issuance model for USDH that includes a 4.85% yield on all holdings, backed by its $8 billion-plus balance sheet and diversified collateral. Sky founder Rune Christensen highlighted access to $2.2 billion in USDC for instant off-chain redemptions and native multichain support via Layerzero. Sky said it is committed to deploying $25 million to create a dedicated “Hyperliquid Star,” an autonomous project aimed at growing DeFi total value locked (TVL) on the platform, potentially attracting billions in liquidity.

The proposal emphasizes Sky’s seven-year security track record without losses and its S&P B- credit rating, the only one among stablecoin protocols. It allows customization for compliance with the U.S. GENIUS Act and pledges to move its $250 million annual buyback system to Hyperliquid, boosting HYPE token liquidity. All yields would fund HYPE buybacks or the Hyperliquid Assistance Fund.

Bastion, a platform focused on regulated stablecoin issuance, outlined a neutral infrastructure built for scale in payments, exchanges, and trading. The bid stresses regulatory licensing across jurisdictions to minimize freezing risks and enable seamless fiat on-ramps. Bastion aims to assemble partners for incentives and global compliance, positioning USDH as a public good without competing chain interests.

Details on revenue sharing remain unspecified, but the proposal avoids conflicts by focusing on strong, permissionless access. Bastion’s team indicated the bid would prioritize Hyperliquid’s ecosystem health over external rake.

Native Markets, led by Max Fiege through Bridge infrastructure, proposed globally compliant issuance with direct minting on HyperEVM and Hypercore transfers enabled at launch. The bid includes Stripe-linked fiat rails for on- and off-ramps, ensuring GENIUS Act compatibility from day one.

A “meaningful share” of reserve proceeds would flow to the Assistance Fund, with reserves designed to recirculate into Hyperliquid rather than external entities. The team, including former Uniswap executives, emphasized alignment with Hyperliquid’s mechanics for long-term growth.

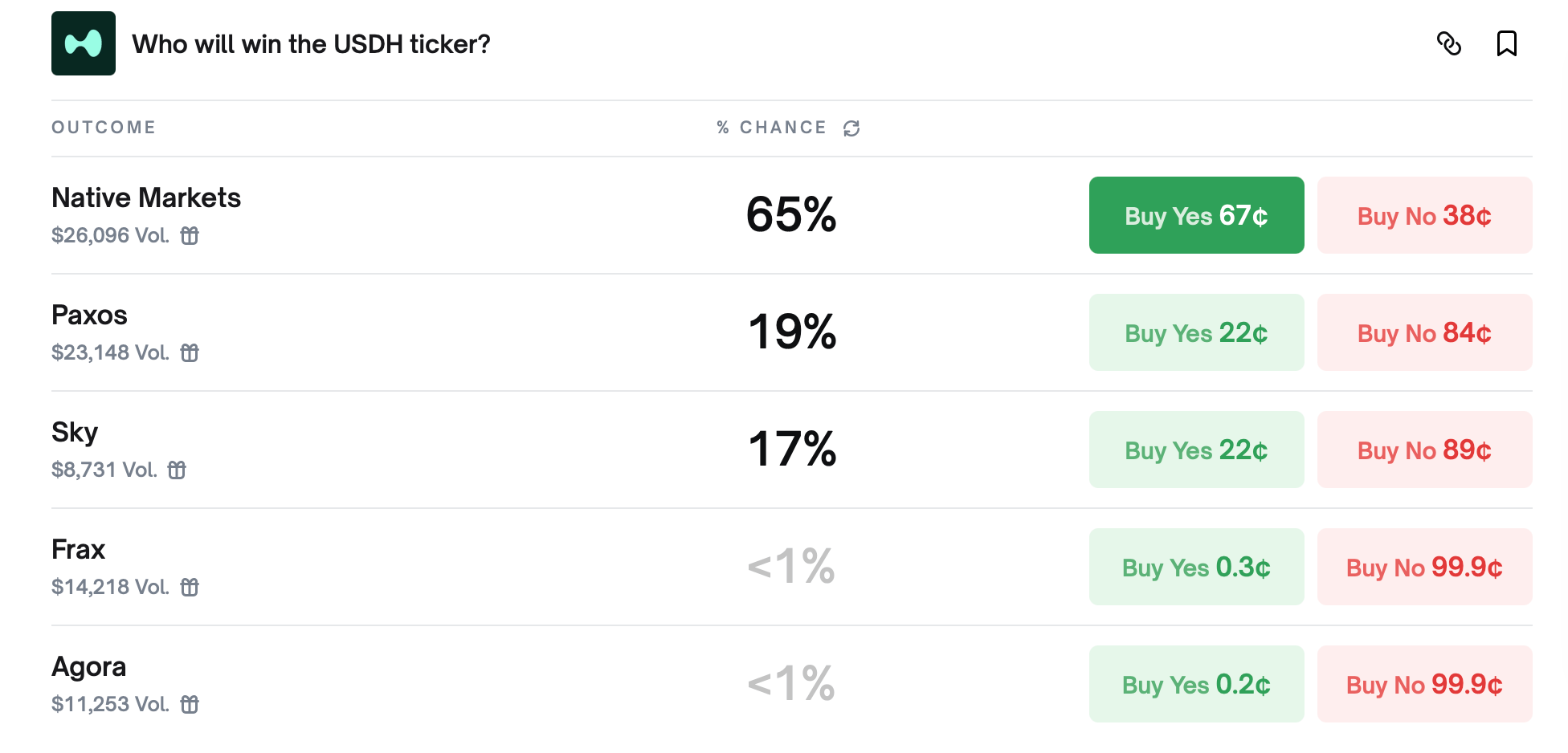

Polymarket odds reflect community sentiment with Native Markets at 65%, Sky at 17% and Paxos at 19%, while Frax and Agora hover below 1%. Bastion does not appear in Polymarket’s listed outcomes.

Polymarket odds on Sept. 9, 2025.

Bids were due Sept. 10, with validators set to decide Sept. 14. Hyperliquid currently holds $5.7 billion in stablecoins, mostly USDC, making USDH a potential revenue driver through reduced fees and captured yields.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。