Author: Loke Choon Khei, Coingecko

Compiled by: Felix, PANews

Today, the competition in Bitcoin mining is more intense than ever, with the difficulty level exceeding 129 trillion units, reaching an all-time high. As an independent miner, the chance of success may be only 1 in 2800, with a successful attempt occurring approximately once every 8 years. Nevertheless, there are still reports of successful independent mining in 2025. Each lucky independent miner can earn Bitcoin worth hundreds of thousands of dollars.

Key Points

- For solo miners, mining one Bitcoin requires approximately 860,000 kilowatt-hours of electricity.

- Successful personal mining is extremely rare, but still possible; recent winners in 2025 received block rewards valued between $330,000 and $373,000.

- The mining difficulty of Bitcoin adjusts automatically every 2016 blocks (approximately every two weeks) to maintain a target block generation time of 10 minutes.

- Globally, the electricity cost to mine one Bitcoin varies greatly: from as low as $1,324 in Iran to over $321,112 in Ireland.

- The current block reward is 3.125 Bitcoins (halved after the April 2024 halving), valued at approximately $350,000 to $400,000 at current prices.

Bitcoin Block Rewards: Understanding the Reward Mechanism

Before delving into mining difficulty, it is crucial to understand what miners are competing for. Bitcoin mining can be imagined as a global lottery held every 10 minutes, with the winners receiving substantial prizes.

Halving Effect

Bitcoin has a built-in scarcity mechanism known as halving (which occurs approximately every four years and reduces mining rewards). When Bitcoin was launched in 2009, miners received 50 Bitcoins for each block mined. Since then, this reward has halved multiple times:

- 2009 to 2012: 50 Bitcoins per block

- 2012 to 2016: 25 Bitcoins per block

- 2016 to 2020: 12.5 Bitcoins per block

- 2020 to 2024: 6.25 Bitcoins per block

- 2024 to 2028: 3.125 Bitcoins per block

The current block reward is 3.125 BTC, valued at approximately $373,000 at the current Bitcoin price.

Halving exerts deflationary pressure on Bitcoin's supply, increasing its scarcity while typically alleviating selling pressure from Bitcoin miners.

Bitcoin Difficulty Adjustment: The Great Balancer

The difficulty adjustment in Bitcoin acts like an automatic referee, ensuring the game remains fair regardless of how many players join or leave. Understanding this mechanism is essential to grasp why Bitcoin mining has become increasingly resource-intensive over time.

Difficulty Adjustment Mechanism

Imagine Bitcoin as a global large-scale puzzle competition, where a new puzzle must be solved precisely every 10 minutes. If puzzles start being solved too quickly (due to more miners joining), Bitcoin automatically makes the puzzles harder. If puzzles are solved too slowly (due to miners leaving), Bitcoin makes the puzzles easier.

The process is as follows:

- Every 2016 blocks (approximately every two weeks), Bitcoin measures the average mining time for the previous 2016 blocks.

- If the average mining time is less than 10 minutes, the difficulty increases.

- If the average mining time exceeds 10 minutes, the difficulty decreases.

- Each adjustment can be up to 25%.

This self-regulating mechanism ensures that whether there are 1,000 or 1 million miners competing, the generation speed of new Bitcoins remains at a predictable level of approximately one block every 10 minutes.

Record Mining Difficulty in 2025

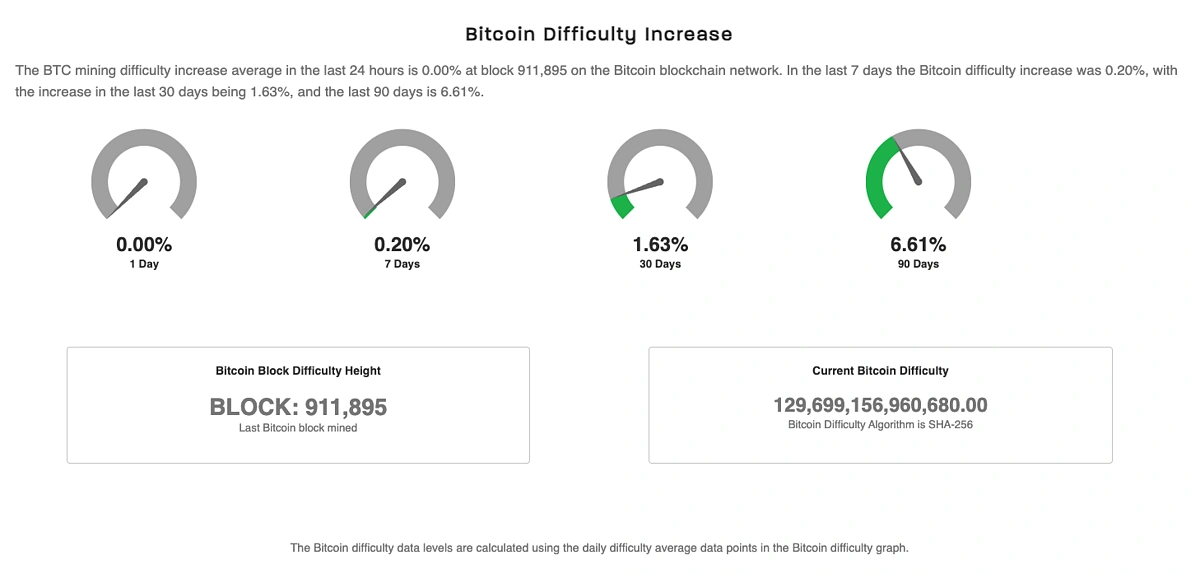

According to Coinwarz's Bitcoin mining difficulty chart, on August 3, 2025, the difficulty reached a new historical record of 129.7 trillion units, significantly increasing from previous years. Over the past 30 days, the difficulty rose by 1.63%, and over the past 90 days, it increased by 6.61%.

From another perspective, the mining difficulty of Bitcoin was only about 1 trillion at the beginning of 2017. The current difficulty of over 129 trillion means that the computational difficulty of mining has increased by more than 129 times compared to eight years ago.

Why Does Difficulty Adjustment Drive Up Resource Demand?

As more miners join the network and equip themselves with more powerful devices, the difficulty automatically increases to maintain the 10-minute block generation time. This triggers an "arms race," where miners must continuously upgrade their equipment and increase their computing power to maintain their chances of mining blocks.

Think of it this way: if you are in a race and the finish line moves further back every time more competitors join, you must keep speeding up to maintain your chances of winning. This is precisely why Bitcoin mining today requires enormous resources, explaining why it was possible to mine Bitcoin with a regular computer in 2008, while now, to have the same opportunity, one needs a warehouse filled with specialized mining machines.

Resources Required for Bitcoin Mining Today

Now that we understand why Bitcoin mining has become increasingly difficult, let's examine the vast resources required to compete in today's mining environment. The difficulty adjustment mechanism discussed earlier is the fundamental reason for the significant increase in resource demand.

Computing Power: Your Computational Firepower

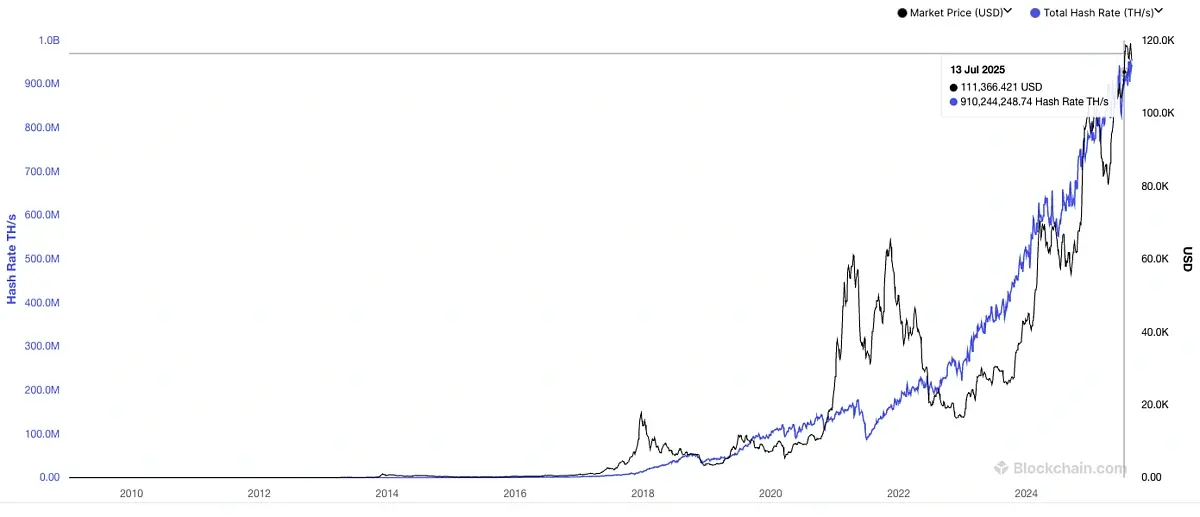

Computing power (the number of cryptographic calculations your mining equipment can perform per second) is the ticket to participating in the mining competition. Today, the total computing power of the Bitcoin network has surged to over 950 EH/s, setting new historical records year after year.

Growth of Bitcoin Network Computing Power Over the Years. For reference:

Source: Blockchain.com

- 1 MH/s = 1 million calculations per second

- 1 TH/s = 1 trillion calculations per second

- 1 PH/s = 1000 TH/s

- 1 EH/s = 1000 PH/s

In today's competitive environment, a modern laptop's CPU may achieve about 1 to 10 megahashes per second (MH/s, or millions of calculations per second) when mining Bitcoin, making the chances of mining a block almost zero. In contrast, a standard ASIC miner like the Antminer S21 can produce 200 TH/s (or 200 trillion calculations per second), which is about 20 million times the computing power of a laptop.

Hardware Requirements

Modern Bitcoin mining relies entirely on ASIC miners (Application-Specific Integrated Circuits), which are computers specifically designed for Bitcoin mining.

Popular models include:

Antminer S19 XP: Approximately 140 TH/s, power consumption of about 3,010 watts:

Antminer S21: Approximately 200 TH/s, power consumption of about 3,550 watts:

WhatsMiner M60S: Approximately 172 TH/s, power consumption of about 3,400 watts:

You can think of ASIC miners as specialized racing cars; they can do nothing but mine Bitcoin, but their mining efficiency is extremely high compared to general-purpose computers.

Power Challenges

By 2025, as an independent miner, it is expected that mining one Bitcoin will require 860,000 kilowatt-hours (kWh) of electricity. This is equivalent to the annual electricity consumption of about 80 American households. However, this is an average across the network, and the costs for independent miners can vary significantly due to differences in efficiency and electricity prices.

Electricity cost differences for independent miners mining one Bitcoin globally in 2025:

- Cheapest country: Iran, $1,324 per Bitcoin (though cryptocurrency mining faces legal restrictions)

- United States: over $107,000 per Bitcoin

- Most expensive: Ireland, $321,112 per Bitcoin

The differences are staggering: the electricity cost for Iranian miners to mine over 240 Bitcoins is the same as that for Irish miners to mine one Bitcoin.

However, this does not mean that all Bitcoin mining operations should move to Iran, as electricity costs are just one factor to consider. For example, Iran's power grid may not actually support commercial mining. Additionally, cryptocurrency mining is illegal in Iran.

Industrial Scale Operations

For large-scale commercial operations, electricity regulations are not fixed. Large mining companies like Riot Bitcoin pay as little as 2.8 cents per kilowatt-hour, while residential electricity prices can exceed 20 cents per kilowatt-hour. This industrial-scale advantage explains why large mining farms dominate the network.

Professional mining facilities can also benefit from:

- Economies of scale in power contracts

- Optimized cooling systems in suitable climates

- Direct relationships with equipment manufacturers

- Professional maintenance and operational experience

Riot Platform's Bitcoin mining facility located in Rockdale, Texas:

Probability of Success in Independent Mining

Independent mining in 2025 is essentially like playing the lottery, with the chances of success depending on the ratio of the computing power you control to the total network computing power. The difficulty adjustment mechanism discussed earlier directly affects these odds: as difficulty increases, the chances of success correspondingly decrease.

Mathematical Reality

With a hashing power of 10 million trillion hashes per second (PH/s), a miner has about a one in 650,000 chance of solving a block every ten minutes. In everyday language, this is equivalent to the probability of flipping a coin and getting heads twenty times in a row.

Probability Examples:

- A Bitaxe miner with 480 GH/s (gigahashes per second): The probability of mining one block per day is 1/1,000,000.

- A configuration of 2.3 PH/s: There is approximately a 1/2,800 chance of mining one block per day, averaging one successful attempt every 8 years.

- Large industrial mining farms (100+ PH/s): Expected to produce multiple blocks annually.

Successful Independent Mining Cases in 2025

Despite the minuscule chances of success, independent miners continue to create surprises:

On July 26, 2025: An independent Bitcoin miner successfully mined block 907283, receiving a block reward of 3.125 Bitcoins, valued at $372,773, plus $3,436 in transaction fees.

On July 4, 2025: An independent miner using only 2.3 PB of hashing power successfully solved block 903883, worth $350,000.

On August 17, 2025: A solo Bitcoin miner overcame numerous challenges and mined block 910440 through the Solo CK Pool, earning a reward of $371,000.

On March 10, 2025: An independent miner using a 480 GH/s Bitaxe small miner solved block 887212, earning approximately $257,963.

The Role of Independent Mining Pools

Many successful independent miners use services like Solo CK Pool, which allows individuals to mine independently while utilizing shared infrastructure. If an independent miner successfully mines a block through Solo CK Pool, they can keep the entire block reward. Since its inception, Solo CK Pool has facilitated 305 independent blocks.

Although the number of independent miners is small, they play a crucial role in maintaining Satoshi Nakamoto's vision of a decentralized Bitcoin.

Why Still Mine Independently?

Despite the extremely low odds, why do people still insist on mining independently? Several factors drive this decision:

- Ideological Reasons: Some miners believe that independent mining is more beneficial for the decentralization of Bitcoin than joining large mining pools.

- Lottery Mentality: Unless you control dozens of PH/s of hashing power, independent mining is essentially a gamble, and such a scale of hashing power is impractical for non-commercial operations. However, those who already own ASIC miners might try their luck for fun.

- Tax and Investment Strategies: The advantage of Bitcoin mining lies in the ability to fully depreciate hardware costs and potentially receive substantial tax credits.

- Geographic/Industrial Advantages: Some users may have access to cheap or even free electricity, making participation in this lottery feasible or cost-effective.

Overall, the general consensus is that Bitcoin mining is currently primarily a commercial operation involving mining farms and electricity trading, and with the growing popularity of Bitcoin, there may be government involvement in the future.

Conclusion: The Reality of Bitcoin Mining Today

Bitcoin mining in 2025 presents a paradox. On one hand, the network has never been as secure and robust as it is now, with difficulty reaching new highs and professional institutions investing billions in infrastructure. On the other hand, independent miners still occasionally manage to mine digital gold, earning hundreds of thousands of dollars in a single transaction.

By 2025, personal independent Bitcoin mining is extremely difficult and economically challenging. To succeed, one either needs extraordinary luck, extremely cheap electricity, or both. While the dream of "striking it rich in the digital gold mine" persists, the reality is that Bitcoin mining has largely evolved into an industrial-scale business.

For most people interested in Bitcoin, directly purchasing and holding this cryptocurrency offers better risk-adjusted returns than independent mining. However, for those with access to cheap electricity, efficient hardware, and a high-risk tolerance, independent mining remains an attractive but unlikely path to potential substantial returns.

Recent successful cases of independent mining strongly demonstrate that individual participation remains crucial in Bitcoin's decentralized network. Although the chances of success in independent mining are minuscule, they are not zero, and in the world of Bitcoin, this mathematical possibility keeps the dream alive.

Frequently Asked Questions

1. Can ordinary people mine Bitcoin?

While technically feasible, independent mining has a very small probability, akin to winning the lottery. However, ordinary people with a few ASIC miners can consider joining a mining pool—where participants combine their mining resources and share the rewards. For ordinary individuals, joining a mining pool to mine Bitcoin is a viable option without being entirely subject to the "lottery" mechanism of Bitcoin mining.

What is the difference between independent mining and pool mining?

Independent Mining: You can receive 100% of the block reward (currently 3.125 BTC), but the success rate is extremely low.

Pool Mining: You combine your hashing power with other miners and share the rewards proportionally. Your earnings are smaller but more stable, and income is more predictable. Most miners choose pools for stable returns.

How long does it take to mine one Bitcoin?

It entirely depends on the hashing power. For example, with a configuration of 2.3 PH/s, assuming the mining difficulty remains constant (which it typically increases over time), it would take about 8 years to mine one block (earning 3.125 Bitcoins).

Can I mine Bitcoin with a laptop?

This is no longer feasible. Due to the difficulty adjustment mechanism of the Bitcoin network, Bitcoin mining has become an industrial process that now requires the use of specialized computers known as ASIC miners. Ordinary computers can no longer compete with ASIC miners, and even those lucky independent miners recently have used dedicated ASIC mining equipment.

How much does it cost to mine one Bitcoin?

Costs vary significantly based on location and equipment configuration.

- Equipment: A decent ASIC miner costs between $2,000 and $15,000.

- Electricity: The cost to mine one Bitcoin ranges from $1,324 in Iran to $321,112 in Ireland.

- Average in the U.S.: Electricity costs alone exceed $107,000.

(Electricity costs are calculated for independent mining. Pool miners face different economic conditions, with smaller but more frequent earnings.)

How much electricity is needed to mine one Bitcoin?

By 2025, approximately 860,000 kilowatt-hours (kWh) will be required, enough to power about 80 American households for a year. (Electricity costs are calculated for independent mining. Pool miners face different economic conditions, with smaller but more frequent earnings.)

Will Bitcoin mining still be profitable in 2025?

Profitability largely depends on various factors, such as electricity costs, hardware efficiency, Bitcoin prices, and network difficulty. If enough of these factors are favorable for you, then Bitcoin mining in 2025 could be profitable. Overall, based on publicly available balance sheets, large mining companies like Riot are expected to be profitable in 2025.

Related Reading: From CPU to ASIC: A Comprehensive Overview of Mining Hardware Evolution

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。