Author: Ryan Yoon and Chi Anh

Translation by: Blockchain in Plain Language

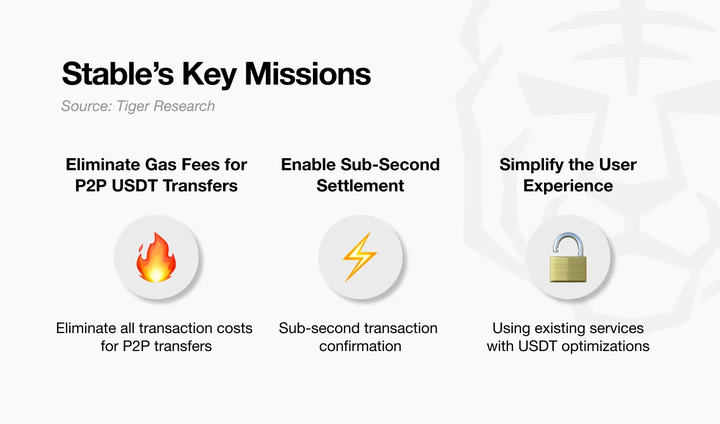

This report is authored by Tiger Research, providing an in-depth analysis of the strategic layout of the blockchain platform Stable, which is centered around USDT. Stable aims to promote the widespread adoption of stablecoins through zero gas fee peer-to-peer transfers, transaction confirmations within one second, and a simplified user experience.

Summary

Stable positions itself as the "Trojan Horse" of the stablecoin market, with USDT at its core, targeting mass adoption.

It addresses the current major pain points of stablecoins in the following ways:

- Zero gas fee USDT transfers, eliminating high transaction costs;

- Sub-second transaction confirmations to meet real-time payment needs;

- Simplified user experience, allowing ordinary users to easily get started.

Stable's strategy is to attract users through a free and smooth transfer experience, gradually expanding into payments, decentralized finance (DeFi) services, and partnerships with institutions, creating a global payment ecosystem centered around USDT.

1. Stablecoins: The Quietly Rising "Trojan Horse"

Stablecoins have entered the crypto market in a low-key manner, akin to a "Trojan Horse." Initially seen as tools to reduce price volatility, they have now become a core pillar of the crypto ecosystem.

The market size of stablecoins, led by USDT, has exceeded $150 billion, with over 350 million users, and their trading volume even surpasses that of Visa. This not only makes stablecoins representatives of crypto assets but also important components of the global payment network.

Stablecoins play a "bridge" role in the following scenarios:

- Centralized exchanges (CEX): Serving as the main medium for converting fiat currency to cryptocurrency;

- Decentralized finance (DeFi): Providing standard assets for liquidity provision and borrowing;

- Cross-border payments: Offering faster and cheaper transfer options than traditional banks.

The change in market behavior is evident. In the past, crypto trading primarily relied on volatile token pairs like BTC/ETH, with prices quoted in Bitcoin. Today, stablecoin trading pairs like BTC/USDT and ETH/USDT dominate, and DeFi yields are often quoted in USDT. In regions like Southeast Asia and Latin America, USDT has even begun to replace cash in USD for everyday payments.

Stablecoins have evolved from initial hedging tools to "universal currency" in the crypto ecosystem.

2. Shadows Behind Growth: Three Major Bottlenecks of Stablecoins

Despite the booming stablecoin market, its infrastructure still faces three structural challenges:

High and Unpredictable Transaction Fees

Stablecoins operate on multiple blockchains, but during network congestion, gas fees can skyrocket. For example, transferring $10 worth of USDT might incur a fee of $20, which contradicts the goal of stablecoins as everyday payment tools.

Long Transaction Confirmation Times

On Ethereum, stablecoin transfers can take several minutes or longer to confirm. This delay severely limits application scenarios for real-time settlement needs (such as online payments or offline consumption).

Complex User Experience

Managing gas fees, wallets, and private keys remains a challenge for ordinary users. Compared to simple and intuitive payment tools like PayPal, the current user experience of stablecoins is not friendly enough for non-technical users. These infrastructure limitations hinder the further adoption of stablecoins. Although stablecoins have become the default asset in the crypto world, their everyday practicality in mainstream markets still needs significant improvement.

The "Trojan Horse" of stablecoins has successfully infiltrated the crypto market; next, it needs to overcome technical bottlenecks and venture into traditional finance and mainstream payment sectors.

3. Stable: The Next "Trojan Horse"

Rather than creating a new stablecoin, Stable chooses to optimize the ecosystem of the existing market leader—USDT.

Stable is not a generic blockchain but a high-speed network specifically designed for USDT, aimed at addressing the three major pain points of existing stablecoins.

Stable's three core objectives:

- Zero gas fee peer-to-peer transfers: Eliminating the high cost of small transfers;

- Sub-second transaction confirmations: Achieving near real-time payment experiences;

- Simplified user experience: Allowing ordinary users to use it easily without a technical background.

These three aspects complement each other: zero gas fees lower the usage threshold, fast confirmations enhance practicality, and a simplified experience attracts a broader user base. Stable is not just a blockchain; it is an infrastructure centered around the $160 billion USDT ecosystem.

4. Stable's Technical Architecture: How to Achieve Goals

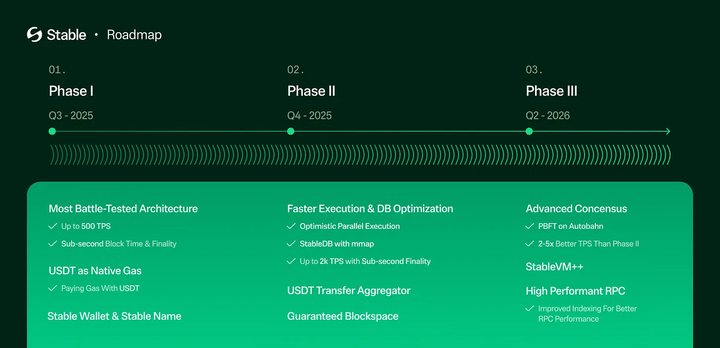

Stable is currently in the testnet phase, progressing towards mainnet launch. Its technical architecture is designed around the following core functions to ensure the realization of its vision.

4.1. Zero Gas Fee USDT Transfers: EIP-7702 and Account Abstraction

The Stable network supports two types of tokens:

- USDT0: USDT bridged from other networks (like Ethereum) via cross-chain bridges;

- gasUSDT: A token used to pay transaction fees, pegged 1:1 to USDT0, used only for internal network fee payments.

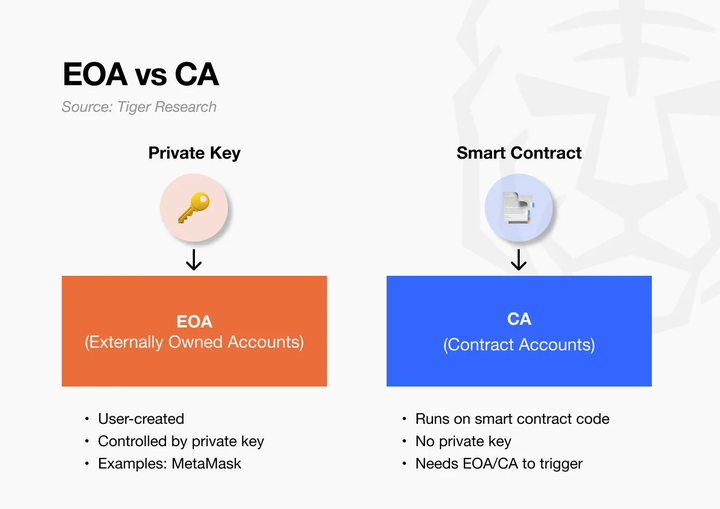

Through EIP-7702 and Account Abstraction, Stable achieves zero gas fee peer-to-peer transfers. Account Abstraction merges traditional external accounts (EOA, such as MetaMask) and smart contract accounts (CA), allowing users to utilize smart contract features without additional setup. For example, users can directly pay gas fees with USDT or waive gas fees through the "Paymaster" service.

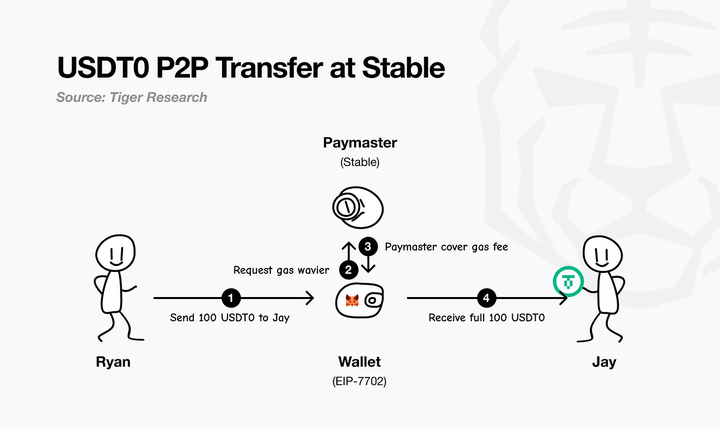

Operation example:

- User Ryan transfers 100 USDT0 to Jay via MetaMask;

- The wallet automatically requests a gas fee waiver, and the Paymaster service pays on behalf;

- Ryan deducts 100 USDT0, and Jay receives 100 USDT0 without any additional fees.

This experience is similar to PayPal, where users do not need to manually calculate or hold gas tokens, greatly simplifying the operation.

4.2. Sub-Second Transaction Confirmations

Stable employs the StableBFT consensus algorithm, generating a block every 0.7 seconds, with transaction confirmation completed in just one step, avoiding the common "pending" state. Additionally, Stable is developing Block-STM parallel processing technology, allowing independent transactions to be processed simultaneously, enhancing network efficiency, similar to a supermarket opening multiple checkout counters to reduce waiting times.

In the future, Stable plans to upgrade to Autobahn DAG consensus, supporting multi-block parallel proposals, with internal tests achieving up to 200,000 TPS (transactions per second). This lays the foundation for real-time payment scenarios.

4.3. Simplified User Experience

Stable is compatible with the Ethereum ecosystem, allowing users to continue using familiar tools like MetaMask and Etherscan, but with an optimized experience:

- MetaMask supports zero gas fee USDT0 transfers;

- Etherscan presents USDT transaction history in an intuitive manner.

- Through the LayerZero cross-chain bridge, USDT can be seamlessly imported into the Stable network, adopting the OFT (Omni-Chain Fungible Token) standard, eliminating asset fragmentation issues in traditional cross-chain scenarios. For example, whether bridged from Ethereum or Arbitrum, the result is unified USDT0.

Additionally, Stable plans to launch the Stable Name System, replacing complex wallet addresses with easily readable names like "ryan.stable," further enhancing user-friendliness.

4.4. Other Technical Highlights

StableDB Database: Significantly reduces data write latency and enhances transaction processing speed through a memory-first storage mechanism and memory-mapped file I/O technology.

Guaranteed Blockspace: Provides dedicated transaction capacity for enterprises, ensuring stable operation even during peak periods, similar to bus lanes on highways.

Confidential Transfer: Supports hiding transaction amounts while meeting anti-money laundering (AML) and know your customer (KYC) requirements.

StableVM++ Engine: Upgrades the existing Go language engine to C++, optimizing memory management, with an expected performance improvement of six times.

5. Stable's Ecosystem Expansion: Three Major Scenarios

Stable attracts users through zero gas fees, fast confirmations, and a simple experience, similar to a "loss-leader" strategy. Once the user base is established, its business model will expand through the following scenarios.

5.1. Scenario One: Enterprise Services and Partnerships

Stable can collaborate with enterprises through advanced services like Guaranteed Blockspace, especially in the field of cross-border payments. Compared to traditional international transfers, Stable can significantly reduce costs and time. For example, fintech companies (like Wise) can integrate Stable's infrastructure to enhance customer experience, while Stable charges fees based on transaction volume.

Cryptocurrency exchanges can also optimize the deposit and withdrawal processes of USDT through Stable, attracting institutional clients engaged in high-frequency trading.

5.2. Scenario Two: Rapid Growth of On-Chain Services

Zero gas fees and high-speed transactions will drive the popularity of DeFi and on-chain services. Small DeFi operations (like providing liquidity for $100) become economically viable, attracting more users to participate. Additionally, micro-payment scenarios (such as subscription content, in-game purchases, or tipping) will flourish. For instance, tipping a YouTuber $1 or paying $0.1 to read an article will become possible.

As transaction volume grows exponentially, Stable can achieve profitability through fees executed via smart contracts.

5.3. Scenario Three: Integration into the Real Economy

In Southeast Asia and Latin America, USDT has already been used for some offline payments. If Stable addresses the issues of fees and speed, offline payment scenarios will rapidly expand. For example, buying a $2 cup of coffee with USDT in Vietnam or shopping at a convenience store in the Philippines could become a daily habit.

Stable can build a global payment network by providing payment terminals for merchants and digital wallets for consumers, charging small transaction fees. If the advancement of central bank digital currencies (CBDCs) is slow, the convenience of Stable may make it a mainstream choice.

6. Stable's True Strategy

Stable's strategy is clear: attract users with free USDT transfers and a simple experience, gradually building a payment ecosystem centered around USDT. Through network effects, users and transaction volume will grow rapidly, similar to how Amazon initially attracted customers with low-priced books and eventually profited through cloud services and advertising.

Free transfers are merely a "loss-leader"; the real goal is to become the hub of the USDT ecosystem, allowing all transactions to flow through Stable. Once network effects are established, users will find it difficult to leave, solidifying Stable's market position. This is the power of the new "Trojan Horse."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。