Author: 100y_eth

Translation: Baihua Blockchain

Key Points

On June 5, 2025, USDC issuer Circle successfully went public on the New York Stock Exchange, injecting new vitality into the entire stablecoin industry. With its vertically integrated product strategy and a crypto-friendly political environment in the U.S., Circle has attracted widespread market attention.

As Circle creates a buzz, people are starting to look for the next potential winner under the GENIUS Act. FraxFinance, a stablecoin protocol with a similar strategy to Circle, is gradually becoming a focal point in the industry with its frxUSD stablecoin, FraxNet front-end platform, and high-performance blockchain Fraxtal.

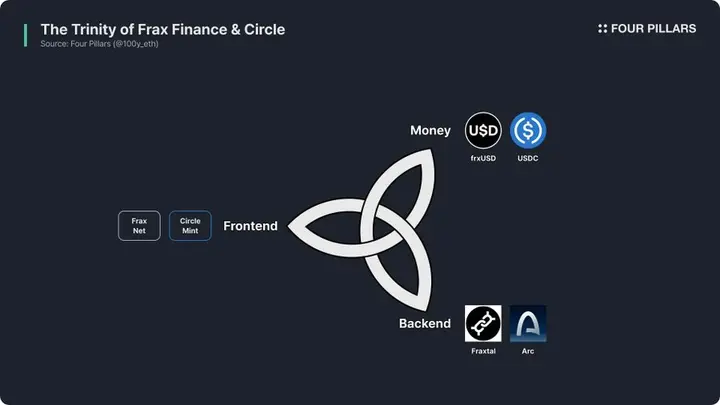

The three pillars of the financial system are currency, front-end, and back-end. From the perspective of financial industry development, traditional inefficient back-end systems are gradually transitioning to blockchain. In this trend, the stablecoin-based financial system is also composed of stablecoins, front-end, and blockchain networks. FraxFinance is one of the few protocols building all three elements, showcasing a vertically integrated strategic direction.

FraxFinance stands at a turning point towards a new chapter. From the political influence of its founder's involvement in drafting the GENIUS Act, to the vertically integrated product vision achieved through a stablecoin operating system, and the comprehensive transformation of the protocol through the Polaris upgrade, FraxFinance is more prepared than anyone else for the future envisioned by the GENIUS Act.

1. What is the secret behind Circle's successful IPO?

1.1 A Victory for the Stablecoin Industry

On June 5, 2025, Circle went public on the New York Stock Exchange under the ticker "CRCL," with an IPO price of $31 per share, exceeding the initial expected range of $27-28, raising approximately $1.1 billion. The opening price on the first day of trading was $69, closing at $83, and by August 25, the stock price had soared to about $135, making it an extremely successful IPO case.

Circle's IPO is not only a milestone for the company but also signifies that crypto companies can enter traditional financial markets against the backdrop of the passage of the GENIUS Act, relaxed SEC regulations, and the Trump administration's crypto-friendly policies. The enthusiastic response to Circle in the public market further proves that stablecoin infrastructure can thrive in traditional finance.

This is not just a victory for Circle, but a success for the entire stablecoin industry.

1.2 Circle's Vertical Integration Strategy

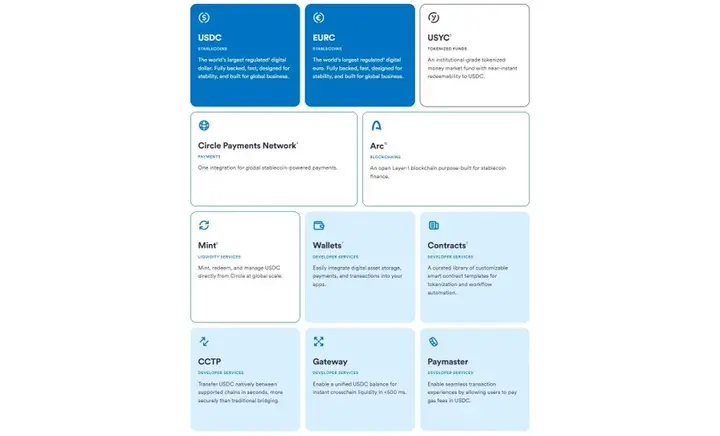

Source: Circle

Circle is one of the largest stablecoin issuers globally, with USDC pegged to the dollar and EURC pegged to the euro. Driven by the mission to build a new financial system based on the internet, Circle offers a range of products, including:

Circle Payments Network (CPN): Circle's global funds transfer standard, aimed at becoming a blockchain-based alternative to SWIFT. Financial institutions and businesses can efficiently process cross-border remittances and settlements through CPN and multiple public blockchains.

Circle Mint: Integrated with traditional banking networks (such as wire transfers and SEPA), allowing businesses and institutional users to mint and redeem USDC and EURC instantly at a 1:1 ratio with fiat currency, serving as the only official issuance channel for USDC.

Circle Wallets: Provides blockchain wallet integration SDK for Web2 companies, supporting account abstraction, MPC security, transaction broadcasting nodes, compliance options, and multi-chain support.

CCTP: Circle's cross-chain messaging protocol, enabling the secure transfer of USDC across different blockchains through a burn-and-mint mechanism, addressing liquidity fragmentation issues.

Circle Paymaster: An account abstraction feature based on ERC-4337, allowing users to pay blockchain fees in USDC or have the platform cover the costs, enabling gasless transactions.

USYC: At the end of 2024, Circle acquired USYC issuer Hashnote. USYC is a tokenized money market fund investing in U.S. Treasury bonds and reverse repos, providing stable on-chain yields for institutional clients and serving as collateral for trading platforms like Deribit and BN.

Arc: A dedicated L1 blockchain for USDC launched in August, utilizing a high-performance consensus algorithm to optimize the USDC user experience.

Through these products, Circle not only issues stablecoins but also builds a stablecoin infrastructure that is convenient for institutional and retail users, covering issuance, wallets, cross-chain bridges, L1 networks, account abstraction, and institutional solutions, showcasing a vertically integrated product strategy.

From a user experience perspective, Circle's product portfolio is highly advantageous. Imagine a business using Circle's products: instant minting and redemption of USDC through Circle Mint; providing convenient stablecoin functions for users unfamiliar with Web3 through Circle Wallets, Paymaster, and CCTP; achieving efficient USDC usage through the Arc blockchain; and conducting transactions and settlements with financial institutions and businesses via CPN. The core of stablecoins lies not in issuance but in practicality. Circle's vertical integration strategy lays the foundation for the widespread adoption of stablecoins in the real world and on-chain ecosystems.

1.3 Why is Circle so noteworthy?

Why has Circle managed to attract attention from both the blockchain industry and traditional financial markets? In addition to product advantages, the following factors are also crucial:

Passage of the GENIUS Act: As the first federal law in the U.S. to explicitly regulate dollar stablecoins, the GENIUS Act provides a framework for the legal status of stablecoins, issuer obligations, and consumer protection, making Circle's internal operating standards a legal benchmark, granting it legitimacy and compliance.

Trump administration's pro-crypto policies: The Trump administration expressed strong support for cryptocurrencies even before taking office. On July 30, 2025, the President's Digital Asset Market Working Group released a 160-page crypto policy report, proposing a roadmap to make the U.S. a global crypto hub.

Relaxation of SEC regulations: New SEC Chairman Paul Atkins has taken a pro-crypto stance, with a more lenient regulatory attitude compared to former Chairman Gary Gensler. The SEC launched the "Project Crypto" initiative, further clarifying regulatory rules for the U.S. crypto industry.

Market share: USDC is the second-largest stablecoin globally, with a current supply of about $63 billion, accounting for approximately 30% of the stablecoin market. Due to the collateral composition of USDT not meeting the GENIUS Act, USDC has become the largest compliant stablecoin under U.S. regulation.

Business model: Circle generates primary revenue by managing USDC reserves (including Treasury bonds, repos, etc.). In the second quarter of 2025, Circle achieved revenue of $658 million, with adjusted EBITDA of $126 million, demonstrating an attractive revenue structure and robust profit margins.

The current political environment in the U.S. provides an excellent stage for Circle's rise, while also laying the groundwork for the rapid growth of the entire stablecoin industry.

1.4 Enthusiasm from South Korean Investors

Interestingly, the buzz around Circle has not only swept through the U.S. but also other countries. In June 2025, Circle (CRCL) became the most sought-after overseas stock among South Korean investors, with net purchases exceeding $600 million, far surpassing the second-ranked Tesla 2X ETF (1.6 times), the third-ranked Coinbase (4 times), and Alphabet and Apple.

Why is Circle so popular in South Korea? In addition to South Korean investors actively participating in U.S. stock trading, a deeper reason is the rapidly growing interest in stablecoins in the South Korean market. In June 2025, newly elected President Lee announced support for the legalization of stablecoins, greatly stimulating market attention towards the stablecoin industry. Although South Korea has not fully realized the legalization of the won stablecoin due to strict foreign exchange regulations, the central bank's conservative attitude, and the small scale of the short-term bond market, every time a company or institution applies for a trademark related to stablecoins, its stock price soars, indicating that the stablecoin craze has expanded from the blockchain industry to the general stock market.

2. Looking for the Next Winner under the GENIUS Act

2.1 Who is Next After Circle?

Circle's successful IPO has shifted the focus of businesses and investors to the stablecoin industry, searching for the next beneficiary under the GENIUS Act. Coinbase is often mentioned, as Circle shares nearly half of its USDC reserve income with Coinbase. In the second quarter of 2025, Circle's reserve income was $634 million, of which $332.5 million was paid to Coinbase.

But aside from companies like Coinbase that benefit indirectly, is there a publicly listed company that directly issues GENIUS Act-compliant stablecoins like Circle? Unfortunately, there are currently no such companies in the U.S. stock market. Paxos is the second-largest stablecoin issuer in the U.S., but it is a private company.

2.2 On-Chain Opportunities

Even if the next Circle cannot be found in the stock market, there is no need to be disappointed. There are protocols on-chain that are issuing dollar stablecoins compliant with the GENIUS Act. Currently, there are two protocols in the market dedicated to this: Ethena and Frax Finance.

Source: Ethena

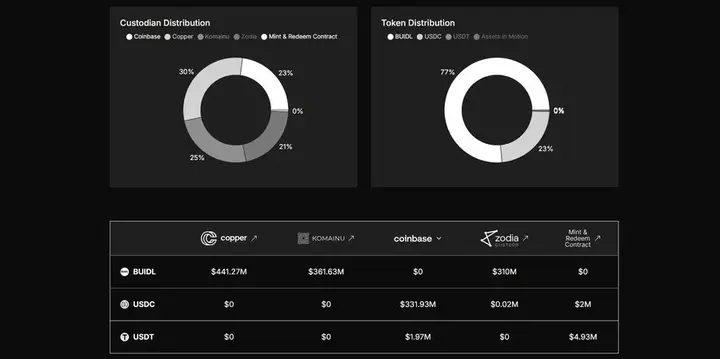

Ethena: Ethena offers two stablecoins, USDe and USDtb. USDe does not comply with the GENIUS Act due to its reserves based on a futures market delta-neutral strategy, but USDtb's reserves consist of MMF fund BUIDL and stablecoins. In July 2025, the issuance of USDtb was moved from the British Virgin Islands to Anchorage Digital Bank in preparation for compliance with the GENIUS Act.

Frax Finance: Frax Finance issues the frxUSD stablecoin, which is backed by a reserve of dollar MMF Tokens and U.S. Treasury fund Tokens. Founder Sam Kazemian is one of the key figures in drafting the GENIUS Act. In March 2025, he met with the bill's co-sponsor, Senator Cynthia Lummis, to provide advice for the bill, helping to establish a legal framework for the digital dollar. Frax Finance not only develops products but also actively participates in regulatory discussions, collaborating with legislators to shape the regulatory framework, showcasing a spirit of policy entrepreneurship. Due to the founder's direct involvement in drafting the bill, Frax Finance has an unparalleled understanding of the GENIUS Act and has designed frxUSD accordingly.

3. frxUSD: The First GENIUS Act-Compliant Stablecoin

3.1 Frax's Stablecoin Operating System

Frax Finance's goal is not only to reliably issue stablecoins but also to build a scalable infrastructure that can be widely used. To this end, Frax has launched a "stablecoin operating system," which includes three core products:

frxUSD: A stablecoin compliant with the GENIUS Act, serving as the core liquidity asset of the Frax ecosystem.

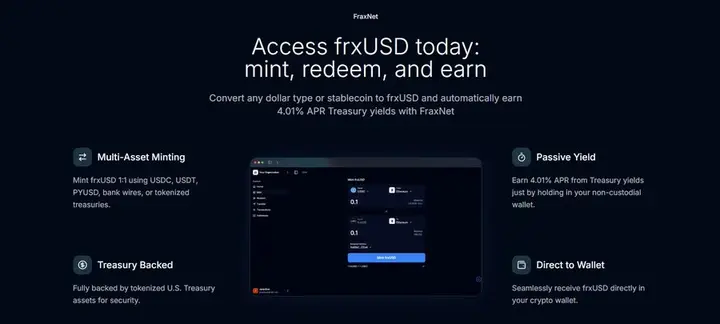

FraxNet: A platform that allows users to issue and redeem frxUSD in various ways and earn stable returns by holding stablecoins in a non-custodial manner, compliant with the GENIUS Act.

Fraxtal: A high-performance EVM L1 blockchain designed specifically for frxUSD, using FRAX as the gas Token.

While the issuance of stablecoins is important, practicality is even more critical. Frax Finance not only issues compliant frxUSD but also provides a user-friendly front-end through FraxNet and an ecosystem built specifically for frxUSD through Fraxtal. In this structure, frxUSD acts as currency, FraxNet plays the role of fintech and banking, and Fraxtal serves as the back-end of the financial system, together forming the core engine of the frxUSD ecosystem.

Additionally, Frax Finance offers services such as Fraxswap (trading), Fraxlend (lending), and frxETH (Ethereum liquid staking protocol), creating a complete stablecoin and DeFi ecosystem.

3.2 frxUSD: The First GENIUS Act-Compliant Stablecoin

Source: GovInfo

Frax Finance founder Sam Kazemian participated in drafting the GENIUS Act, giving the team an in-depth understanding of the bill. Based on this regulatory expertise, Frax Finance began issuing the regulatory-compliant frxUSD in February 2025. So, what exactly makes a stablecoin compliant with the GENIUS Act? Is frxUSD truly compliant?

The full text of the GENIUS Act is available online, and here is a summary of the key requirements:

3.2.1 Issuer Qualifications

Only authorized issuers within the United States can issue stablecoins, and authorized issuers are divided into three categories: subsidiaries of banks or credit unions, OCC-approved institutions, and institutions approved by state financial regulators. Frax Finance has transferred the issuance, reserve management, and compliance responsibilities of frxUSD to FRAX Inc., a company registered in Delaware, through the FIP-432 governance proposal, and is currently preparing to obtain a stablecoin issuance license from the OCC or state financial regulators.

3.2.2 Reserve Requirements

The GENIUS Act requires stablecoin reserves to be fully backed 1:1, with reserve assets limited to the following high-liquidity assets:

- U.S. dollars or Federal Reserve account balances

- Demand deposits, withdrawable deposits, insured deposits, or credit union shares

- U.S. Treasury securities with a remaining or original maturity of 93 days or less

- Overnight repurchase agreements signed by the issuer as the seller, collateralized by Treasury securities with a maturity of 93 days or less

- Overnight reverse repurchase agreements signed by the issuer as the buyer, collateralized by U.S. Treasury securities

- Registered government money market funds or securities registered under the Investment Company Act of 1940 that only hold the above assets

- Other high-liquidity, stable assets directly issued by the U.S. federal government

- Tokenized forms of the above assets

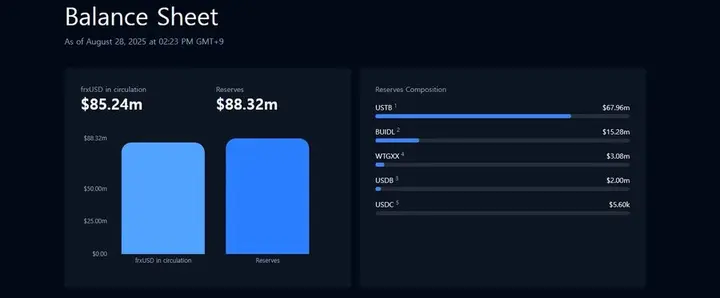

The reserves of frxUSD are entirely composed of tokenized assets, including:

- USTB: Tokenized form of a short-term U.S. Treasury fund issued by Superstate.

- BUIDL: Tokenized form of a fund issued by BlackRock that invests in Treasury securities, cash equivalents, and repos.

- WTGXX: Tokenized form of a money market fund issued by WisdomTree that invests in short-term Treasury and government agency bonds.

- USDB: A stablecoin issued by Bridge, acquired by Stripe.

- USDC: A stablecoin issued by Circle.

The reserves of frxUSD are over-collateralized at more than 100% to meet the reserve requirements of the GENIUS Act, maintaining stable value.

3.2.3 Yield Distribution

The GENIUS Act prohibits stablecoin issuers from paying interest to holders solely for holding or using stablecoins to avoid confusion with deposit products. frxUSD complies with this regulation, as users holding frxUSD do not earn interest. However, users holding frxUSD on the FraxNet platform can earn stable returns generated from bonds. This does not violate the act, as the returns are provided by FraxNet (operated by Frax Network Labs Inc., independent of the issuer) rather than being directly paid by the issuer. Similarly, Coinbase provides about 4.1% yield for USDC on its platform, and PayPal offers about 3.7% for PYUSD.

4. Frax Follows in Circle's Footsteps: Familiar Yet Unique

The success of Circle and Frax Finance's frxUSD feels reminiscent. The direction of Frax Finance in building a stablecoin ecosystem is highly similar to Circle's but carries unique innovations.

4.1 Currency: Issuance of Stablecoins

Both Circle and Frax Finance issue stablecoins compliant with the GENIUS Act, with reserves composed of cash, short-term Treasury securities, and repos to maintain stable value, serving as the monetary foundation for the next-generation financial system. The difference is that the interest income from frxUSD reserves is used for FraxNet holders, team operations, and FRAX Token holders, creating a positive cycle within the ecosystem, while all interest income from USDC goes to Circle.

4.2 Front-End: User Experience

Circle provides a user-friendly front-end through Circle Mint, Circle Wallet, and Circle Gateway.

Frax Finance's FraxNet also offers similar functionalities:

- Multi-asset issuance: Supports the issuance of frxUSD using USDC, USDT, PYUSD, USDB, bank wire transfers, and RWATokens, similar to Circle Mint.

- Embedded wallets: Automatically creates blockchain wallets through Google and other account logins, lowering the Web3 barrier, similar to Circle Wallet.

- Dashboard: Displays multi-chain assets and supports convenient transfers, similar to Circle Gateway.

- Passive income: Holders of frxUSD on FraxNet can automatically earn bond yields, similar to Coinbase's USDC yields.

FraxNet also plans to launch:

- Virtual Visa card: In collaboration with Stripe and Bridge, supporting real-world payments.

- Virtual bank account: In partnership with Lead Bank, providing deposit and withdrawal services through traditional banking networks.

- FraxNet mobile app: A mobile application set to launch in 2026, offering a complete mobile banking experience.

These plans aim to create a complete user interaction lifecycle, surpassing the experience of Circle Mint.

4.3 Back-End: Blockchain Infrastructure

An efficient back-end is crucial for the financial system. In February 2024, Frax Finance launched the high-performance blockchain Fraxtal, optimized for frxUSD. Subsequently, Ethena's Converge, Tether's Stable and Plasma, and Circle's Arc were launched, demonstrating that Frax Finance is leading industry trends.

4.4 The Trinity of Stablecoins

The three essential elements of modern financial systems are currency, front-end, and back-end. In the future, complex back-ends will gradually shift to blockchain, with stablecoins, front-ends, and blockchain networks becoming the core of blockchain-based financial systems. Frax Finance has constructed this "trinity of stablecoins" through frxUSD, FraxNet, and Fraxtal, showcasing a vertically integrated strategy.

5. Following the North Star

Source: Frax Finance

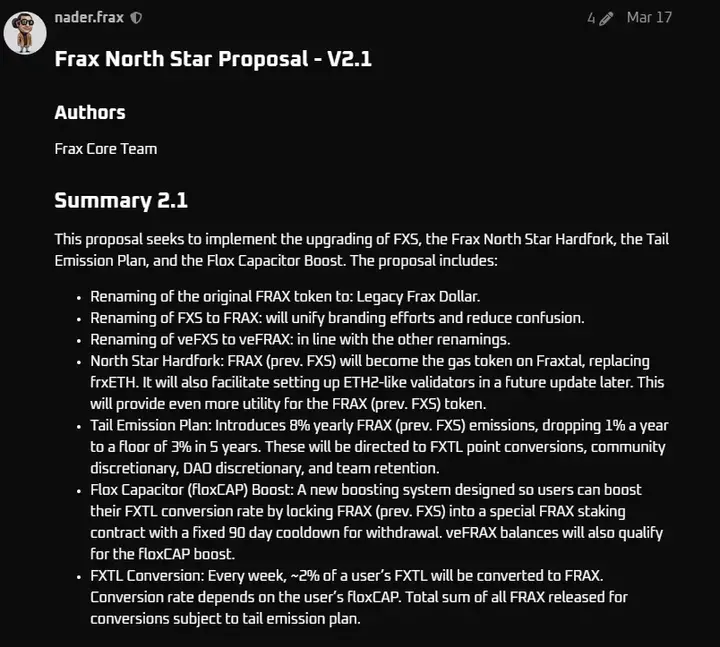

Since March 2025, Frax Finance has been preparing for the GENIUS Act through the North Star upgrade, including renaming the original FRAX and FXSTokens to frxUSD and FRAX, changing the gas Token of Fraxtal from frxETH to FRAX, and adjusting the Token incentive structure.

Frax Finance is entering a new chapter. From the founder's involvement in drafting the GENIUS Act to achieving vertical integration through the stablecoin operating system, and the comprehensive transformation of the North Star upgrade, Frax Finance is well-prepared for the future of the GENIUS Act.

Some believe that Frax Finance is imitating Circle, but the reality is quite the opposite. The launch of FraxNet and Fraxtal shows that Frax Finance is not just a follower but a leader in setting industry direction. Just as the North Star guides sailors, Frax Finance has established a new benchmark for the industry through the North Star upgrade, and will become a guiding light in the stablecoin industry in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。