Bitcoin traded at $110,894 on Saturday, Sept. 6, 2025, down 1.8% in the past 24 hours, with an intraday range between $110,339 and $113,142. Coinglass.com metrics show that futures open interest stood at 717,980 BTC ($79.63 billion). CME led with 136,380 BTC ($15.12 billion), representing 18.98% of the market, followed by Binance with 126,540 BTC ($14.03 billion, 17.62%), and Bybit with 89,280 BTC ($9.90 billion, 12.42%).

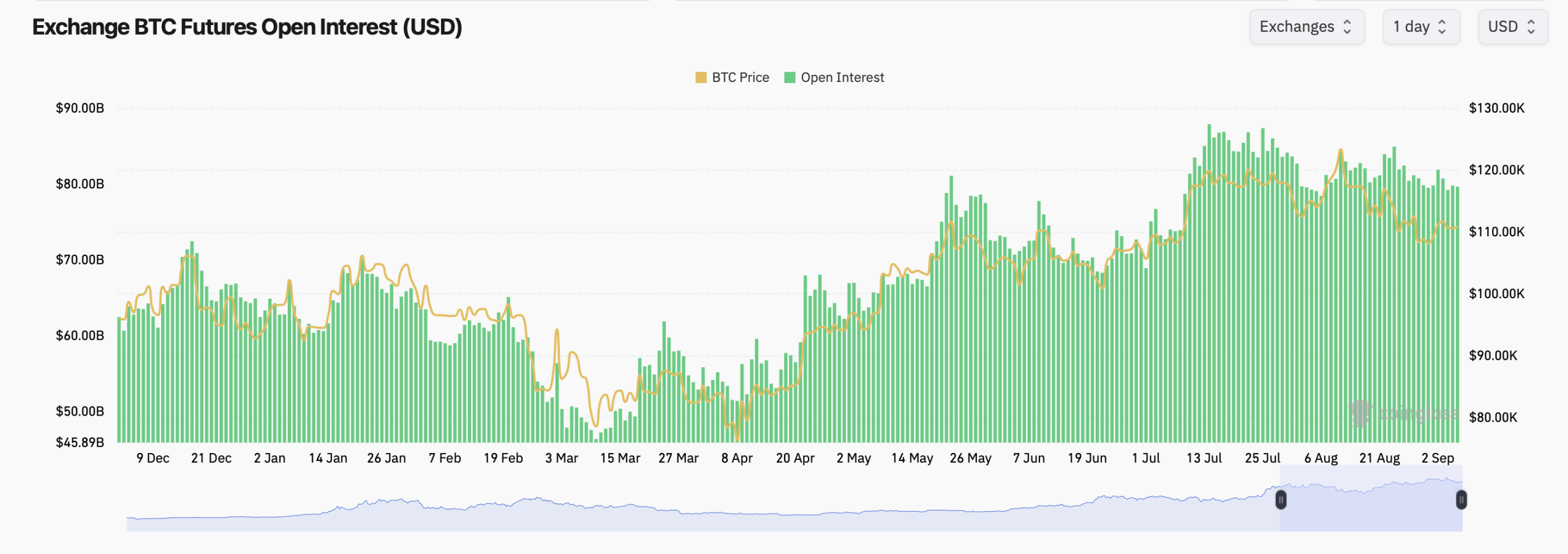

OKX, Gate, and Kucoin trailed behind, with Gate showing the strongest 24-hour increase at +1.45% in open interest. BingX saw the largest decline, dropping 15.84% in the past four hours and 7.03% on the day. Metrics show that aggregate futures open interest has declined modestly since late August but remains elevated relative to earlier in the year. Open interest values have consistently tracked bitcoin’s price, with peaks above $90 billion during mid-July’s rally.

As of early September, futures interest sits near $80 billion, reflecting a slight pullback after the summer highs. In the options market, total open interest reached nearly $60 billion, with activity concentrated mostly on Deribit. Calls accounted for 59.27% of open interest at 240,927 BTC, compared to 40.73% for puts at 165,572 BTC. Over the past 24 hours, calls also led volume with 52.19% (15,716 BTC), slightly ahead of puts at 47.81% (14,397 BTC).

The tilt toward calls indicates stronger demand for upside exposure, although puts remain pretty active. The largest open interest positions included Dec. 26, 2025, $140,000 calls (10,386 BTC), Sept. 26, 2025, $140,000 calls (9,989 BTC), and Sept. 26, 2025, $95,000 puts (9,918 BTC). Other notable strikes clustered around $115,000 to $150,000, with significant demand for both bullish and bearish contracts.

On the volume side, near-term expiries dominated, including Sept. 12 $110,000 puts and Sept. 26 $116,000 calls. Max pain, the level where option holders face the greatest aggregate loss, stood near $110,000 across September expirations. This positioning suggests short-term price pressures could center around that level, as market makers aim to minimize payouts.

With bitcoin trading just above max pain on Saturday, derivatives markets appear balanced between bullish call demand and defensive put hedging. Still, it’s on a razor’s edge.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。