Navigating through the fog of false signals to find real market validation.

Author: Mac Budkowski

Translation: Deep Tide TechFlow

Over the past few years, I have been interacting with cryptocurrency founders. I have interviewed them on my podcast, engaged with them at conferences, and became one of them while creating a startup called Kiwi focused on Ethereum hacking news.

Since I left Kiwi in June, I have had some time to reflect. I truly believe that consumer-facing crypto projects are very different from regular consumer startups.

Here are the reasons why.

Finding Water Sources

We all know that the goal of a startup is to find product-market fit (PMF), a magical combination where product features and distribution channels align perfectly, allowing the business to grow rapidly.

Finding PMF is like using a magic wand to locate a water source.

When a water source is near, the magic wand vibrates. But the problem is, when you are eager to find the water source, it’s easy to mistake the vibrations for a signal when it’s actually just your anxious hand shaking.

In the crypto space, this search becomes even more difficult because the environment is filled with false signals that can cause your “magic wand” to vibrate incorrectly. You might waste a lot of time moving in one direction only to find out there is no water source at all.

Let’s start with an example.

When $1 Million in Revenue Doesn’t Provide Clear Signals

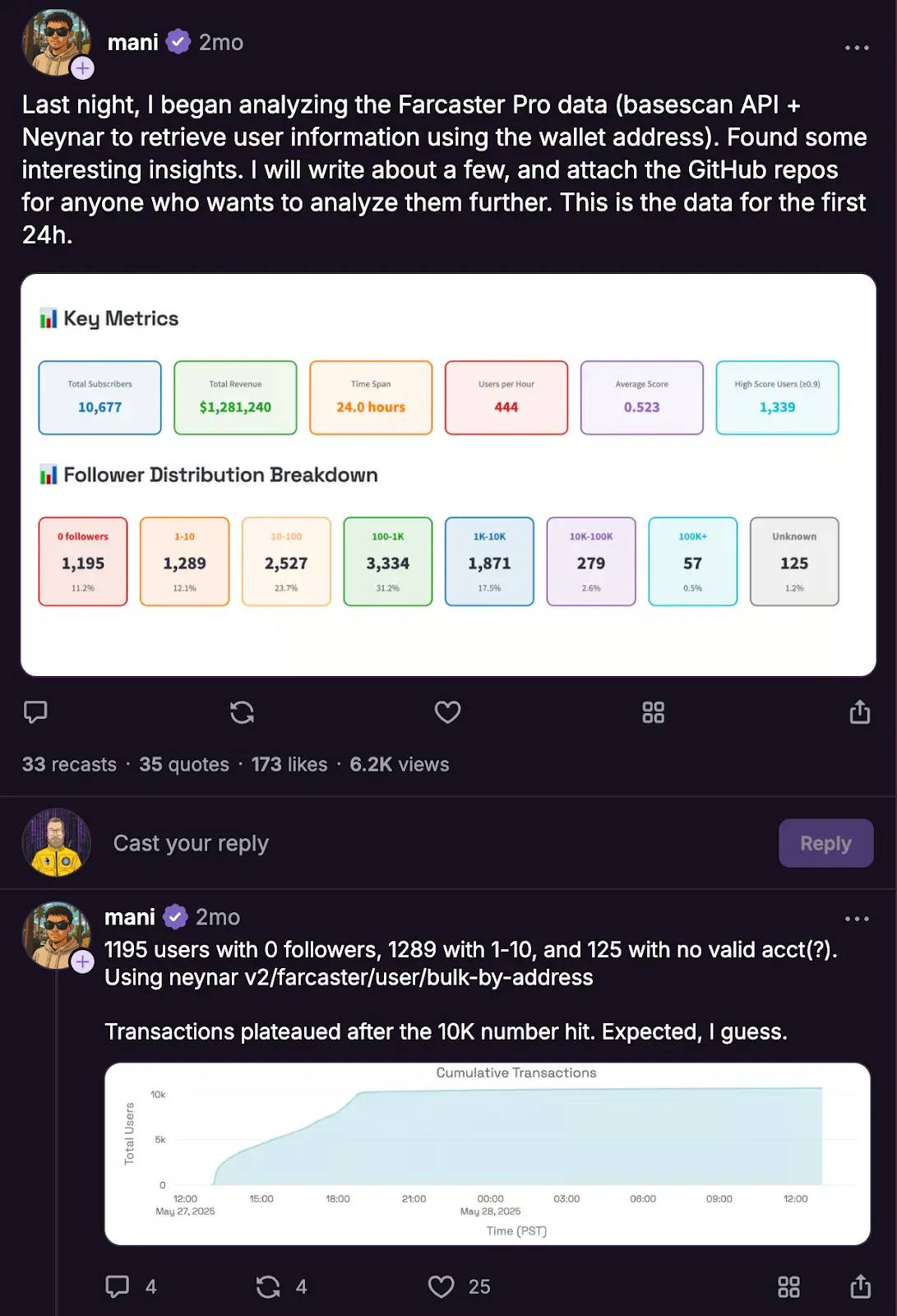

You may have heard of Farcaster, a decentralized social application. This year, they launched Farcaster Pro, a paid service similar to Twitter Premium. However, upon launch, Farcaster Pro did not offer many premium features.

Surprisingly, Farcaster Pro generated over $1 million in revenue within the first 24 hours! And this was in the consumer-facing crypto space. It seemed like a moment worth celebrating with champagne, right?

But… if you dig deeper, you’ll find a strange phenomenon: nearly half of the users who purchased a Farcaster Pro subscription had fewer than 100 followers. It’s important to note that Farcaster Pro was designed for “power users” (hence its name “Pro”).

Why would these low-follower users spend $120 on a subscription?

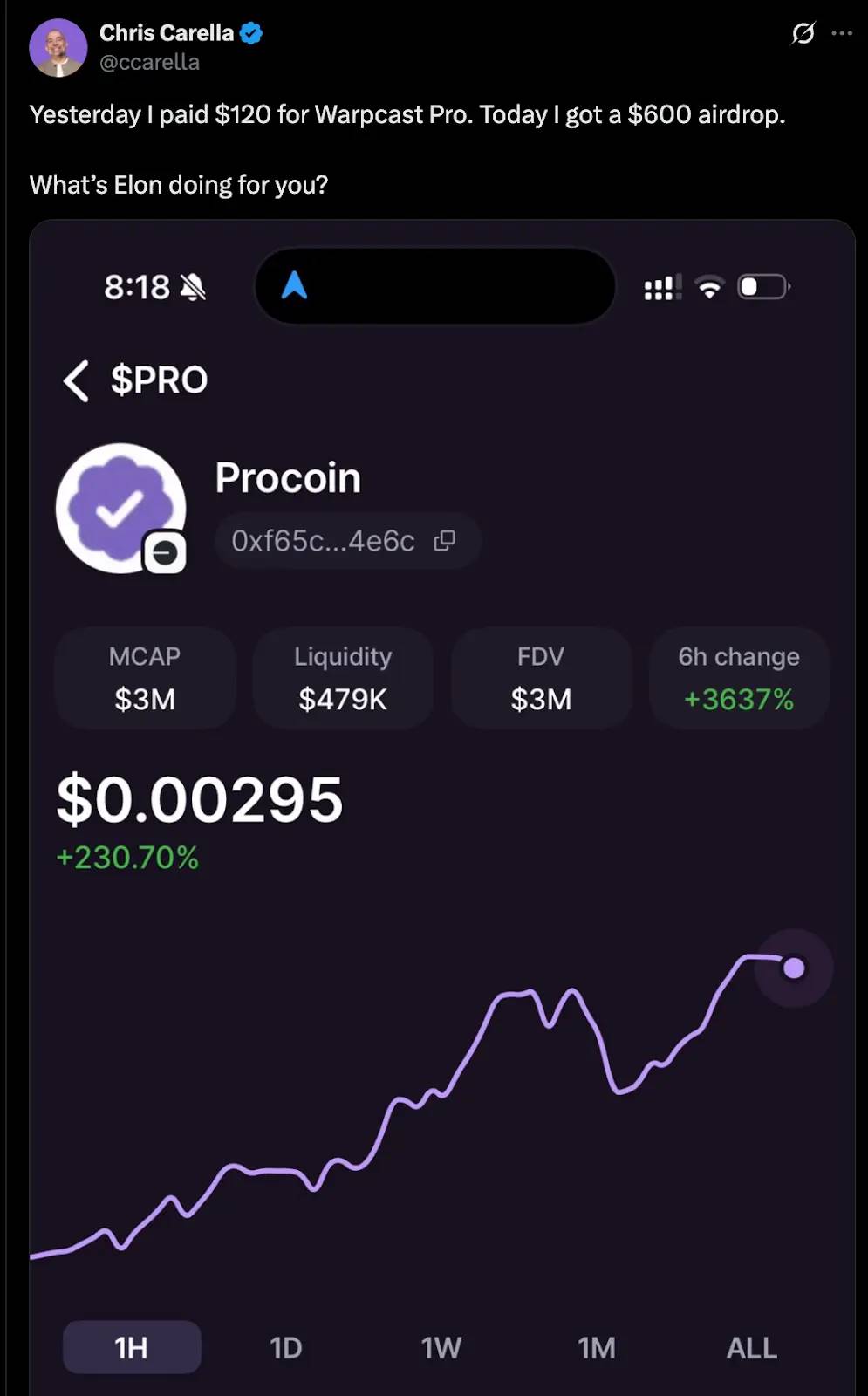

Some users might have purchased it to get an exclusive badge to make their profile stand out and attract more followers. But more users bought the subscription for speculation. And this speculation indeed paid off: the first 10,000 users who purchased Farcaster Pro received an airdrop worth $600 the next day, achieving a 5x return. A 5x return in 24 hours is certainly impressive.

Interestingly, the post mentioned above was not written by an airdrop hunter (users who specifically chase airdrop rewards) but by Chris, a long-time senior user of Farcaster and an early supporter.

This indicates that at least two types of people purchased Farcaster Pro: speculators and believers.

This also reveals the first reason why signals are distorted in the crypto space: when you are looking for PMF, you want market validation from users who genuinely want to use the product. However, as we see here, you can make $1 million in 24 hours and still be uncertain whether you have gained market acceptance.

This is not the fault of the Farcaster team. They genuinely want to create a real consumer product, and the tokens for this airdrop were not initiated by them. But this is the reality of the crypto industry and the environment we all find ourselves in. This environment makes it difficult to determine whether you are truly “building what people want,” as Paul Graham puts it.

And this is just the tip of the iceberg.

Airdrop Hunters Are Not Always Shiny

When we launched Kiwi, users needed to purchase a $10 NFT—Kiwi Pass—to fully use the product. In the first three months, over 100 people purchased it, including some well-known users like Fred Wilson. This was entirely organic growth, with no marketing push.

At that time, I thought:

“We have paying users from day one in a bear market? Doesn’t that mean we’ve found some breakthrough?”

However, we soon realized that things were not that simple.

We found that some people bought the Kiwi Pass because they were friends and wanted to support us; some did so because they resonated with our commitment to decentralization and open source; and others paid the $10 simply because it felt easy to use “magical internet money,” so why not give it a try?

This means that, although there were no airdrop hunters in our user base, only a portion of the paying users genuinely wanted to use our product.

If you think about it, this is quite crazy.

If you ask web2 founders, they might inquire about vanity metrics like “Twitter followers” or “page views.” But I don’t think anyone would mention “revenue,” as that is the most fundamental startup metric.

If you ask web2 entrepreneurs what vanity metrics are, they might say “Twitter follower count” or “page views.” But almost no one would say “revenue,” because revenue is the most basic metric for startups. However, in the crypto space, this is not so clear. Even if you see revenue growth, you cannot be sure if you are heading in the right direction—this could be due to speculators or well-meaning supporters. Thus, a seemingly reliable “PMF signal” can actually mislead you.

And the market structure does not help solve this problem.

Why the Crypto Consumer Market is So Difficult

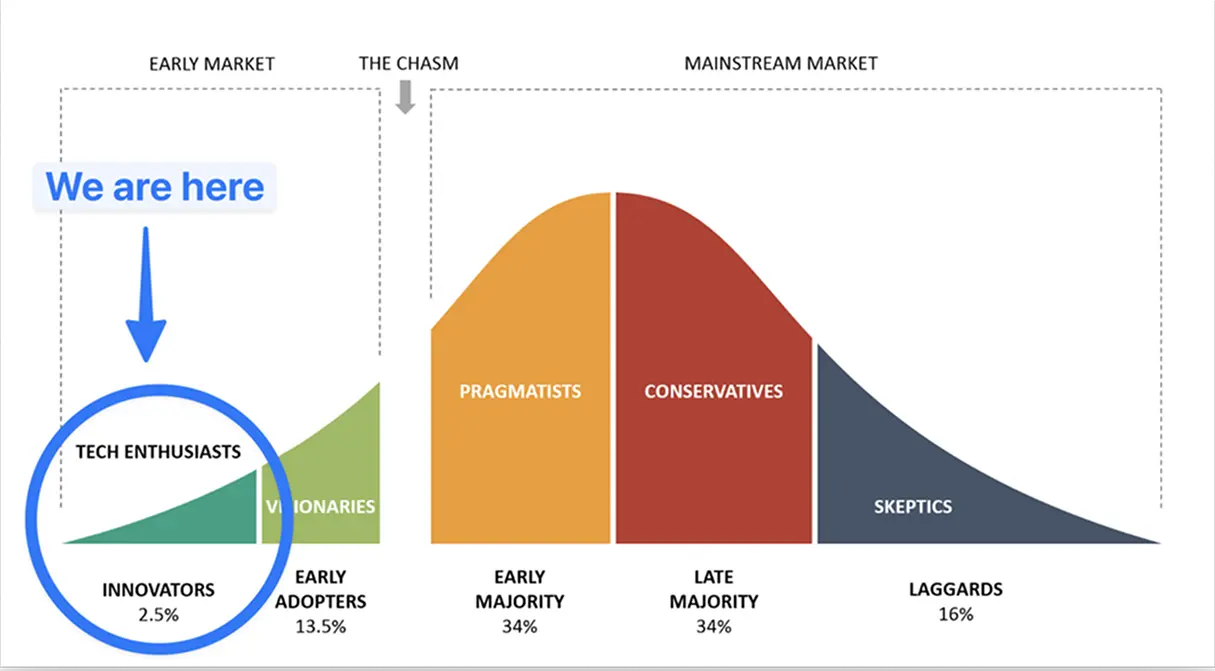

If we count the mainnet and all L2s, Ethereum has about 45 million active addresses per month.

If we assume each person has only one address (which is not the case), this means Ethereum's market penetration globally is less than 1%.

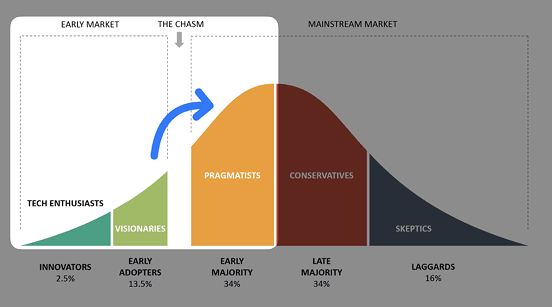

Therefore—using Geoffrey Moore's classic terminology—most users (in the West, as the situation is different in Turkey or Argentina) are innovators and early adopters.

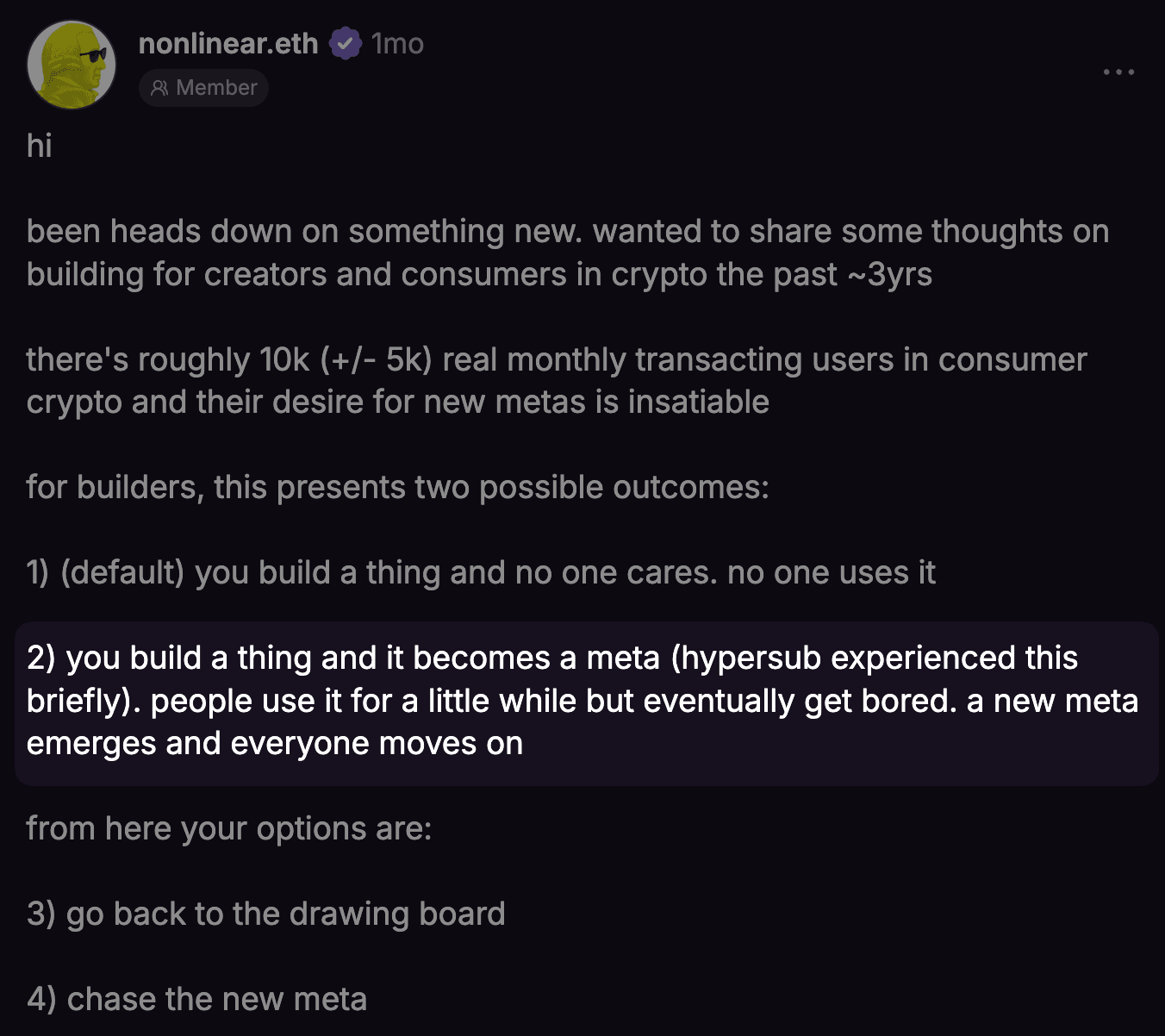

These users are very interested in the crypto space, and even with poor user experience (UX), they are willing to test your product. This sounds good, but this double-edged sword also brings problems. Because these users are willing to try new products, your usage curve may spike one week, but the next week they might turn to the next shiny thing.

This is the first problem. These users have far lower retention than “regular users.”

Additionally, the crypto market is highly diverse.

For example, in Kiwi, our user base includes developers, founders, artists, venture capitalists, and researchers, each with very diverse expectations for content. Some want to see more technical content, some want more artistic works, and others want more articles. This makes it difficult for us to meet everyone’s needs without losing focus.

The duality of the Ethereum community

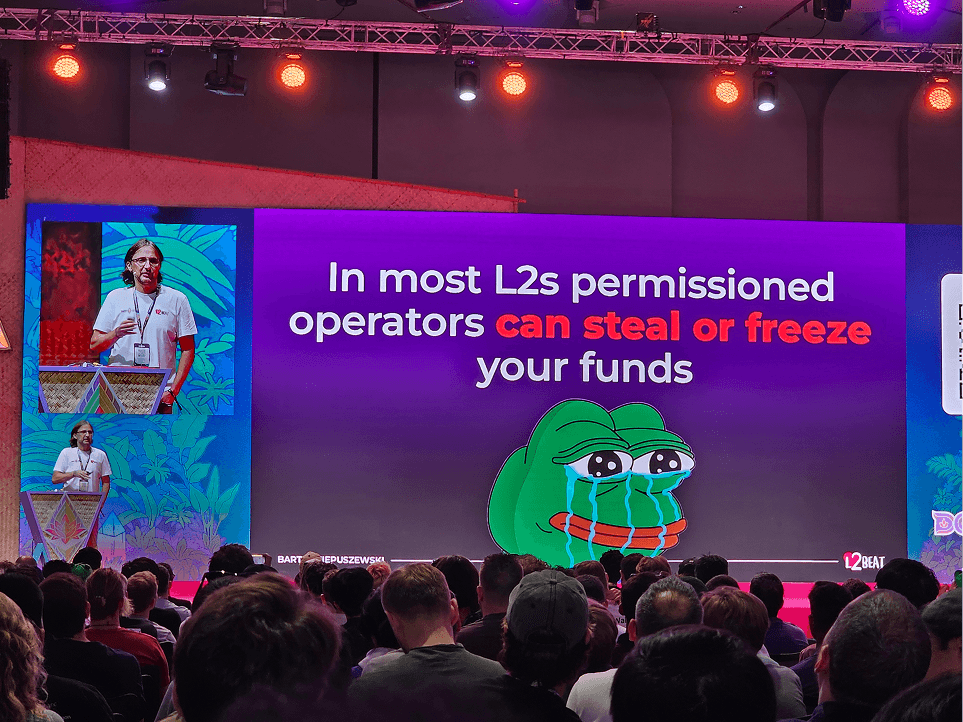

This diversity applies not only to Kiwi but to the entire crypto space. Here, you will also encounter speculators, philosophers, cryptographers, traditional finance people, and more. This means that this already small market further divides into multiple subgroups, which are also scattered across different L1 and L2 networks.

This poses challenges for growth and product design:

Growth Problem: How do you find and attract users when there are so few?

Design Problem: How do you filter feedback from multiple user groups? The needs of these groups often contradict each other, and their reasons for entering the market vary widely.

In a large market like coffee, you have enough space to accommodate many niches. For example, there is a multimillion-dollar business run by veterans that specializes in providing coffee for people who love America.

But in the crypto market, choosing a niche that is too small may lead to an inability to build a sustainable business. Even if people continue to use your product, you may not find enough users to cover costs.

As pmarca said:

“In a great market—a market with a lot of potential customers—the market pulls the startup’s product.”

But in the crypto space, aside from stablecoins, speculative behavior, and a few niche applications like prediction markets or collectibles, we do not have “a lot of potential customers.”

Therefore, aside from those users distorting signals and those chasing the “next hot thing,” our market size is also very small. And if you want to find PMF, this is crucial.

PMF is Not Just Growth

Most people equate PMF with growth.

An app suddenly gets 100,000 downloads in a week? PMF!

All your friends start using your product? PMF!

The protocol generates $10 million in trading volume within a month? PMF!

But in reality, PMF is not just about growth; it also concerns user retention.

If customers come to your store, look around, and leave, is that a successful store? Of course not. However, we often assume that apps with high download numbers must have PMF, forgetting counterexamples like Clubhouse, which rapidly declined after a brief surge in popularity.

There are many similar stories. The Twitch team created 16 million downloads within four months during the early version of their app. And—according to its founders—they still had not achieved PMF.

If you want to hear this story, please turn to 7:30 in the video below:

Original video link: Watch video

They did not have PMF because their retention rate was too low; their app was essentially burning through the market. Users came to their store, then left, never to return.

In the crypto space, we are no strangers to these high growth/low retention stories, as we have all seen airdrop hunters. But the problem does not stop there.

But it goes far beyond that.

There is also the influence of market trends. If you built an NFT marketplace in 2020, you would gain a lot of attention; but if you tried to do the same thing in 2025, the results could be completely different. These trends come and go, and you might think you’ve succeeded, but when the trend fades, your product disappears along with it.

How Tokens Affect User Attention

In addition, there are two key factors at play.

The cryptocurrency space is filled with dozens of zombie projects that siphon off retail attention and funds. Since declaring a project dead is seen as taboo, founders often “exit the community,” while their users remain in the project’s Discord channels, believing that their tokens, NFTs, or points will eventually pay off.

This is a brutal zero-sum game. If users still believe Cardano will win, they won’t spend time learning about Ethereum or your decentralized application (dapp) because they are surrounded by promotional content from their preferred network.

Another factor is that cryptocurrency token prices can affect user retention.

For example, during the Base memecoin frenzy in 2024, we found that Kiwi's usage declined. Why was that?

When users can choose to spend 15 minutes reading an article about decentralization or spend 15 minutes searching for the next coin that could 100x, even those who originally came to the crypto space for legitimate reasons will choose the latter.

There was a time when AI + memecoins captured people's attention away from everything else.

What Should You Do in Such a Challenging Market?

To summarize: we face speculators, users who support you but do not use the product, a small and diverse market, challenges with user retention, and token prices making attention competition even harder.

The purpose of this article is to describe the reality I see, not to discourage entrepreneurs from innovating in the crypto consumer space.

So I owe you some solutions. While these methods have not made Kiwi the “next big hit” (at least not yet!), they have indeed made our work a bit easier.

Problem 1: Speculators

Do Not Create Distortion

If you launch a points or referral program, it will be hard to determine whether people genuinely like your product or are just expecting some monetary reward. Therefore, if you are looking for early signals, do not do this. It’s a trap!

We once launched a promotional program at Kiwi, but it did not perform well.

Until one day, we saw a large influx of users. Upon further investigation, we found that most users were from South Korea.

We quickly learned that a Korean influencer shared his referral link, claiming users would receive airdrop rewards. We did gain many registrations, but very few long-term users. Since we were looking for signals rather than an extra $200 in revenue, we decisively terminated the program.

By the way, not creating distortion is one of the reasons why Kiwi Pass has been non-transferable in the past—we do not want people to speculate on it, as that would add more noise.

Reward Good User Behavior

At Kiwi, we reward users with Karma. Just like on Reddit, the more upvotes your posts receive, the more Karma you earn.

Users can see the most active curators on the leaderboard, and we also recognize them in our weekly newsletter, acknowledging their efforts. This is a positive social reward mechanism that encourages users to be good users rather than speculators.

Additionally, we have clear guidelines outlining the types of content we want to see. If someone shares low-quality junk content, we can easily kick them out because their links do not meet the guidelines.

If we cannot determine, we check the on-chain history to decide whether they are regular users or guideline-violating speculators. While not every product can add guidelines, there are many ways to reward good user behavior.

Problem 2: People Not Using the Product

Communicate with Users

When you mint a Kiwi Pass, we invite you to join our Telegram chat. This is a significant advantage in the crypto space—most people use the same messaging app. Getting casual feedback through Telegram is ten times easier than through email.

In the Kiwi chat, we share product updates, discuss crypto news, gather feedback on feature ideas, and more. This also allows us to reach out to the most active users privately.

We have communicated with hundreds of users, whether through Telegram or video calls, to understand how to make the app more appealing. Sometimes I feel like a missionary, asking users if they would like to talk about “Jesus,” but it is indeed worth it.

Segment Feedback

When you receive feedback, it is crucial to understand its source.

Social applications have a “90/9/1 rule,” meaning 90% of users just read content, 9% interact with the content, and 1% are high-frequency content creators. This is also similar in Kiwi.

We collect feedback from different types of users and then develop features to address current bottlenecks.

When content is lacking, we developed a Chrome extension for creators to easily submit links with one click. When comments are insufficient, we focus on developing features for contributors, such as improving the comment editor. When we want to attract more readers, we focus on developing features for lurkers, such as optimizing app loading times, feed algorithms, and so on.

Understanding which group of users you are talking to can be very helpful.

Communicate with Churned Users

When we find that certain users have become inactive, we reach out to them to try to understand what happened.

Users usually politely say they are “busy,” but when we dig deeper, some become quite candid.

Some say they “got logged out multiple times and are tired of logging back in,” or “their links did not get enough upvotes,” or even “they feel reading our links takes more time than scrolling through Twitter.” These are all valuable insights we can reference.

Problem 3: Small and Diverse Market Size

Look for High ARPU Markets

If you had to choose which “Winnie the Pooh” to serve, would you choose the regular version or the one in a suit?

If you hesitate, choose the one in a suit because he has more purchasing power. Even if there are not many users, you can still make a lot of money through high average revenue per user (ARPU).

Last month, Aave charged over $60 million in fees on Ethereum, with approximately 25,000 monthly active users. This means that each user incurs over $2,400 in fees per month. This is due to some "whales" borrowing and lending millions of dollars. Of course, not all fees go into Aave's treasury, but it is still an astonishing figure.

So, you don’t need a lot of users; you need the right users.

Similarly, Blur focuses on a very niche market of professional traders and has achieved excellent results when everyone thought the NFT market was dead.

Expand the Market

If your niche market is too small but you believe it has potential, you can choose to actively expand the market size or wait for the market to grow naturally, just like the master in Teenage Mutant Ninja Turtles.

In 2022, the privacy sector on Ethereum was a tiny market. But by 2025, it had grown large enough for Railgun to generate $5 million in revenue. And because they had been around for three years, they became the preferred solution for users as the market grew. OpenSea is similar; it established its market position before NFTs became the "next big hit."

Cross the Chasm

A more aggressive way to expand the market is to cross the chasm and attract ordinary users.

NBA Top Shot is an example. They made collectibles more appealing to ordinary users by partnering with the NBA and provided a simple way to purchase their first NFT. This strategy worked!

Another example is Polymarket. They brought the prediction market to the mainstream—partly due to their top-notch operations on social media, partly because they successfully predicted the U.S. presidential election, and partly because of their creative innovations in betting.

If you decide to go this route, I recommend focusing on niche markets with 100,000 to 1 million users. You can read more in my article, which criticizes efforts to onboard the next billion users to Ethereum.

Problem Four: Difficulty in Retention

Create a "Toothbrush" Product

Google co-founder Larry Page once said he looks for "toothbrush" products—those that are used once or twice a day and improve life.

If you focus on the core functionality of your product and design it for daily use, it will bring two benefits:

First, the product's positioning will become clear. For example, Kiwi's core function is "discovering quality Ethereum content." When there is excellent content in our feed, usage increases because that is what users need. Focusing on a core function also makes user feedback more concentrated—you can have 20 conversations around one topic rather than 20 conversations around 20 topics.

Second, when you focus on daily issues, you can receive feedback every day, allowing for more frequent adjustments. If you focus on monthly issues, the adjustment cycle will be longer.

Of course, this does not mean you cannot build excellent products around weekly or monthly issues. For example, most people do not stake their ETH daily, but Lido is still very successful. However, looking for daily interaction opportunities may help gather more signals.

The simplification of this "toothbrush" product also has the benefit of reducing time wasted on non-priorities. For instance, one day we noticed that Kiwi's personal homepage was loading slowly. We could have spent time fixing it, but since users did not come to Kiwi for a complex homepage, we directly removed many features from the homepage to make it faster while focusing on improving core functionality.

Enhance Value Realization Time

If I cook instant noodles, my value realization time is about one minute—I just need to pour in hot water to have a meal. If I order from a restaurant, my value realization time is about 30 minutes, but the food is tastier, so the value I get is higher than from the noodles.

In our case, our value comes from content. But the problem is that most of our content is long, making it more like a restaurant—users need to spend a lot of time to get a quality experience.

However, we found that on Hacker News, many users do not click on links; they just read the discussions below, which is a quicker way to "consume." This prompted us to make comments more popular, such as adding comment previews, emoji reactions, and mobile-friendly comment writing methods.

We also tried more "instant" content, like memes or charts, which may have lower value but provide immediate gratification to users.

Focus on High Product-User Fit

If your mom downloads a DeFi aggregator app, the product-user fit will be very low; she will feel like a confused bird at a meeting. But if you attract a DeFi veteran who trades five times a day, the fit will be very high. The higher the fit, the higher the potential user retention rate.

When we attended Ethereum conferences, many people were interested in Kiwi and immediately downloaded the app, with some becoming long-term users. This is because the product-user fit is high, which is also why top conferences charge sponsorship fees of over $10,000—every product wants to attract such a user base.

Build a Good Mobile App

I know the Ethereum ecosystem is filled with desktop-first users.

Yes, tools like Figma and Cursor do not need to worry about mobile apps, but consumer products do. So, please build a great mobile app. We tried PWA (Progressive Web App), which performed well in the short term, but in the long run, it was not ideal due to limited analytics capabilities, poor push notification performance, and it was more prone to crashing due to users using different mobile browsers.

So just get an iOS or Android app.

Problem Five: Tokens and Failed Projects Competing for User Attention

Explore "Small Channels"

Andrew Chen proposed a concept called "small channels." If your app has 100 users and gains 10 new users in a week, then your app's growth rate is 10%, which is fantastic.

Therefore, when your product is small, you can focus on some smaller, high-signal channels, such as subreddits, forums, niche podcasts, etc., rather than trying to go viral on Twitter. This is also how ZORA gained its first users—they directly DM'd artists on Instagram.

When your product is small, you can even explain your product to people one by one, just like the person in the meme.

We took Kiwi to specialized podcasts like Dev N Tell to increase exposure in Gitcoin projects and attract users one by one. Some methods did not work well, but some performed nicely, such as participating in the ENS ecosystem conference, where 50% of attendees immediately registered for Kiwi.

It is this high level of focus that allows you to find people who genuinely care about technology rather than token prices. Moreover, their retention rates are also higher.

Attend Ethereum Conferences

One benefit of Ethereum conferences is that you can hardly hear anyone discussing prices there. Attendees are there for the technology.

This is also a very reliable way to gather feedback. For example, we learned how to improve the user onboarding process and why mobile Ethereum wallets were not working properly. We were also able to observe how the app interacted across different browsers, operating systems, and wallets.

By the way, this is how Railgun learned to improve its documentation.

Before publishing, you will never know the outcome.

This is my final piece of advice.

All of these suggestions are aimed at early-stage projects.

Early-stage projects refer to: "You have just launched a product and are looking for signals to determine if you are heading in the right direction." If your goal is to improve data to raise the next round of funding, or if you have already found PMF and want to scale, it is better to leverage some noise for greater growth.

Speaking of early-stage projects, my final advice, although obvious, still needs to be said: none of these ideas will work until you get the product out there. Therefore, launching early is always the better choice.

When Tim launched Kiwi, you had to download Kiwi's GitHub repository, set up a node, and submit links via CLI. From a consumer product perspective, this was overly complicated. But it was enough to pique the interest of some users (including me), and that’s how we started collaborating with Tim.

Finding signals is not easy.

In my view, entrepreneurs live in a 24/7 casino, playing a game. In this game, if you combine the right features and distribution strategies in the correct order and hit "publish," you might win the jackpot. But even experienced founders and venture capitalists find it difficult to judge whether the combination is right before clicking the "publish" button.

It is more like art than science. In the realm of art, you can cultivate your taste and sense of trends, but that doesn’t mean you can always predict which song will top the Billboard charts.

For example, Black Sabbath's biggest hit song "Paranoid"—which they chose as the final song for the band's last performance—was actually written in just 20 minutes, originally just a filler track on the album. Quentin Tarantino and his director friends thought "Pulp Fiction" would flop. And "The Shawshank Redemption," the movie ranked number one on IMDB, actually had a poor box office performance upon release, gradually building its legendary status only after becoming a hit in the video rental market.

Entrepreneurship is similar—it's hard to predict what will succeed. Ultimately, consumer products and consumer culture have many commonalities.

So, please don’t be discouraged by all the challenges I mentioned; get your product out there, and good luck!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。