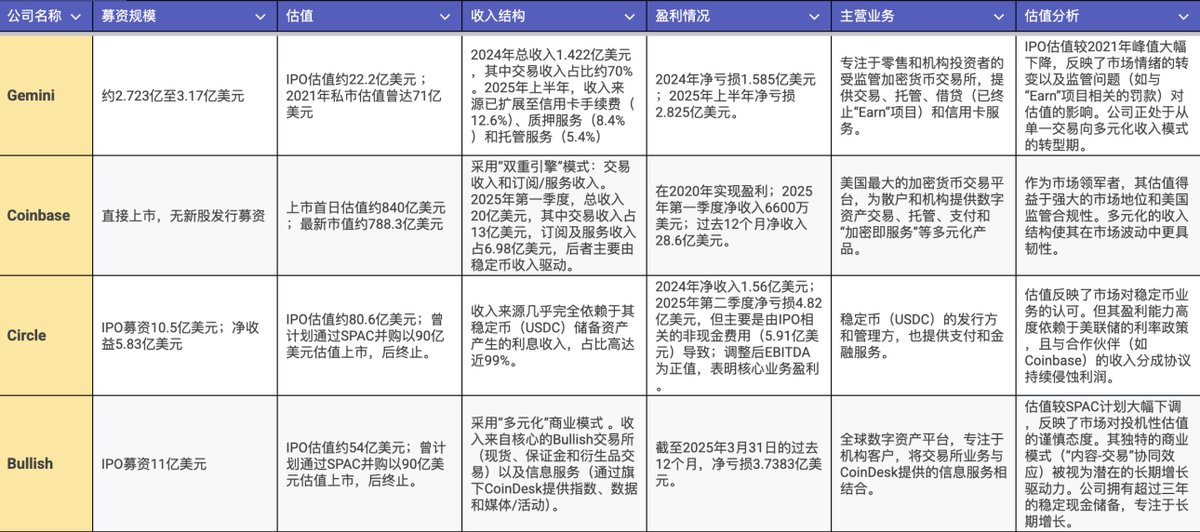

The US stock market is about to welcome another exchange, and it seems that choosing to go public through an IPO for compliance is the trend of the future. Today, let's briefly introduce #Gemini, a well-established American cryptocurrency exchange! Additionally, we have prepared an analysis chart of mainstream US crypto companies for reference (as shown in the image below, created by Google Gemini)!

Gemini was founded in 2014 and is considered one of the older cryptocurrency exchanges in the US, with an asset custody amount of $18 billion. It has a comprehensive business line, including an exchange, stablecoins, custody, staking, and credit card rewards, essentially completing the puzzle of a "crypto financial supermarket."

However, the problems are quite evident: the company is still losing money. In the first half of 2025, revenue was only $68.6 million, with a net loss of as much as $283 million. Looking at these numbers, it’s clear that not only is it not profitable, but the revenue/loss ratio is also not very healthy, indicating that the rate of burning cash is much faster than making money. More critically, 65.5% of their revenue comes from trading fees—meaning they are reliant on trading volume; if trading cools down, their performance will be severely impacted.

🧮 Valuation and Financing

For this IPO, #Gemini's price range is set at $17-19 per share, with a total financing target of $317 million, corresponding to a market value of approximately $2.2 billion.

In comparison: #Circle raised $1.2 billion in its IPO, #Bullish raised $1.1 billion, making #Gemini's scale seem relatively small. However, this aligns with its size, as Gemini has always ranked behind Coinbase and Kraken in the US market, with a relatively small market share.

Thus, the market valuation is not considered high; $2.2 billion for a company managing $18 billion in assets is a relatively "tight" valuation. Investors will discount profitability and regulatory risks.

📝 Regulation and Policy

This point is crucial. #Gemini has previously been involved in lawsuits with the SEC and CFTC and has paid fines, but fortunately, these issues have mostly been resolved recently. Additionally, the Trump administration has clearly shown a "friendly attitude," and stablecoin legislation is progressing, making the environment much more relaxed than in previous years.

Moreover, the Winklevoss brothers donated $21 million in Bitcoin to the Trump campaign, which in a sense is buying policy insurance. In the short term, the regulatory risk is much lower than it was when #Coinbase went public.

🧐 Short-term Speculative Opportunities

Recently, IPOs of crypto companies have attracted a lot of attention, and market funds are eager to support them, creating a positive market sentiment. For instance, #Circle and #Bullish saw their stock prices soar on their listing days (increasing by 168% and 84%, respectively). We expect #Gemini might replicate this "first-day excitement," as enthusiasm for crypto IPOs remains high, making short-term speculation a good opportunity.

However, in the medium to long term, I may not be very optimistic; #Gemini's performance issues will not disappear just because of the IPO. The moat of the exchange model is not very thick, user stickiness is average, and competition is fierce (Coinbase, Kraken, and http://Binance.US are all competing). If market trading volume declines, its losses could worsen, so everything hinges on performance!

My strategy is to take a short-term gamble on the IPO, referencing the performances of Circle and Bullish, aiming for a 30%-40% increase. Additionally, #MyStonks has launched a $10,000 participation event, and you can currently join our US stock team for free (early private messages can join the group for free): https://mystonks.org/?code=Vu2v44

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。