Fed Rate Cut Holding Faces Backlash Amid Global Cuts: Why Powell Wait?

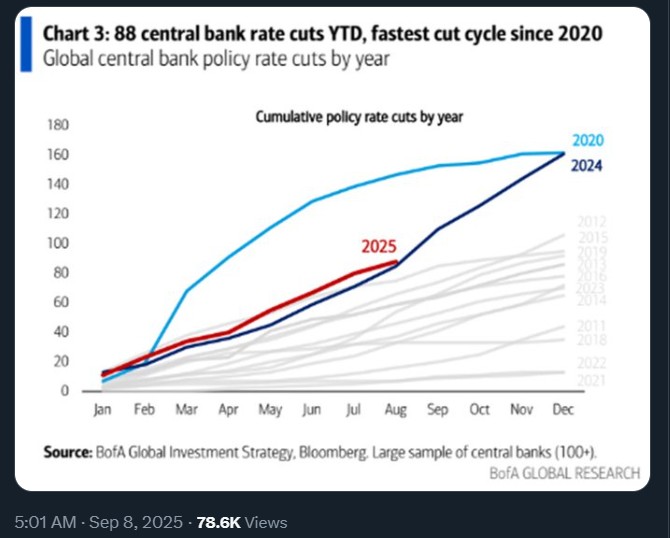

In the recent news, the world's central banks have cut rates 88 times in 2025, one of the most rapid easing cycles since 2020. Yet the US Fed rate cut still holding steady. This divide reflects a widening policy gap as investors wonder how much longer Powell can hold out against the global trend.

Global Central Banks Slash Rates in 2025

Around the world, banks have been quick to slash interest rates in 2025. According to data from Bank of America, there have already been 88 rate cuts year-to-date (YTD) -- making this the fastest global cutting cycle since 2020.

Major institutions such as the European Central Bank (ECB), the Bank of England (BoE), and the Swiss National Bank are leading the charge in terms of easing monetary policy.

This aggressive easing trend is driven by slowing growth, softer inflation, and the need to support fragile economies. In fact, the Swiss National Bank has already cut the rate back down to 0%, becoming the first major central bank to go back down to near-zero levels since the pandemic.

Source: The Kobeissi Letter X

Europe and Canada Lead the Cuts

The ECB has reduced rates four times this year, and the BoE has reduced rates three times. The Bank of Canada has made two cuts, as has Switzerland. These moves underscore the speed with which advanced economies outside the U.S. are adjusting to changing world conditions.

The Federal Reserve Standstill

In sharp contrast, the U.S. Federal Reserve has not reduced interest rate at all in 2025. Despite increasing global pressure, the Fed keeps its benchmark interest rate steady.

This standstill puts the U.S. in a unique position. While most central banks are signalling urgency, the Fed Chair Jerome Powell is still waiting and watching.

Policymakers reason that the American economy is still holding up relatively well, with growth still steady and inflation not quite low enough to make aggressive cuts.

Why the Fed is Still At Zero?

The cautious approach can be explained by three major factors:

Inflation Concerns: While inflation has subsided from its 2022-2023 highs, it is still above the Fed's long-term target. Officials want better evidence that price pressures are under full control.

Resilient U.S. Economy: The American labor market and consumer demand remain relatively strong compared to other regions. That gives the Fed less urgency to act.

Global Spillovers: The Fed is aware that cutting rates too quickly could weaken the U.S. dollar and create instability in global markets. Holding steady gives the Fed more control over financial conditions.

Market Expectations

Investors are closely watching the Federal Reserve's next move. Many believe the US central bank will eventually join the global rate-cut cycle later this year, especially if economic growth slows or inflation falls faster than expected. For now, however, Federal Reserve Chair Jerome Powell and his colleagues are in “wait-and-see” mode.

Conclusion

The growing policy divide between the Federal Reserve and the rest of the world is striking. This cautious stance may help the U.S. maintain stability in the short run, but it also risks making U.S. policy look out of sync with global economic realities. As the year progresses, the big question remains: Will the Fed cut rates in September 2025 , or will it still wait?

Also read: How Crypto Market Will React in September 2025 After Major Events免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。