Author: Yield Basis

Compiled by: Tim, PANews

PANews Editor's Note: Yield Basis is a new project launched by the founder of Curve, aimed at addressing the issue of impermanent loss in liquidity pools. The Yield Basis team has provided an introduction to the mainnet launch, and the following is the compiled content.

Today, we are excited to announce that the Yield Basis mainnet is about to launch. This marks the introduction of a new DeFi primitive: zero impermanent loss liquidity pools, and this is just the first step. The protocol design of Yield Basis has been detailed in the original white paper and community educational content.

Yield Basis, starting with Bitcoin.

This article aims to help LPs and the community prepare for the launch of the Yield Basis mainnet.

Mainnet Launch Timeline

Phase 0

A necessary step for the Yield Basis mainnet launch is to immediately propose to the Curve DAO governance after the code deployment. This proposal was published by Curve and Yield Basis founder Michael Egorov two weeks ago, with the core content being the approval of crvUSD minting rights (capped at $60 million) to support the operation of the Yield Basis liquidity pools. After extensive discussion within the Curve community, now is the right time to formally initiate this proposal.

Shortly before the proposal is launched, the Yield Basis mainnet version will be deployed, showcasing the protocol's deployment status. Since crvUSD cannot be minted before the proposal is approved, the impermanent loss protection feature will not be active during the voting period. Therefore, it is strictly prohibited to inject liquidity into the liquidity pools.

During this launch phase, the Yield Basis user interface will not allow deposit operations.

Deposit operations must take place during the full activation phase of the product after crvUSD leverage is enabled. Only then will it operate as planned and possess the initial design functionalities.

Phase 0 Action: Please actively participate in governance and vote for this proposal. The numbers listed in the proposal are crucial for the healthy launch of the protocol and YB tokens after the testing period; if each Yield Basis liquidity pool fails to reach a minimum viable liquidity (MVL) of $10 million in BTC, the product will not be able to demonstrate the expected results.

The scale of MVL must meet the following two points: (1) Attract sufficient arbitrage trading volume from centralized and decentralized exchanges to create ample returns for LPs and veCRV stakers; (2) Demonstrate the positive impact of the Yield Basis product launch on crvUSD/veCRV yields and the entire Curve ecosystem.

Phase 1

If the proposal is approved by Curve governance, $60 million of crvUSD will be minted for the operation of the Yield Basis pools. Specifically, $30 million of crvUSD will be reserved for three liquidity pools, with $10 million allocated to each Bitcoin-pegged asset (wBTC, cbBTC, and tBTC). The main goal of this phase is to quickly validate the operational performance of these liquidity pools in a real environment. These three initial Bitcoin-pegged assets are adopted by different trading venues and typically operate efficiently through arbitrage traders.

Thus, by examining the three major Bitcoin-pegged assets, the most effective and rapid real-world validation of algorithm performance can be achieved.

The remaining $30 million will be reserved for the leverage maintenance mechanism, activated only during significant Bitcoin volatility (this reserve can cover scenarios where Bitcoin prices double or exceed $200,000, although such situations are unlikely).

Phase 1 is the initial guiding phase for the liquidity of the Yield Basis protocol. It is also a public testing phase to verify whether the protocol operates as expected, lasting at least 10 days.

Phase 1 Action: Deposit liquidity into the liquidity pool of your choice. Please note that each liquidity pool has a deposit limit (with a Bitcoin deposit value of $10 million), and all users can participate. If the liquidity pool reaches its limit, you will not be able to continue depositing.

Phase 2

Phase 2 of Yield Basis will be announced based on the results of Phase 1. If you participated in staking during the first phase and continue to engage with the liquidity pools, no additional action is required to participate in subsequent phases.

Ultimate Guide for LPs

Adding liquidity is the first step for LPs to start using Yield Basis.

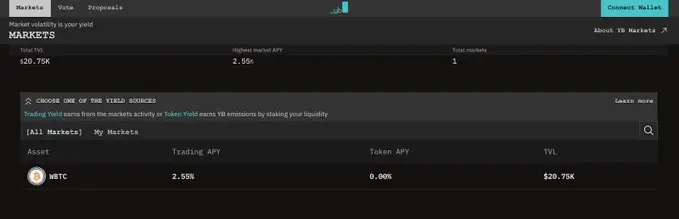

First, visit the "Applications" section of the Yield Basis website and connect your wallet (multiple wallet options are supported).

Select an asset from the list and deposit. Initially, three assets will be supported: cbBTC, wBTC, tBTC. Please note that the liquidity cap for each pool is $10 million TVL, on a first-come, first-served basis:

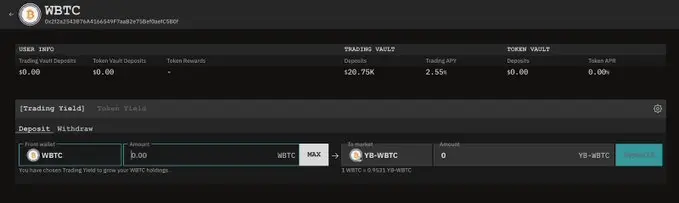

When LPs deposit Bitcoin-pegged assets into the Yield Basis pool, they will receive ybBTC tokens.

The earnings generated from your holdings will be compounded, meaning they will automatically be added to your holdings, thereby increasing the LP funds in the liquidity pool. When exiting the liquidity pool (i.e., redeeming ybBTC), LPs will receive their initial Bitcoin investment, along with all compounded earnings accumulated during the liquidity provision period.

Please note that after the TGE, LPs will have the option to receive YB tokens instead of native Bitcoin earnings. To activate this option, LPs must deposit ybBTC into a specific staking contract, and withdrawals will have no cooling-off period.

Conclusion

The Yield Basis mainnet is about to launch, and now is the best time for LPs to prepare for participation.

Disclaimer: This article does not constitute any investment advice. Please do your own research.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。