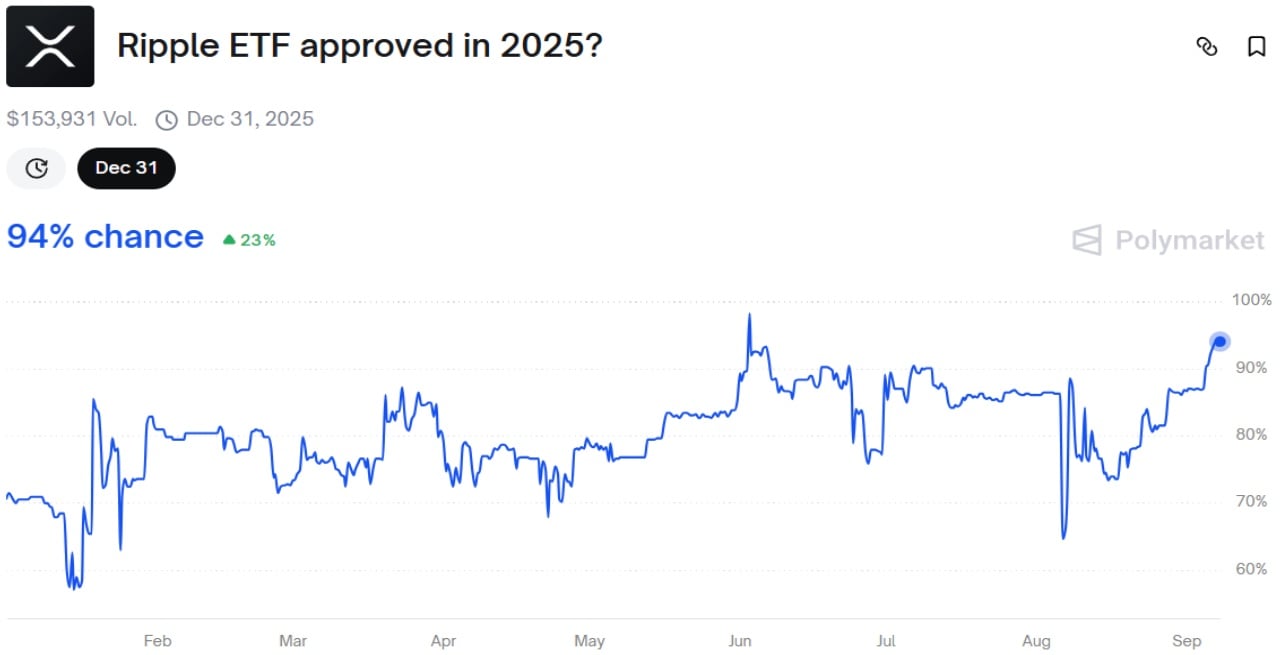

XRP is gaining momentum in financial markets as optimism grows over potential approval of a new investment product. Recent figures from Polymarket, a leading prediction market, show a significant uptick in confidence that the U.S. Securities and Exchange Commission (SEC) will approve a spot XRP exchange-traded fund (ETF) in 2025. As of Sept. 7, market-implied probability climbed to 94%, up sharply from 86.8% at the end of August. The shift underscores a recalibration of investor expectations and hints at deeper regulatory traction on digital asset ETFs.

Data compiled by Polymarket indicates heightened market belief in XRP ETF approval. Source: Polymarket

Forecasts from financial professionals have added to the rising speculation. Nate Geraci, president of Novadius Wealth Management and co-founder of The ETF Institute, took to social platform X to suggest that approval odds may be even higher than market projections.

Offering a more assertive stance than the one implied by Polymarket’s numbers at the close of August, he wrote:

Personally think closer to 100% … People are severely underestimating investor demand for spot XRP & SOL ETFs. Just like they did w/ spot BTC & ETH ETFs.

James Seyffart and Eric Balchunas, ETF analysts at Bloomberg, have maintained their approval estimate for a spot XRP ETF at 95%, aligning with the broader narrative that regulatory posture is turning more permissive.

Recent amendments to spot XRP ETF filings by asset managers, including Canary, Coinshares, Franklin, 21Shares, Wisdomtree, and Bitwise, point to escalated regulatory engagement. The coordinated timing of these revisions suggests issuers are responding to SEC staff comments, a pattern typically interpreted by market participants as indicative of active dialogue and progressing review cycles. From a regulatory process standpoint, iterative amendments of this nature often precede formal approvals in the ETF pipeline.

Looking forward, Geraci emphasized last week that broader industry coordination is underway:

Major exchanges continue to quietly work w/ SEC behind the scenes on generic listing standards for spot crypto ETFs… Given final deadlines on existing spot crypto ETF filings, reasonable to expect this would be in place by early October. Then crypto ETF floodgates open.

With the SEC having approved spot bitcoin and ethereum ETFs earlier, proponents contend that XRP is a logical progression in extending regulated market access. Institutional allocators, in particular, could benefit from broader crypto exposure under a unified compliance framework, should additional approvals follow. Ripple CEO Brad Garlinghouse has repeatedly called an XRP ETF “inevitable,” aligning with this broader push.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。