Tonight's non-farm payroll revision data, along with Wednesday's PPI, retail data, and Thursday's CPI data, based on current market predictions, indicate that only the PPI data is slightly better, while the other three data points are not very good. The significant downward revision of non-farm data and the decline in retail data both suggest that the U.S. economy may be heading towards a downturn, which is the main reason for the market's expectation of interest rate cuts.

The PPI data may not reflect a significant impact, while the CPI data is expected to rise. However, the increase in CPI should be within the Federal Reserve's expectations, considering the impact of tariffs. Therefore, the most likely scenario now is that the poor employment and economic data could turn into a favorable condition for the Federal Reserve to cut interest rates.

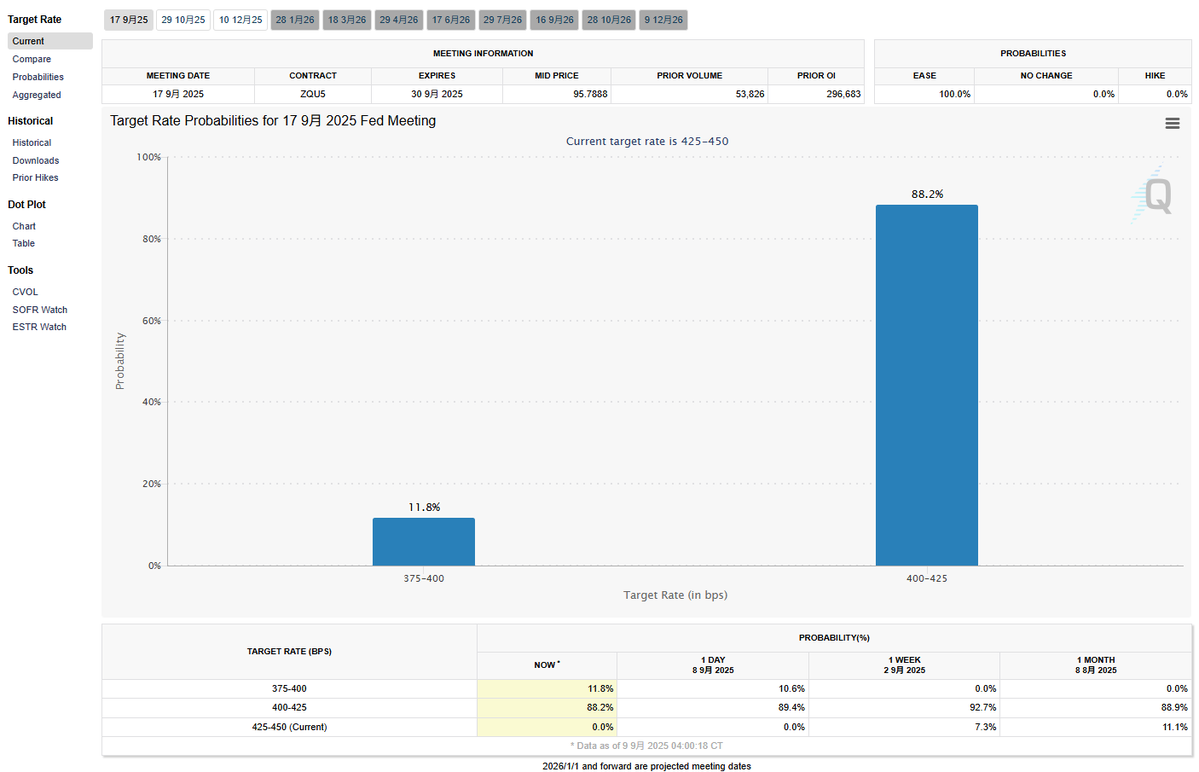

In other words, it's a case of turning misfortunes into fortunes. Currently, the market expects an 11.8% chance of a 50 basis point rate cut in September. After the data is released at 10 PM tonight, if the revised figures are greater than expected, the probability of a 50 basis point rate cut may rise again. This may not necessarily be a bad thing at the moment, as it is still a bit early to talk about a recession.

If interest rates can be cut quickly in the early stages, it might just nip the problem in the bud.

This article is sponsored by #Bitget | @Bitget_zh

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。