ARK Invest news shows Cathie Wood raising BitMine stake to 6.33M share

Cathie Wood’s ARK Invest is steadily boosting its position in Tom Lee's BitMine. Previously, the firm purchased 339,113 shares of BitMine Immersion, and now it has added even more.

According to a fresh report of Opinion Leader and Entrepreneur, Ted Pillows shared on his X , company has placed a massive $247 million bet, boosting company’s status as the largest Ethereum ($ETH) treasury company worldwide.

Source: X

This growing confidence highlights it's long-term strategy in the crypto sector and signals strong institutional interest in largest Ether treasury holdings.

ARK Invest Growing Stake in Bitmine

Cathie Wood’s ARK Invest now holds 6.33 million shares of Tom Lee's that is equal to 3.65% ownership, making it the largest institutional holder. The firm recently added 77,140 shares on September 4 which is showing continued confidence.

This steady accumulation highlights Wood's long-term bet on the largest Ether reserve, building its position as a key institutional backer in the crypto market.

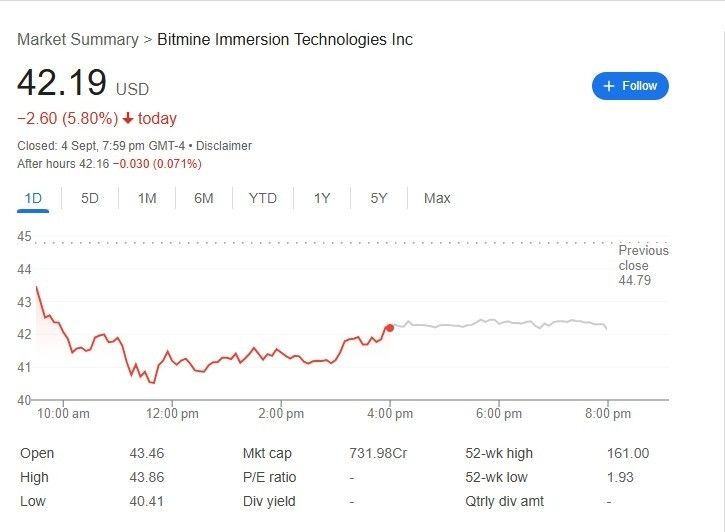

Bitmine Stock details

Tom Lee's Immersion Technologies stock slipped to 5.80% and closed at $42.19 September 4, compared to the previous close of $44.79. The day’s trading saw a high of $43.86 and a low of $40.41 with the stock after closing.

Source: Google

While short-term pressure dragged the price down, institutional backing stays firm. Cathie lifted her company stake to 6.33 million shares which is building Tom Lee's firm role as the top Ethereum treasury company .

Why Cathie Wood’s ARK Invest Backs BitMine?

According to data from CoinGecko, Bitmine's total Ethereum holding is 1,033,837 ETH and while the Ether market is showing dips from past one week, the organization added 153,075 ETH in its treasury. This buying of the firm suggests that it is taking the advantages from the dips and accumulating more.

As per CoinGabbar experts, Cathie Wood betting on the organization for three main reasons:

-

Exposure to Ether’s long-term growth

-

Belief in largest $ETH reserve role.

-

Alignment with Wood's strategy of investing in disruptive, future-focused companies.

Conclusion

Wood’s ARK sees the organization as a strong long-term Ethereum play. With rising Ethers holdings and steady share accumulation, firm's backing signals strong institutional trust, positioning biggest Ether holder as a key player in the growing crypto treasury market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。