From an industry perspective, Figure's IPO, along with this year's Circle and Bullish, constitutes three paths for "crypto finance entering the mainstream market."

Author: U.S. Stock Investment Network

After the successful listings of the first stablecoin stock Circle (CRCL) and the first compliant exchange stock Bullish (BLSH), Wall Street's "crypto finance trilogy" welcomes its third act. Figure Technology Solutions, with the stock symbol FIGR, is expected to debut on Nasdaq next Thursday.

Unlike the previous two companies, Figure does not rely on the "crypto narrative" but chooses to embed blockchain into the most traditional and largest financial landscape in the U.S.—home equity lines of credit (HELOC) and asset securitization.

Therefore, this IPO has transcended the significance of the company itself and resembles an industry exam question: Can blockchain truly break out of the virtual asset bubble and enter the core of traditional finance?

Company Overview and Core Business

Figure was founded in 2018 by Mike Cagney, co-founder of SoFi. Cagney has already proven his ability to bring internet thinking into consumer finance at SoFi, and at Figure, he chose a more disruptive path: reshaping the loan and asset circulation processes with blockchain.

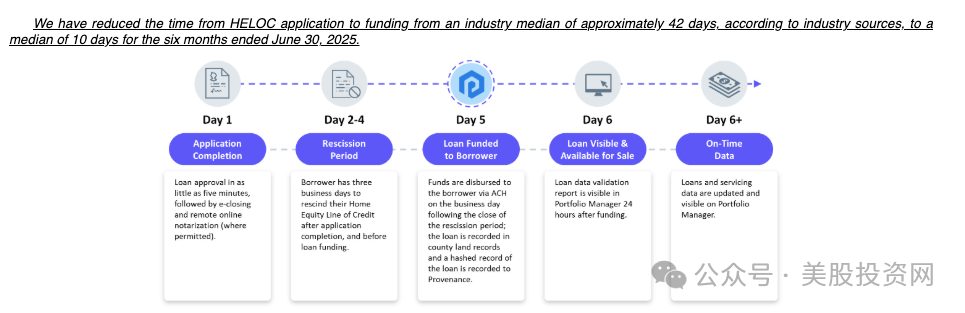

Headquartered in San Francisco, Figure's initial entry point was home equity loans (HELOC). This is the most commonly used financing method for U.S. residents, but the traditional process is cumbersome, averaging over 40 days. Figure leverages its self-developed Provenance blockchain to shorten the approval cycle to about 10 days. This efficiency gap has become the key to its rapid emergence. By 2025, the company had issued over $16 billion in HELOCs.

However, Figure has not stopped at self-operated loans. It has gradually built a more complete fintech platform: providing loan origination systems (LOS) to financial institutions, launching a loan matching market (Figure Marketplace), developing digital asset registration technology (DART), and even venturing into stablecoins and DeFi. The company is well aware that the story it wants to tell is not that of a "blockchain company," but rather a "next-generation financial infrastructure provider."

Core Business

Figure's business can be broken down into three levels.

The first level is the loan business. HELOC is Figure's foundation, contributing about 75% of revenue in the first half of 2025. Its advantage lies in the efficiency difference, with approval speed being a quarter of that of traditional institutions. However, HELOC is highly dependent on the real estate market and interest rate environment, inherently carrying cyclical risks.

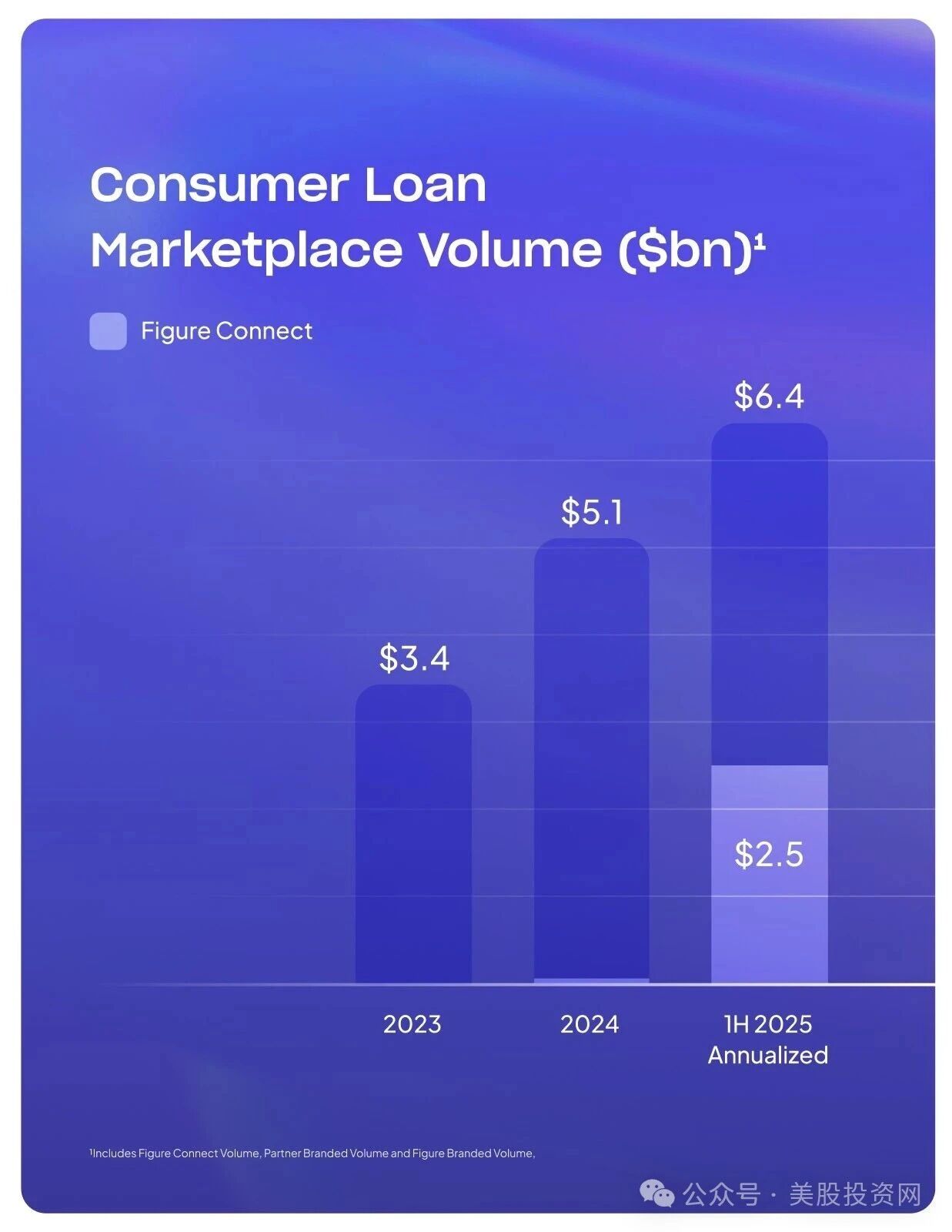

The second level is platform services. Figure provides LOS systems to banks and lending institutions, enabling them to issue loans in bulk; at the same time, it has built Figure Marketplace to match loan supply and demand. The platform's transaction volume reached $3.4 billion in 2023, increasing to $5.1 billion in 2024, and reaching $2.5 billion in the first half of 2025, with the full year expected to exceed $6.4 billion. This means Figure is transitioning from a "lender" to a "loan market," earning revenue through services and matchmaking.

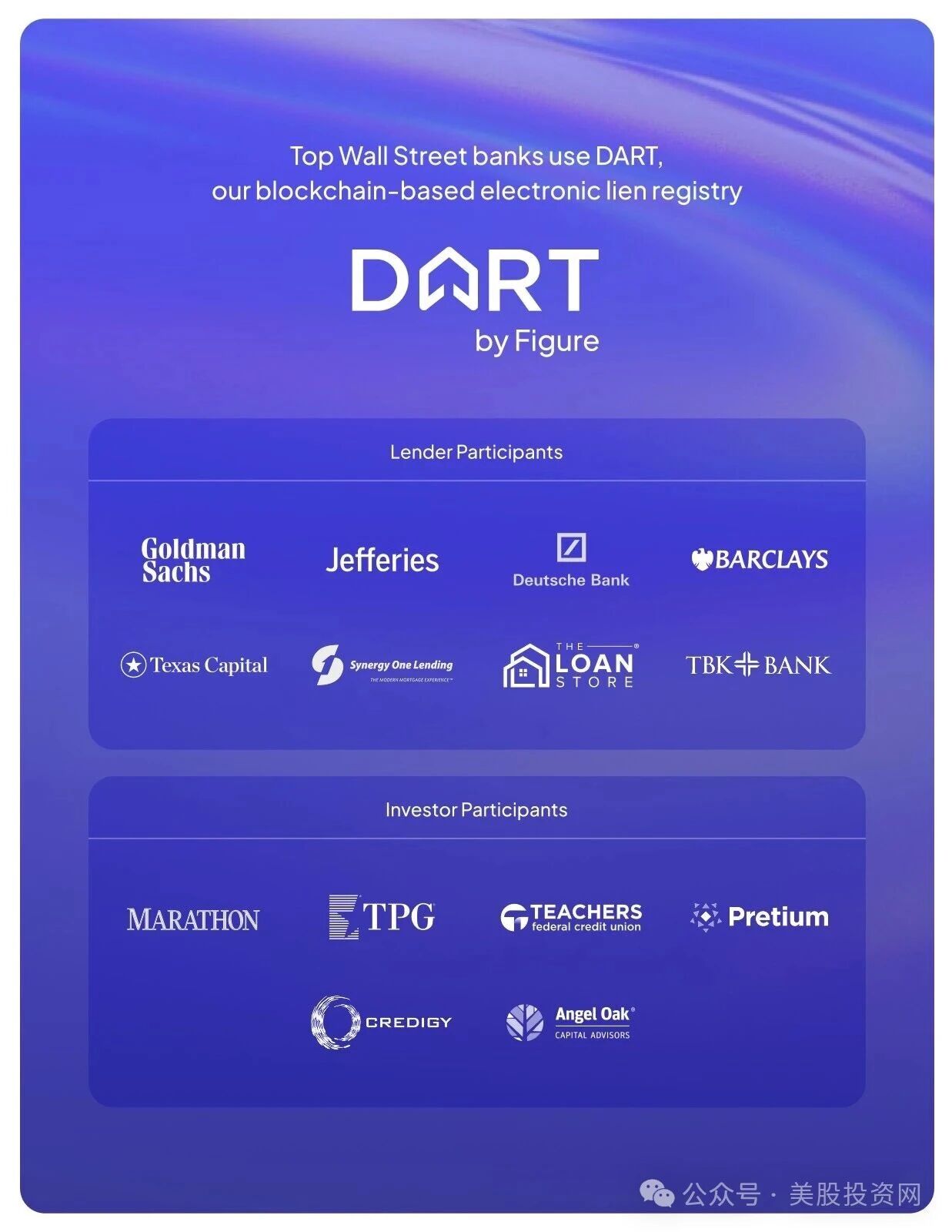

The third level is the asset side and securitization. Figure has developed the DART system, allowing loan assets to be registered and circulated on-chain. Major Wall Street firms such as Goldman Sachs, Jefferies, Deutsche Bank, and Barclays have already become its clients. This is one of Figure's biggest endorsements.

In 2025, the blockchain asset securitization product launched by the company received AAA ratings from Moody's and S&P, marking a first in financial history. At the same time, Figure also launched the world's first SEC-approved interest-bearing stablecoin, further opening up the imagination space for "compliant DeFi."

Financial Performance

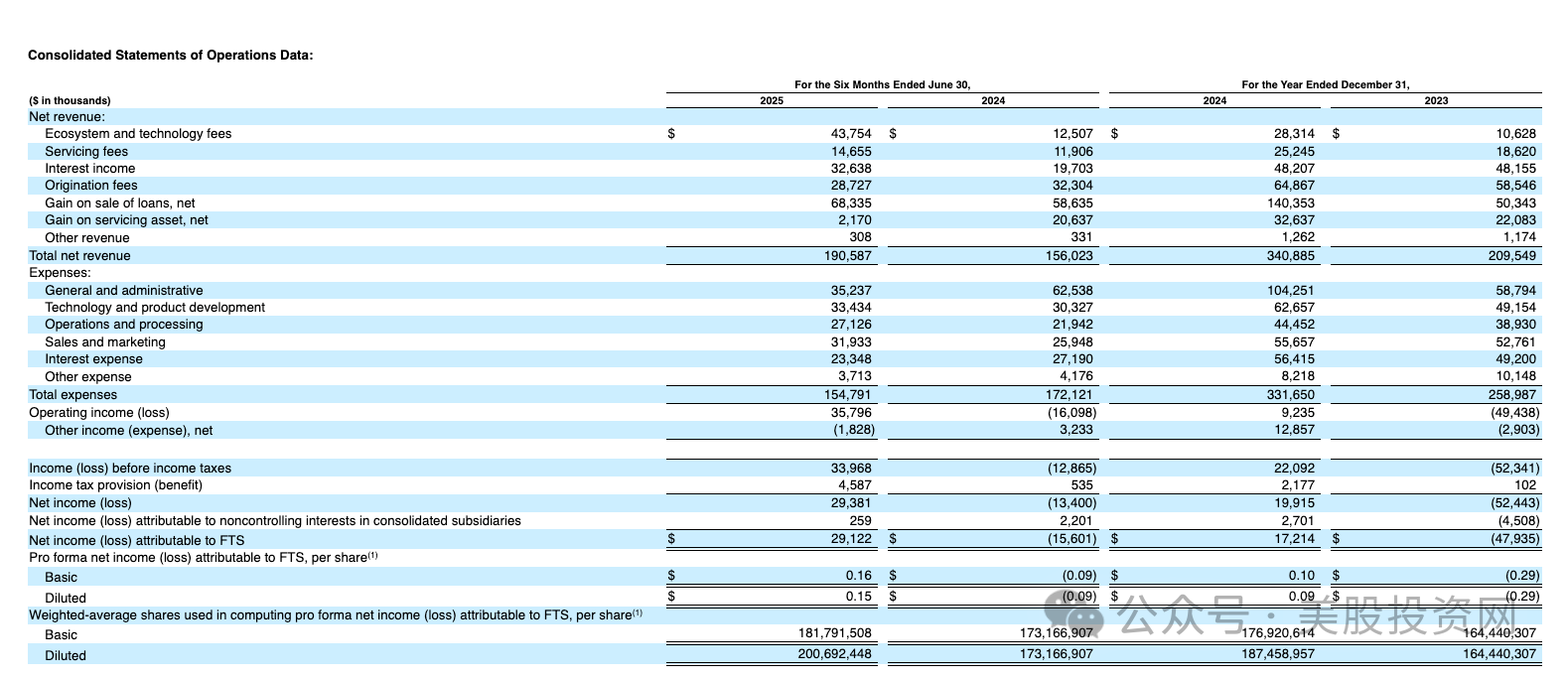

From a financial data perspective, Figure showed substantial improvement in the first half of 2025. The company's total revenue reached $191 million, a significant increase compared to $156 million in the same period of 2024. Net profit also turned from loss to profit: in the first half of 2025, it recorded a net profit of $29.38 million, while in the same period of 2024, it had a loss of $12.86 million.

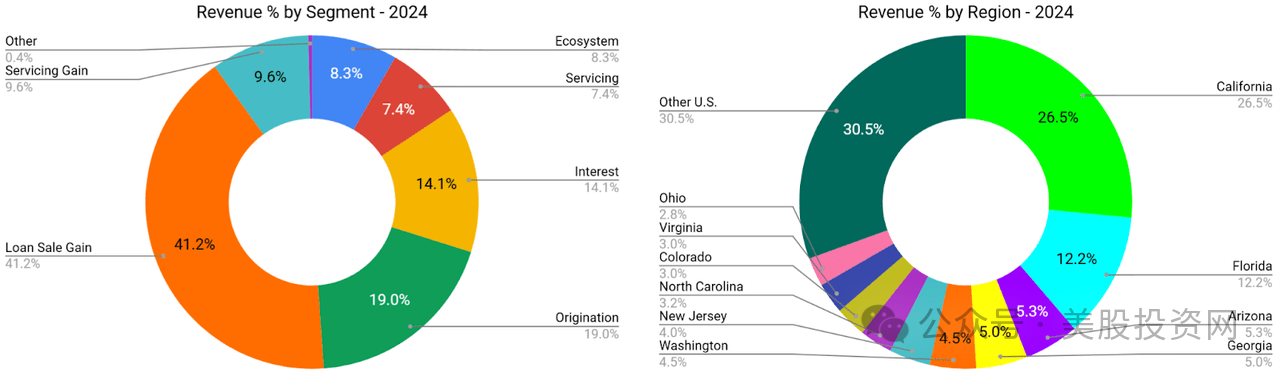

In terms of revenue structure, loan sale income and interest income remain Figure's core sources, accounting for more than half of total revenue; additionally, ecosystem and technology fees reached $43.75 million, indicating that the contribution from platform business is on the rise.

On the expense side, Figure's total expenditure was $155 million, including management and administrative expenses of $35.24 million, technology and product development of $33.43 million, and sales and marketing expenses of $31.93 million. This ratio appears manageable compared to revenue, indicating that the company is improving efficiency through cost structure optimization.

It is worth noting that Figure was still in a loss of $52.44 million in 2023, achieved a net profit of $19.92 million in 2024, and by the first half of 2025, net profit had expanded to nearly $30 million, indicating a gradually clarifying profit trend.

However, the company has still experienced significant profit fluctuations over the past few years, especially during the prolonged high-loss phase between 2021 and 2022. This historical burden serves as a reminder to investors that the profit model still needs further validation.

Overall, Figure's financial turning point has emerged, with revenue continuing to grow, losses gradually narrowing, and turning towards profitability, but the stability of profits remains to be observed. From the revenue composition, it relies heavily on loan sales and interest income; although platform and ecosystem fees are growing rapidly, their proportion is still not high enough. Whether future business can further "de-leverage" will determine the sustainability of its profitability.

Industry Environment and Competitive Landscape

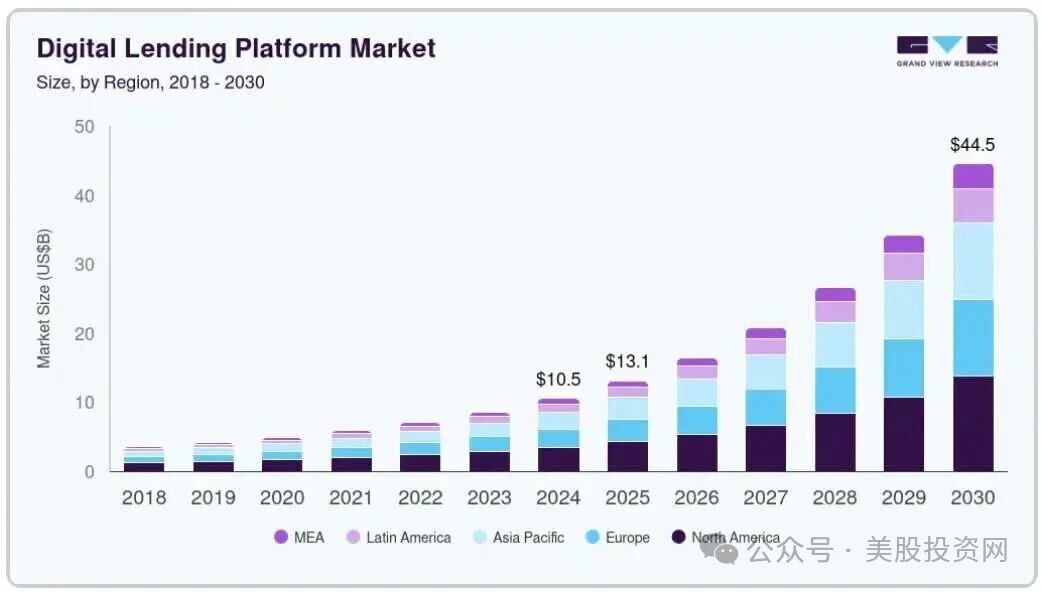

The digital lending market where Figure operates is in a rapid growth phase. According to Grand View Research, the market size is projected to be $10.6 billion in 2024 and reach $44.5 billion by 2030, with a compound annual growth rate of 27.7%. Consumers are increasingly demanding faster loan processing, and financial institutions are accelerating their digital transformation.

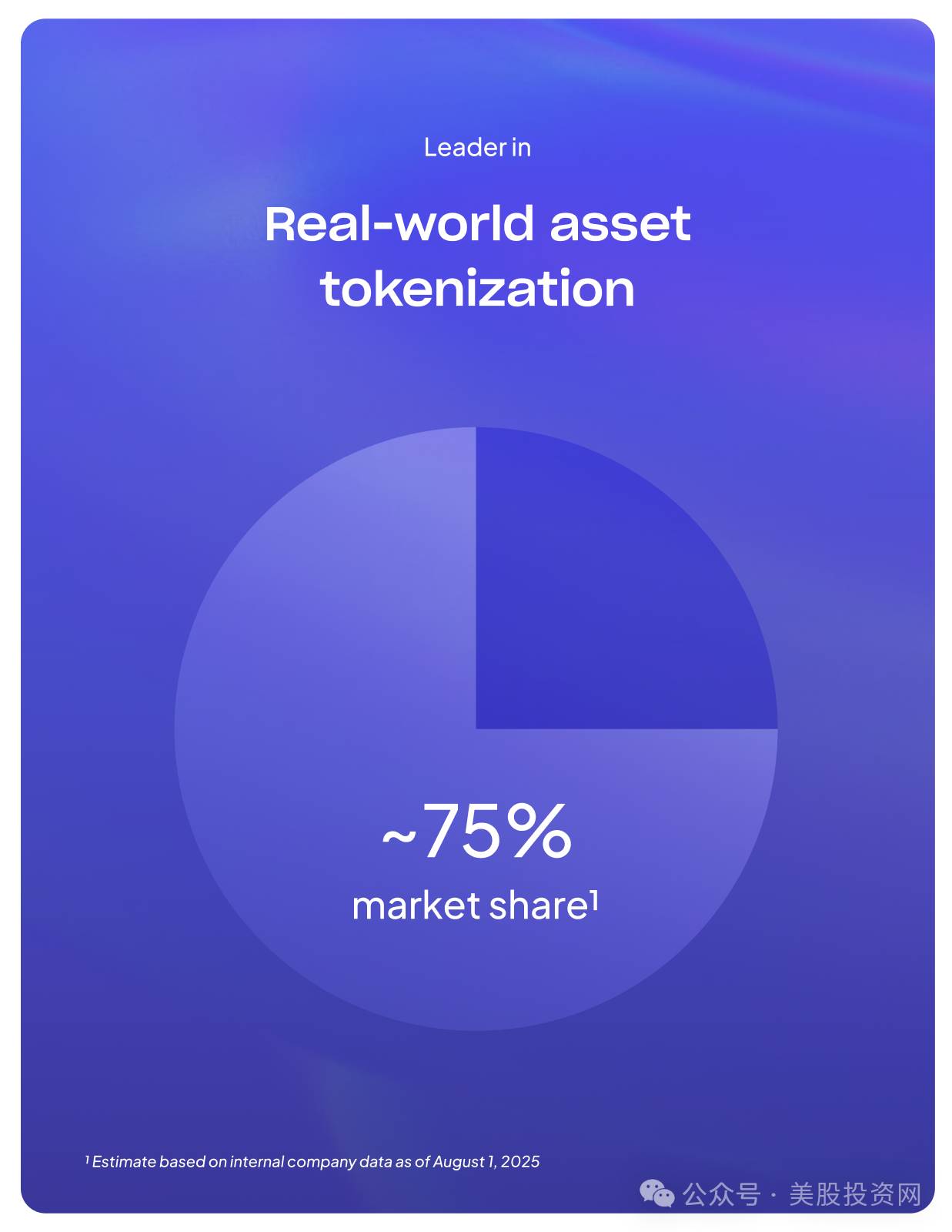

In the realm of Real World Assets (RWA) on-chain, Figure is already in a leading position. The company disclosed that its market share has reached 75%, almost forming a monopoly. This means it is not just a "lending company," but one of the first players to apply blockchain on a large scale in asset securitization. If Figure can continue to achieve breakthroughs in compliant stablecoins and on-chain securitization, it may build a true bridge between Wall Street and blockchain.

Unlike BNPL platforms like Klarna and Affirm, Figure focuses on secured loans, which differentiates it from its peers. However, competition is not easy. Public companies like SoFi, Upstart, and LendingClub have accumulated years of experience in various loan segments; new players like OppFi, Coinbase, and Ledn are also trying different forms of digital lending. In the traditional finance sector, large banks are accelerating their digitalization, gradually narrowing the gap with fintech companies.

In other words, Figure's advantages lie in efficiency and technology, but to become a long-term winner in the industry, it must convert its first-mover advantage into stable scale and ecosystem; otherwise, it could easily be caught up by more resourceful institutions.

Risks and Challenges

The first risk is revenue concentration. Currently, HELOC accounts for 75% of revenue, and if the U.S. real estate market enters a downturn, the company's revenue will be the first to be impacted.

The second risk is cash flow issues. Although Figure achieved profitability in the first half of 2025, its free cash flow over the past 12 months remains negative at $40.3 million, indicating that its funding needs for expansion and R&D still rely on capital market support.

The third is regulatory uncertainty. Especially in the areas of stablecoins and DeFi, there is still a lack of a clear regulatory framework in the U.S. If policies tighten, it could not only increase compliance costs but also directly limit Figure's new business expansion.

The fourth is competitive pressure. Whether from fintech companies like SoFi and Upstart or traditional banks that are gradually digitalizing, they could all erode Figure's market share.

Finally, the company also faces a high concentration of partners. In the first half of 2025, the top ten loan origination partners contributed 57% of the transaction volume; if key partnerships are shaken, it will affect the company's business stability.

IPO and Future Outlook

Figure's IPO aims to raise $526 million, with an offering price range set at $18–20 per share, corresponding to a valuation of approximately $4.1–4.3 billion. After going public, the company will adopt a dual-class share structure: Class A shares will have one vote per share, while Class B shares will have ten votes per share, allowing the founding team to maintain control. Underwriters include Goldman Sachs, Jefferies, and Bank of America Securities, indicating Wall Street's recognition of its story.

From an industry perspective, Figure's IPO, along with this year's Circle and Bullish, constitutes three paths for "crypto finance entering the mainstream market." Circle represents compliant stablecoins, Bullish represents compliant exchanges, and Figure represents compliant loans and asset securitization. These three companies serve as three entry points for the crypto economy to penetrate traditional finance: payments, trading, and credit.

U.S. Stock Investment Network analyzes that whether Figure can stand out depends on whether it can truly convert the advantages of blockchain into stable cash flow and establish a long-term moat in a compliant environment. If successful, it may become the "first stock of blockchain financial infrastructure"; if it fails, it could merely be another fleeting experiment in the capital market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。